Question

The answers are listed below, but I am unsure how to get those answers. For the next year, Dunder-Mifflin is planning to expand its paper

The answers are listed below, but I am unsure how to get those answers.

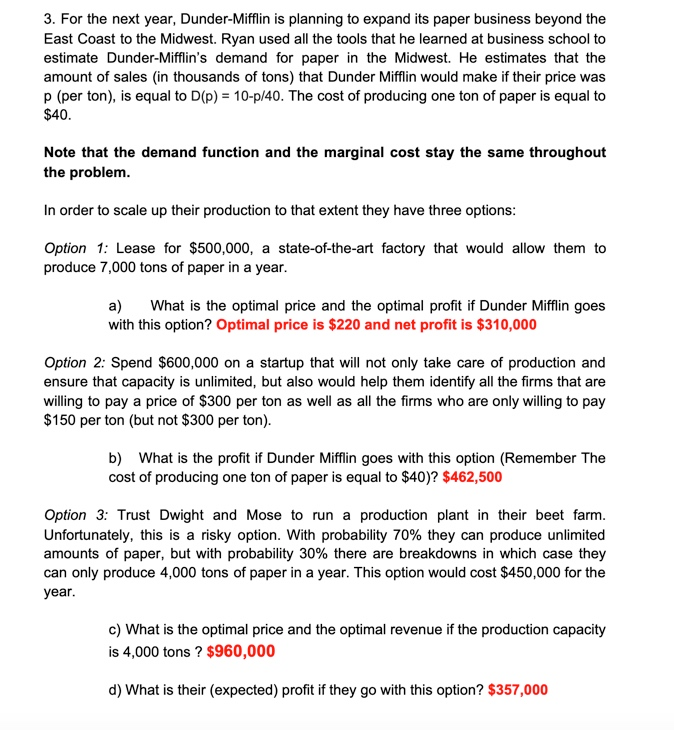

For the next year, Dunder-Mifflin is planning to expand its paper business beyond the East Coast to the Midwest. Ryan used all the tools that he learned at business school to estimate Dunder-Mifflins demand for paper in the Midwest. He estimates that the amount of sales (in thousands of tons) that Dunder Mifflin would make if their price was p (per ton), is equal to D(p) = 10-p/40. The cost of producing one ton of paper is equal to $40.

Note that the demand function and the marginal cost stay the same throughout the problem.

In order to scale up their production to that extent they have three options:

Option 1: Lease for $500,000, a state-of-the-art factory that would allow them to produce 7,000 tons of paper in a year.

a) What is the optimal price and the optimal profit if Dunder Mifflin goes with this option? Optimal price is $220 and net profit is $310,000

Option 2: Spend $600,000 on a startup that will not only take care of production and ensure that capacity is unlimited, but also would help them identify all the firms that are willing to pay a price of $300 per ton as well as all the firms who are only willing to pay $150 per ton (but not $300 per ton).

b) What is the profit if Dunder Mifflin goes with this option (Remember The cost of producing one ton of paper is equal to $40)? $462,500

Option 3: Trust Dwight and Mose to run a production plant in their beet farm. Unfortunately, this is a risky option. With probability 70% they can produce unlimited amounts of paper, but with probability 30% there are breakdowns in which case they can only produce 4,000 tons of paper in a year. This option would cost $450,000 for the year.

c) What is the optimal price and the optimal revenue if the production capacity is 4,000 tons ? $960,000

d) What is their (expected) profit if they go with this option? $357,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started