The Appendix Info is attached at the bottom. Please help with these questions.

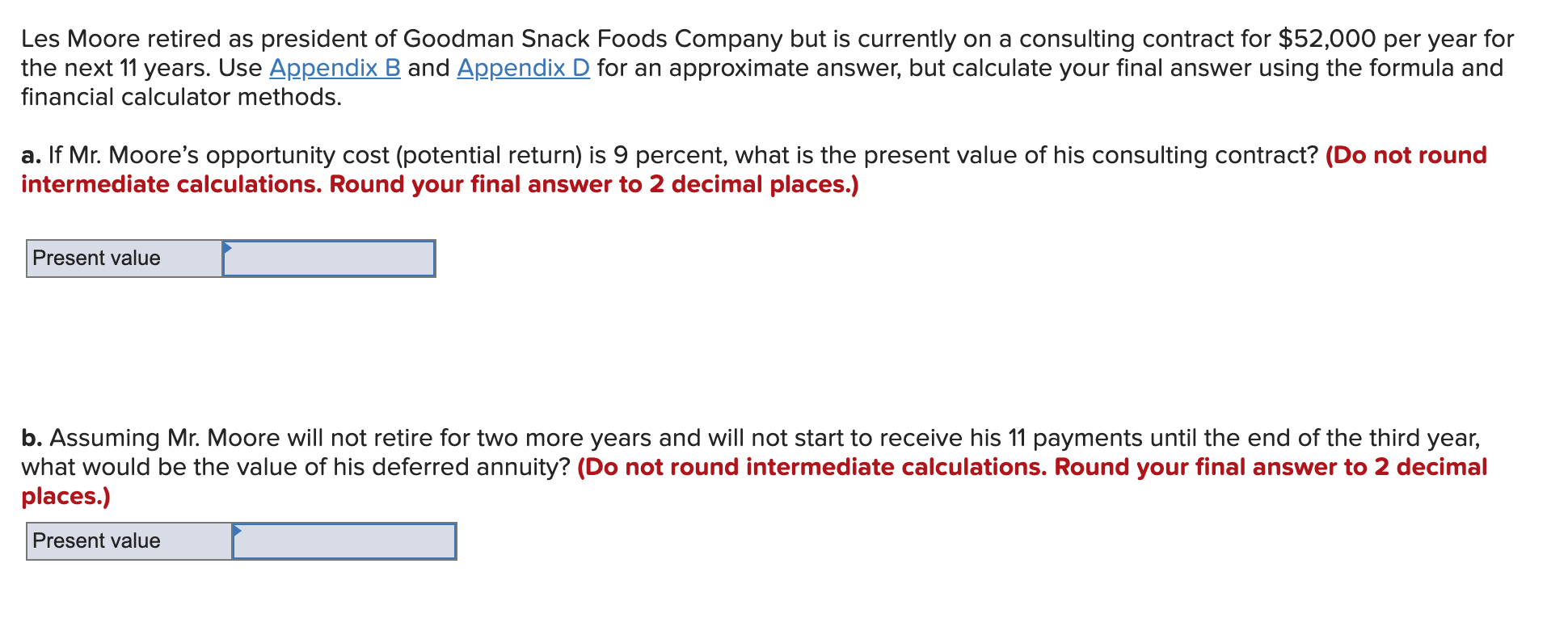

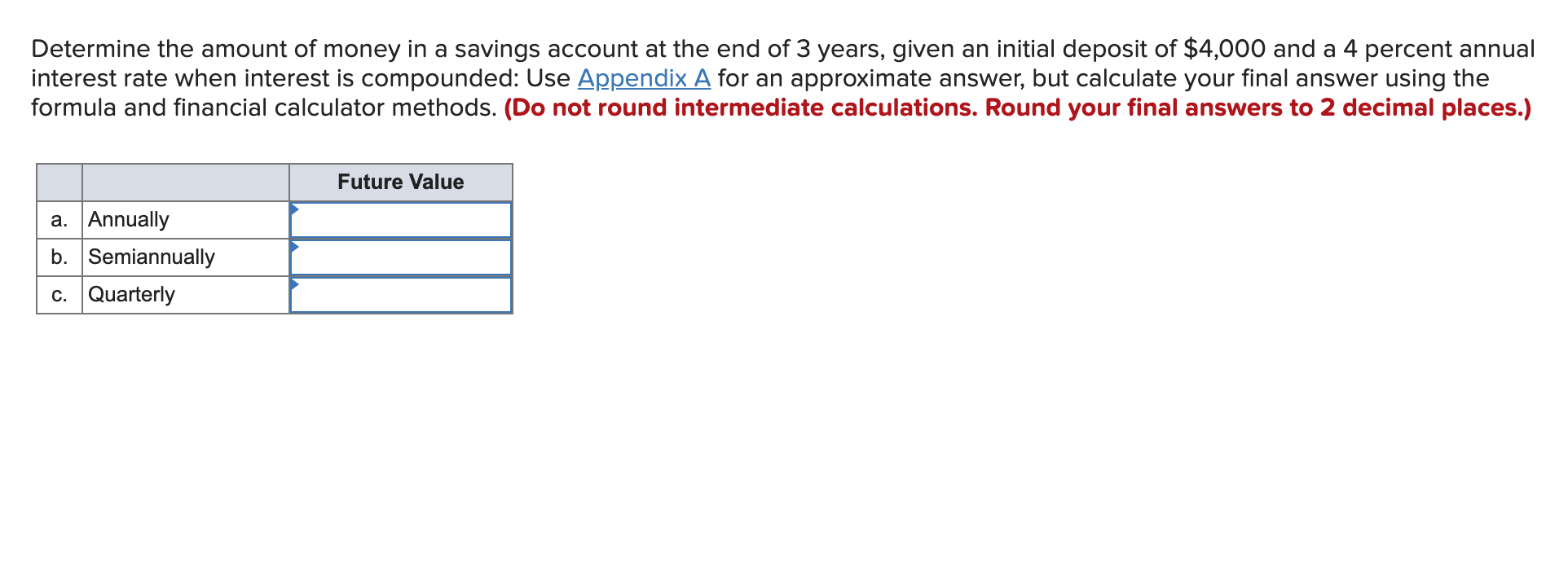

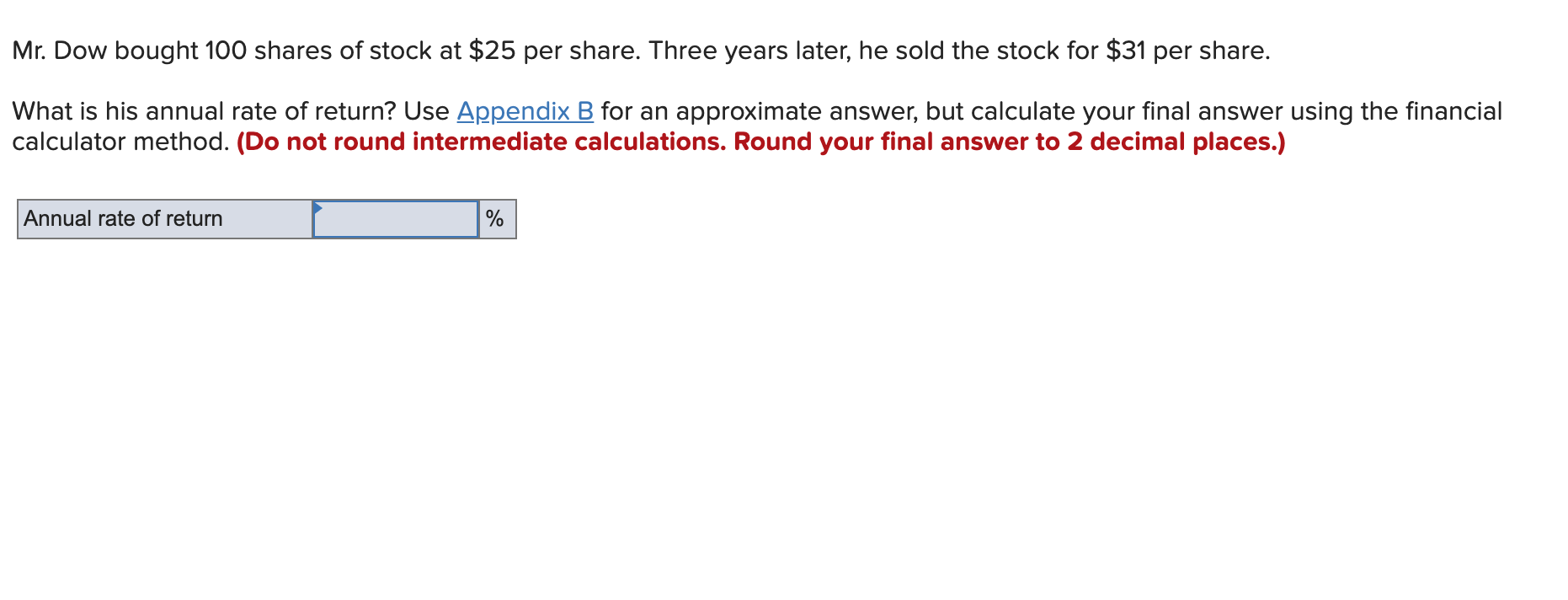

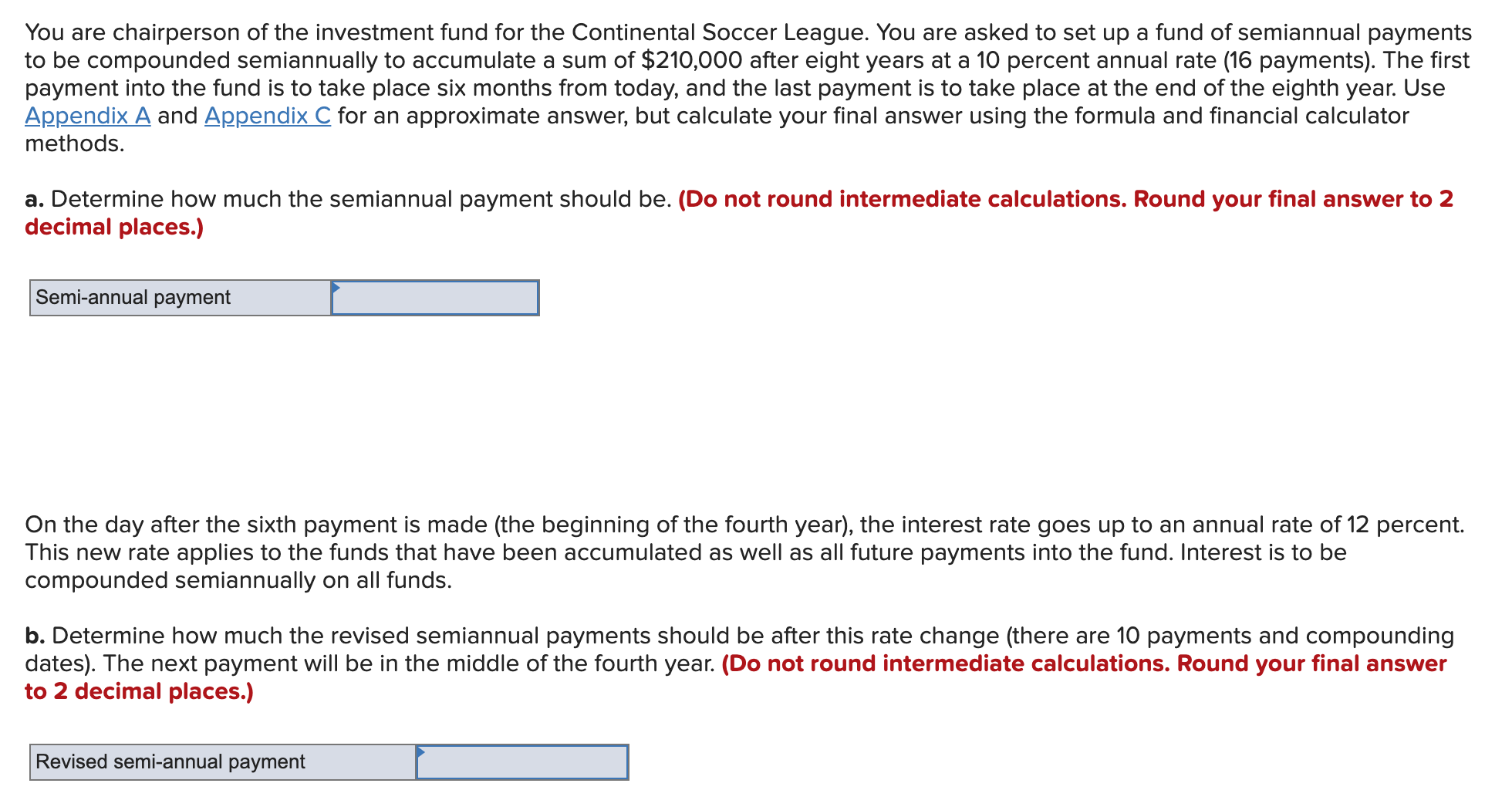

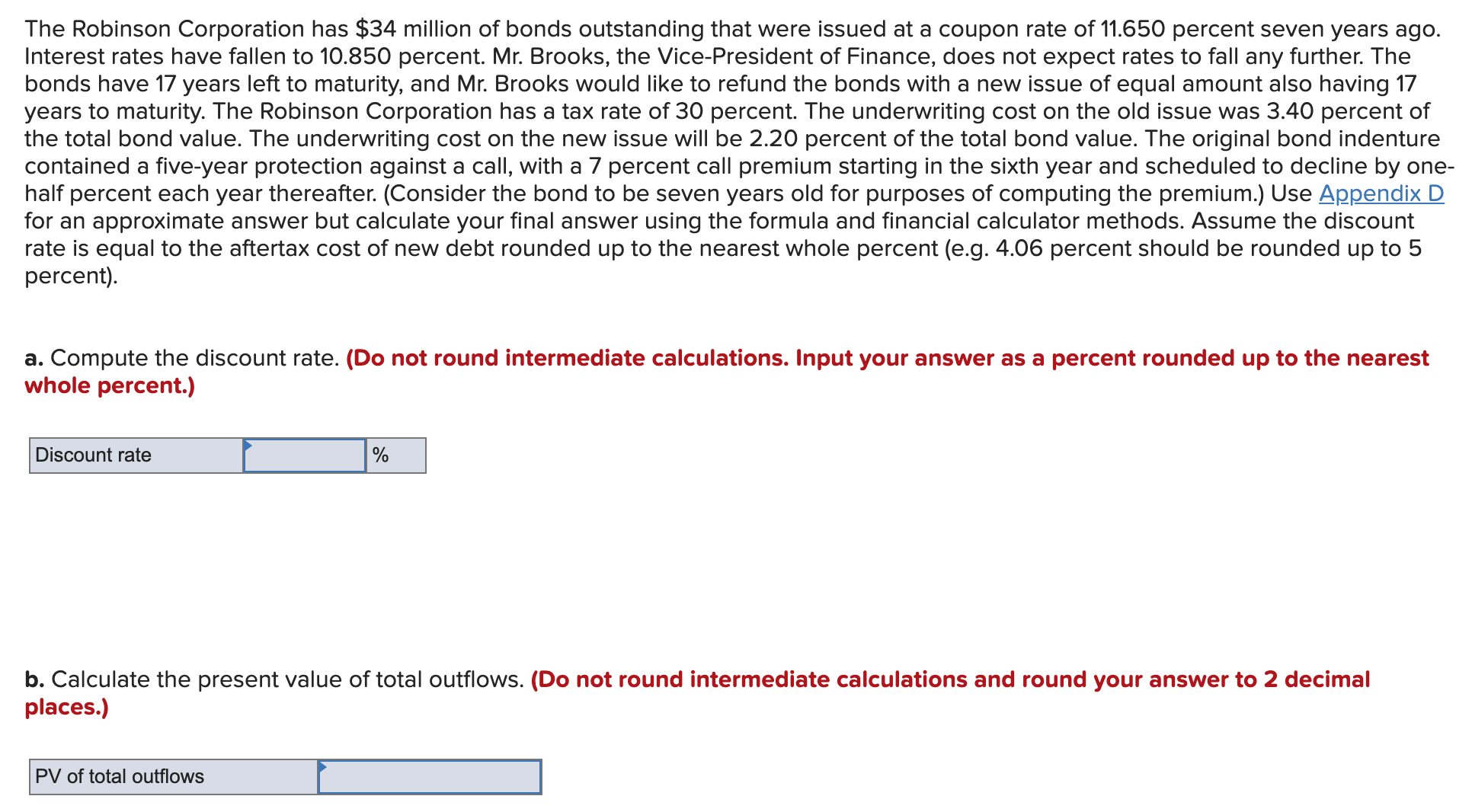

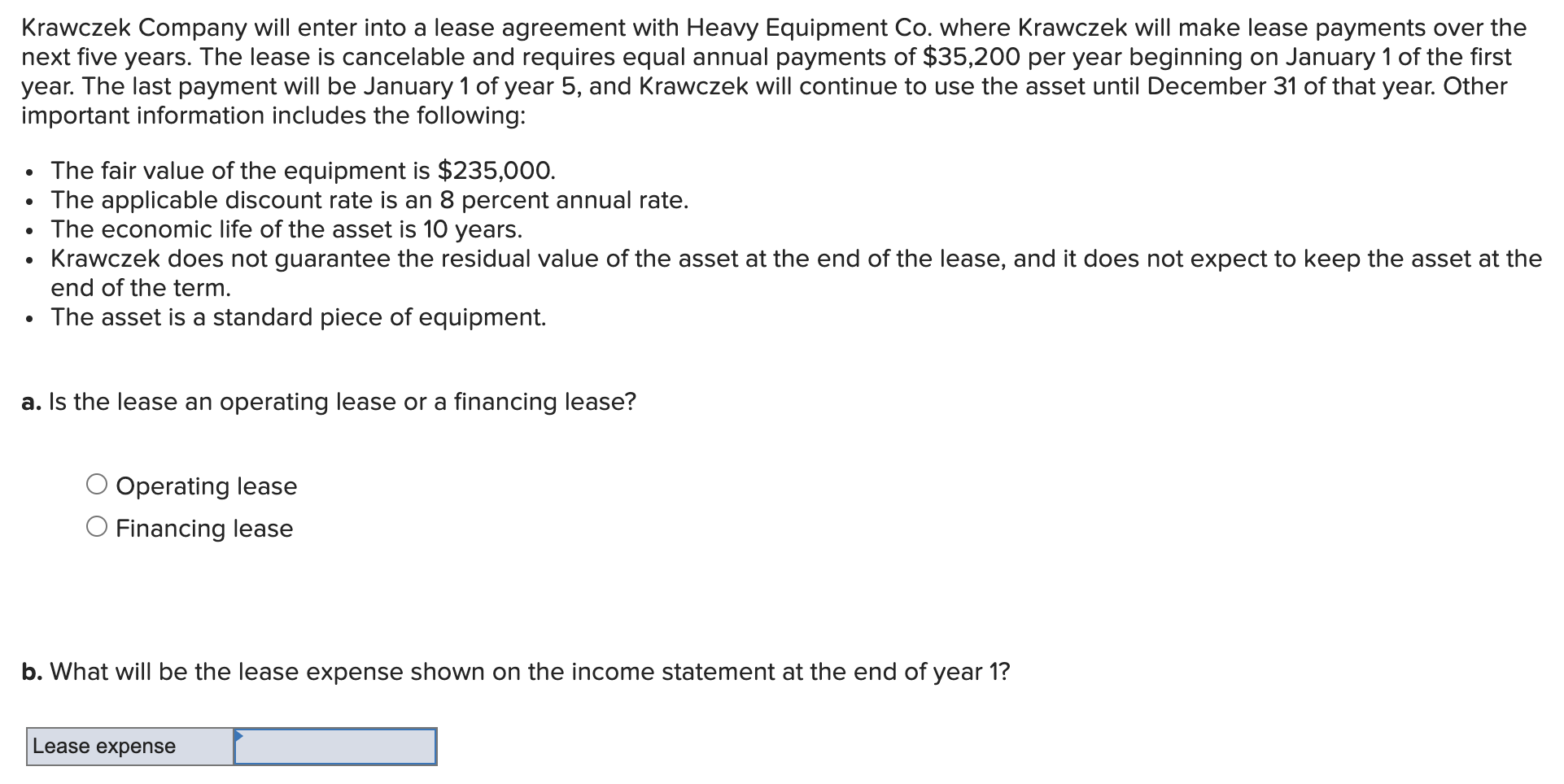

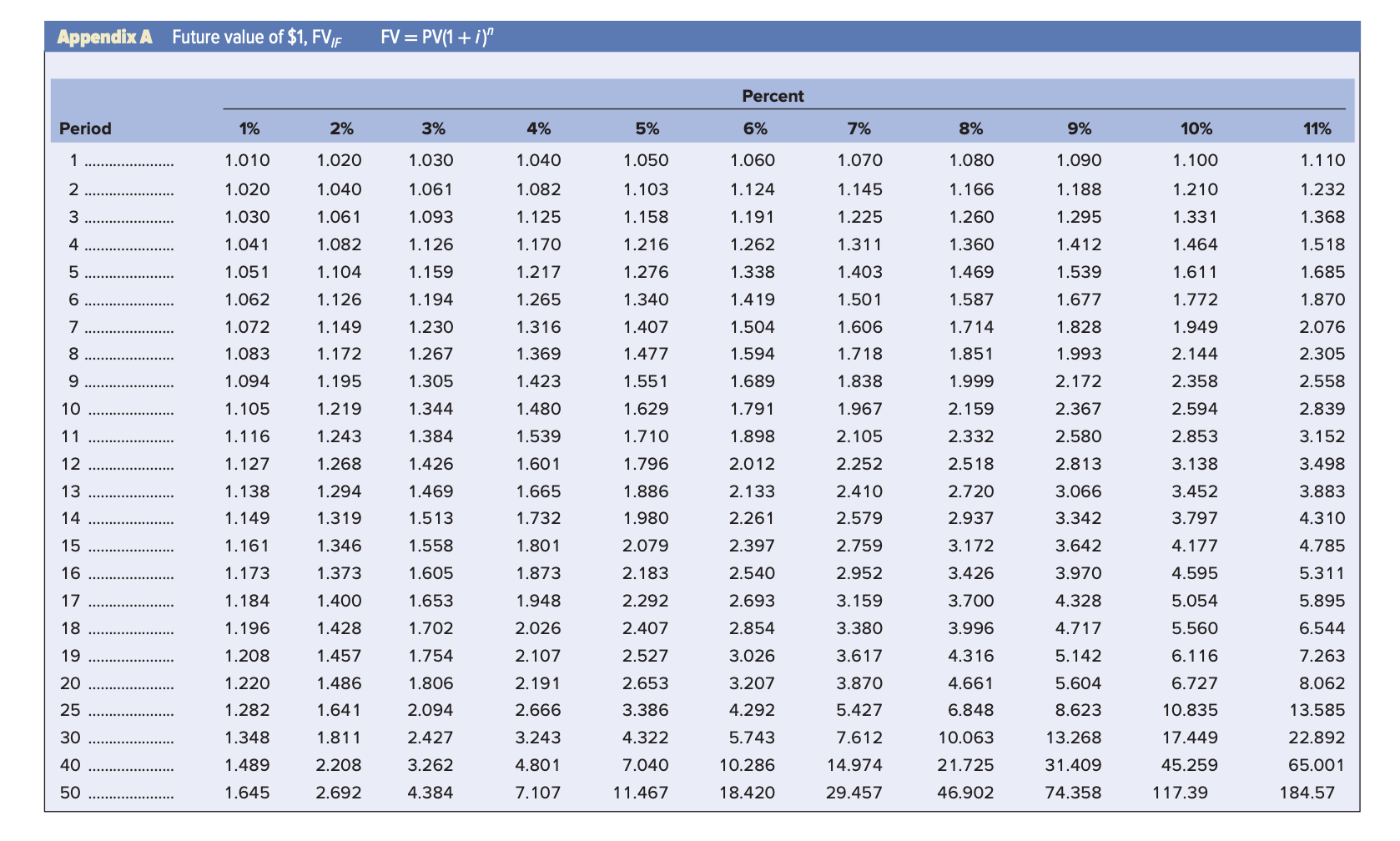

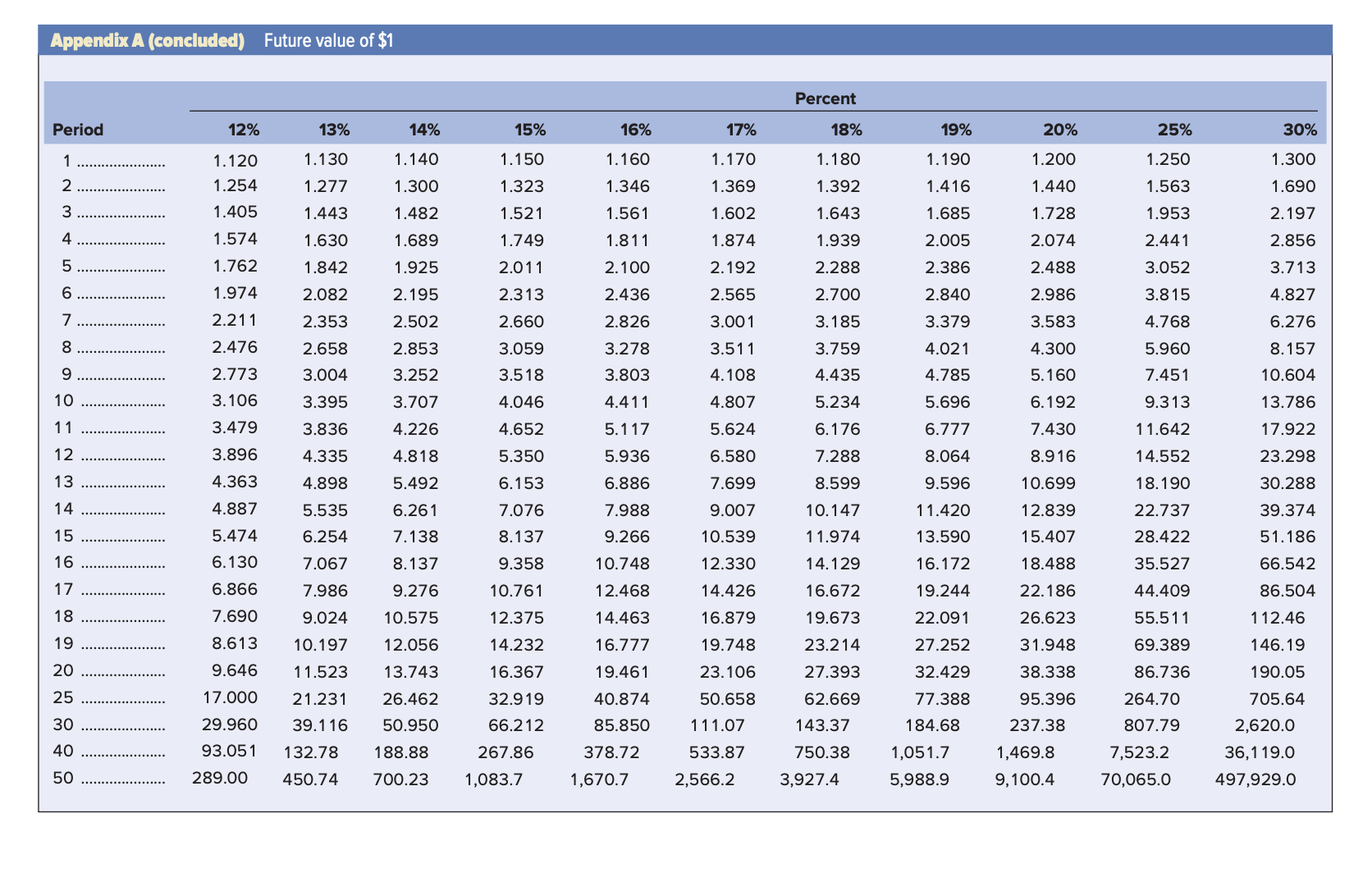

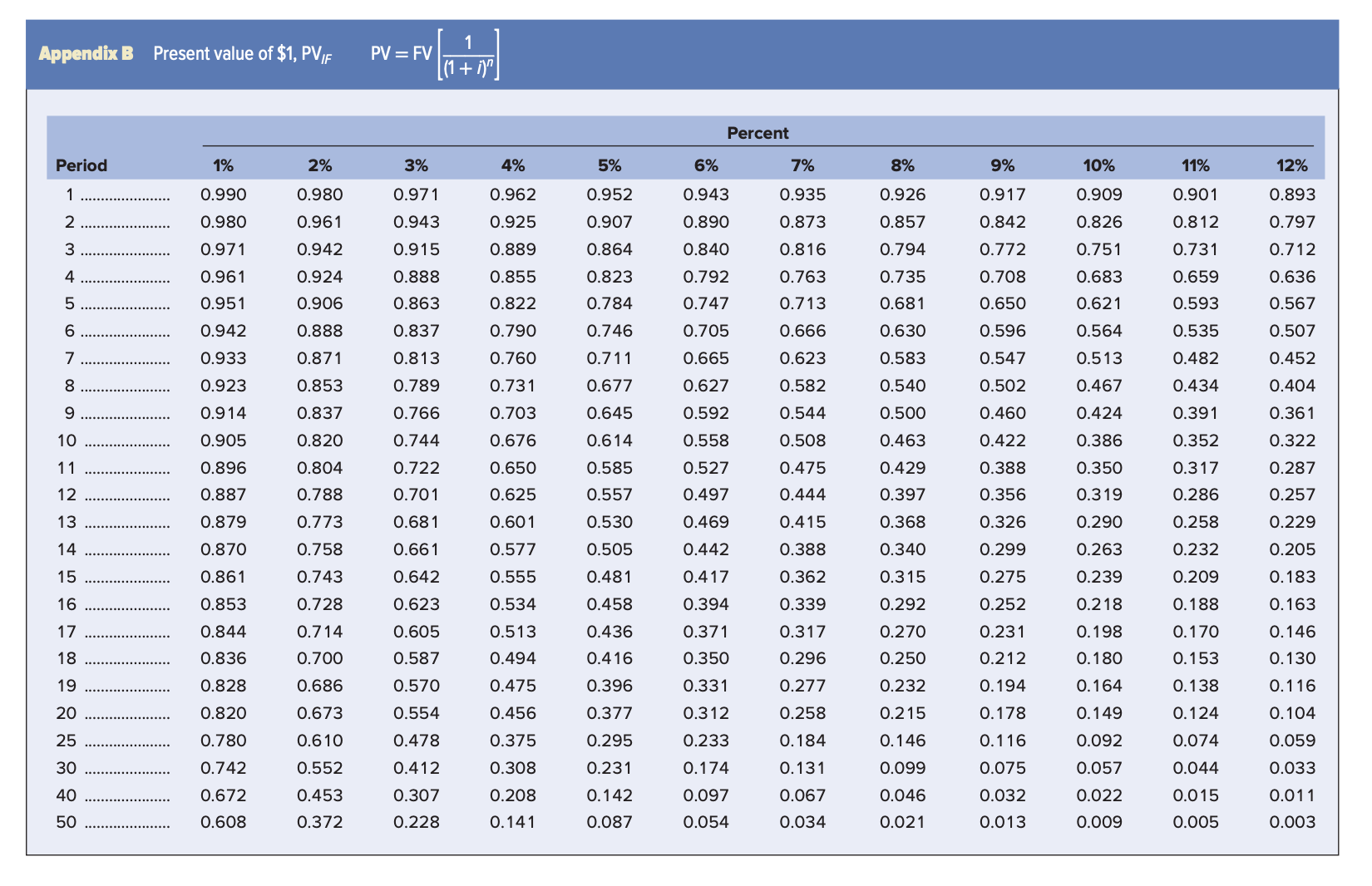

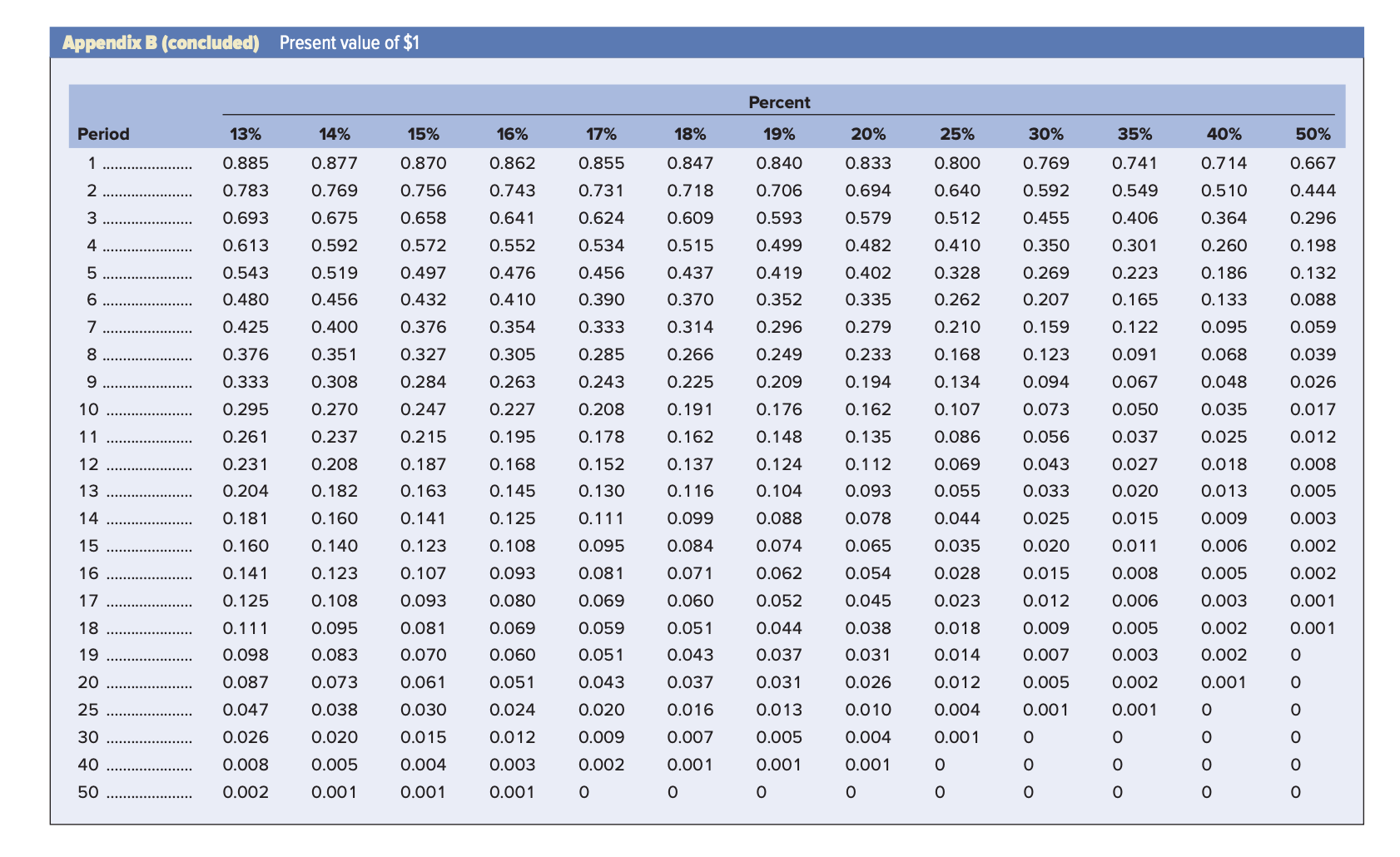

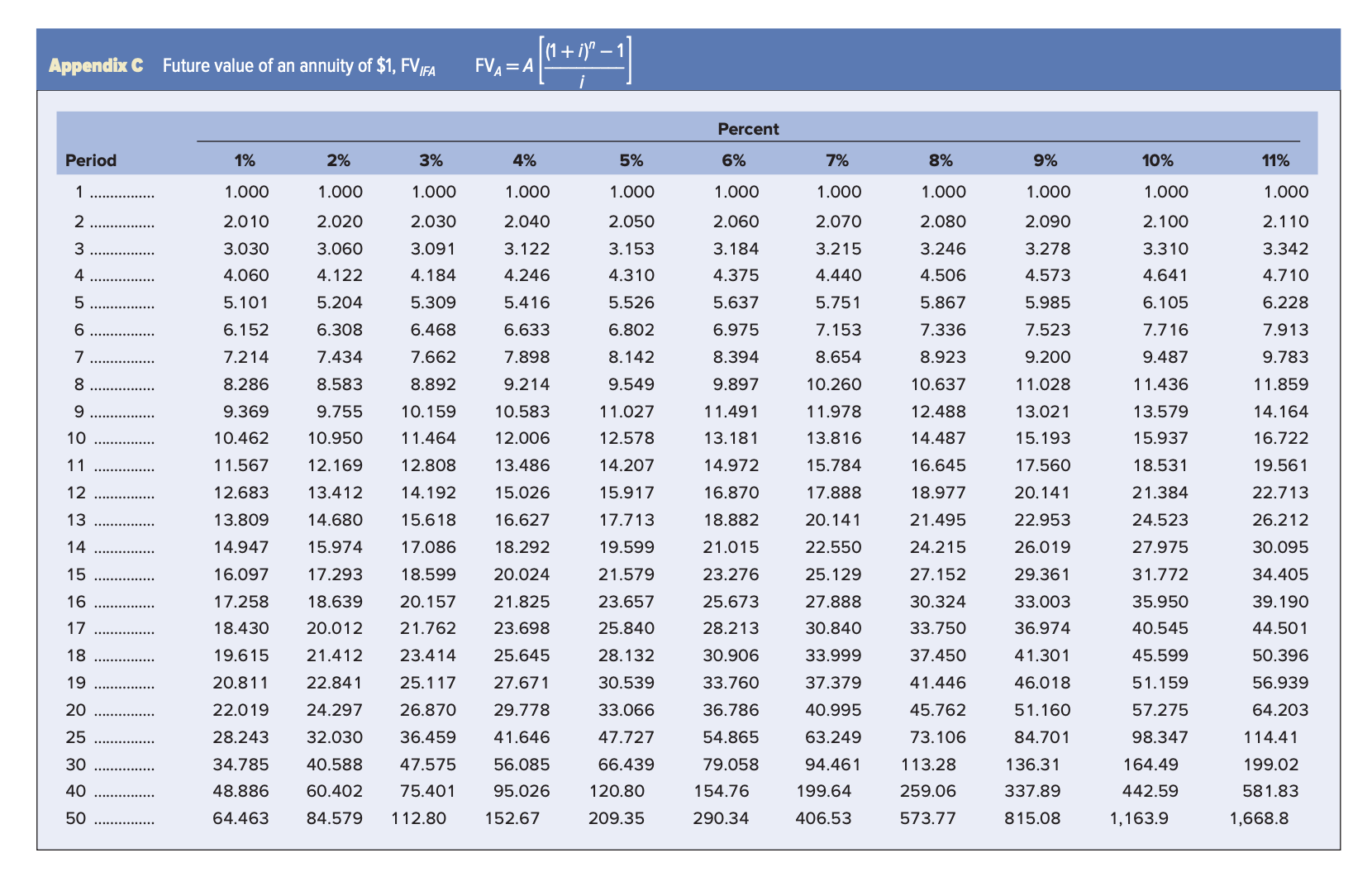

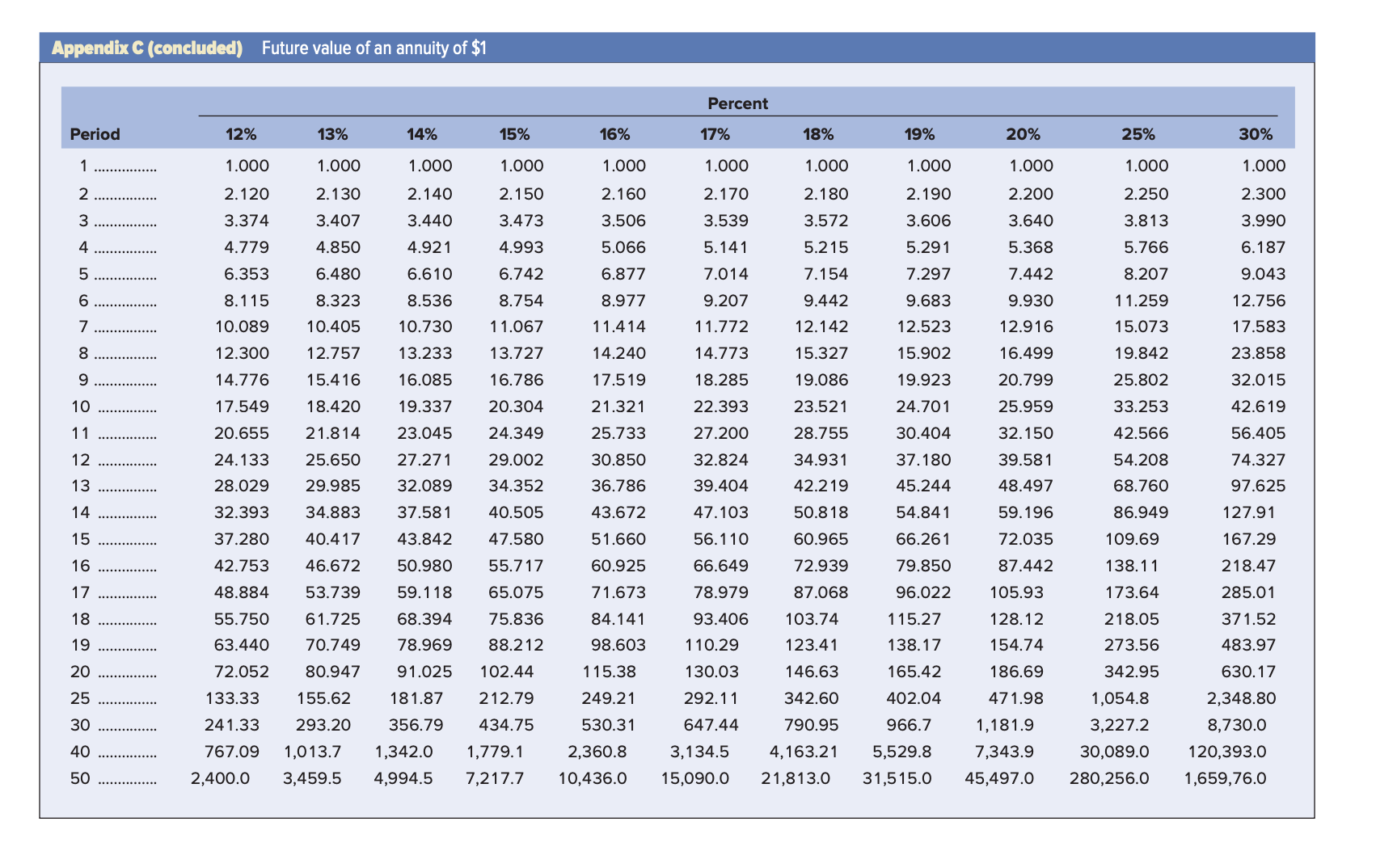

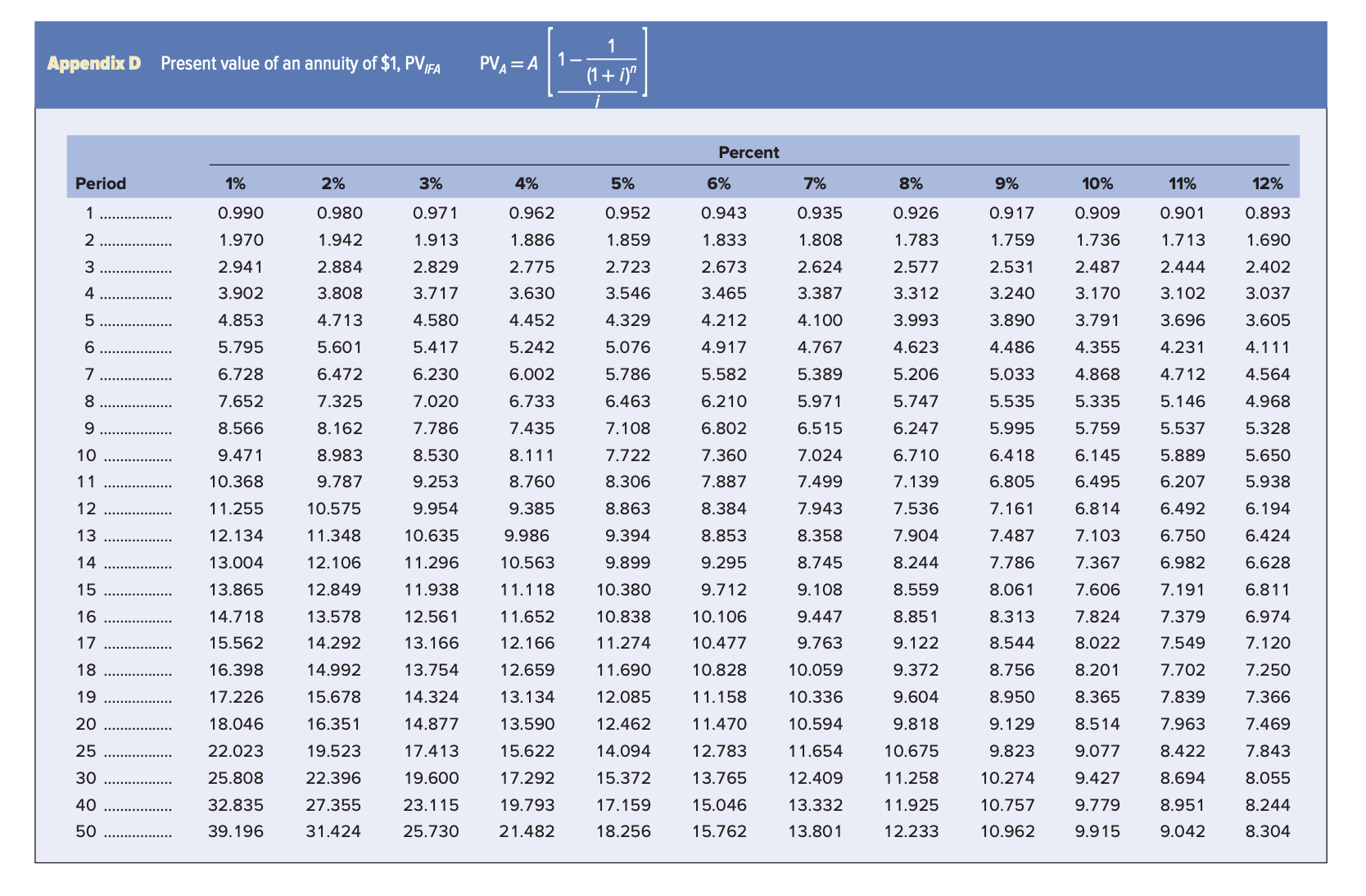

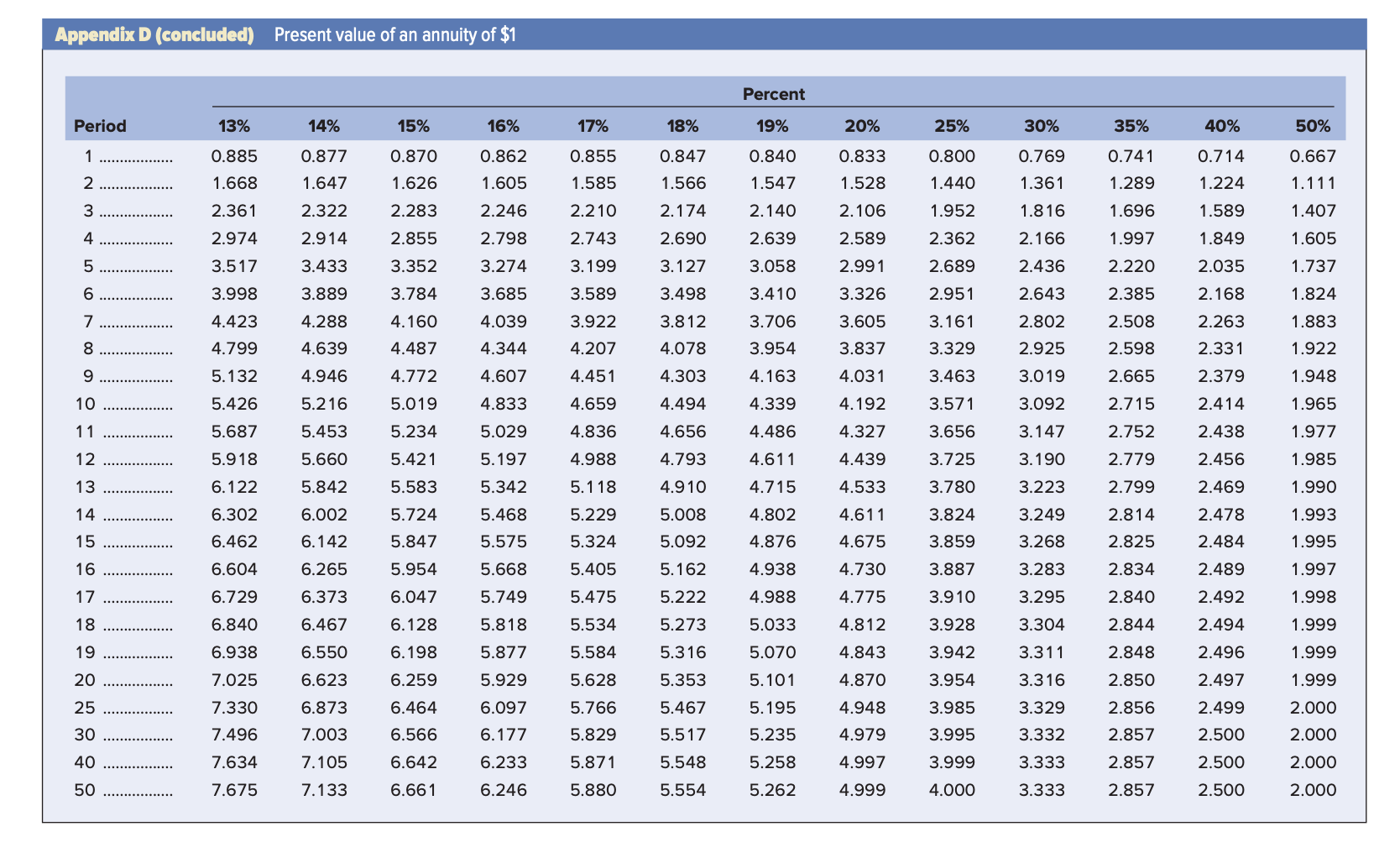

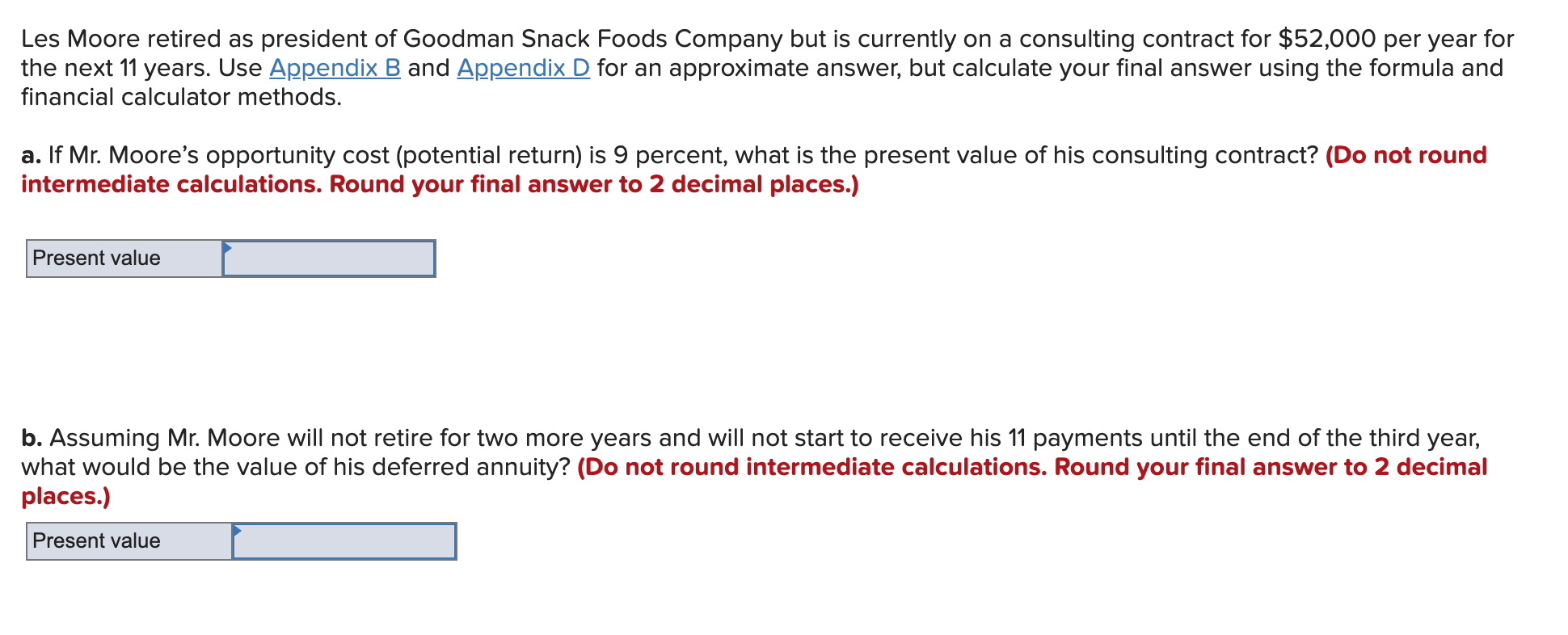

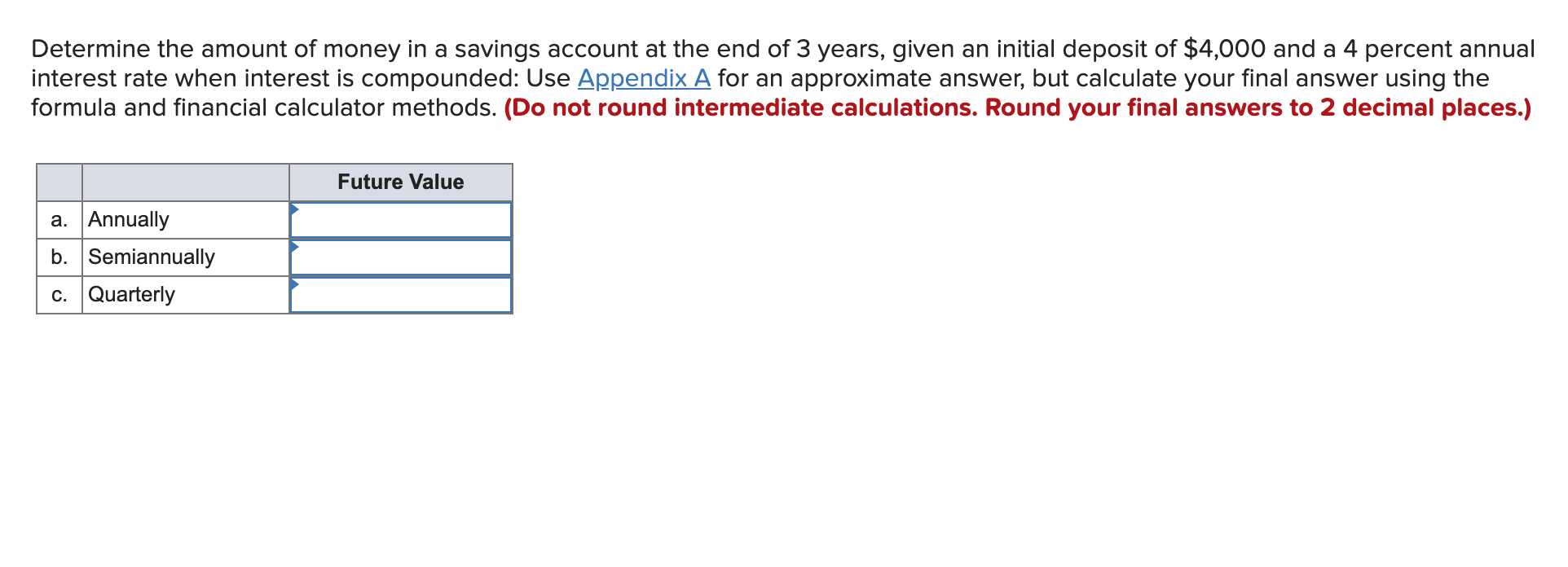

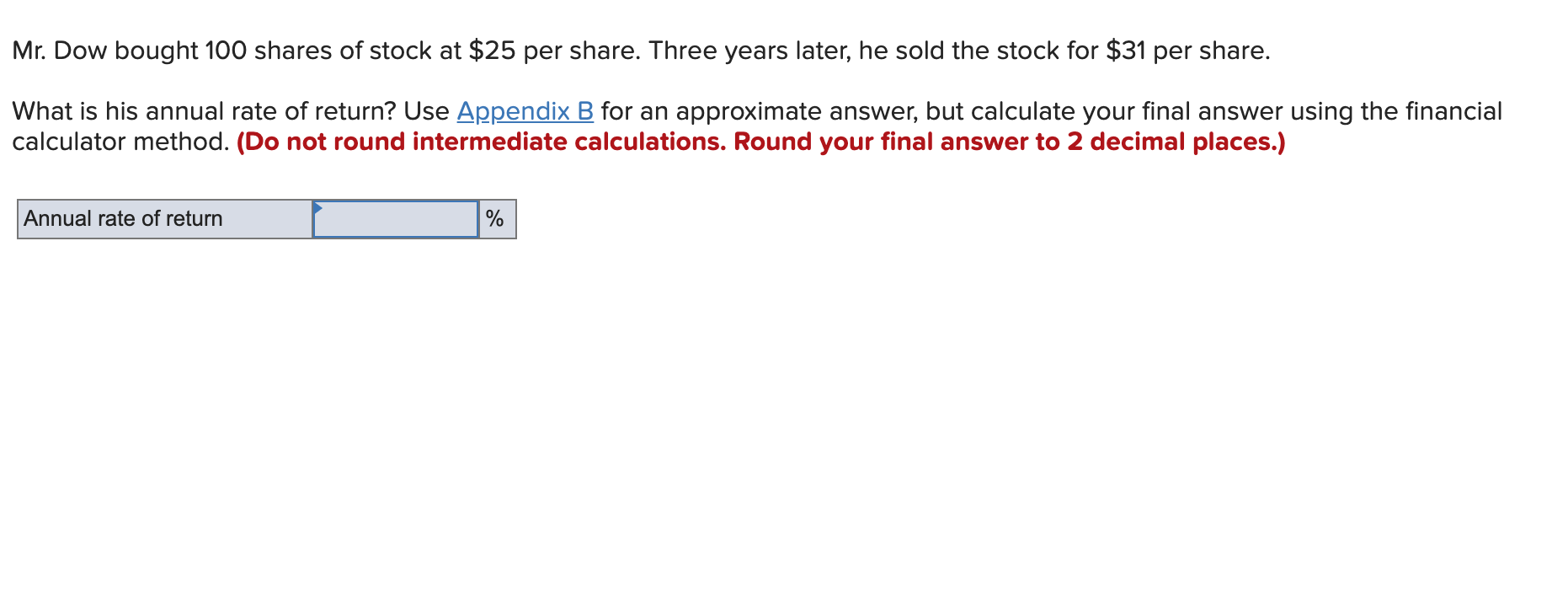

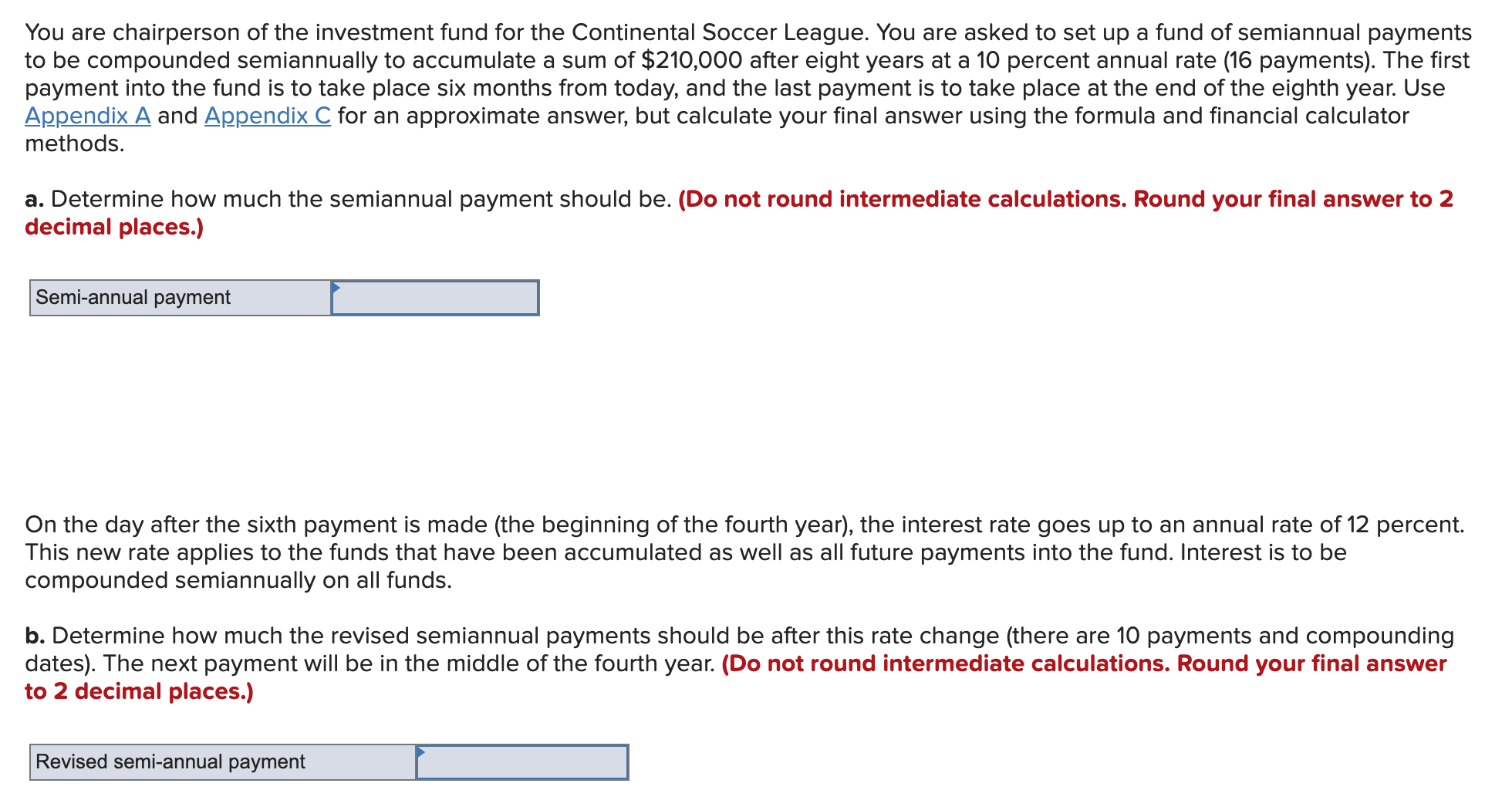

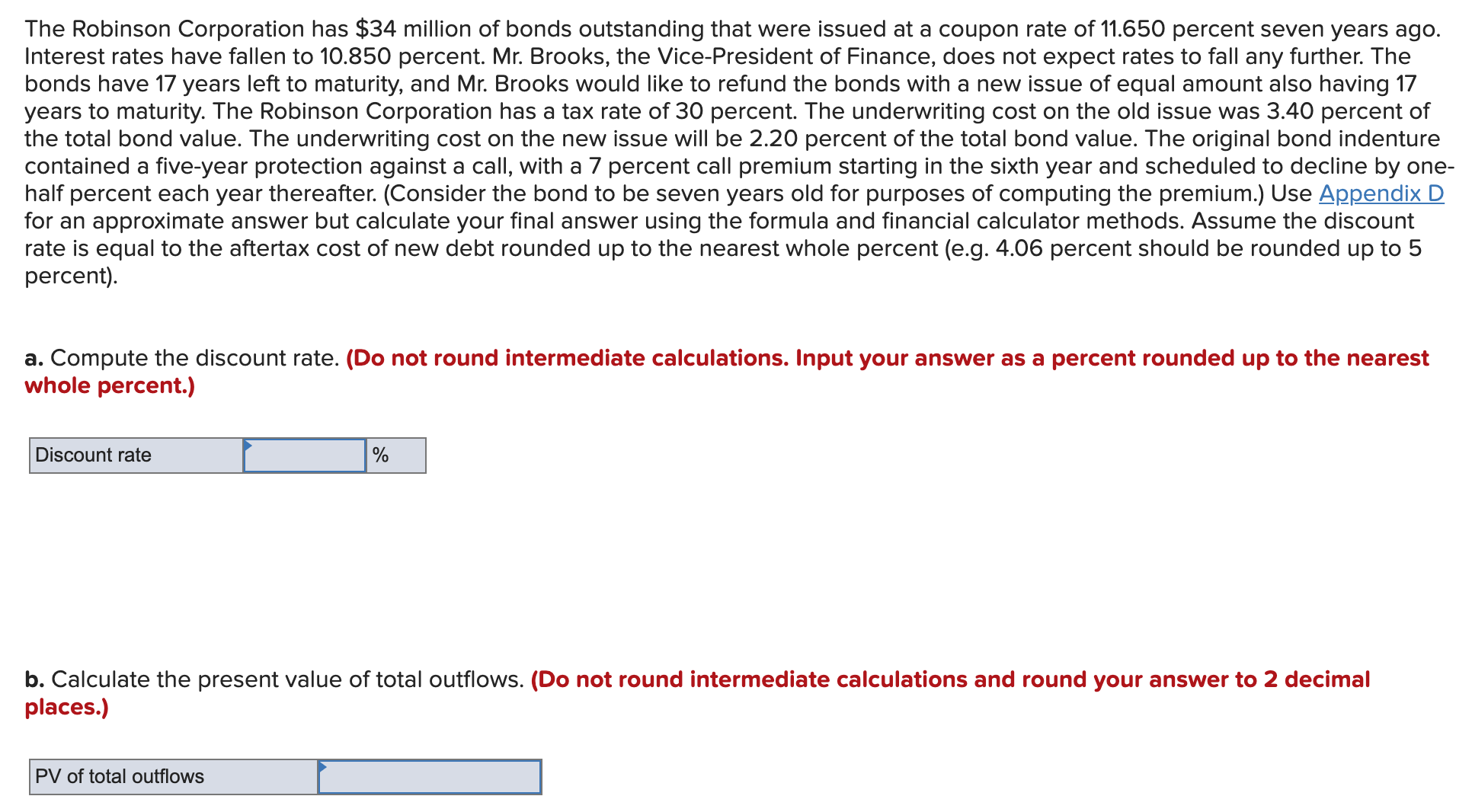

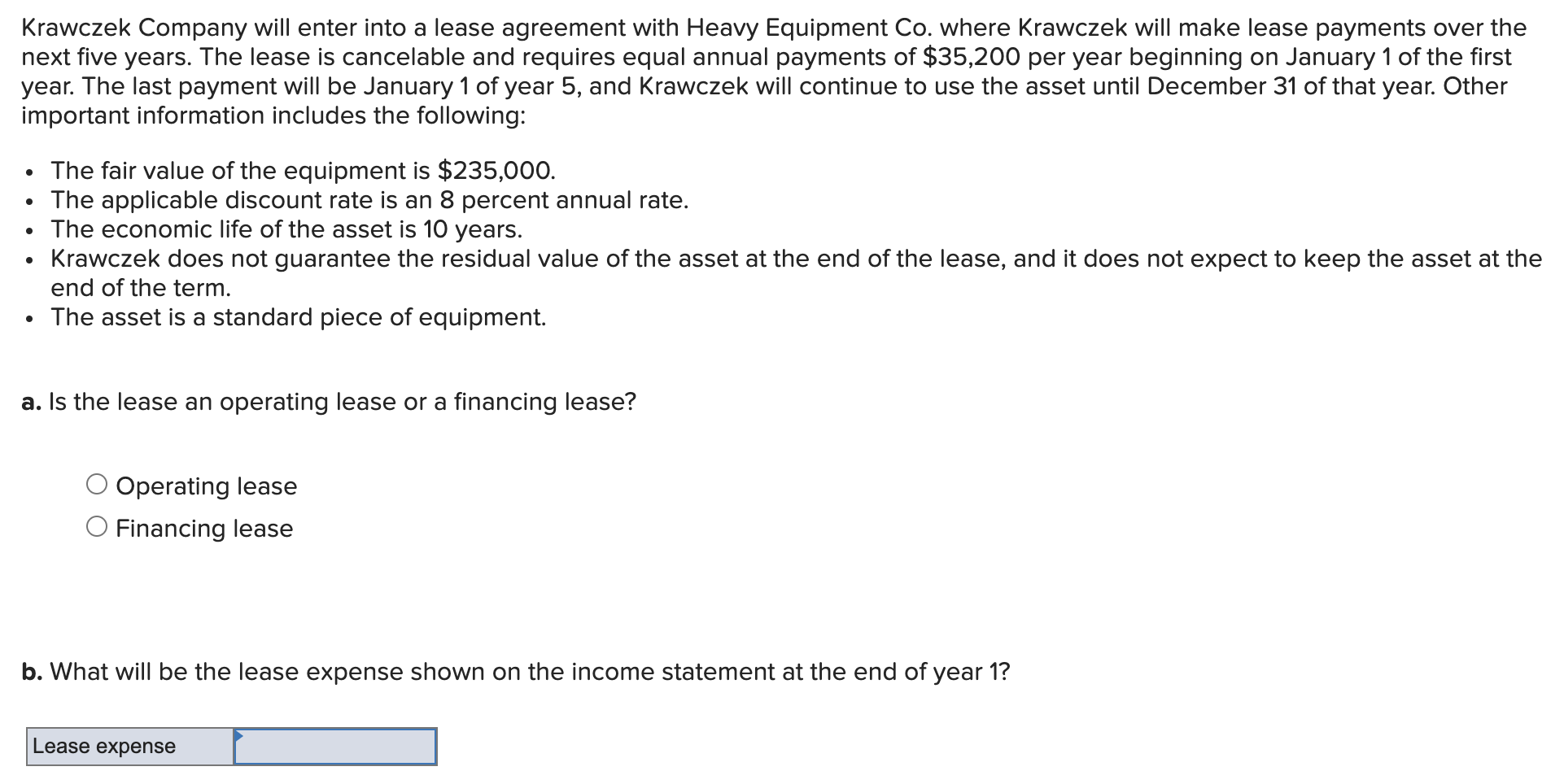

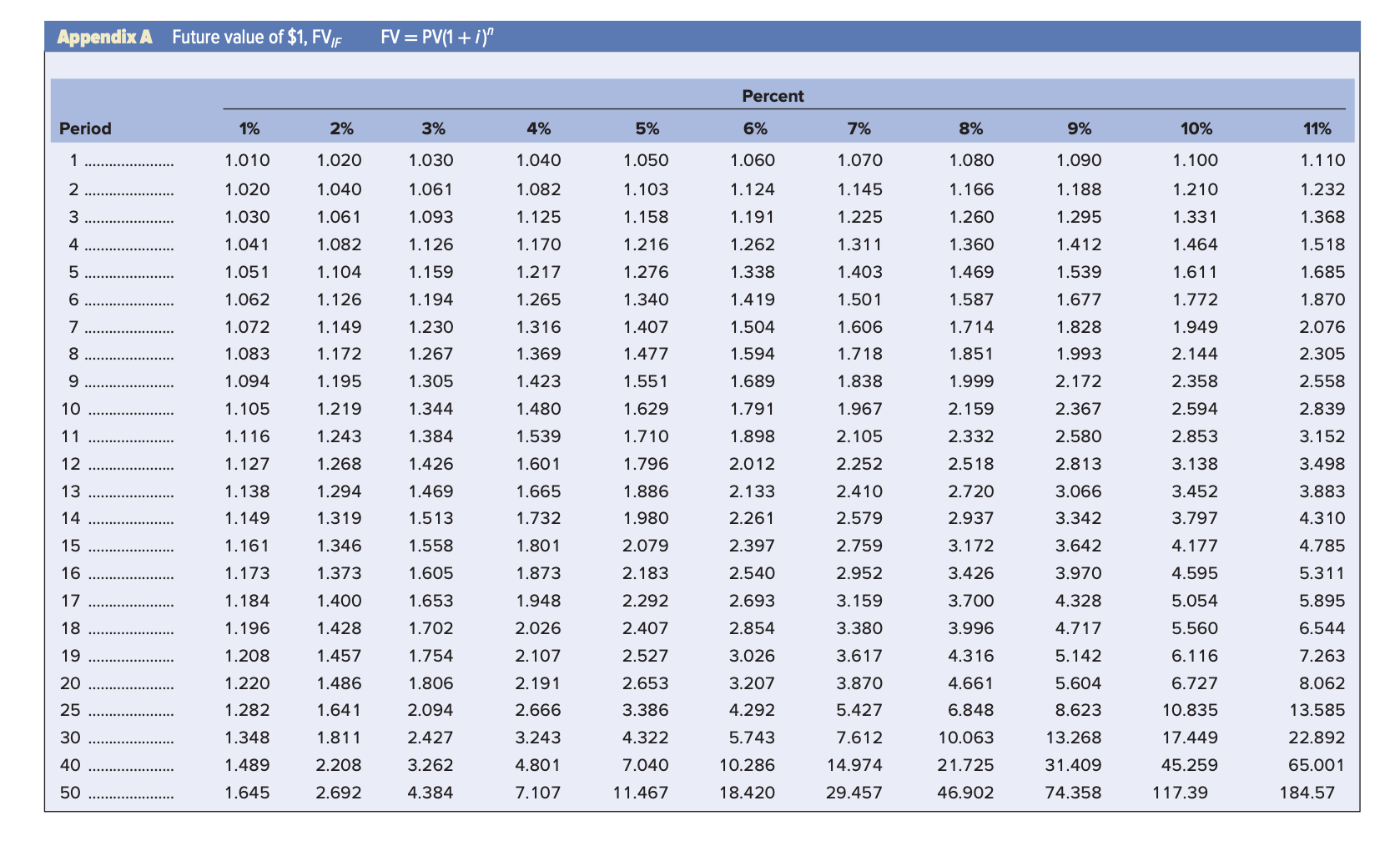

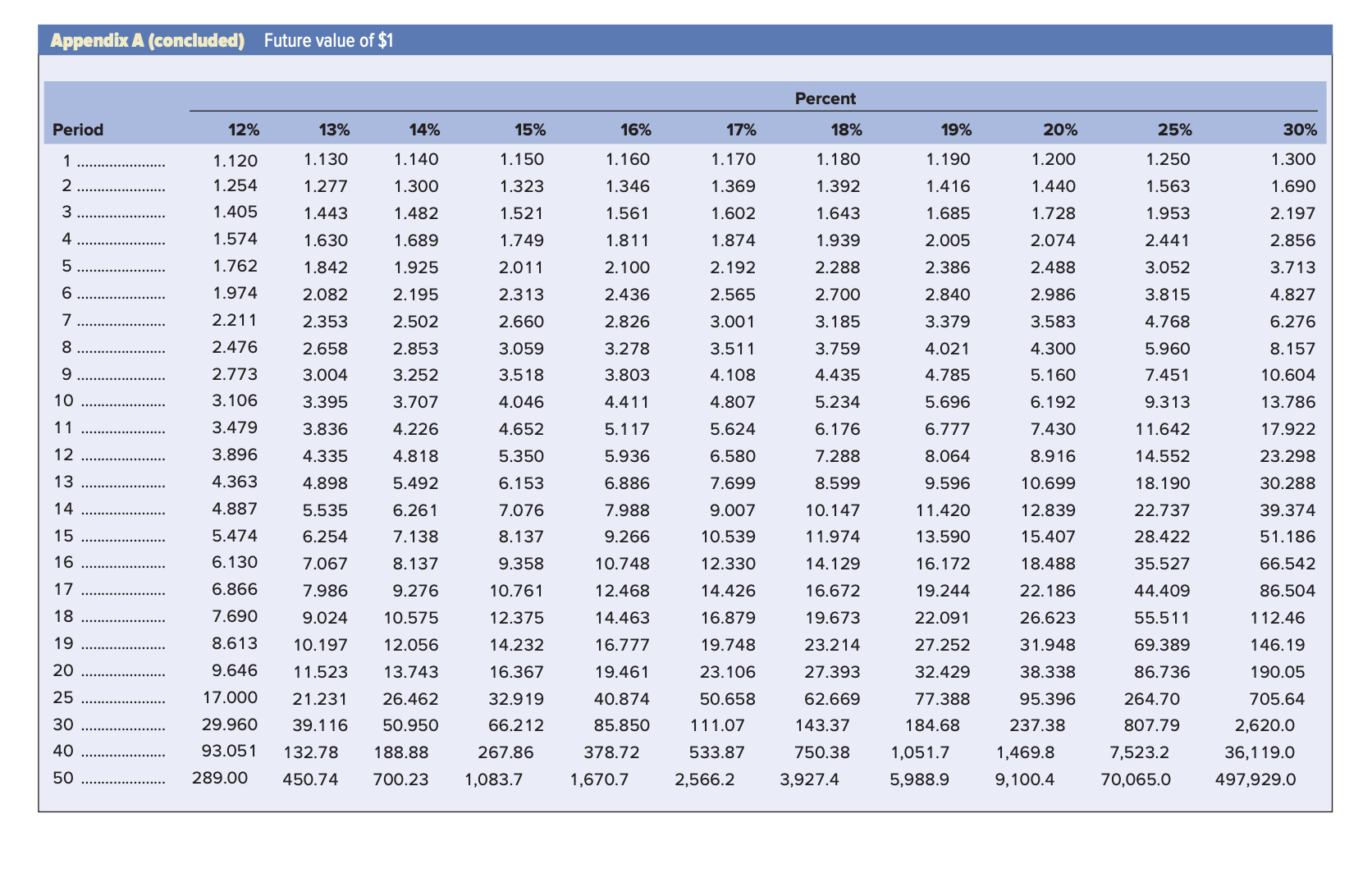

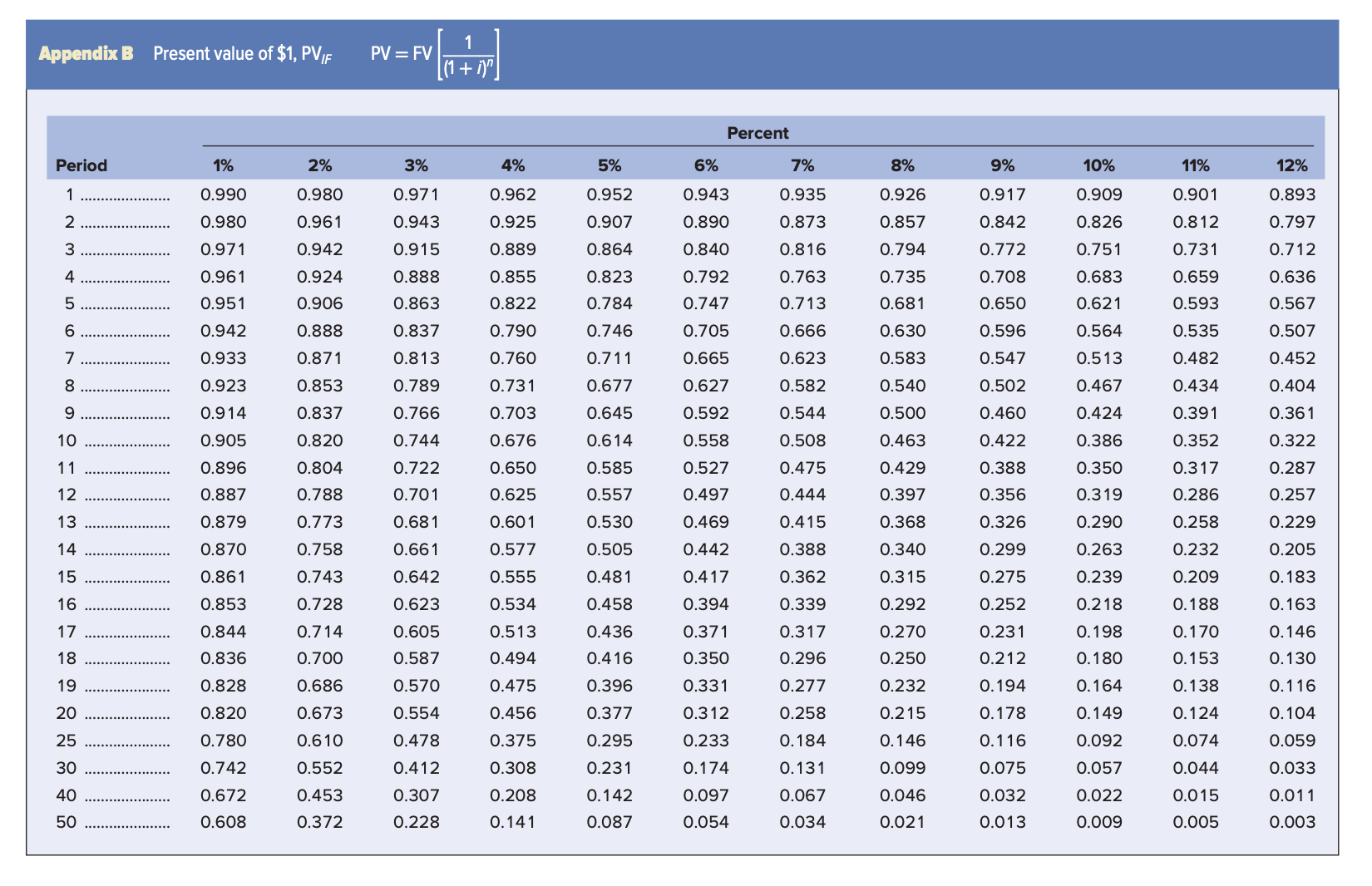

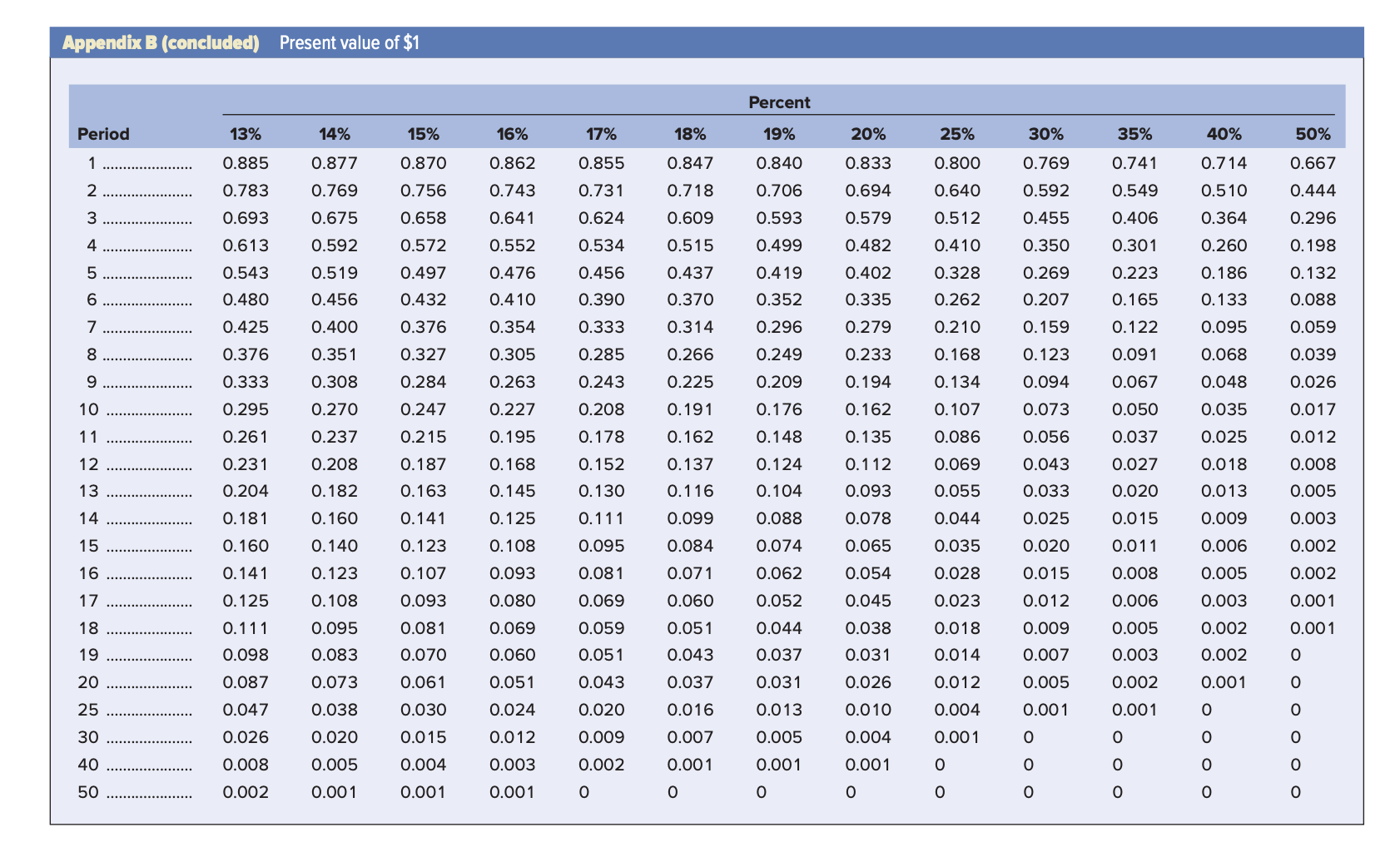

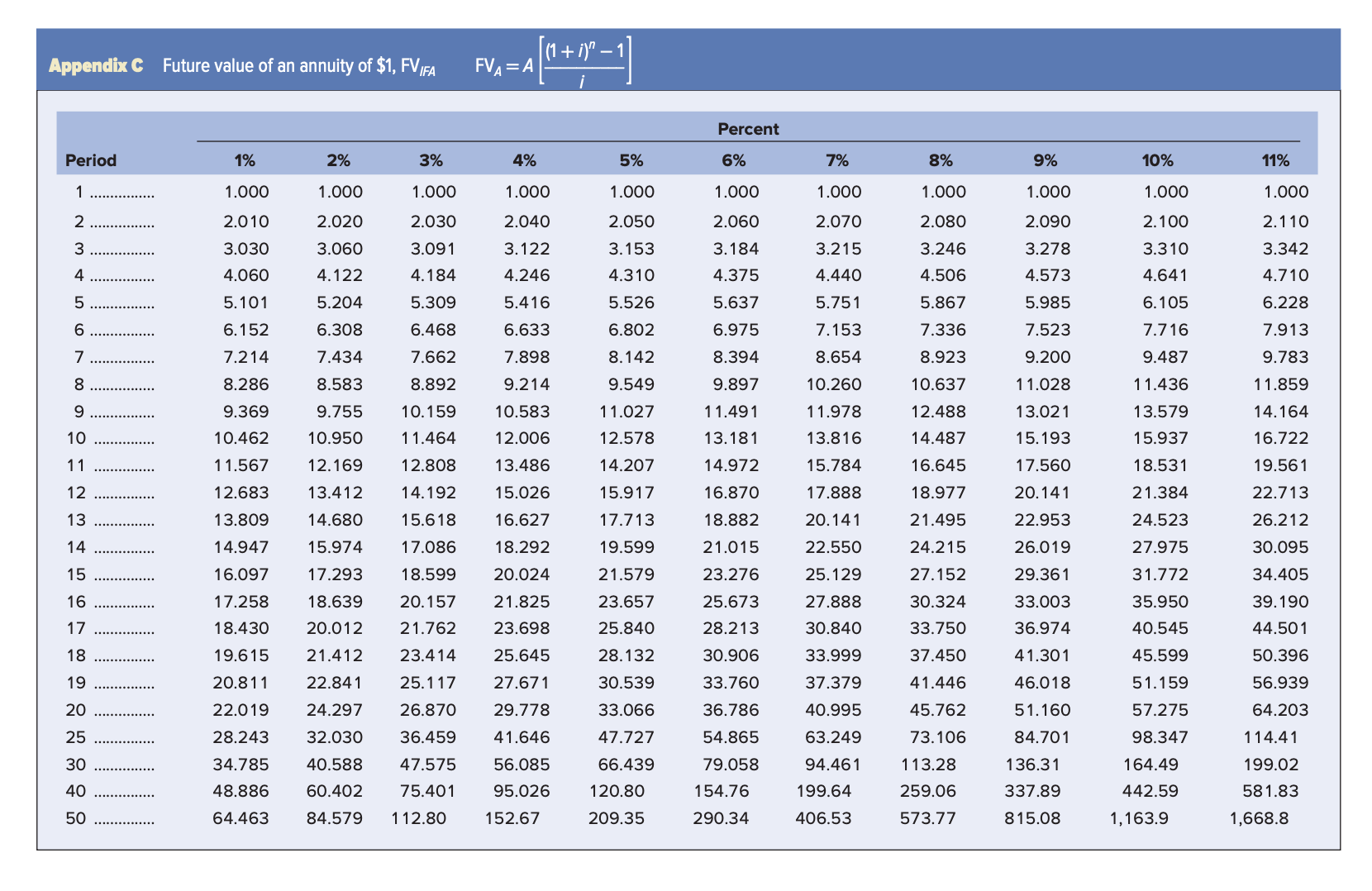

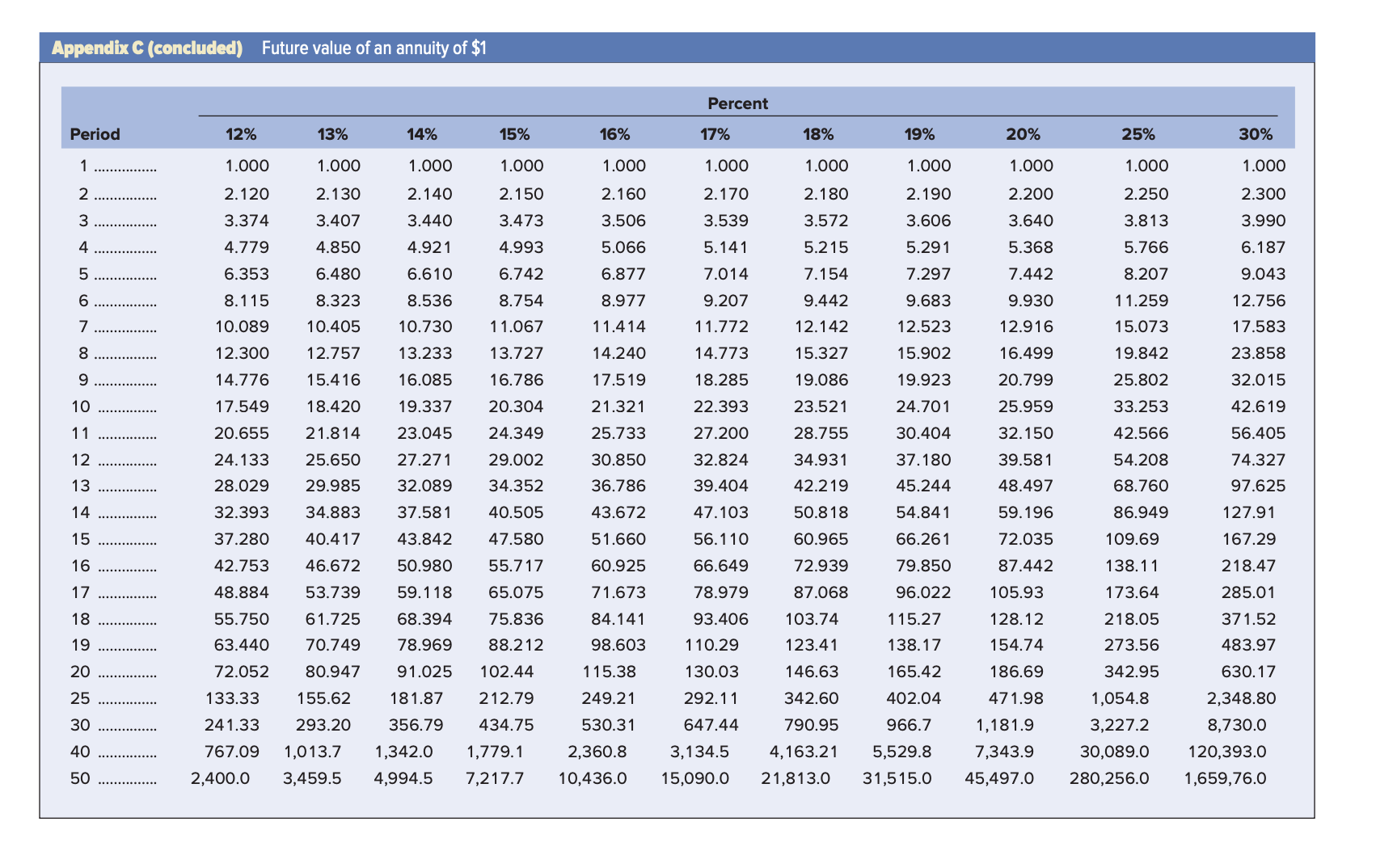

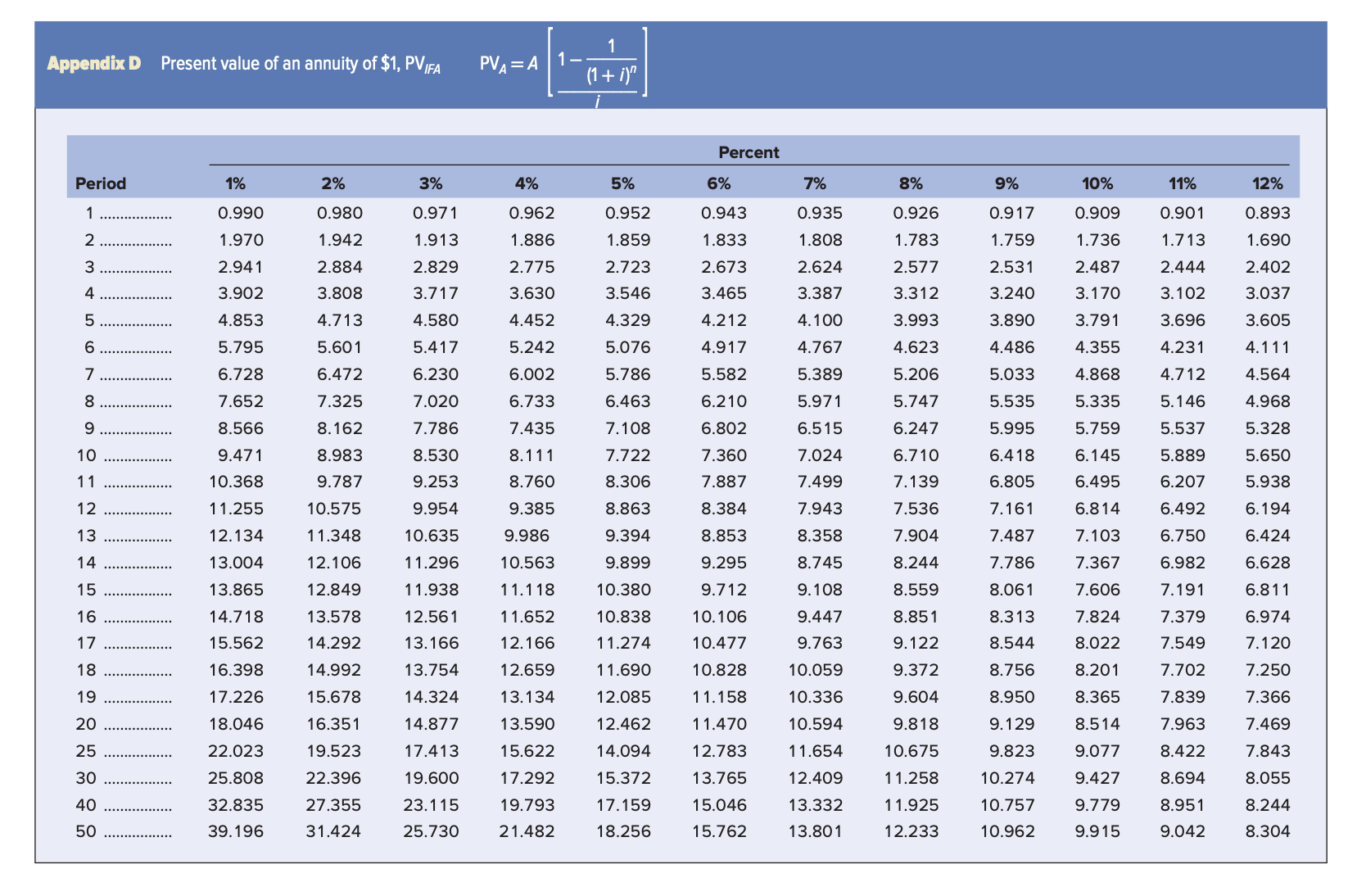

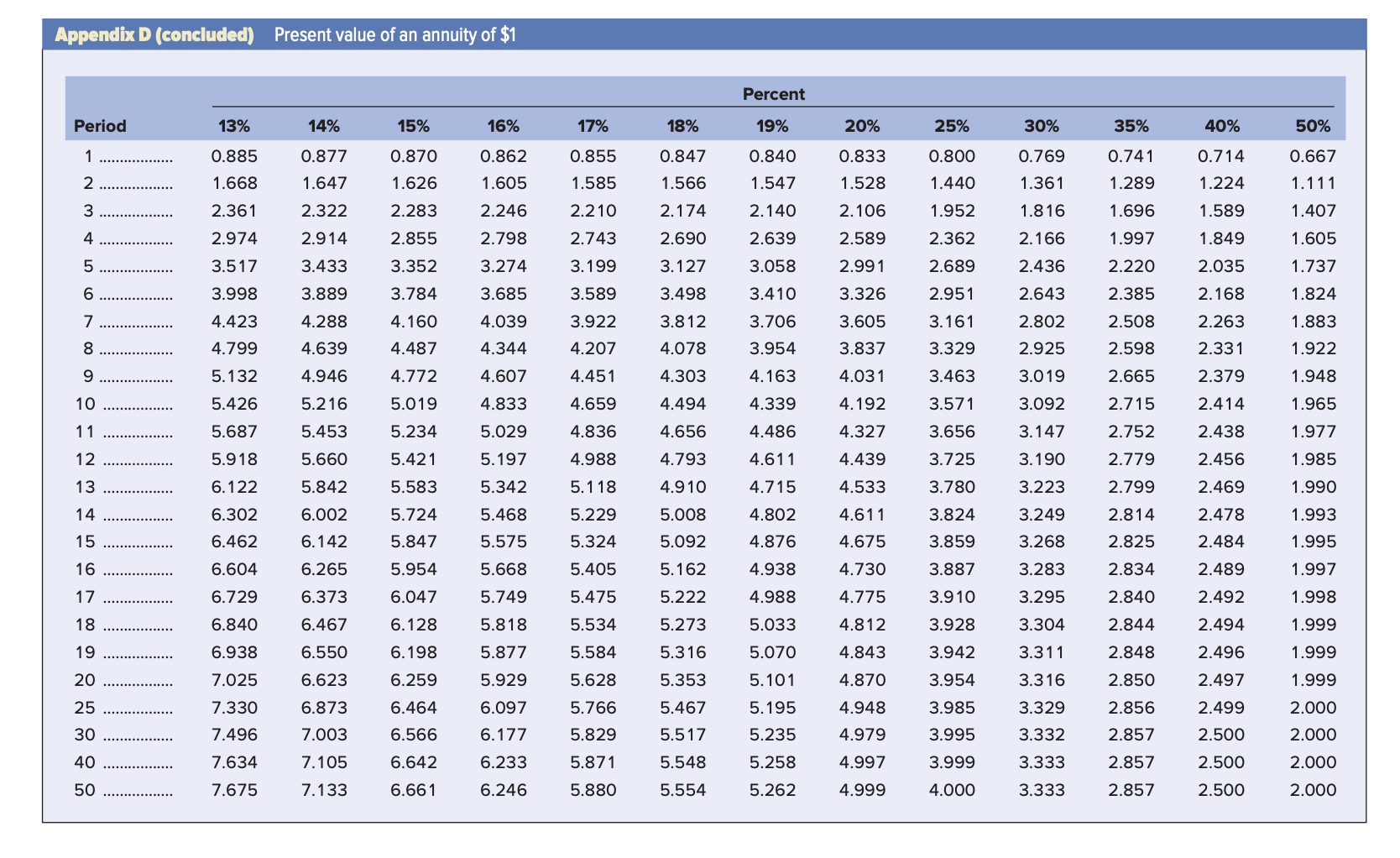

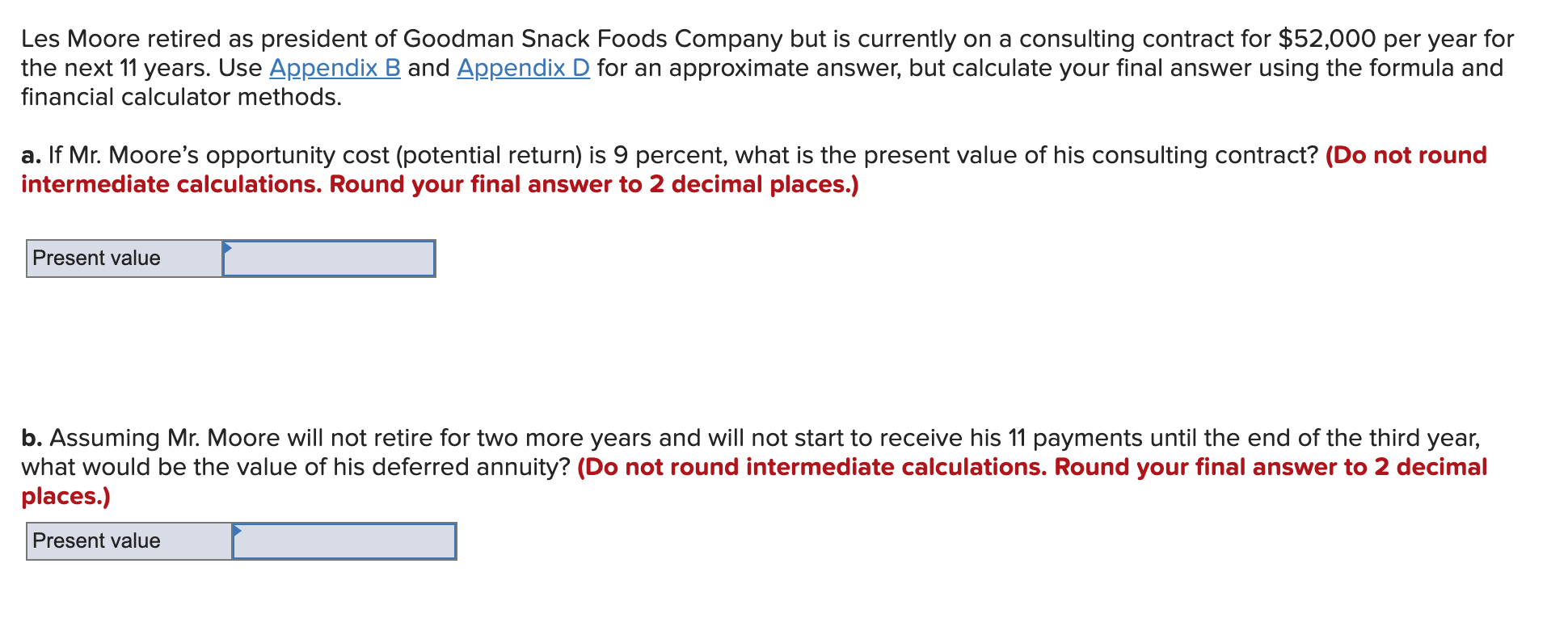

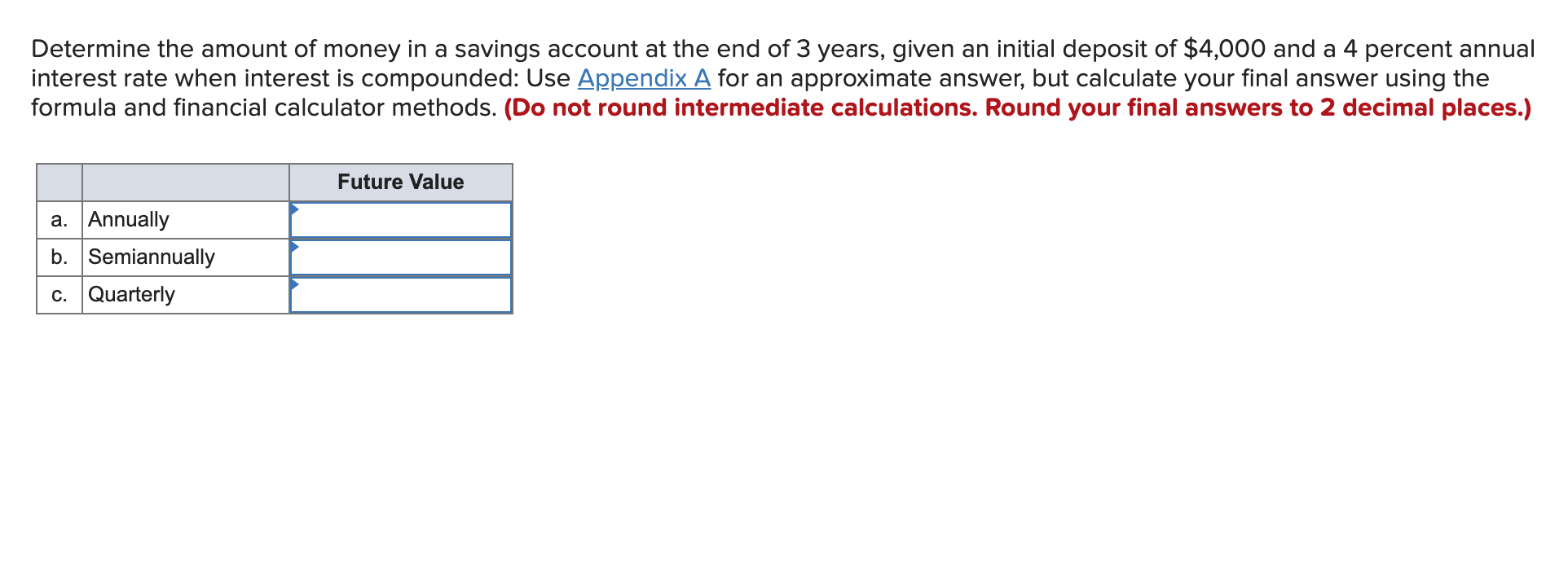

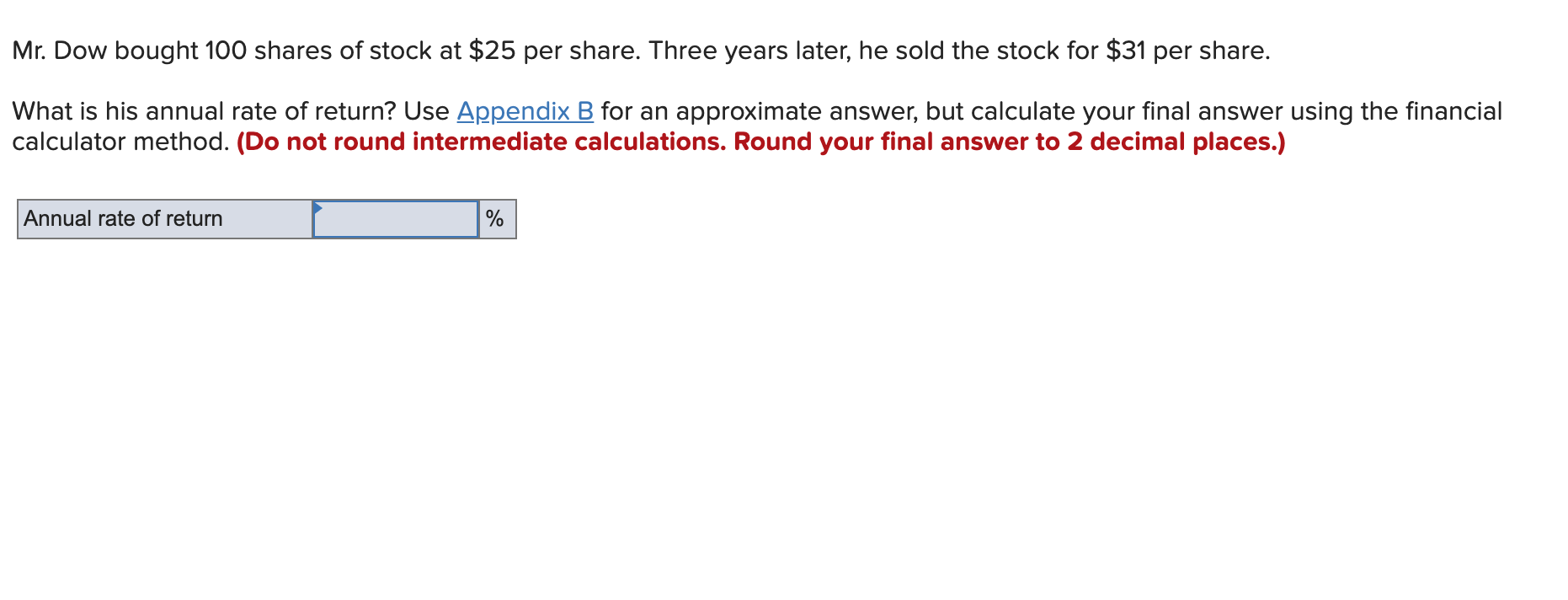

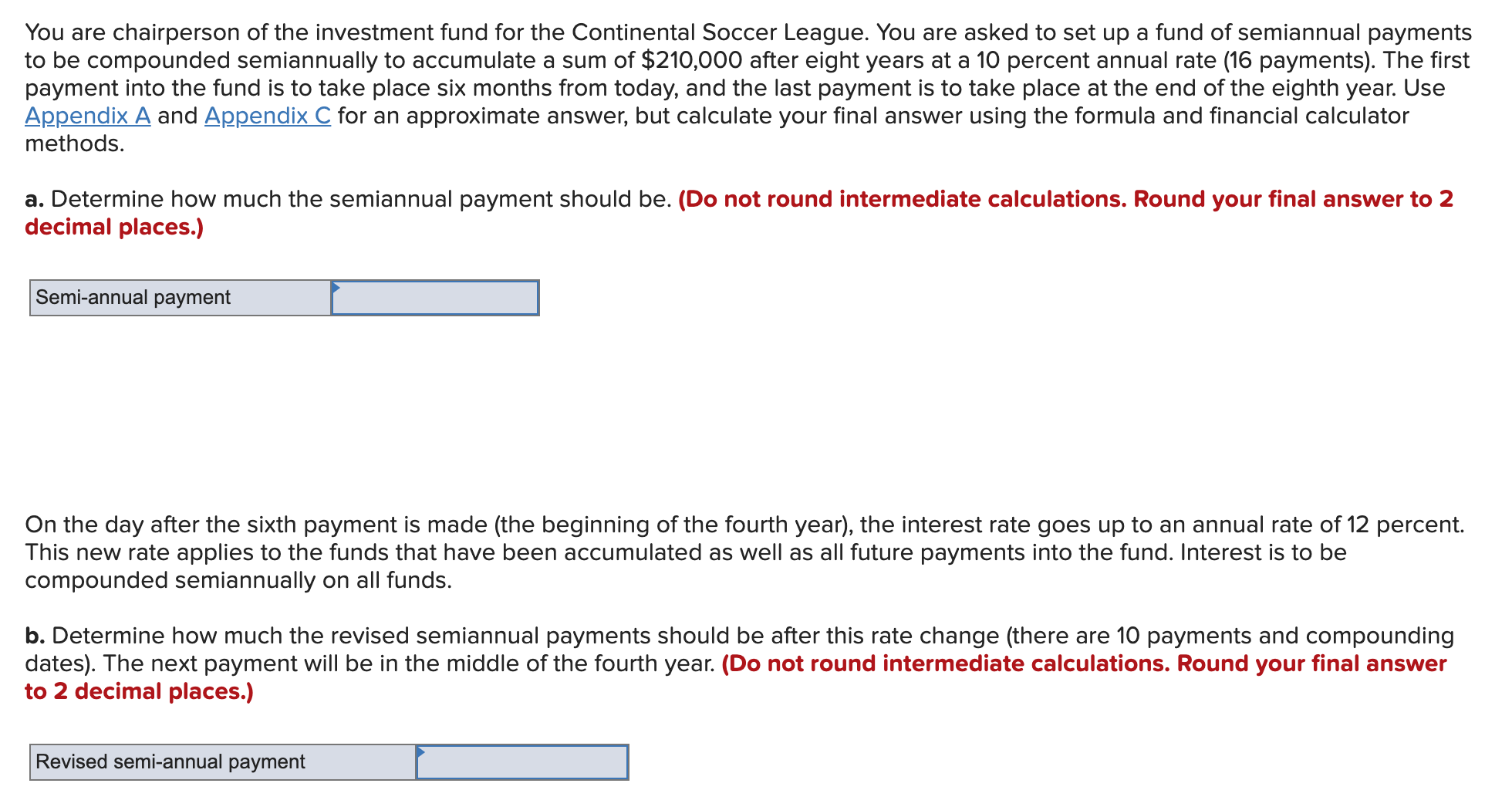

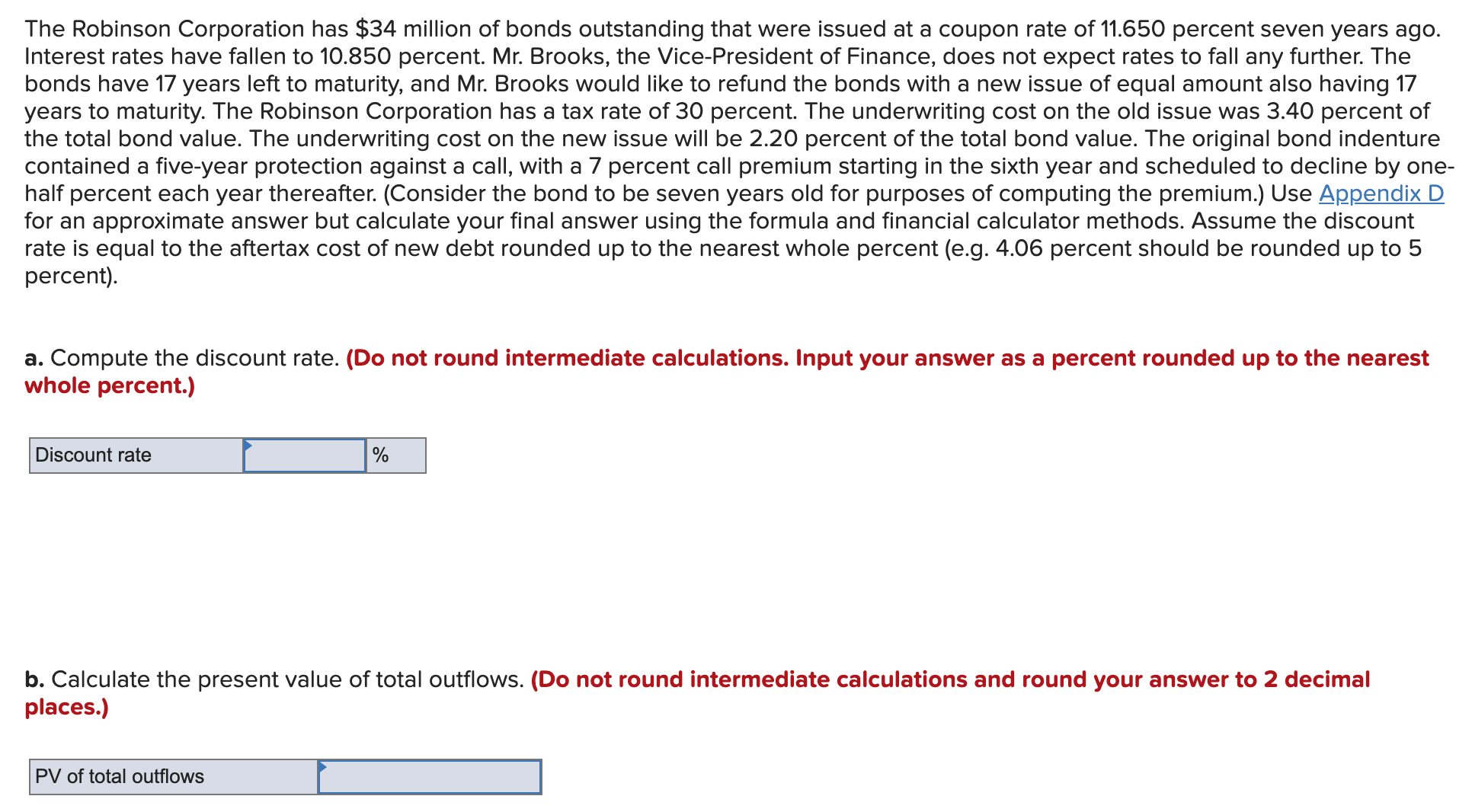

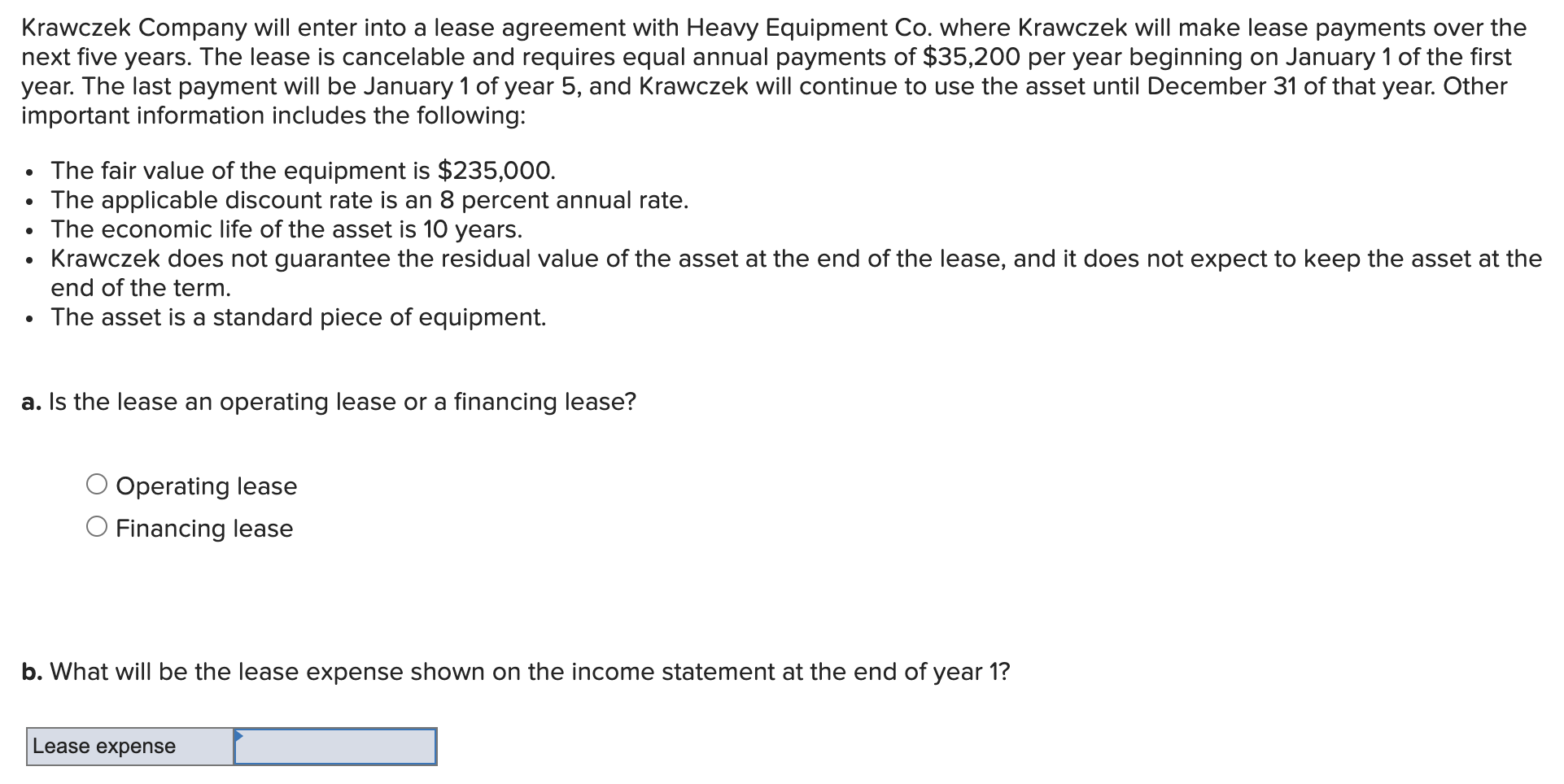

