Question

The Apple company is considering a machine to reduce operation costs. The machine costs $2B. If bought, the machine will reduce the cost of

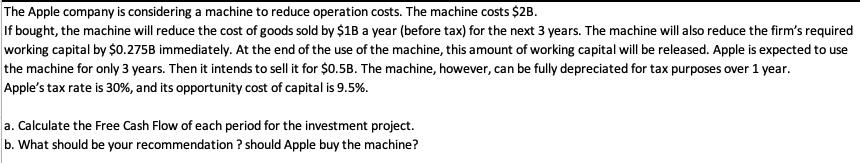

The Apple company is considering a machine to reduce operation costs. The machine costs $2B. If bought, the machine will reduce the cost of goods sold by $1B a year (before tax) for the next 3 years. The machine will also reduce the firm's required working capital by $0.275B immediately. At the end of the use of the machine, this amount of working capital will be released. Apple is expected to use the machine for only 3 years. Then it intends to sell it for $0.5B. The machine, however, can be fully depreciated for tax purposes over 1 year. Apple's tax rate is 30%, and its opportunity cost of capital is 9.5%. a. Calculate the Free Cash Flow of each period for the investment project. b. What should be your recommendation? should Apple buy the machine?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting Tools for Business Decision Making

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly

3rd Canadian edition

978-1118727737, 1118727738, 978-1118033890

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App