Question

(The answer is below: Please can someone explain why the 20,000 servicing revenue is multiplied by 6/12 (6 months)? The question doesn't mention the year-end

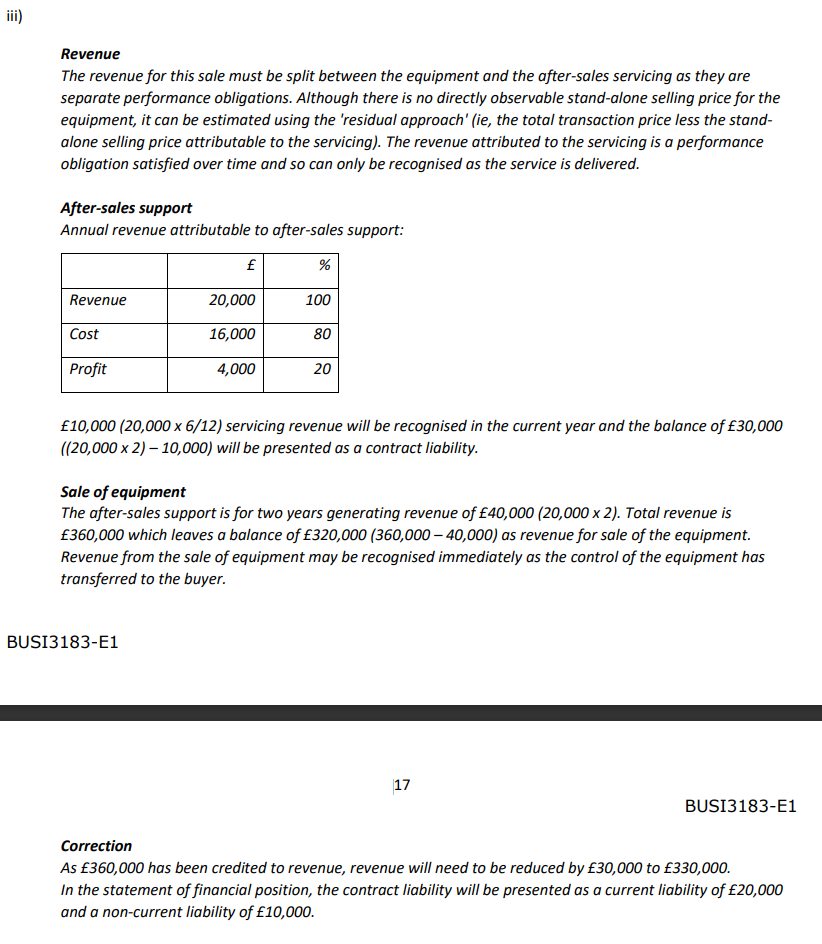

(The answer is below: Please can someone explain why the 20,000 servicing revenue is multiplied by 6/12 (6 months)? The question doesn't mention the year-end being October 1st. Why and how is this assumption made? Question: On 1 April 2019 Zeal plc sold equipment to Flatford Ltd for 360,000. The contract included after-sales support to be provided by Zeal plc for two years from the date of sale. These are to be considered as separate performance obligations. The support will cost Zeal plc 16,000 pa to deliver and it would normally expect to make a 20% gross profit margin on the provision of such services. Flatford Ltd undertook to pay the amount due in three equal instalments on 1 April, 1 July and 1 October 2019. The first two instalments have been received and the cost of aftersales support has been included in the cost of sales. Zeal plc has credited 360,000 to revenue in respect of this sale. Required: Explain the required IFRS accounting treatment of Issues (i) to (iii) above in the financial statements of the respective companies at year-end. Prepare all relevant calculations and set out the required adjustments.

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started