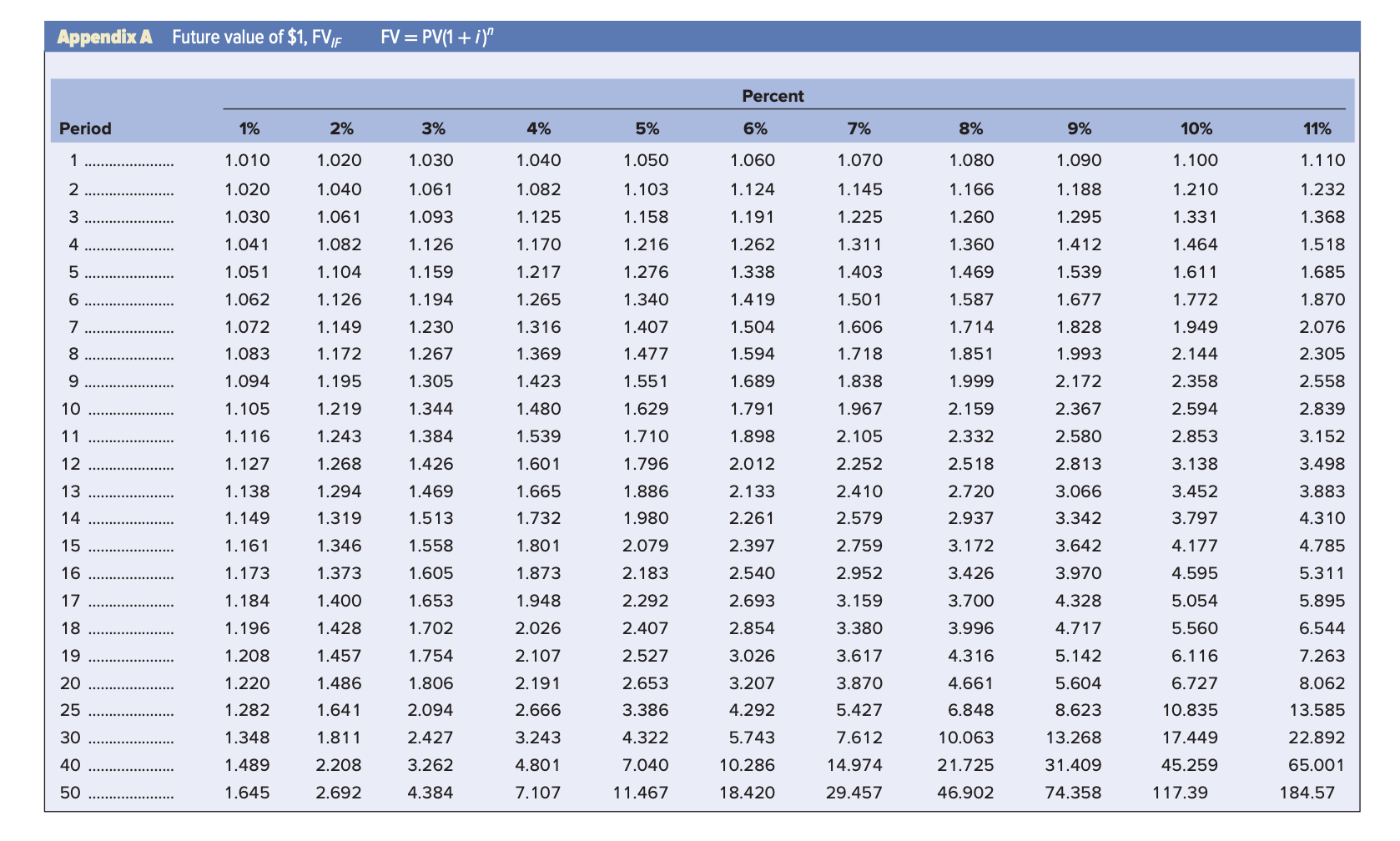

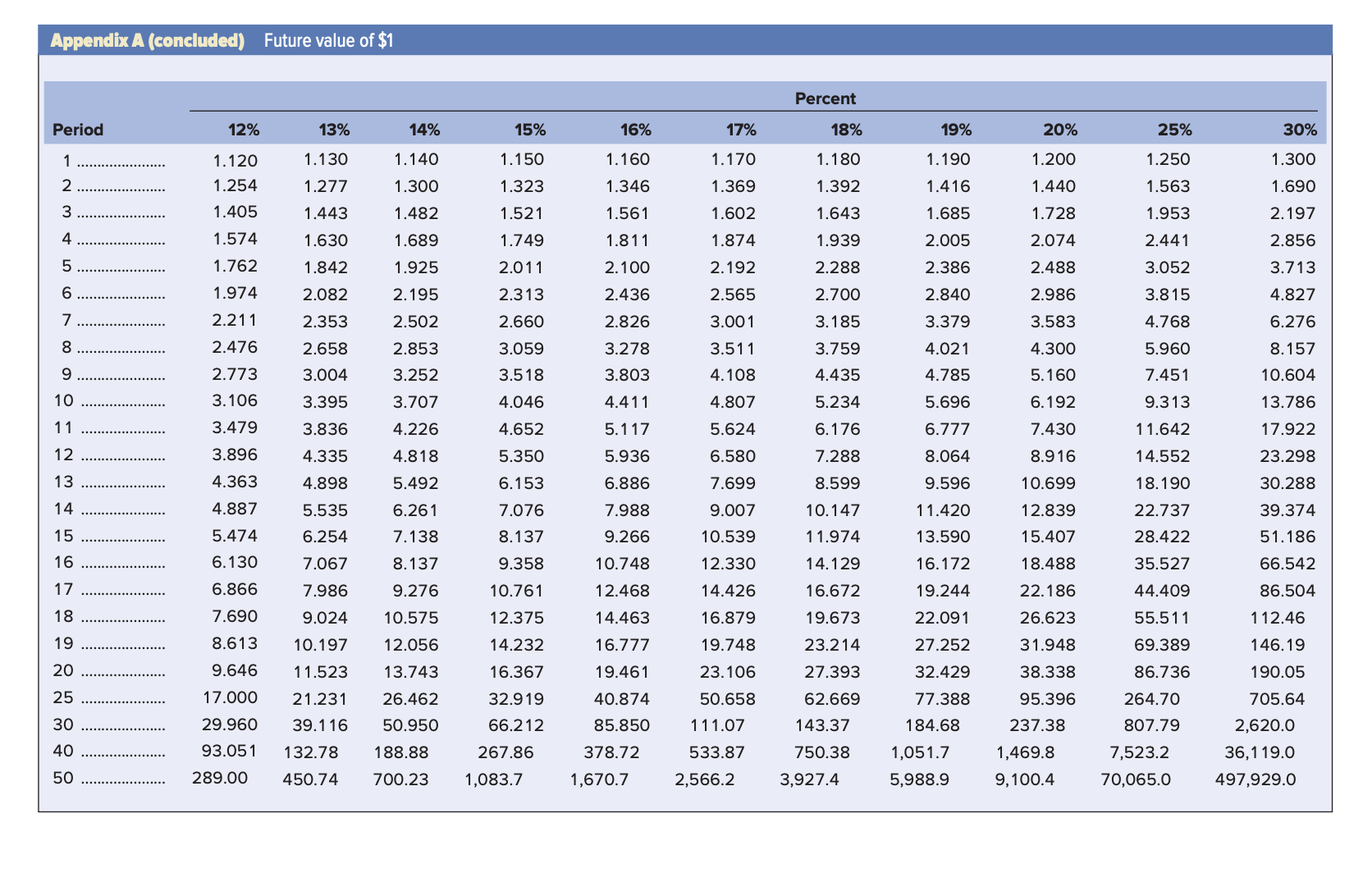

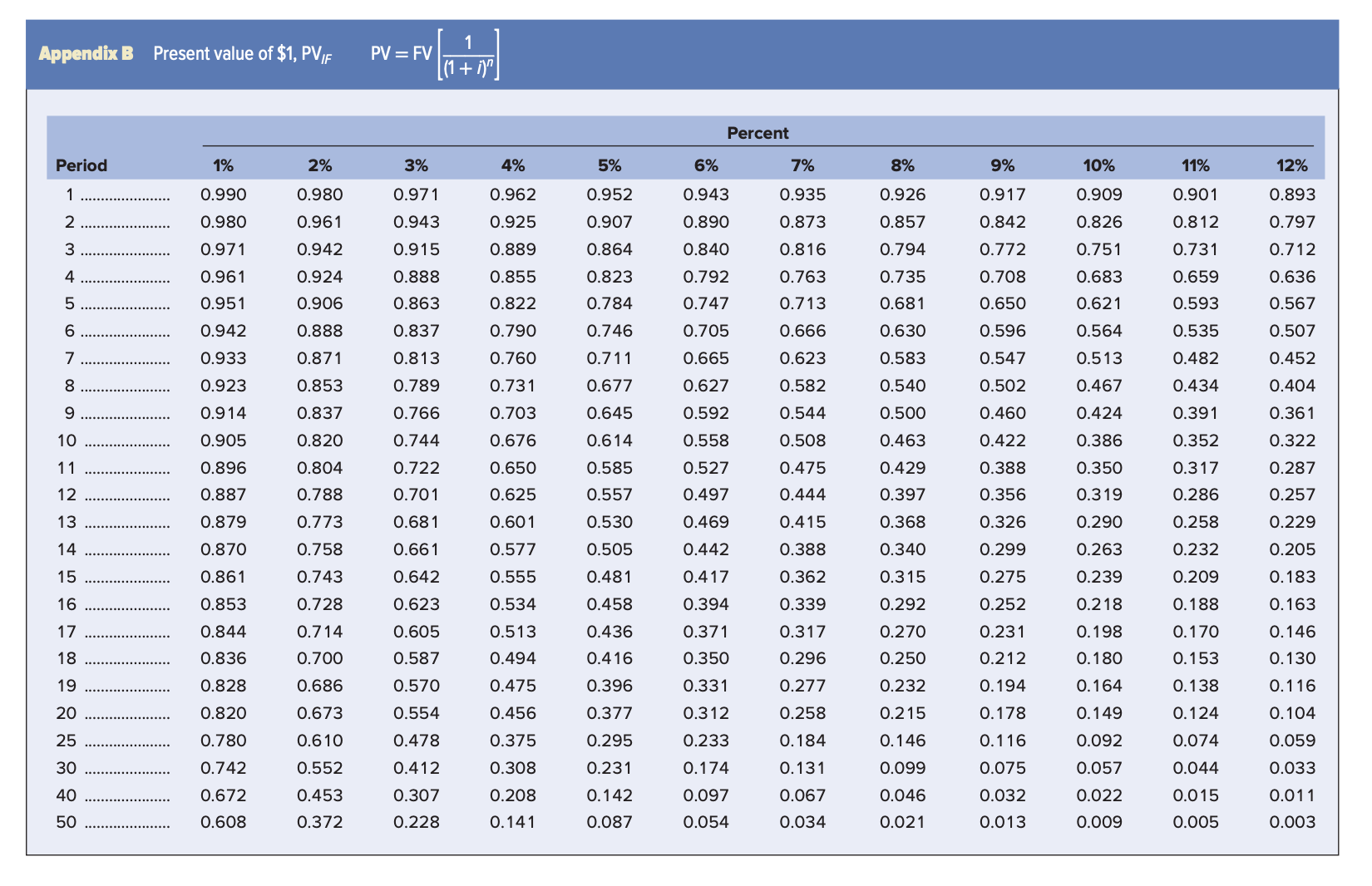

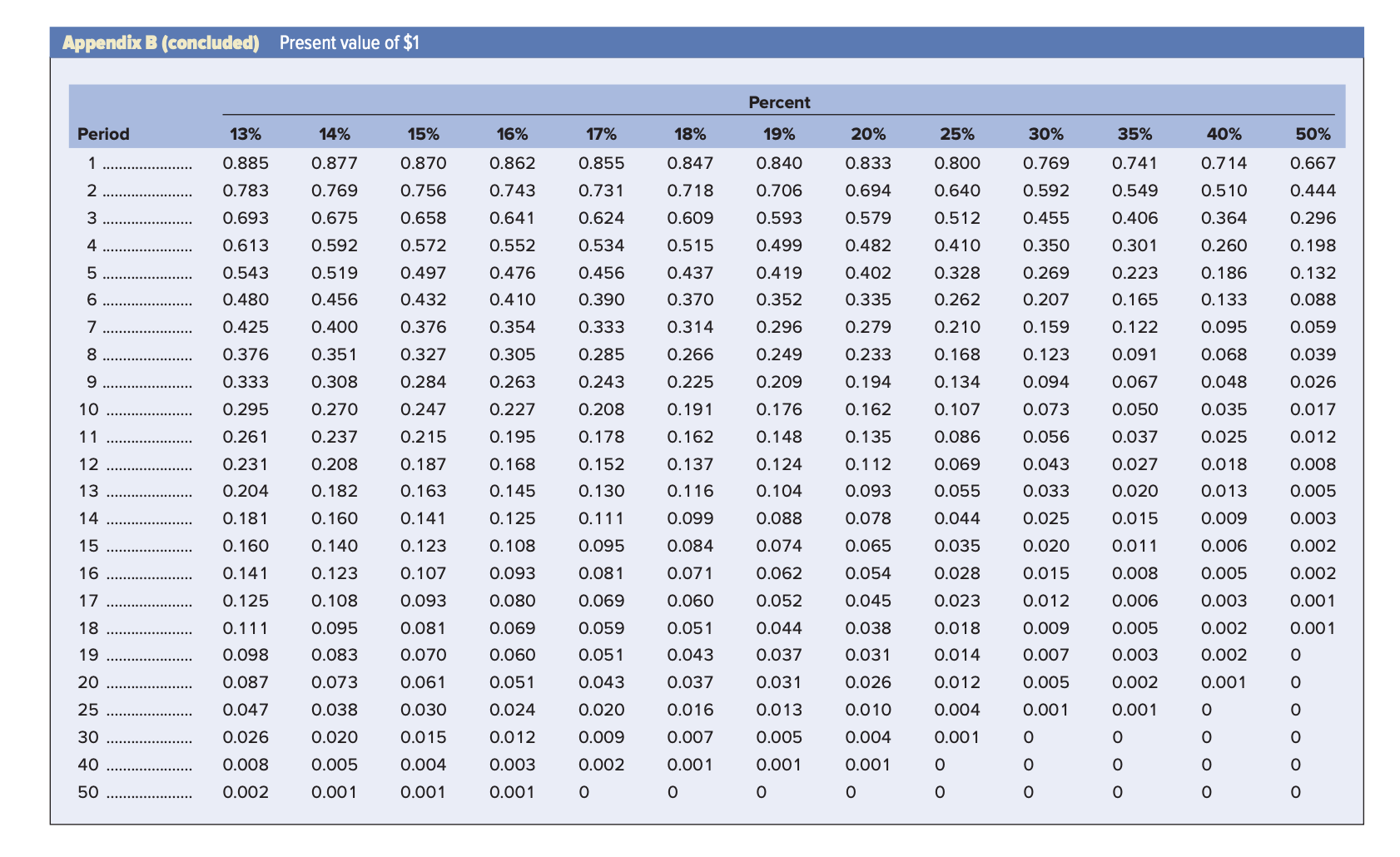

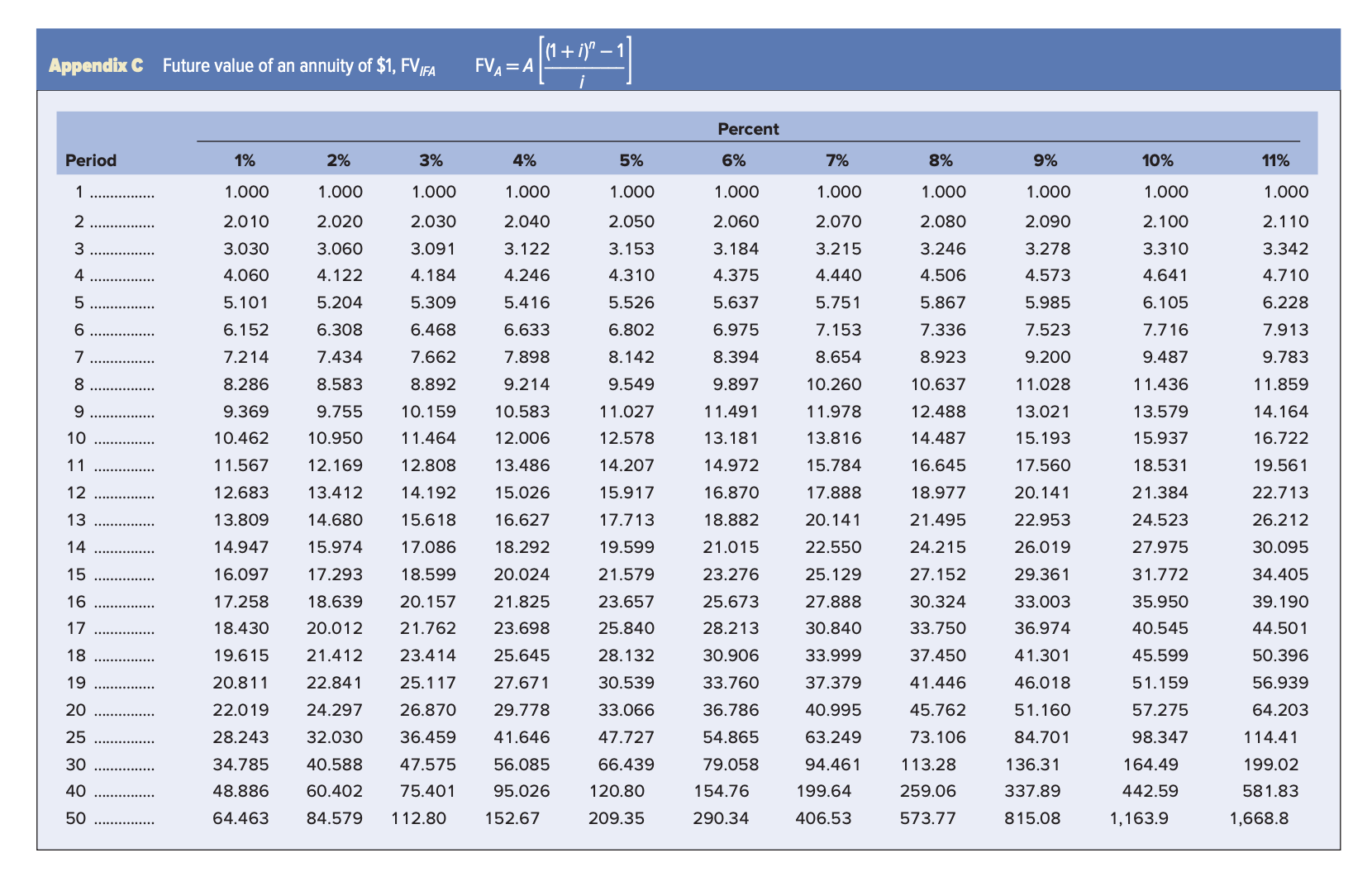

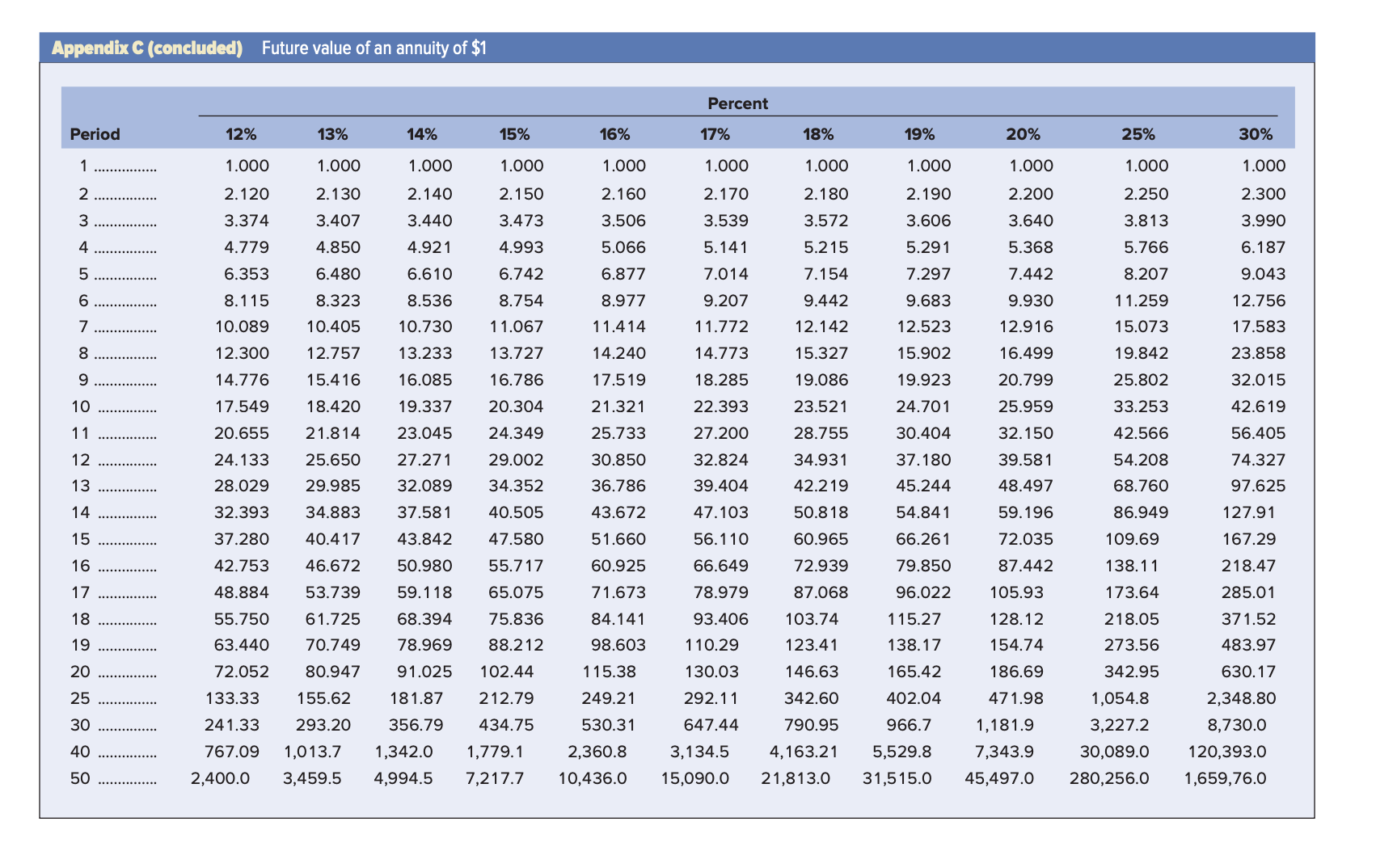

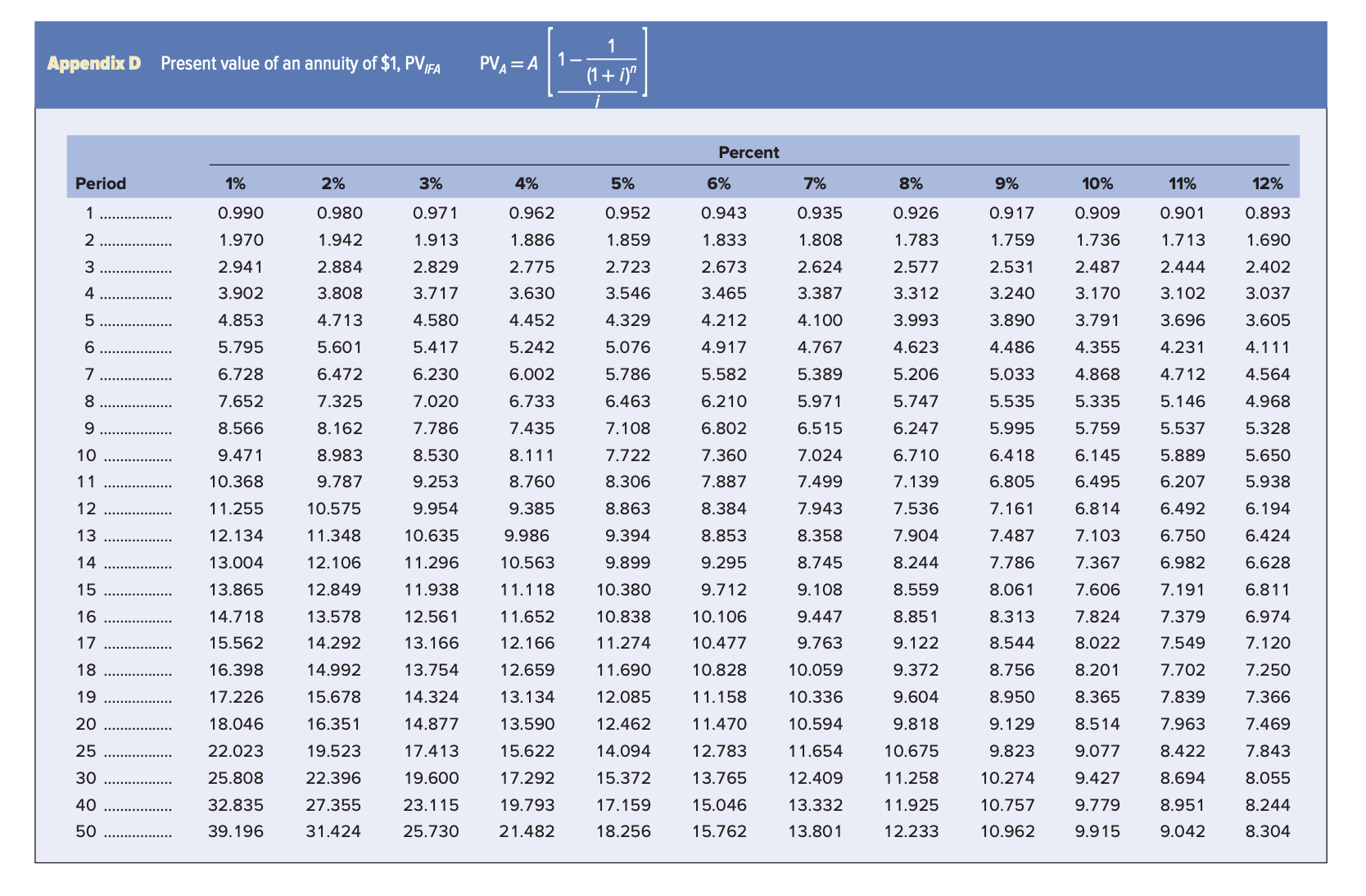

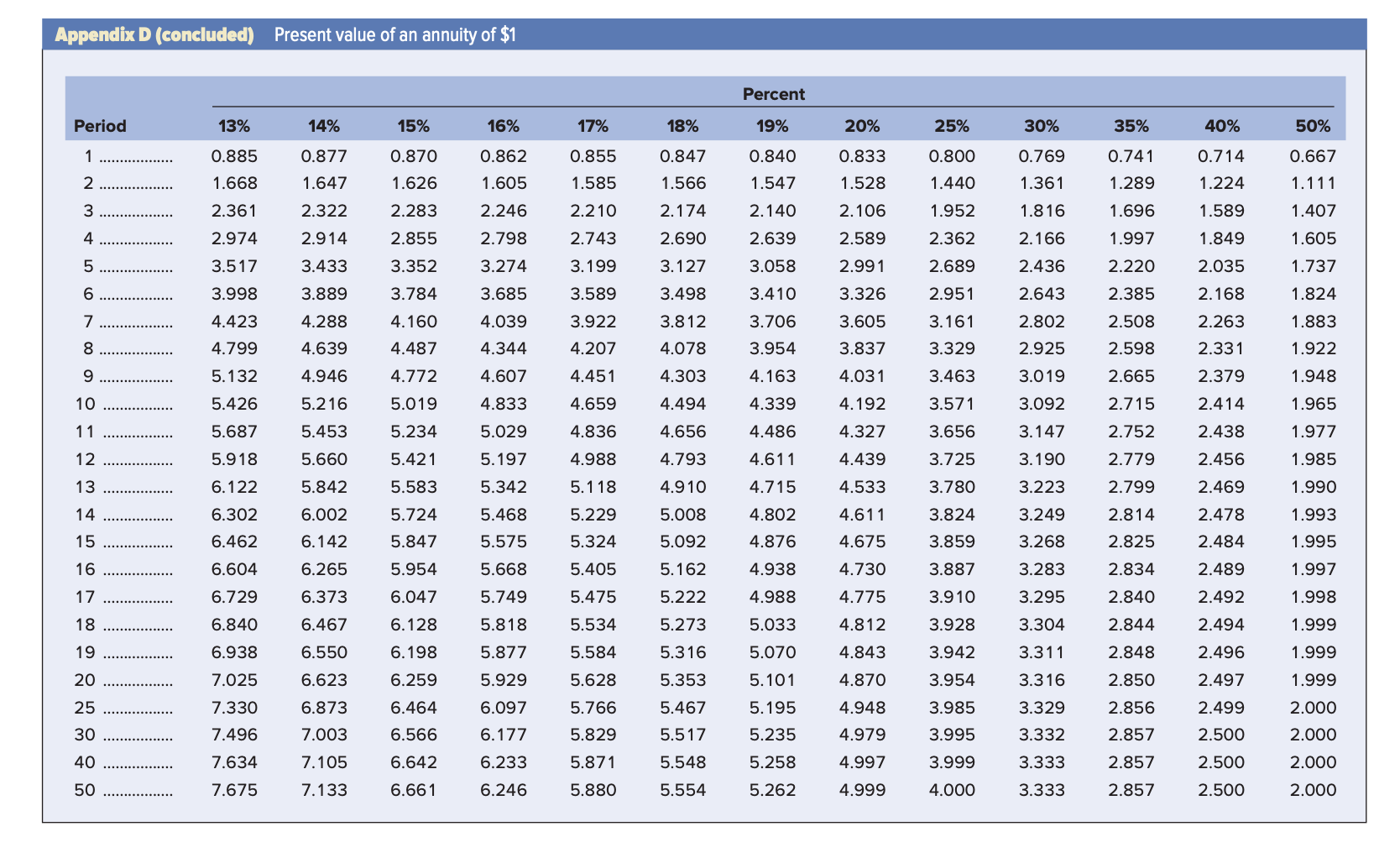

Les Moore retired as president of Goodman Snack Foods Company but is currently on a consulting contract for $52,000 per year for the next 11 years. Use Appendix B and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. If Mr. Moore's opportunity cost (potential return) is 9 percent, what is the present value of his consulting contract? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value b. Assuming Mr. Moore will not retire for two more years and will not start to receive his 11 payments until the end of the third year, what would be the value of his deferred annuity? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value Determine the amount of money in a savings account at the end of 3 years, given an initial deposit of $4,000 and a 4 percent annual interest rate when interest is compounded: Use Appendix A for an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Future Value a. Annually b. Semiannually C. QuarterlyMr. Dow bought 100 shares of stock at $25 per share. Three years later, he sold the stock for $31 per share. What is his annual rate of return? Use Appendix B for an approximate answer, but calculate your final answer using the financial calculator method. