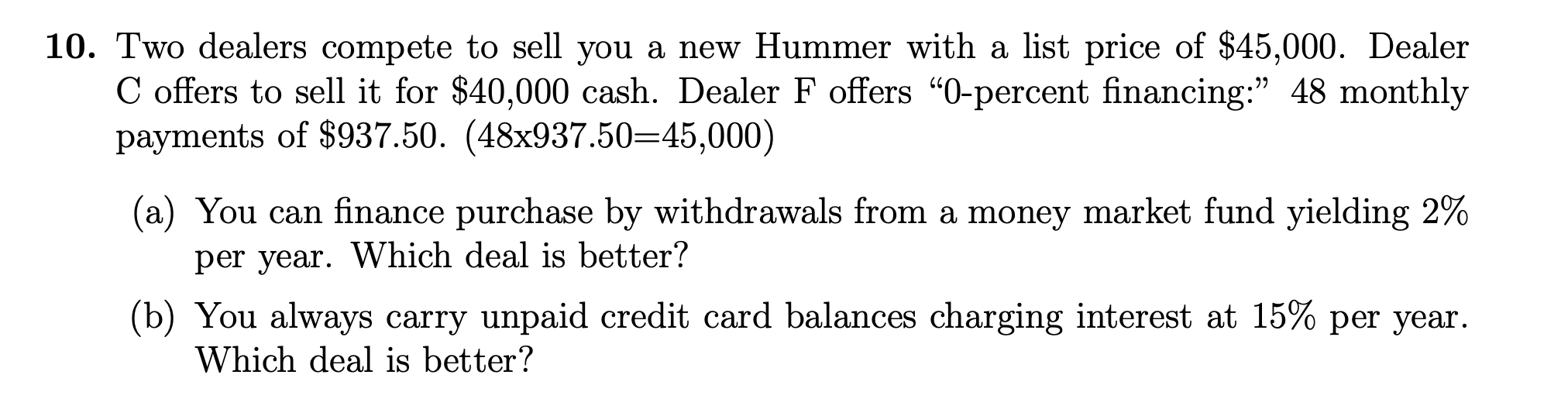

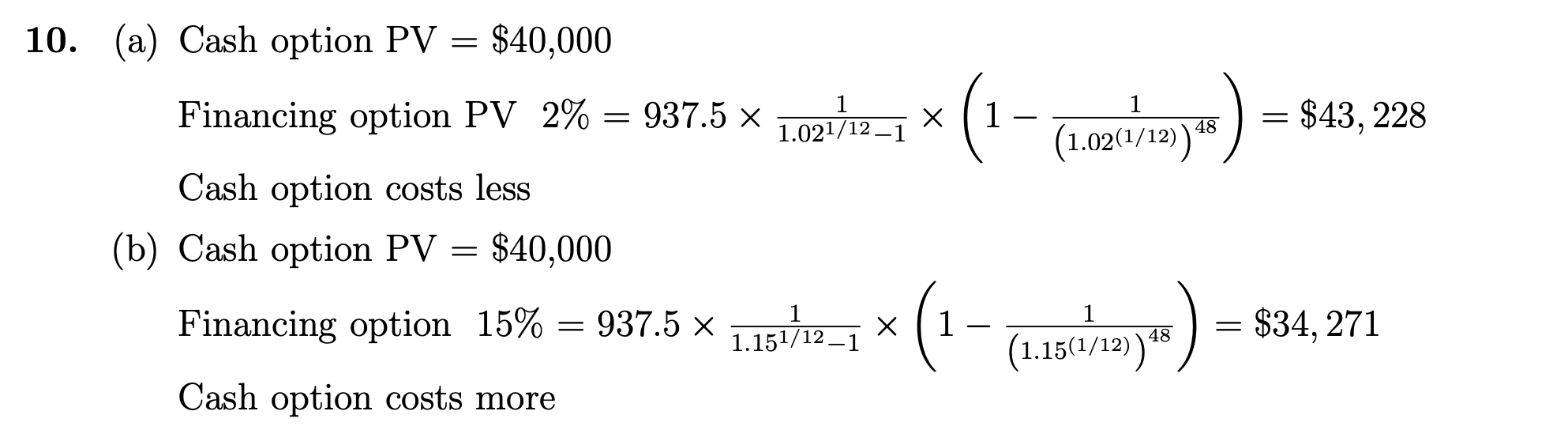

Question

The answer to this problem is provided above, but can someone explain the intuition behind these results? I am confused because the interest rate of

