the applicable tax rate is 16.5%. I really need help on this.... i am begging you guys, i know this is kinda time consuming but please help...

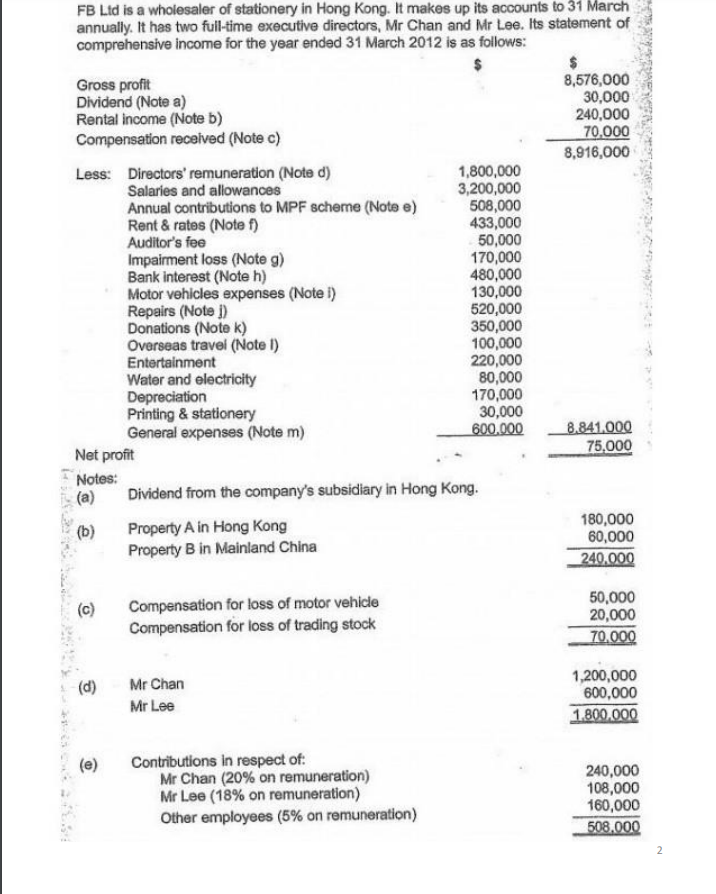

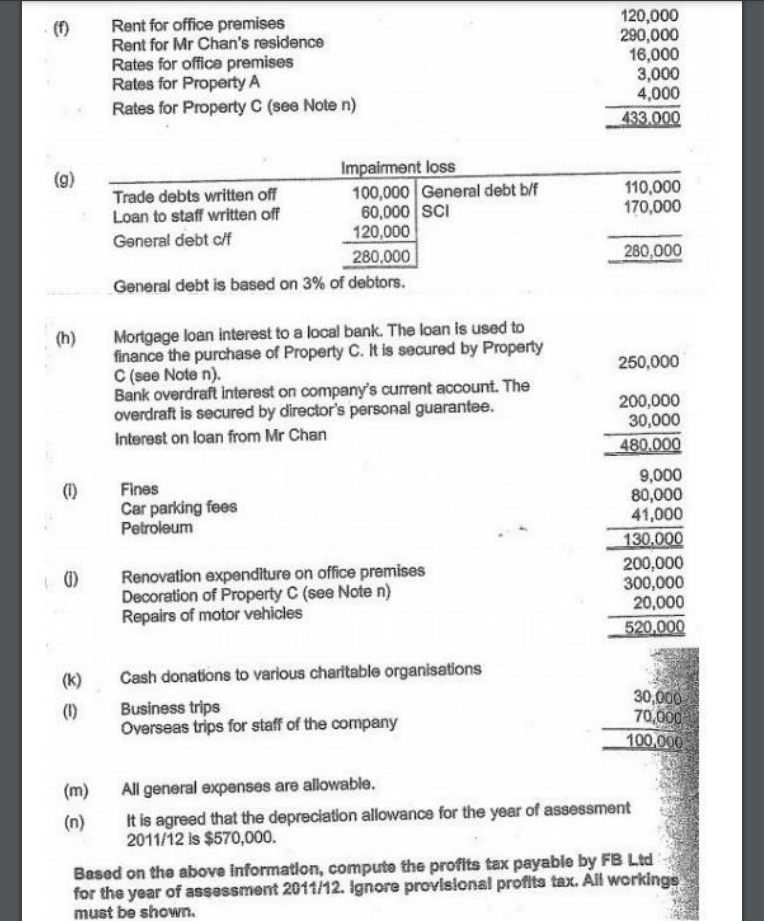

FB Lid is a wholesaler of stationery in Hong Kong. It makes up its accounts to 31 March annually. It has two full-time executive directors, Mr Chan and Mr Lee. Its statement of comprehensive income for the year ended 31 March 2012 is as follows: $ Gross profit 8,576,000 Dividend (Note a) 30,000 Rental income (Note b) 240,000 Compensation received (Note c) 70.000 8,916,000 Less: Directors' remuneration (Note d) 1,800,000 Salaries and allowances 3,200,000 Annual contributions to MPF scheme (Note e) 508,000 Rent & rates (Note f) 433,000 Auditor's fee 50,000 Impairment loss (Note g) 170,000 Bank interest (Note h) 480,000 Motor vehicles expenses (Note I) 130,000 Repairs (Note ]) 520,000 Donations (Note k) 350,000 Overseas travel (Note I) 100,000 Entertainment 220,000 Water and electricity 80,000 Depreciation 170,000 Printing & stationery 30,000 General expenses (Note m) 600,000 8.841,000 Net profit 75,000 Notes: (a Dividend from the company's subsidiary in Hong Kong. (b ) Property A in Hong Kong 180,000 Property B in Mainland China 60,000 240.000 (c) Compensation for loss of motor vehicle 50,000 Compensation for loss of trading stock 20,000 70,000 (d) Mr Chan 1,200,000 600,000 Mr Lee 1.800,000 (e) Contributions in respect of: Mr Chan (20% on remuneration) 240,000 Mr Lee (18% on remuneration) 108,000 Other employees (5% on remuneration) 160,000 508.000 2Rent for office premises 120,000 Rent for Mr Chan's residence 290,000 Rates for office premises 16,000 Rates for Property A 3,000 Rates for Property C (see Note n) 4,000 433.000 (g) Impairment loss Trade debts written off 100,000 General debt b/f 110,000 Loan to staff written off 60,000 SCI 170,000 General debt c/f 120,000 280,000 280,000 General debt is based on 3% of debtors. (h) Mortgage loan interest to a local bank. The loan is used to finance the purchase of Property C. It is secured by Property C (see Note n). 250,000 Bank overdraft interest on company's current account. The overdraft is secured by director's personal guarantee. 200,000 Interest on loan from Mr Chan 30,000 480.000 Fines 9,000 Car parking fees 80,000 Petroleum 41,000 130,000 () Renovation expenditure on office premises 200,000 Decoration of Property C (see Note n) 300,000 Repairs of motor vehicles 20,000 520.000 (K) Cash donations to various charitable organisations (1) Business trips 30,000 Overseas trips for staff of the company 70,000 100,000 (m) All general expenses are allowable. (n) It is agreed that the depreciation allowance for the year of assessment 2011/12 Is $570,000. Based on the above information, compute the profits tax payable by FB Ltd for the year of assessment 2011/12. Ignore provisional profits tax. All workings must be shown