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Annual rate of return % You are chairperson ofthe investment fund for the Continental Soccer League. You are asked to set up a fund of semiannual payments to be compounded semiannually to accumulate a sum of $210,000 after eight years at a 10 percent annual rate (16 payments). The first payment into the fund is to take place six months from today, and the last payment is to take place at the end ofthe eighth year. Use Appendix A and Appendix C for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. Determine how much the semiannual payment should be. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Semi-annual payment On the day after the sixth payment is made (the beginning of the fourth year), the interest rate goes up to an annual rate of12 percent. This new rate applies to the funds that have been accumulated as well as all future payments into the fund. Interest is to be compounded semiannually on all funds. b. Determine how much the revised semiannual payments should be after this rate change (there are 10 payments and compounding dates). The next payment will be in the middle of the fourth year. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) I Revised semi-an nual payment :I The Robinson Corporation has $34 million of bonds outstanding that were issued at a coupon rate of 11.650 percent seven years ago. Interest rates have fallen to 10.850 percent. Mr. Brooks, the Vice-President of Finance, does not expect rates to fall any further. The bonds have 17 years left to maturity, and Mr. Brooks would like to refund the bonds with a new issue of equal amount also having 17 years to maturity. The Robinson Corporation has a tax rate of 30 percent. The undenNriting cost on the old issue was 3.40 percent of the total bond value. The underwriting cost on the new issue will be 2.20 percent of the total bond value. The original bond indenture contained a ve-year protection against a call, with a 7 percent call premium starting in the sixth year and scheduled to decline by one- half percent each year thereafter. (Consider the bond to be seven years old for purposes of computing the premium.) Use Appendix D for an approximate answer but calculate your nal answer using the formula and nancial calculator methods. Assume the discount rate is equal to the aftertax cost of new debt rounded up to the nearest whole percent (e.g. 4.06 percent should be rounded up to 5 percent). a. Compute the discount rate. (Do not round intermediate calculations. Input your answer as a percent rounded up to the nearest whole percent.) b. Calculate the present value of total outflows. (Do not round intermediate calculations and round your answer to 2 decimal places.) onnotauoumows Krawczek Company will enter into a lease agreement with Heavy Equipment Co. where Krawczek will make lease payments over the next ve years. The lease is cancelable and requires equal annual payments of $35,200 per year beginning