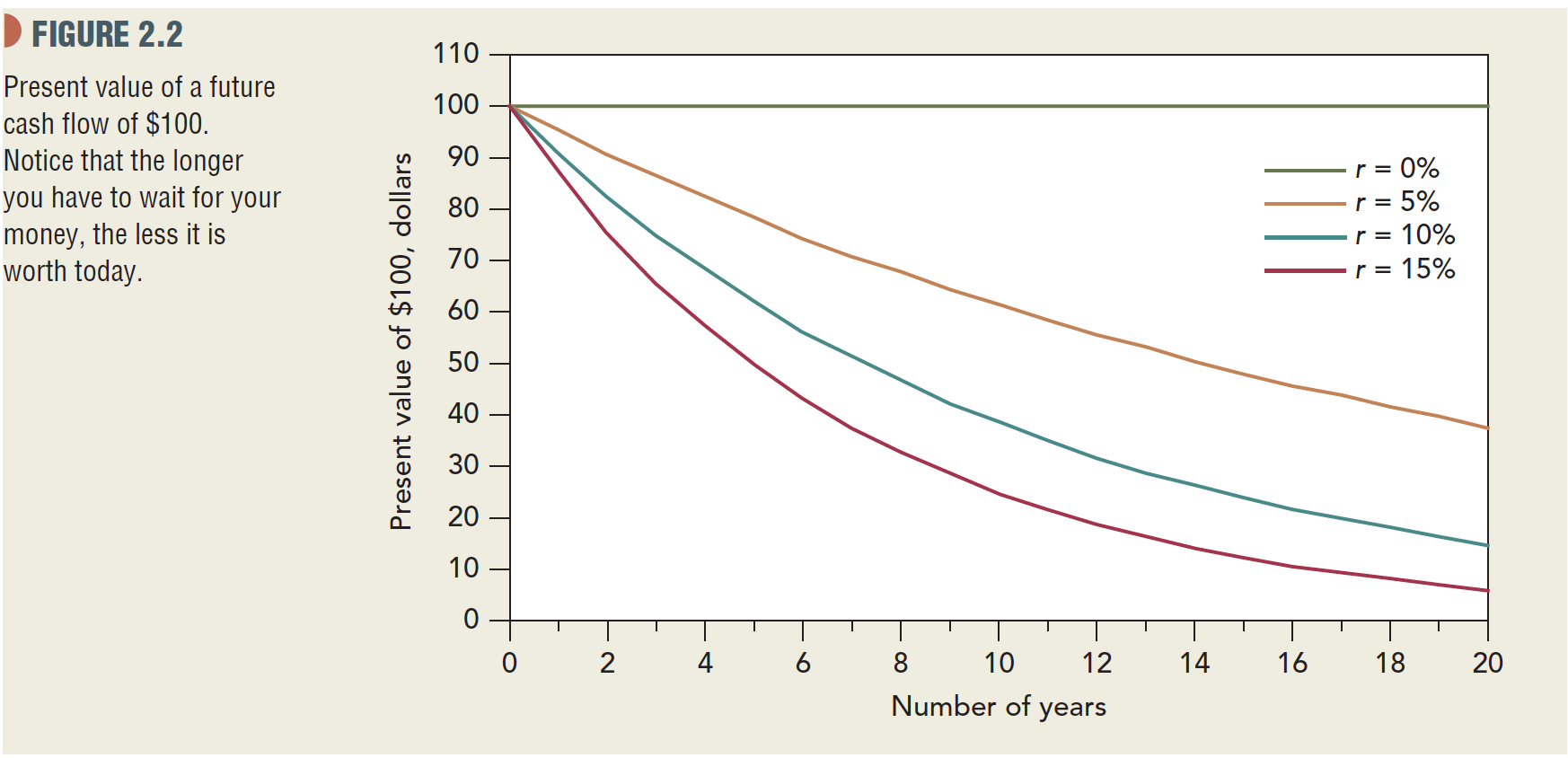

The answer to this problem is provided above, but can someone explain the intuition behind these results? I am confused because the interest rate of 2% for part A is an opportunity cost, while the interest rate for part B is a cost of capital. I do not understand why these are treated as the same variable in these two cases even though they each have different implications. The fact that the credit card financed at 15% interest offers a better present value alternative appears to be very counter intuitive to me. I need some help with this intuition! It is the same intuition as is displayed in the graph below.. It does not make sense to me why $100 at 15% in 20 years has a lower present value than $100 at 5% in 20 years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started