Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the answers are provided as this is a review, I need help on how to solve number 3 & 4. Assets (in Millions) Current Liabilities

the answers are provided as this is a review, I need help on how to solve number 3 & 4.

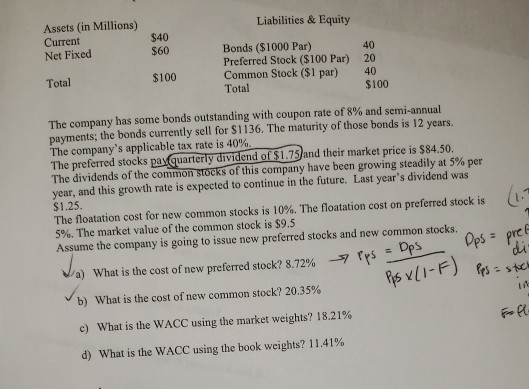

Assets (in Millions) Current Liabilities & Equity $40 $60 Net Fixed Bonds ($1000 Par) Preferred Stock ($100 Par) Common Stock ($1 par) Total 40 20 40 $100 Total $100 The company has some bonds outstanding with coupon rate of 8% and semi-annual payments; the bonds currently sell for $1136. The maturity of those bonds is 12 years. The company's applicableateis400% The preferred stocks paxquarterly dividend of $1.75 and their market price is $84.50. The dividends of the common tocks ofth scompany have been growing steadily at 5% per year, and this growth rate is expected to continue in the future. Last year's dividend was $1.25 The floatation cost for new common stocks is 10%. The floatation cost on preferred stock is 5%. The market value of the common stock is $9.5 Assume the company is going to issue new preferred stocks and new common stocks. -o - 4 . d oos- a) What is the cost of new preferred stock? 8.72% -9 rrs- b) What is the cost of new common stock? 20.35% c) What is the WACC using the market weights? 18.21% d) What is the WACC using the book weights? 1 1 .41%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started