Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The area of teachers' offices in the Antonio Lucchetti building has problems associated with the air conditioning system. Currently the existing system is a

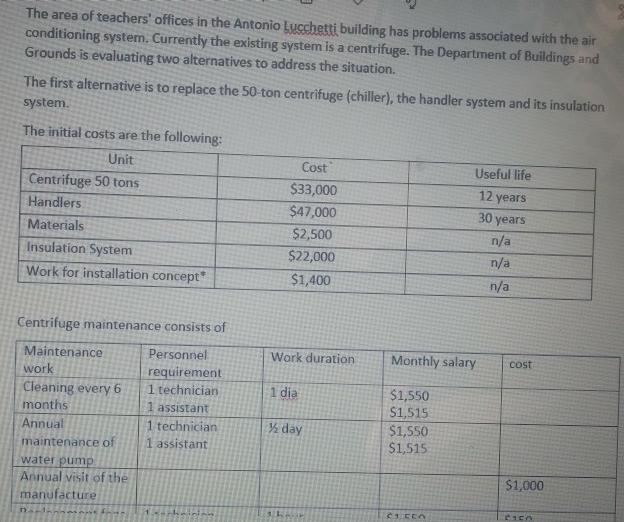

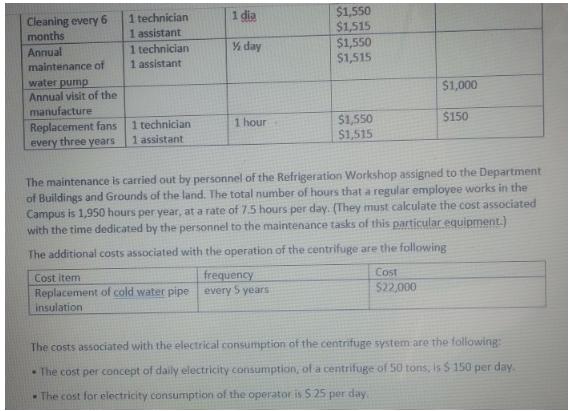

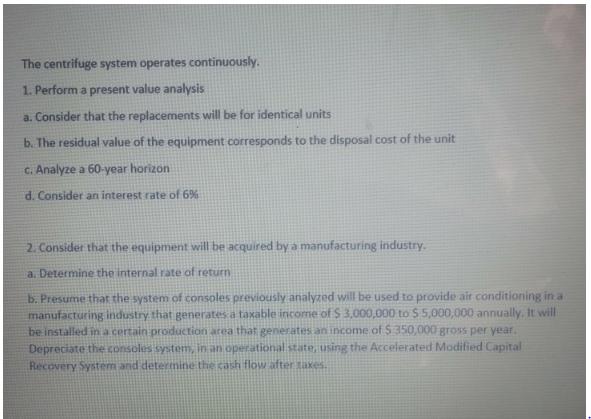

The area of teachers' offices in the Antonio Lucchetti building has problems associated with the air conditioning system. Currently the existing system is a centrifuge. The Department of Buildings and Grounds is evaluating two alternatives to address the situation. The first alternative is to replace the 50-ton centrifuge (chiller), the handler system and its insulation system. The initial costs are the following: Unit Centrifuge 50 tons Handlers Materials Insulation System Work for installation concept Centrifuge maintenance consists of Maintenance Personnel requirement 1 technician 1 assistant work Cleaning every 6 months Annual maintenance of water pump Annual visit of the manufacture na. 1 technician 1 assistant wat die 1 thainian. Cost $33,000 $47,000 $2,500 $22,000 $1,400 Work duration 1 dia day RAK Monthly salary $1,550 $1,515 $1,550 $1,515 Useful life 12 years 30 CLEEN years n/a n/a n/a cost $1,000 CICA Cleaning every months Annual maintenance of water pump Annual visit of the manufacture Replacement fans every three years 1 technician 1 assistant 1 technician 1 assistant 1 technician 1 assistant 1 dia day 1 hour $1,550 $1,515 Cost item frequency Replacement of cold water pipe every 5 years insulation $1,550 $1,515 $1,550 $1,515 The maintenance is carried out by personnel of the Refrigeration Workshop assigned to the Department of Buildings and Grounds of the land. The total number of hours that a regular employee works in the Campus is 1,950 hours per year, at a rate of 7.5 hours per day. (They must calculate the cost associated with the time dedicated by the personnel to the maintenance tasks of this particular equipment.) The additional costs associated with the operation of the centrifuge are the following $1,000 $150 Cost $22,000 The costs associated with the electrical consumption of the centrifuge system are the following: The cost per concept of daily electricity consumption, of a centrifuge of 50 tons, is $150 per day. The cost for electricity consumption of the operator is 5.25 per day. The centrifuge system operates continuously. 1. Perform a present value analysis a. Consider that the replacements will be for identical units b. The residual value of the equipment corresponds to the disposal cost of the unit c. Analyze a 60-year horizon d. Consider an interest rate of 6% 2. Consider that the equipment will be acquired by a manufacturing industry. a. Determine the internal rate of return b. Presume that the system of consoles previously analyzed will be used to provide air conditioning in a manufacturing industry that generates a taxable income of $3,000,000 to $5,000,000 annually. It will be installed in a certain production area that generates an income of $ 350,000 gross per year. Depreciate the consoles system, in an operational state, using the Accelerated Modified Capital Recovery System and determine the cash flow after taxes. The area of teachers' offices in the Antonio Lucchetti building has problems associated with the air conditioning system. Currently the existing system is a centrifuge. The Department of Buildings and Grounds is evaluating two alternatives to address the situation. The first alternative is to replace the 50-ton centrifuge (chiller), the handler system and its insulation system. The initial costs are the following: Unit Centrifuge 50 tons Handlers Materials Insulation System Work for installation concept Centrifuge