Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the answer for Q7 is A and question 8 is B but i don't know how they get theses numbers please provide explanation. 7. Robin

the answer for Q7 is A and question 8 is B but i don't know how they get theses numbers please provide explanation.

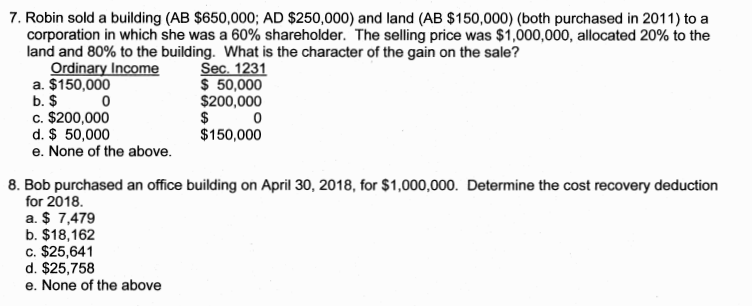

7. Robin sold a building (AB $650,000; AD $250,000) and land (AB $150,000) (both purchased in 2011) to a corporation in which she was a 60% shareholder. The selling price was $1,000,000, allocated 20% to the land and 80% to the building. What is the character of the gain on the sale? Ordinary Income Sec. 1231 a. $150,000 $ 50,000 b. $ 0 $200,000 c. $200,000 $ 0 d. $ 50,000 $150,000 e. None of the above. 8. Bob purchased an office building on April 30, 2018, for $1,000,000. Determine the cost recovery deduction for 2018 a. $ 7,479 b. $18,162 c. $25,641 d. $25,758 e. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started