Answered step by step

Verified Expert Solution

Question

1 Approved Answer

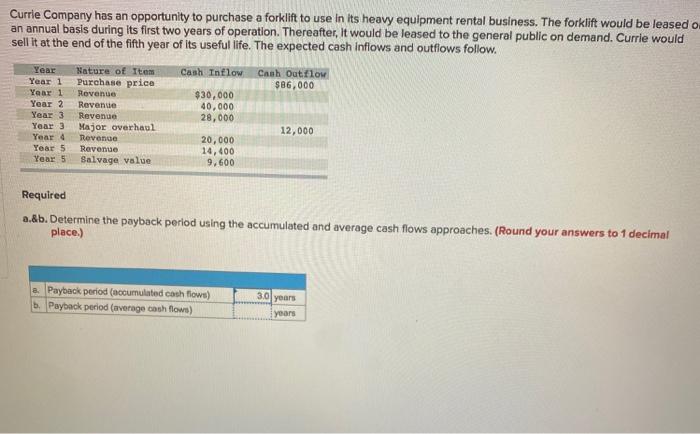

the answer is not 4.0 years or 4.14. plz help Currle Company has an opportunity to purchase a forklift to use in its heavy equipment

the answer is not 4.0 years or 4.14. plz help

Currle Company has an opportunity to purchase a forklift to use in its heavy equipment rental business. The forklift would be leased o an annual basis during its first two years of operation. Thereafter, it would be leased to the general public on demand. Currie would sell it at the end of the fifth year of its useful life. The expected cash inflows and outflows follow. Cash Inflow Cash Outflow S86,000 Year Nature of Item Year 1 Purchase price Year 1 Rovanus Year 2 Revenue Year 3 Revenue Year 3 Major overhaul Year 4 Revenge Year 5 Revenue Year 5 Salvage value $30,000 40,000 28,000 12,000 20,000 14,400 9,600 Required a.&b. Determine the payback period using the accumulated and average cash flows approaches. (Round your answers to 1 decimal place.) a. Payback period (accumulated cash flows) b. Payback period (average cash flows) 30 years years Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started