maintenance consists of Maintenance Personnel requirement 1 technician 1 assistant work Cleaning every 6 months Annual maintenance of water pump Annual visit of the manufacture na. 1 technician 1 assistant wat die 1 thainian. Cost $33,000 $47,000 $2,500 $22,000 $1,400 Work duration 1 dia day RAK Monthly salary $1,550 $1,515 $1,550 $1,515 Useful life 12 years 30 CLEEN years n/a n/a n/a cost $1,000 CICA Cleaning every months Annual maintenance of water pump Annual visit of the manufacture Replacement fans every three years 1 technician 1 assistant 1 technician 1 assistant 1 technician 1 assistant 1 dia day 1 hour $1,550 $1,515 Cost item frequency Replacement of cold water pipe every 5 years insulation $1,550 $1,515 $1,550 $1,515 The maintenance is carried out by personnel of the Refrigeration Workshop assigned to the Department of Buildings and Grounds of the land. The total number of hours that a regular employee works in the Campus is 1,950 hours per year, at a rate of 7.5 hours per day. (They must calculate the cost associated with the time dedicated by the personnel to the maintenance tasks of this particular equipment.) The additional costs associated with the operation of the centrifuge are the following $1,000 $150 Cost $22,000 The costs associated with the electrical consumption of the centrifuge system are the following: The cost per concept of daily electricity consumption, of a centrifuge of 50 tons, is $150 per day. The cost for electricity consumption of the operator is 5.25 per day. The centrifuge system operates continuously. 1. Perform a present value analysis a. Consider that the replacements will be for identical units b. The residual value of the equipment corresponds to the disposal cost of the unit c. Analyze a 60-year horizon d. Consider an interest rate of 6% 2. Consider that the equipment will be acquired by a manufacturing industry. a. Determine the internal rate of return b. Presume that the system of consoles previously analyzed will be used to provide air conditioning in a manufacturing industry that generates a taxable income of $3,000,000 to $5,000,000 annually. It will be installed in a certain production area that generates an income of $ 350,000 gross per year. Depreciate the consoles system, in an operational state, using the Accelerated Modified Capital Recovery System and determine the cash flow after taxes. The area of teachers' offices in the Antonio Lucchetti building has problems associated with the air conditioning system. Currently the existing system is a centrifuge. The Department of Buildings and Grounds is evaluating two alternatives to address the situation. The first alternative is to replace the 50-ton centrifuge (chiller), the handler system and its insulation system. The initial costs are the following: Unit Centrifuge 50 tons Handlers Materials Insulation System Work for installation concept Centrifuge maintenance consists of Maintenance Personnel requirement 1 technician 1 assistant work Cleaning every 6 months Annual maintenance of water pump Annual visit of the manufacture na. 1 technician 1 assistant wat die 1 thainian. Cost $33,000 $47,000 $2,500 $22,000 $1,400 Work duration 1 dia day RAK Monthly salary $1,550 $1,515 $1,550 $1,515 Useful life 12 years 30 CLEEN years n/a n/a n/a cost $1,000 CICA Cleaning every months Annual maintenance of water pump Annual visit of the manufacture Replacement fans every three years 1 technician 1 assistant 1 technician 1 assistant 1 technician 1 assistant 1 dia day 1 hour $1,550 $1,515 Cost item frequency Replacement of cold water pipe every 5 years insulation $1,550 $1,515 $1,550 $1,515 The maintenance is carried out by personnel of the Refrigeration Workshop assigned to the Department of Buildings and Grounds