Answered step by step

Verified Expert Solution

Question

1 Approved Answer

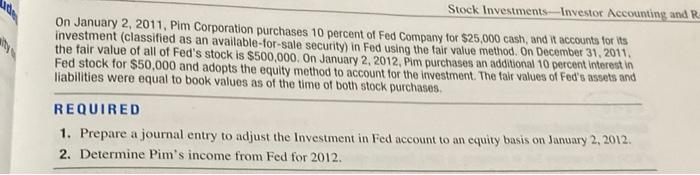

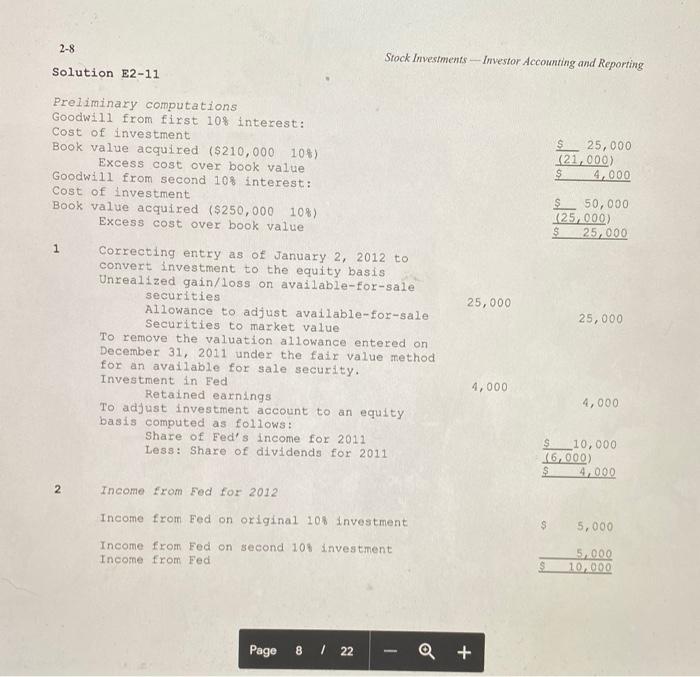

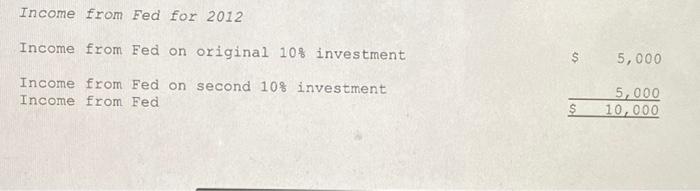

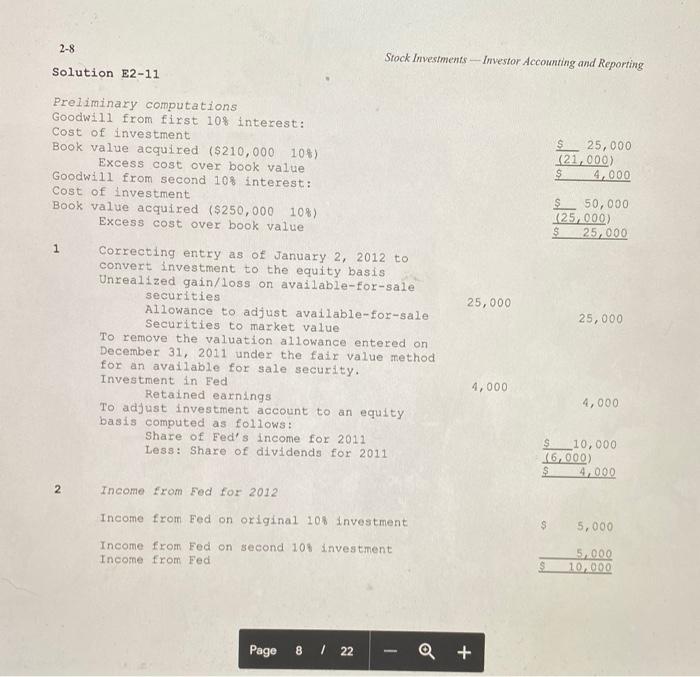

the answer is posted for this question but I dont know how they do the work on 2 to get 5,000 for each of the

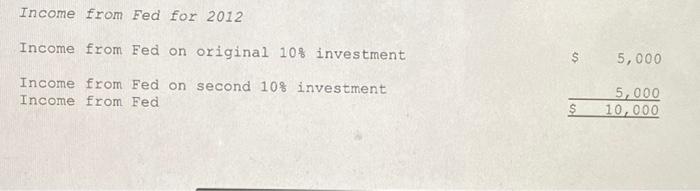

the answer is posted for this question but I dont know how they do the work on 2 to get 5,000 for each of the income from investment. could someone explain or show how they got those

