Answered step by step

Verified Expert Solution

Question

1 Approved Answer

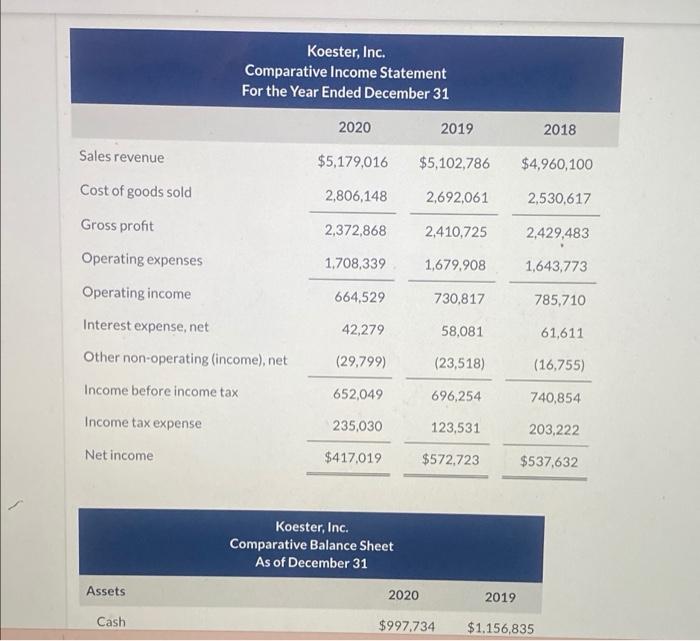

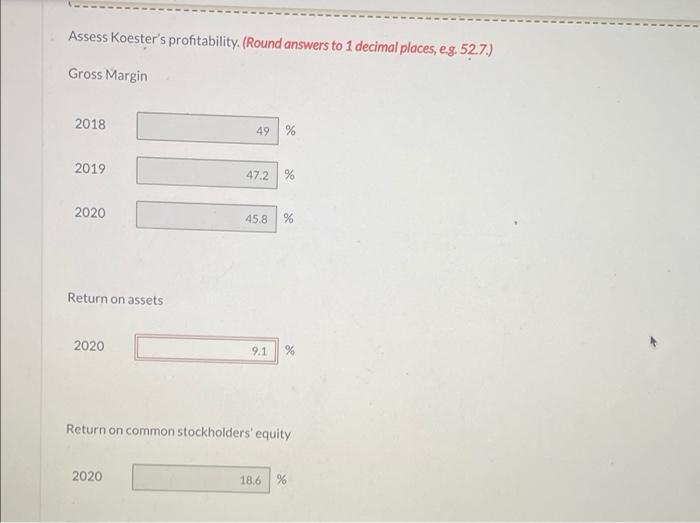

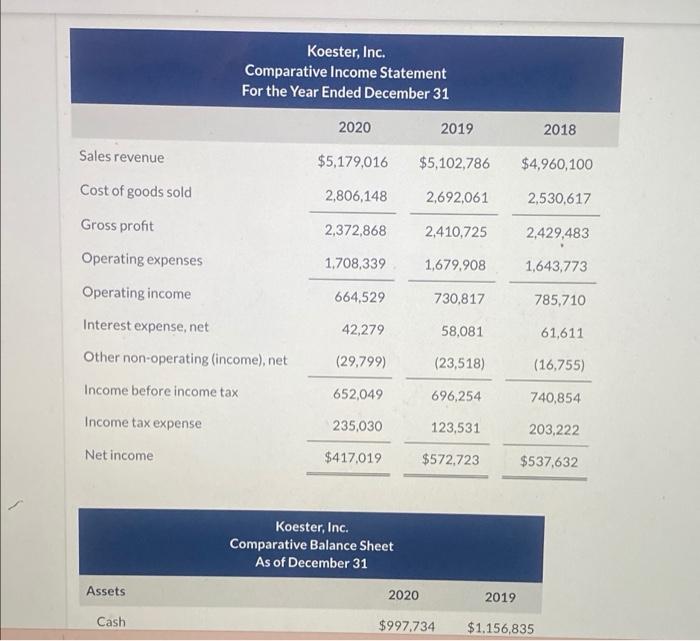

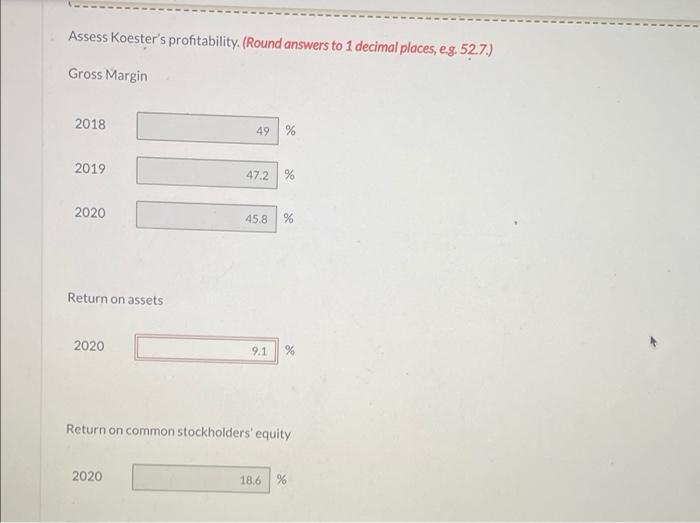

the anser is not 9.14, 9.1, or 9.5 please help me figure this out Koester, Inc. Comparative Income Statement For the Year Ended December 31

