Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answers are 16,700 then 43.4%, and 39.43. I just don't know how to solve them. Please explain it on excel 4) Bluth Enterprises is

The answers are 16,700 then 43.4%, and 39.43. I just don't know how to solve them. Please explain it on excel

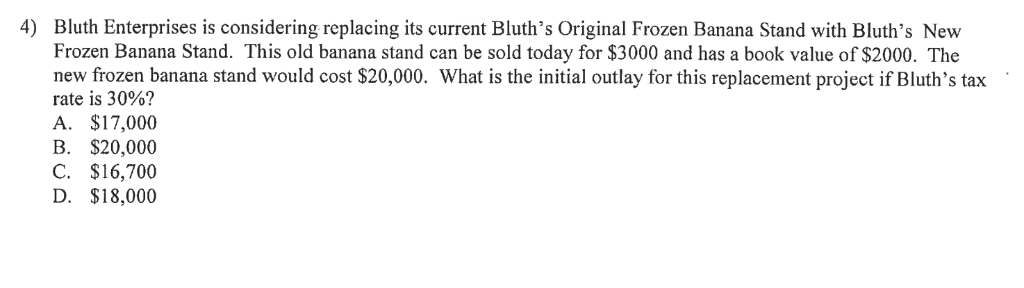

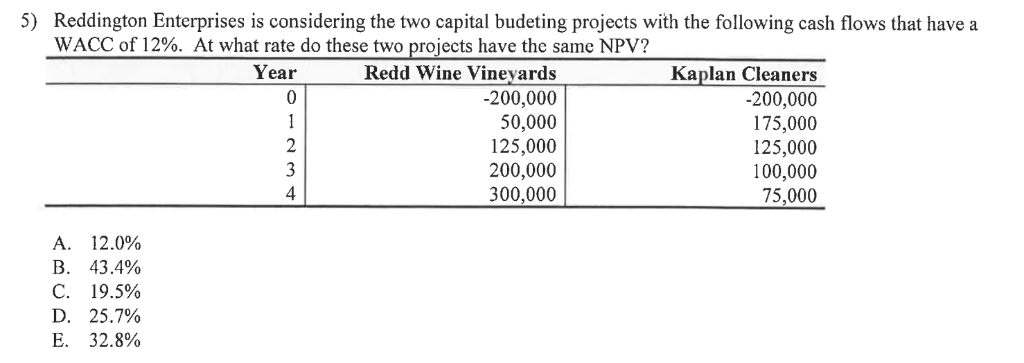

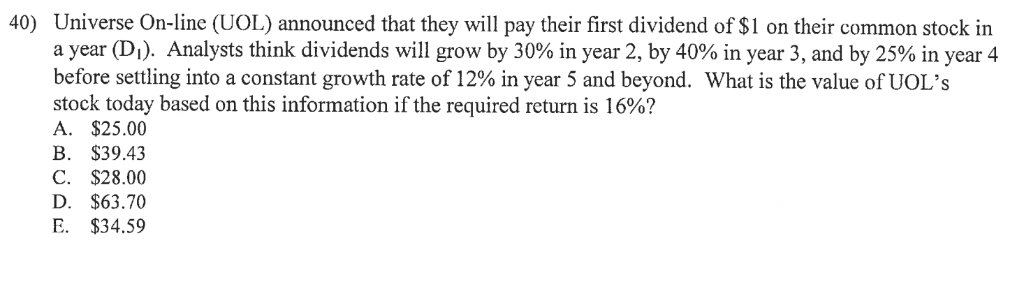

4) Bluth Enterprises is considering replacing its current Bluth's Original Frozen Banana Stand with Bluth's New Frozen Banana Stand. This old banana stand can be sold today for $3000 and has a book value of $2000. The new frozen banana stand would cost $20,000. What is the initial outlay for this replacement project if Bluth's tax rate is 30%? A. $17,000 B. $20,000 C. $16,700 D. $18,000 5) Reddington Enterprises is considering the two capital budeting projects with the following cash flows that have a WACC of 12%. At what rate do these two projects have the same NPV? Year Redd Wine Vineyards -200,000 50,000 125,000 200,000 300,000 Kaplan Cleaners -200,000 175,000 125,000 100,000 75,000 2 3 4 A. 12.0% B. 43.4% C. 19.5% 25.7% E 32.8% 40) Universe On-line (UOL) announced that they will pay their first dividend of $1 on their common stock in a year (D). Analysts think dividends will grow by 30% in year 2, by 40% in year 3, and by 25% in year 4 before settling into a constant growth rate of 12% in year 5 and beyond. What is the value of UOL's stock today based on this information if the required return is 16%? $25.00 A. $39.43 . C $28.00 $63.70 E D. $34.59Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started