Answered step by step

Verified Expert Solution

Question

1 Approved Answer

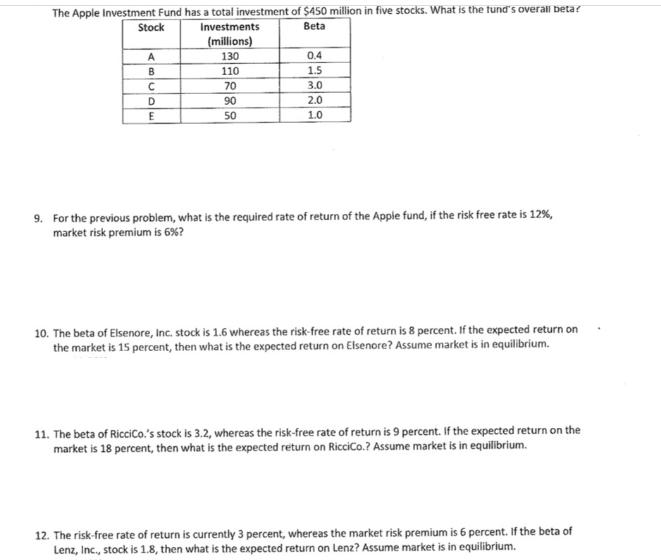

The Apple Investment Fund has a total investment of $450 million in five stocks. What is the fund's overall betar Stock Beta A B

The Apple Investment Fund has a total investment of $450 million in five stocks. What is the fund's overall betar Stock Beta A B D E Investments (millions) 130 110 70 90 50 0.4 1.5 3.0 2.0 1.0 9. For the previous problem, what is the required rate of return of the Apple fund, if the risk free rate is 12%, market risk premium is 6%? 10. The beta of Elsenore, Inc. stock is 1.6 whereas the risk-free rate of return is 8 percent. If the expected return on the market is 15 percent, then what is the expected return on Elsenore? Assume market is in equilibrium. 11. The beta of RicciCo.'s stock is 3.2, whereas the risk-free rate of return is 9 percent. If the expected return on the market is 18 percent, then what is the expected return on RicciCo.? Assume market is in equilibrium. 12. The risk-free rate of return is currently 3 percent, whereas the market risk premium is 6 percent. If the beta of Lenz, Inc., stock is 1.8, then what is the expected return on Lenz? Assume market is in equilibrium.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

9 To calculate the required rate of return for the Apple Investment Fund we can use the Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started