the anser is not 9.14, 9.1, or 9.5

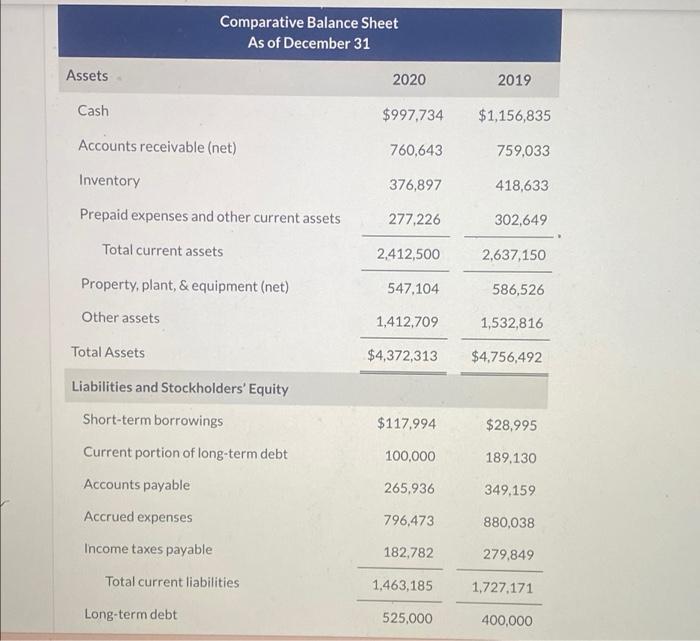

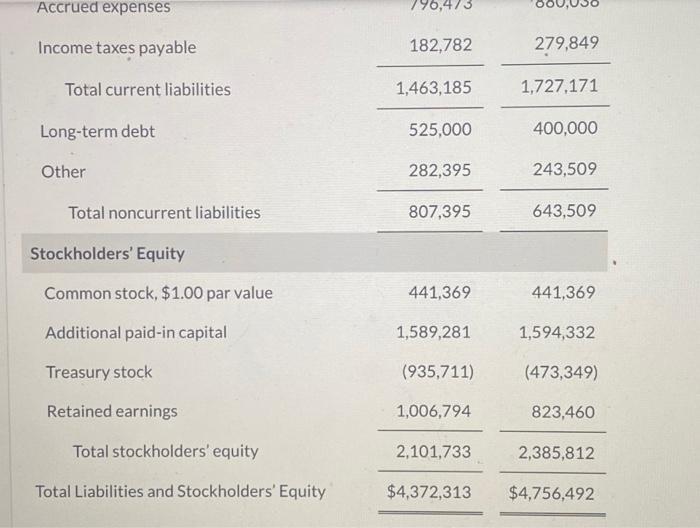

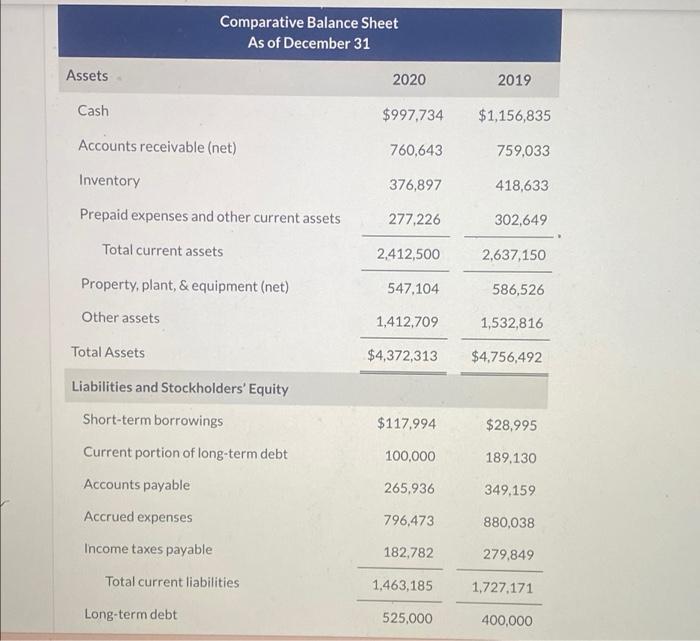

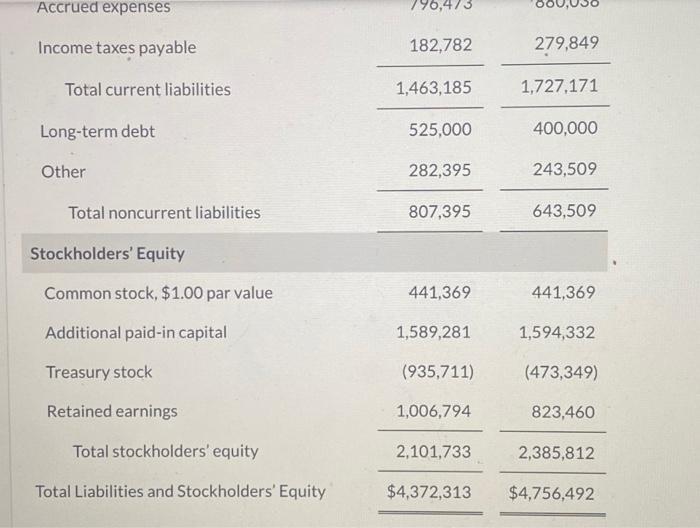

Koester, Inc. Comparative Income Statement For the Year Ended December 31 2020 2019 2018 Sales revenue $5,179,016 $5,102,786 $4,960,100 Cost of goods sold 2,806,148 2,692,061 2,530,617 Gross profit 2,372,868 2,410,725 2,429,483 1.708,339 1,679,908 1,643.773 664,529 730.817 785,710 42,279 Operating expenses Operating income Interest expense, net Other non-operating (income), net Income before income tax Income tax expense 58,081 61,611 (29,799) (23,518) (16,755) 652,049 696,254 740,854 235,030 123,531 203,222 Net income $417,019 $572,723 $537,632 Koester, Inc. Comparative Balance Sheet As of December 31 Assets 2020 2019 Cash $997,734 $1.156,835 Comparative Balance Sheet As of December 31 Assets 2020 2019 Cash $997,734 $1,156,835 Accounts receivable (net) 760,643 759,033 Inventory 376,897 418,633 Prepaid expenses and other current assets 277,226 302,649 Total current assets 2,412,500 2,637,150 Property, plant, & equipment (net) 547,104 586,526 Other assets 1,412,709 1,532,816 Total Assets $4,372,313 $4,756,492 $117.994 $28,995 Liabilities and Stockholders' Equity Short-term borrowings Current portion of long-term debt Accounts payable 100,000 189,130 265,936 349.159 Accrued expenses 796,473 880,038 Income taxes payable 182,782 279,849 Total current liabilities 1.463,185 1,727,171 Long-term debt 525.000 400,000 Accrued expenses 196,473 Income taxes payable 182,782 279,849 Total current liabilities 1,463,185 1,727,171 Long-term debt 525,000 400,000 Other 282,395 243,509 Total noncurrent liabilities 807,395 643,509 Stockholders' Equity Common stock, $1.00 par value 441,369 441,369 Additional paid-in capital 1,589,281 1,594,332 Treasury stock (935,711) (473,349) Retained earnings 1,006,794 823,460 Total stockholders' equity 2,101,733 2,385,812 Total Liabilities and Stockholders' Equity $4,372,313 $4,756,492 Assess Koester's profitability. (Round answers to 1 decimal places, eg. 52.7.) Gross Margin 2018 49 % 2019 47.2 % 2020 45.8 % Return on assets 2020 9.1 % Return on common stockholders' equity 2020 18.6 % please help me figure this out

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started