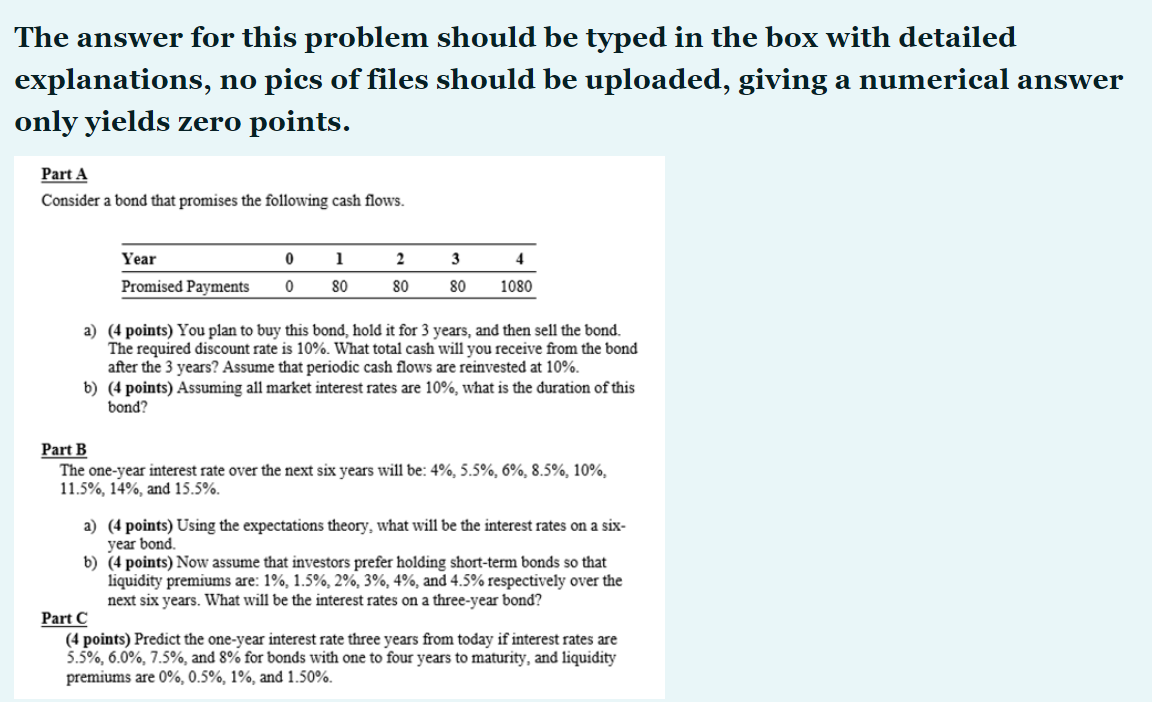

The answer for this problem should be typed in the box with detailed explanations, no pics of files should be uploaded, giving a numerical answer only yields zero points. Part A Consider a bond that promises the following cash flows. Year 0 1 2 3 4 Promised Payments 0 80 80 80 1080 a) (4 points) You plan to buy this bond, hold it for 3 years, and then sell the bond. The required discount rate is 10%. What total cash will you receive from the bond after the 3 years? Assume that periodic cash flows are reinvested at 10%. b) (4 points) Assuming all market interest rates are 10%, what is the duration of this bond? Part B The one-year interest rate over the next six years will be: 4%, 5.5%, 6%, 8.5%, 10%, 11.5%, 14%, and 15.5%. a) (4 points) Using the expectations theory, what will be the interest rates on a six- year bond b) (4 points) Now assume that investors prefer holding short-term bonds so that liquidity premiums are: 1%, 1.5%, 2%, 3%, 4%, and 4.5% respectively over the next six years. What will be the interest rates on a three-year bond? Part C (4 points) Predict the one-year interest rate three years from today if interest rates are 5.5%, 6.0%, 7.5%, and 8% for bonds with one to four years to maturity, and liquidity premiums are 0%, 0.5%, 1%, and 1.50%. The answer for this problem should be typed in the box with detailed explanations, no pics of files should be uploaded, giving a numerical answer only yields zero points. Part A Consider a bond that promises the following cash flows. Year 0 1 2 3 4 Promised Payments 0 80 80 80 1080 a) (4 points) You plan to buy this bond, hold it for 3 years, and then sell the bond. The required discount rate is 10%. What total cash will you receive from the bond after the 3 years? Assume that periodic cash flows are reinvested at 10%. b) (4 points) Assuming all market interest rates are 10%, what is the duration of this bond? Part B The one-year interest rate over the next six years will be: 4%, 5.5%, 6%, 8.5%, 10%, 11.5%, 14%, and 15.5%. a) (4 points) Using the expectations theory, what will be the interest rates on a six- year bond b) (4 points) Now assume that investors prefer holding short-term bonds so that liquidity premiums are: 1%, 1.5%, 2%, 3%, 4%, and 4.5% respectively over the next six years. What will be the interest rates on a three-year bond? Part C (4 points) Predict the one-year interest rate three years from today if interest rates are 5.5%, 6.0%, 7.5%, and 8% for bonds with one to four years to maturity, and liquidity premiums are 0%, 0.5%, 1%, and 1.50%