on January 1 of the rst year. The last payment will be January 1 of year 5, and Krawczek will continue to use the asset until December 31 of that year. Other important information includes the following: . The fair value of the equipment is $235,000. . The applicable discount rate is an 8 percent annual rate. . The economic life of the asset is 10 years. . Krawczek does not guarantee the residual value of the asset at the end of the lease, and it does not expect to keep the asset at the end of the term. . The asset is a standard piece of equipment. a. Is the lease an operating lease or a financing lease? 0 Operating lease 0 Financing lease b. What will be the lease expense shown on the income statement at the end of year 1? Appendix C Future value of an annuity of $1, FV IFA (1 +1) -1 Percent Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2. 100 2. 1 10 3 ............... 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.342 4 4.060 4.122 4. 184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 4.710 5 ............. 5. 101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6. 105 6.228 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 8 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.637 1 1.028 11.436 11.859 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13.021 13.579 14. 164 10 10.462 10.950 11.464 12.006 12.578 13. 181 13.816 14.487 15. 193 15.937 16.722 11 11.567 12.169 12.808 13.486 14.207 14.972 15.784 16.645 17.560 18.531 19.561 12.683 13.412 14. 192 15.026 15.917 17.888 18.977 20.141 22.713 13.809 14.680 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 14.947 15.974 17.086 18.292 19.599 21.015 22.550 24.215 26.019 27.975 30.095 15 16.097 17.293 18.599 20.024 21.579 23.276 25.129 27.152 29.361 31.772 34.405 16 . . ............. 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39. 190 17 . . ............. 18.430 20.012 21.762 23.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 18 19.615 21.412 23.414 25.645 28.132 30.906 33.999 37.450 41.301 45.599 50.396 19 20.811 22.841 25.1 17 27.671 30.539 33.760 37.379 41.446 46.018 51. 159 56.939 20 22.019 24.297 26.870 29.778 33.066 36.786 40.995 45.762 51. 160 57.275 64.203 28.243 32.030 36.459 41.646 47.727 54.865 63.249 73.106 84.701 98.347 114.41 30 34.785 40.588 47.575 56.085 66.439 79.058 94.461 113.28 136.31 164.49 199.02 40 48.886 60.402 75.401 95.026 120.80 154.76 199.64 259.06 337.89 442.59 581.83 50 64.463 84.579 1 12.80 152.67 209.35 290.34 406.53 573.77 815.08 1, 163.9 1,668.8Appendix C (concluded) Future value of an annuity of $1 Percent Period 12% 13% 14% 17% 18% 19% 20% 25% 30% 1 . ...........". 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2 ........mmm. 2.120 2.130 2.140 2. 150 2.160 2.170 2.180 2. 190 2.200 2.250 2.300 3.374 3.407 3.440 3.473 3.506 3.539 3.572 3.606 3.640 3.813 3.990 4 ........... 