Answered step by step

Verified Expert Solution

Question

1 Approved Answer

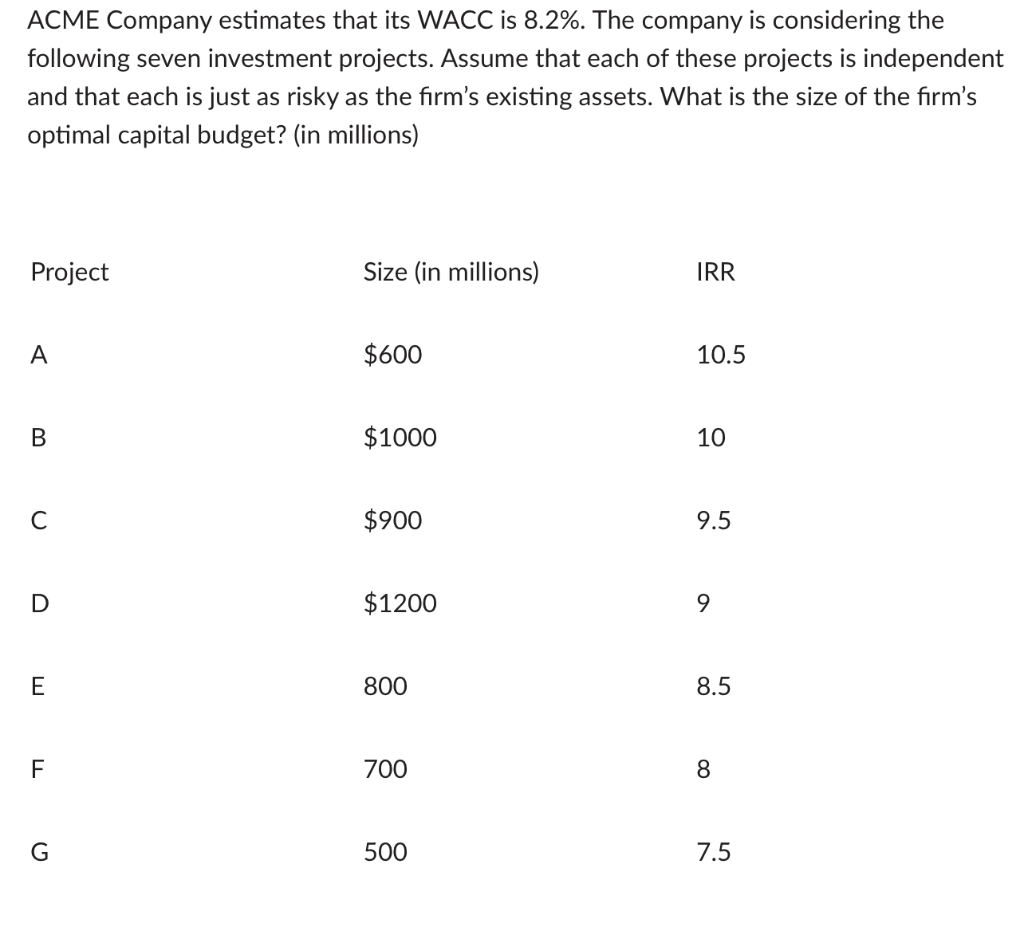

The answer choices are 6000, 3000, 4800, 4200, 4500 ACME Company estimates that its WACC is 8.2%. The company is considering the following seven investment

The answer choices are 6000, 3000, 4800, 4200, 4500

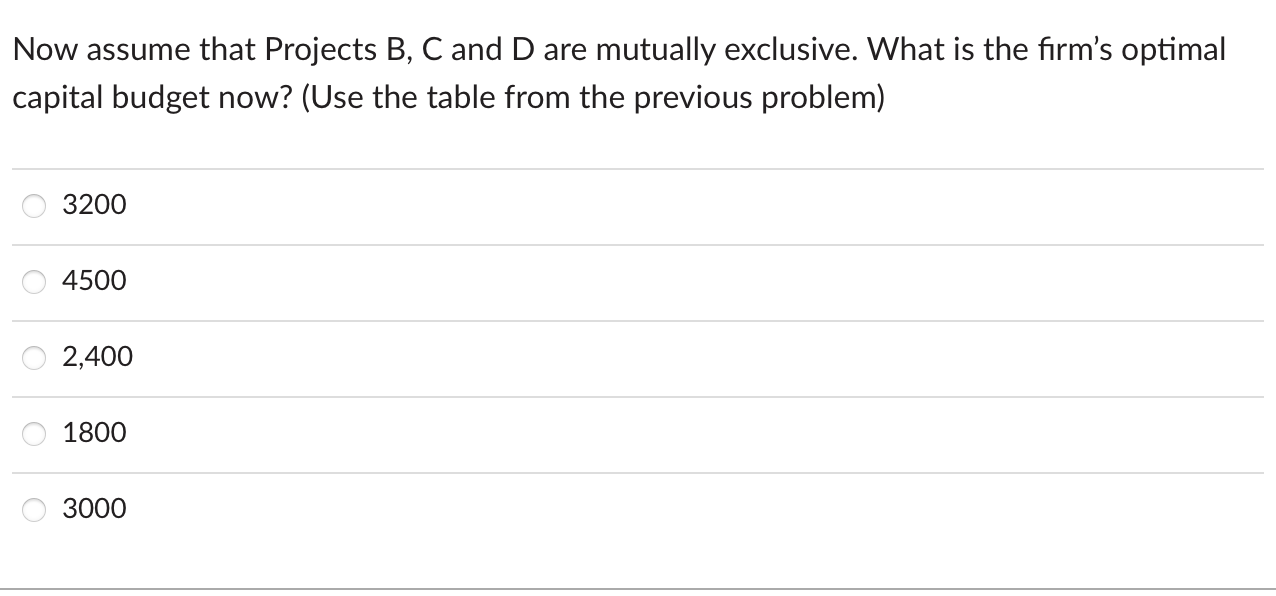

ACME Company estimates that its WACC is 8.2%. The company is considering the following seven investment projects. Assume that each of these projects is independent and that each is just as risky as the firm's existing assets. What is the size of the firm's optimal capital budget? (in millions) Project Size (in millions) IRR A $600 10.5 B $1000 10 C $900 9.5 D $1200 9 E 800 8.5 F 700 8 G 500 7.5 Now assume that Projects B, C and D are mutually exclusive. What is the firm's optimal capital budget now? (Use the table from the previous problem) 3200 4500 2,400 ooo. 1800 3000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started