Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the answer was incomplete as per requirement Revision Question Current tax worksheets and tax entries Merelyn Ltd reported a profit before tax for the year

the answer was incomplete as per requirement

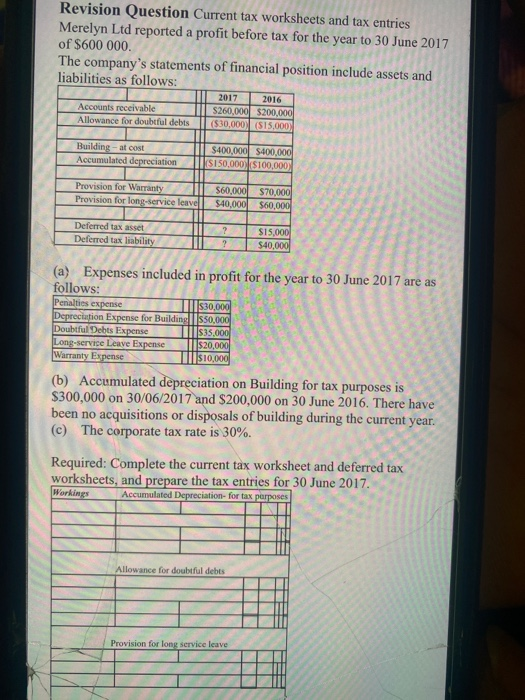

Revision Question Current tax worksheets and tax entries Merelyn Ltd reported a profit before tax for the year to 30 June 2017 of $600 000. The company's statements of financial position include assets and liabilities as follows: Accounts receivable Allowance for doubtful debts 2017 2016 S260,000 $200,000 ($30,000 (515,000) Building - at cost Accumulated depreciation $400,000 $400,000 (S150,000 $100,000 Provision for Warranty Provision for long-service leave S60,000 $40,000 $70,000 $60,000 Deferred tax asset Deferred tax liability ? $15,000 ? $40,000 (a) Expenses included in profit for the year to 30 June 2017 are as follows: Penalties expense $30,000 Depreciation Expense for Building S50,000 Doubtful Debts Expense $35.000 Long-service Leave Expense $20,000 Warranty Expense $10,000 (b) Accumulated depreciation on Building for tax purposes is $300,000 on 30/06/2017 and $200,000 on 30 June 2016. There have been no acquisitions or disposals of building during the current year. (c) The corporate tax rate is 30%. Required: Complete the current tax worksheet and deferred tax worksheets, and prepare the tax entries for 30 June 2017 Workings Accumulated Depreciation for tax purposes Allowance for doubtful debts Provision for long service leave Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started