4.850 4.921 4.993 5.066 5.141 5.215 5.291 5.368 5.766 6.187 6.353 6.480 6.610 6.742 6.877 7.014 7.154 7.297 7.442 8.207 9.043 8.115 8.323 8.536 8.754 8.977 9.207 9.442 9.683 9.930 1 1.259 12.756 10.089 10.405 10.730 11.067 11.414 11.772 12.142 12.523 12.916 15.073 17.583 12.300 12.757 13.233 13.727 14.240 14.773 15.327 15.902 16.499 19.842 23.858 14.776 15.416 16.085 16.786 17.519 18.285 19.086 19.923 20.799 25.802 32.015 17.549 18.420 19.337 20.304 21.321 22.393 23.521 24.701 25.959 33.253 42.619 11 20.655 21.814 23.045 24.349 25.733 27.200 28.755 30.404 32.150 42.566 56.405 12 . . ...... 24.133 25.650 27.271 29.002 30.850 32.824 34.931 37.180 39.581 54.208 74.327 13 28.029 29.985 32.089 34.352 36.786 39.404 42.219 45.244 48.497 68.760 97.625 14 32.393 34.883 37.581 40.505 43.672 47.103 50.818 54.841 59. 196 86.949 127.91 15 .. ............. 37.280 40.417 43.842 47.580 51.660 56. 110 60.965 66.261 72.035 109.69 167.29 16 42.753 46.672 50.980 55.717 60.925 66.649 72.939 79.850 87.442 138. 11 218.47 17 48.884 53.739 59. 118 65.075 71.673 78.979 87.068 96.022 105.93 173.64 285.01 18 55.750 61.725 68.394 75.836 84.141 93.406 103.74 115.27 128.12 218.05 371.52 19 63.440 70.749 78.969 88.212 98.603 110.29 123.41 138.17 154.74 273.56 483.97 20 72.052 80.947 91.025 102.44 115.38 130.03 146.63 165.42 186.69 342.95 630.17 25 133.33 155.62 181.87 212.79 249.21 292.11 342.60 402.04 471.98 1,054.8 2,348.80 30 241.33 293.20 356.79 434.75 530.31 647.44 790.95 966.7 1, 181.9 3,227.2 8,730.0 40 767.09 1,013.7 1,342.0 1,779.1 2,360.8 3, 134.5 4, 163.21 5,529.8 7,343.9 30,089.0 120,393.0 50 ...........". 