Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answer must include an analysis of the pertinent of the relevant legislation, rulings and the relevant case law and give reasons? Mohan sells computers

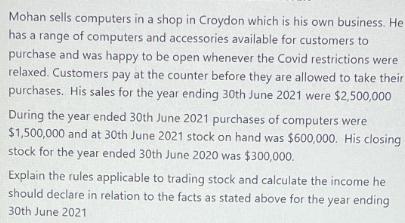

Mohan sells computers in a shop in Croydon which is his own business. He has a range of computers and accessories available for customers to purchase and was happy to be open whenever the Covid restrictions were relaxed. Customers pay at the counter before they are allowed to take their purchases. His sales for the year ending 30th June 2021 were $2,500,000 During the year ended 30th June 2021 purchases of computers were $1,500,000 and at 30th June 2021 stock on hand was $600,000. His closing stock for the year ended 30th June 2020 was $300,000. Explain the rules applicable to trading stock and calculate the income he should declare in relation to the facts as stated above for the year ending 30th June 2021

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The rules applicable to trading stock determine how businesses should account for their inventory fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started