the answer should be similer to this.

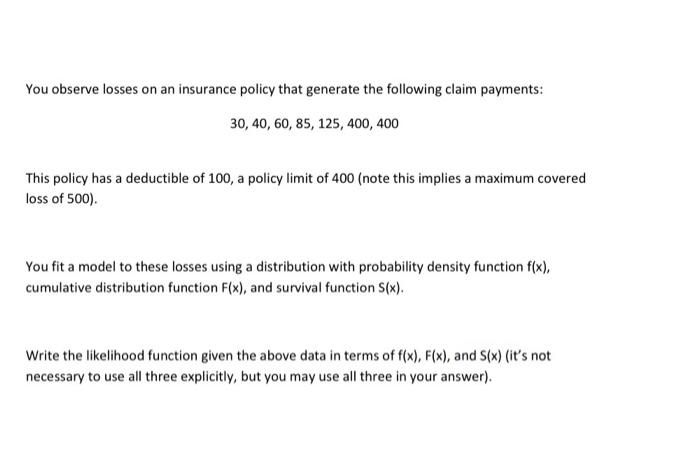

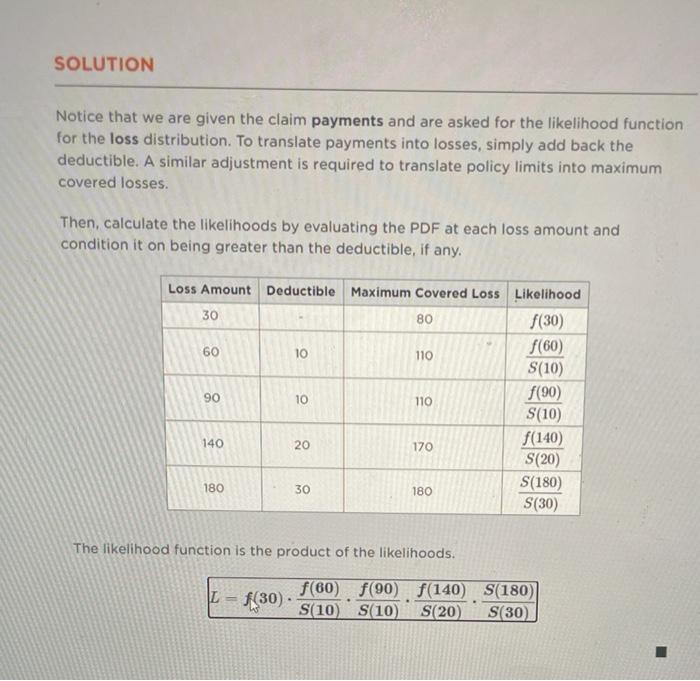

You observe losses on an insurance policy that generate the following claim payments: 30, 40, 60, 85, 125, 400, 400 This policy has a deductible of 100, a policy limit of 400 (note this implies a maximum covered loss of 500). You fit a model to these losses using a distribution with probability density function f(x), cumulative distribution function F(x), and survival function S(x). Write the likelihood function given the above data in terms of f(x), F(x), and S(x) (it's not necessary to use all three explicitly, but you may use all three in your answer). SOLUTION Notice that we are given the claim payments and are asked for the likelihood function for the loss distribution. To translate payments into losses, simply add back the deductible. A similar adjustment is required to translate policy limits into maximum covered losses. Then, calculate the likelihoods by evaluating the PDF at each loss amount and condition it on being greater than the deductible, if any. f(30) Loss Amount Deductible Maximum Covered Loss Likelihood 30 80 f(60) 60 10 110 S(10) f(90) 10 110 S(10) 140 f(140) 170 S(20) S(180) 180 30 180 S(30) 90 20 The likelihood function is the product of the likelihoods. L = f(30) f(60) f(90) f(140) S(180) S(10) S(10) S(20) S(30) You observe losses on an insurance policy that generate the following claim payments: 30, 40, 60, 85, 125, 400, 400 This policy has a deductible of 100, a policy limit of 400 (note this implies a maximum covered loss of 500). You fit a model to these losses using a distribution with probability density function f(x), cumulative distribution function F(x), and survival function S(x). Write the likelihood function given the above data in terms of f(x), F(x), and S(x) (it's not necessary to use all three explicitly, but you may use all three in your answer). SOLUTION Notice that we are given the claim payments and are asked for the likelihood function for the loss distribution. To translate payments into losses, simply add back the deductible. A similar adjustment is required to translate policy limits into maximum covered losses. Then, calculate the likelihoods by evaluating the PDF at each loss amount and condition it on being greater than the deductible, if any. f(30) Loss Amount Deductible Maximum Covered Loss Likelihood 30 80 f(60) 60 10 110 S(10) f(90) 10 110 S(10) 140 f(140) 170 S(20) S(180) 180 30 180 S(30) 90 20 The likelihood function is the product of the likelihoods. L = f(30) f(60) f(90) f(140) S(180) S(10) S(10) S(20) S(30)