2,400.0 3,459.5 4,994.5 7,217.7 10,436.0 15,090.0 21,813.0 31,515.0 45,497.0 280,256.0 1,659,76.0Appendix D Present value of an annuity of $1, PV IFA PVA = A Percent Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 0.990 0.980 0.971 0.962 0.943 0.935 0.926 0.909 0.901 0.893 1.970 1.942 1.913 1.886 1.859 1.833 1.783 1.759 1.736 1.713 1.690 2.941 2.884 2.829 2.775 2.673 2.624 2.577 2.531 2.487 2.444 2.402 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 4.853 4.713 4.580 4.452 4.329 4.212 4. 100 3.993 3.890 3.791 3.696 3.605 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.1 11 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 4.868 4.712 4.564 7.652 7.325 7.020 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 8.566 8. 162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 10 9.471 8.983 8.530 8. 111 7.722 7.360 7.024 6.418 6.145 5.889 5.650 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7. 139 6.805 6.495 6.207 11.255 10.575 9.954 9.385 8.384 7.943 7.536 7.161 6.814 6.492 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 13.004 11.296 10.563 9.295 8.745 8.244 7.786 7.367 6.982 6.628 15 13.865 12.849 11.938 11.1 18 10.380 9.712 9.108 8.559 7.606 6.811 16 14.718 13.578 12.561 1 1.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 15.562 14.292 13. 166 12. 166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 1 1.258 10.274 9.427 8.694 8.055 40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 1 1.925 10.757 9.779 8.951 8.244 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 9.042 8.304