Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answer is C. Please show detailed calculation process, thanks. 4. Geek Corporation an established publicly traded computer-hardware company, is contemplating an investment in the

The answer is C. Please show detailed calculation process, thanks.

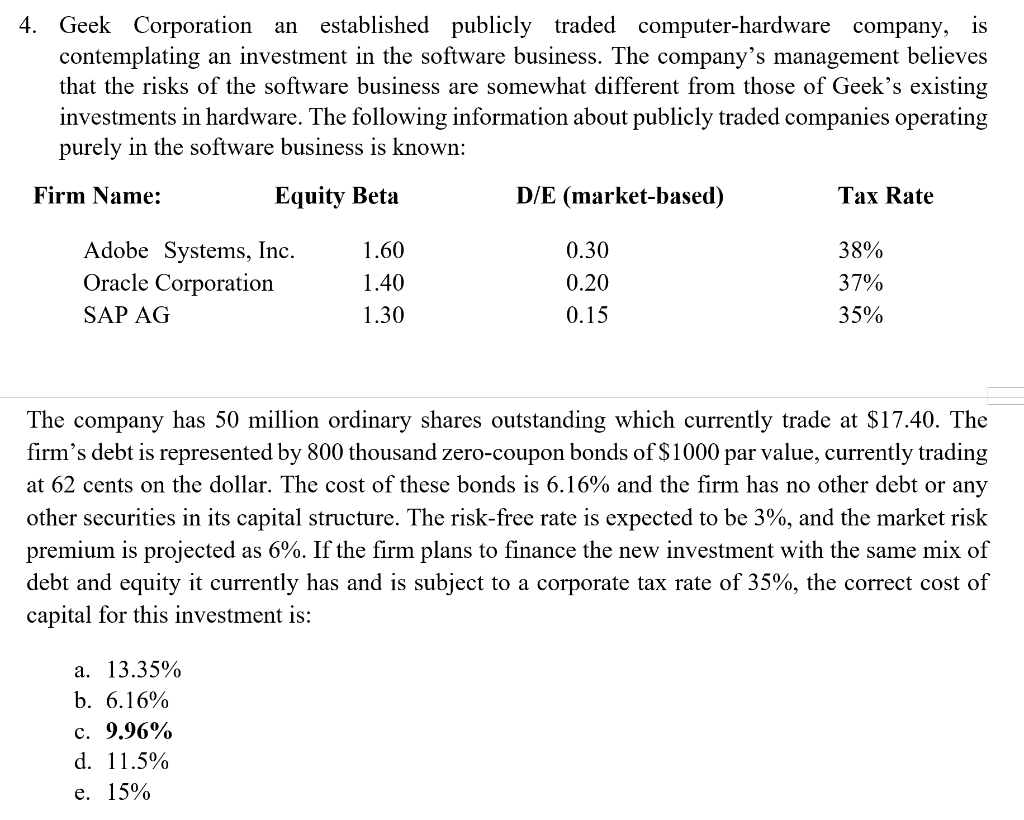

4. Geek Corporation an established publicly traded computer-hardware company, is contemplating an investment in the software business. The company's management believes that the risks of the software business are somewhat different from those of Geek's existing investments in hardware. The following information about publicly traded companies operating purely in the software business is known: Firm Name: Equity Beta D/E (market-based) Tax Rate Adobe Systems, Inc. Oracle Corporation SAP AG 1.60 1.40 1.30 0.30 0.20 0.15 38% 37% 35% The company has 50 million ordinary shares outstanding which currently trade at $17.40. The firm's debt is represented by 800 thousand zero-coupon bonds of $1000 par value, currently trading at 62 cents on the dollar. The cost of these bonds is 6.16% and the firm has no other debt or any other securities in its capital structure. The risk-free rate is expected to be 3%, and the market risk premium is projected as 6%. If the firm plans to finance the new investment with the same mix of debt and equity it currently has and is subject to a corporate tax rate of 35%, the correct cost of capital for this investment is: a. 13.35% b. 6.16% c. 9.96% d. 11.5% e. 15%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started