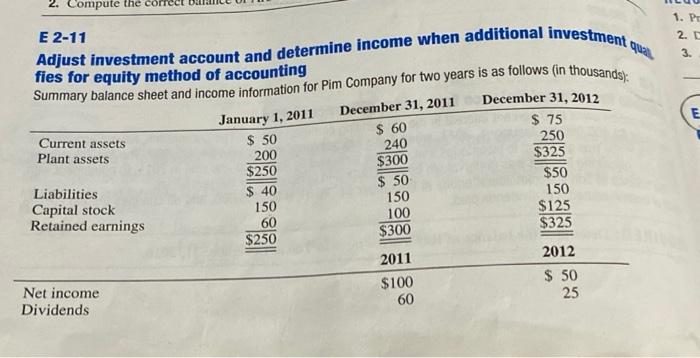

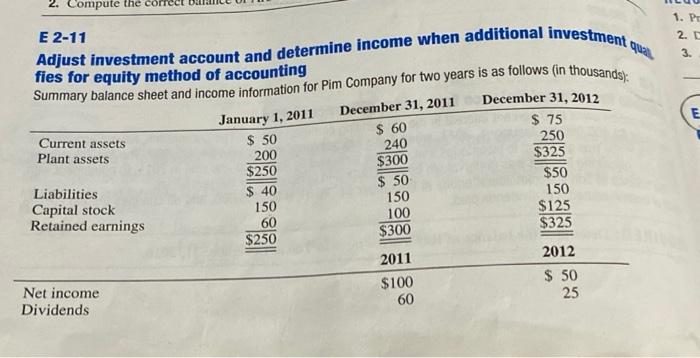

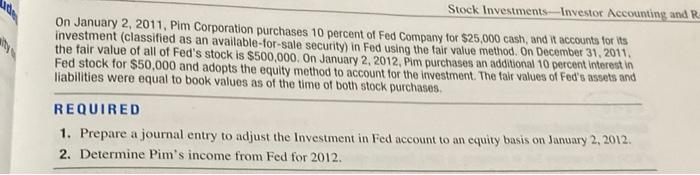

2. Compute the 1. Pr 2. que 3. E E January 1, 2011 E 2-11 Adjust investment account and determine income when additional investment fies for equity method of accounting Summary balance sheet and income information for Pim Company for two years is as follows (in thousands) December 31, 2012 $ 75 Current assets $ 50 250 Plant assets 200 $325 $250 $50 Liabilities 150 Capital stock 150 $125 Retained earnings 100 60 $325 $250 2011 2012 Net income $100 $ 50 25 60 Dividends December 31, 2011 $ 60 240 $300 $ 50 150 $ 40 $300 Stock Investments--Investor Accounting and R. On January 2, 2011. Pim Corporation purchases 10 percent of Fed Company for $25,000 cash, and it accounts for its investment (classified as an available-for-sale security) in Fed using the tair value method. On December 31, 2011. the fair value of all of Fed's stock is $500,000. On January 2, 2012, Pim purchases an additional 10 percent interest in Fed stock for $50,000 and adopts the equity method to account for the investment. The tale values of Fed's assets and liabilities were equal to book values as of the time of both stock purchases REQUIRED 1. Prepare a journal entry to adjust the Investment in Fed account to an equity basis on January 2, 2012 2. Determine Pim's income from Fed for 2012 2-8 Stock Investments - Investor Accounting and Reporting Solution E2-11 Preliminary computations Goodwill from first 10% interest: Cost of investment Book value acquired ($210,000 10%) Excess cost over book value Goodwill from second 10% interest: Cost of investment Book value acquired ($250,000 108) Excess cost over book value 25,000 (21,000) $ 4,000 $ 50,000 (25,000) $ 25,000 1 25,000 25,000 Correcting entry as of January 2, 2012 to convert investment to the equity basis Unrealized gain/loss on available-for-sale securities Allowance to adjust available-for-sale Securities to market value To remove the valuation allowance entered on December 31, 2011 under the fair value method for an available for sale security. Investment in Eed Retained earnings To adjust investment account to an equity basis computed as follows: Share of Fed's income for 2011 Less: Share of dividends for 2011 4,000 4,000 $ -10,000 (6,000) 4,000 N Income from Fed for 2012 Income from Fed on original 108 investment $ 5,000 Income from Fed on second 10% investment Income from Fed $ 5.000 10,000 Page 8 / 22 Q + Income from Fed for 2012 Income from Fed on original 10% investment 02 5,000 Income from Fed on second 10% investment Income from Fed 5,000 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started