of the land. The total number of hours that a regular employee works in the Campus is 1,950 hours per year, at a rate of 7.5 hours per day. (They must calculate the cost associated with the time dedicated by the personnel to the maintenance tasks of this particular equipment.) The additional costs associated with the operation of the centrifuge are the following $1,000 $150 Cost $22,000 The costs associated with the electrical consumption of the centrifuge system are the following: The cost per concept of daily electricity consumption, of a centrifuge of 50 tons, is $150 per day. The cost for electricity consumption of the operator is 5.25 per day. The centrifuge system operates continuously. 1. Perform a present value analysis a. Consider that the replacements will be for identical units b. The residual value of the equipment corresponds to the disposal cost of the unit c. Analyze a 60-year horizon d. Consider an interest rate of 6% 2. Consider that the equipment will be acquired by a manufacturing industry. a. Determine the internal rate of return b. Presume that the system of consoles previously analyzed will be used to provide air conditioning in a manufacturing industry that generates a taxable income of $3,000,000 to $5,000,000 annually. It will be installed in a certain production area that generates an income of $ 350,000 gross per year. Depreciate the consoles system, in an operational state, using the Accelerated Modified Capital Recovery System and determine the cash flow after taxes. The area of teachers' offices in the Antonio Lucchetti building has problems associated with the air conditioning system. Currently the existing system is a centrifuge. The Department of Buildings and Grounds is evaluating two alternatives to address the situation. The first alternative is to replace the 50-ton centrifuge (chiller), the handler system and its insulation system. The initial costs are the following: Unit Centrifuge 50 tons Handlers Materials Insulation System Work for installation concept Centrifuge maintenance consists of Maintenance Personnel requirement 1 technician 1 assistant work Cleaning every 6 months Annual maintenance of water pump Annual visit of the manufacture na. 1 technician 1 assistant wat die 1 thainian. Cost $33,000 $47,000 $2,500 $22,000 $1,400 Work duration 1 dia day RAK Monthly salary $1,550 $1,515 $1,550 $1,515 Useful life 12 years 30 CLEEN years n/a n/a n/a cost $1,000 CICA Cleaning every months Annual maintenance of water pump Annual visit of the manufacture Replacement fans every three years 1 technician 1 assistant 1 technician 1 assistant 1 technician 1 assistant 1 dia day 1 hour $1,550 $1,515 Cost item frequency Replacement of cold water pipe every 5 years insulation $1,550 $1,515 $1,550 $1,515 The maintenance is carried out by personnel of the Refrigeration Workshop assigned to the Department of Buildings and Grounds of the land. The total number of hours that a regular employee works in the Campus is 1,950 hours per year, at a rate of 7.5 hours per day. (They must calculate the cost associated with the time dedicated by the personnel to the maintenance tasks of this particular equipment.) The additional costs associated with the operation of the centrifuge are the following $1,000 $150 Cost $22,000 The costs associated with the electrical consumption of the centrifuge system are the following: The cost per concept of daily electricity consumption, of a centrifuge of 50 tons, is $150 per day. The cost for electricity consumption of the operator is 5.25 per day. The centrifuge system operates continuously. 1. Perform a present value analysis a. Consider that the replacements will be for identical units b. The residual value of the equipment corresponds to the disposal cost of the unit c. Analyze a 60-year horizon d. Consider an interest rate of 6% 2. Consider that the equipment will be acquired by a manufacturing industry. a. Determine the internal rate of return b. Presume that the system of consoles previously analyzed will be used to provide air conditioning in a manufacturing industry that generates a taxable income of $3,000,000 to $5,000,000 annually. It will be installed in a certain production area that generates an income of $ 350,000 gross per year. Depreciate the consoles system, in an operational state, using the Accelerated Modified Capital Recovery System and determine the cash flow after taxes. The area of teachers' offices in the Antonio Lucchetti building has problems associated with the air conditioning system. Currently the existing system is a centrifuge. The Department of Buildings and Grounds is evaluating two alternatives to address the situation. The first alternative is to replace the 50-ton centrifuge (chiller), the handler system and its insulation system. The initial costs are the following: Unit Centrifuge 50 tons Handlers Materials Insulation System Work for installation concept Centrifuge maintenance consists of Maintenance Personnel requirement 1 technician 1 assistant work Cleaning every 6 months Annual maintenance of water pump Annual visit of the manufacture na. 1 technician 1 assistant wat die 1 thainian. Cost $33,000 $47,000 $2,500 $22,000 $1,400 Work duration 1 dia day RAK Monthly salary $1,550 $1,515 $1,550 $1,515 Useful life 12 years 30 CLEEN years n/a n/a n/a cost $1,000 CICA Cleaning every months Annual maintenance of water pump Annual visit of the manufacture Replacement fans every three years 1 technician 1 assistant 1 technician 1 assistant 1 technician 1 assistant 1 dia day 1 hour $1,550 $1,515 Cost item frequency Replacement of cold water pipe every 5 years insulation $1,550 $1,515 $1,550 $1,515 The maintenance is carried out by personnel of the Refrigeration Workshop assigned to the Department of Buildings and Grounds of the land. The total number of hours that a regular employee works in the Campus is 1,950 hours per year, at a rate of 7.5 hours per day. (They must calculate the cost associated with the time dedicated by the personnel to the maintenance tasks of this particular equipment.) The additional costs associated with the operation of the centrifuge are the following $1,000 $150 Cost $22,000 The costs associated with the electrical consumption of the centrifuge system are the following: The cost per concept of daily electricity consumption, of a centrifuge of 50 tons, is $150 per day. The cost for electricity consumption of the operator is 5.25 per day. The centrifuge system operates continuously. 1. Perform a present value analysis a. Consider that the replacements will be for identical units b. The residual value of the equipment corresponds to the disposal cost of the unit c. Analyze a 60-year horizon d. Consider an interest rate of 6% 2. Consider that the equipment will be acquired by a manufacturing industry. a. Determine the internal rate of return b. Presume that the system of consoles previously analyzed will be used to provide air conditioning in a manufacturing industry that generates a taxable income of $3,000,000 to $5,000,000 annually. It will be installed in a certain production area that generates an income of $ 350,000 gross per year. Depreciate the consoles system, in an operational state, using the Accelerated Modified Capital Recovery System and determine the cash flow after taxes.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

PART 1a PVFV1in PV33000106147000106125000106122000106114001061 PV9826154 PART 1b PVF...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started