Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the Ares highlighted in pink is what I'm struggling with. please help as much as much as possible! During 2019, the following transactions occurred: 1.

the Ares highlighted in pink is what I'm struggling with. please help as much as much as possible!

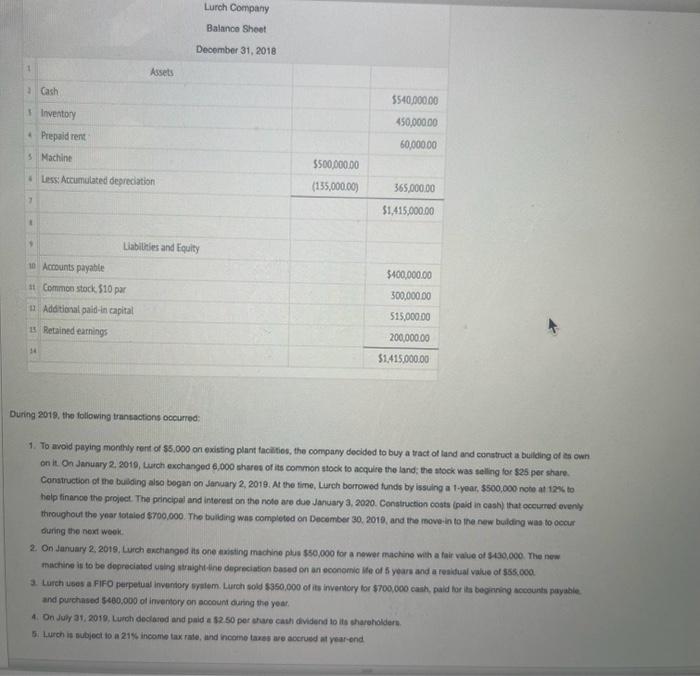

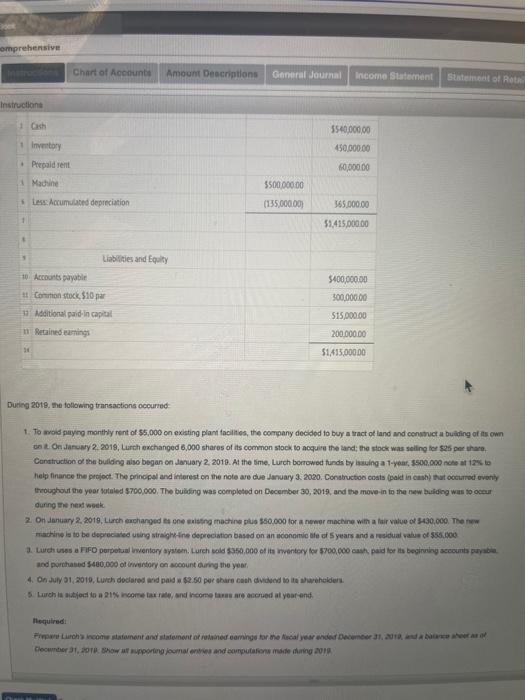

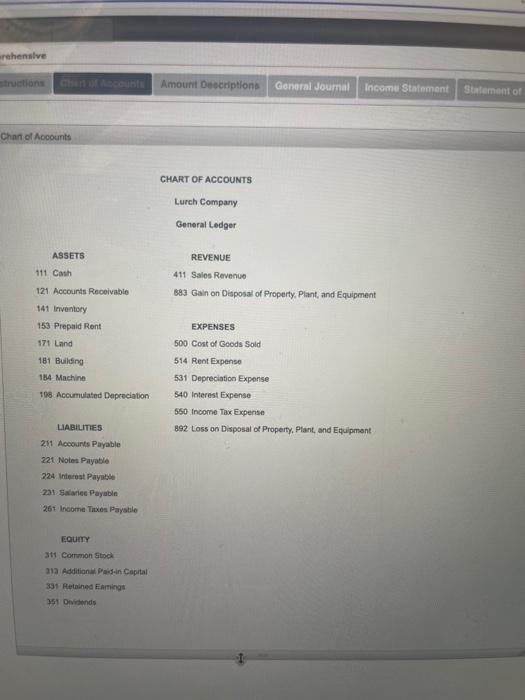

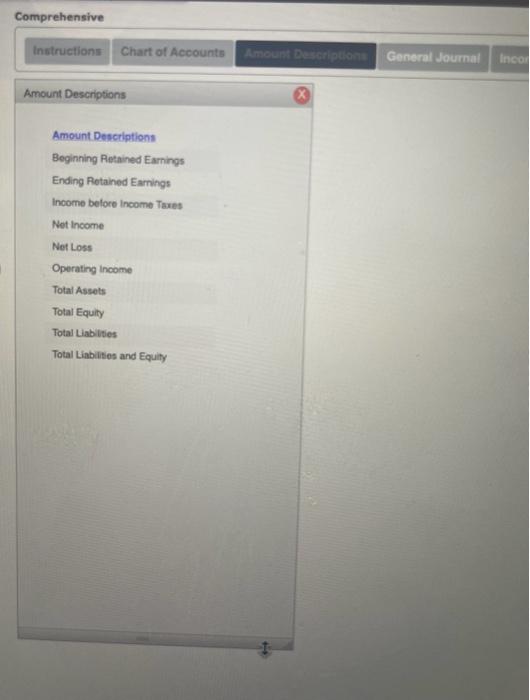

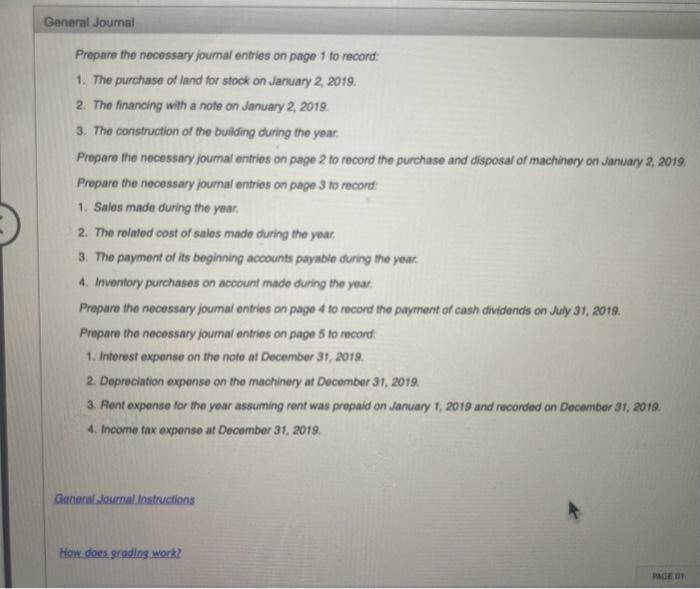

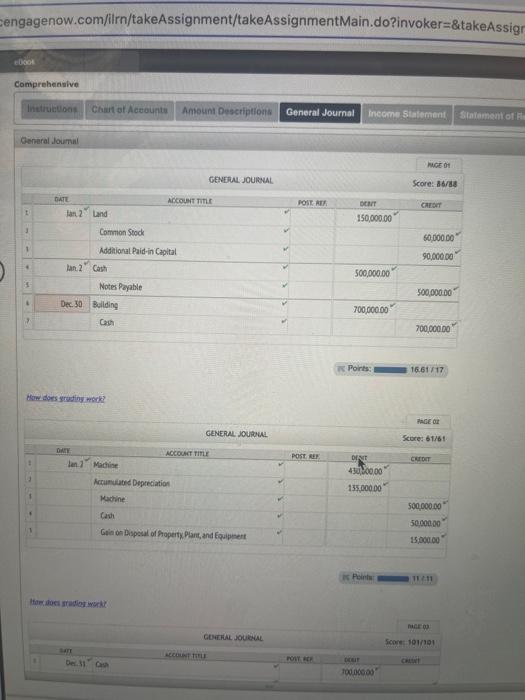

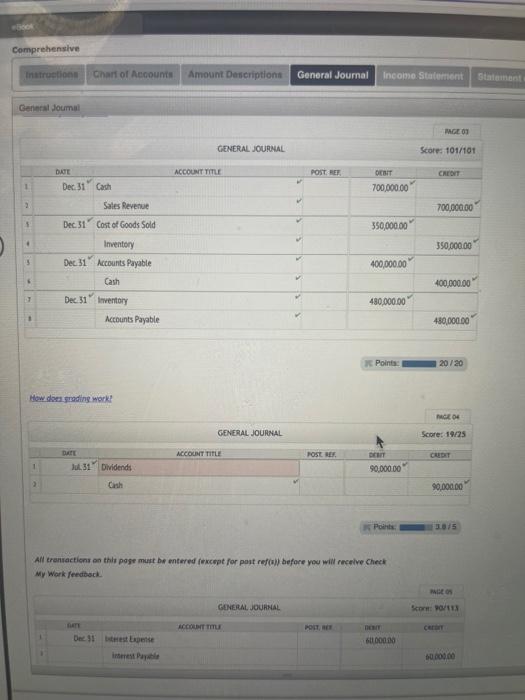

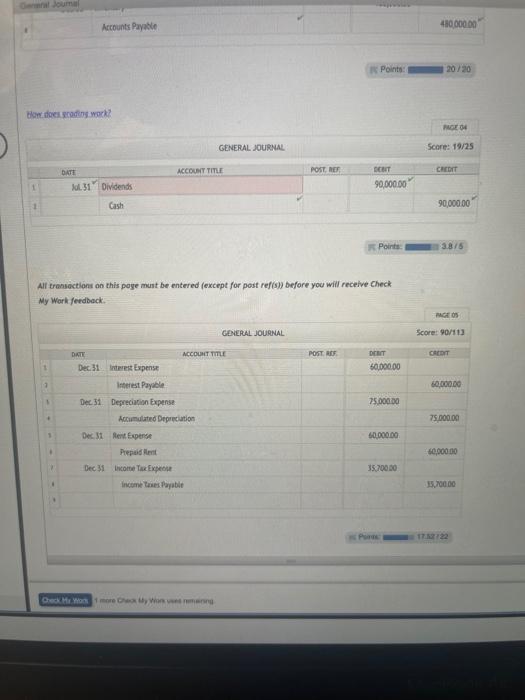

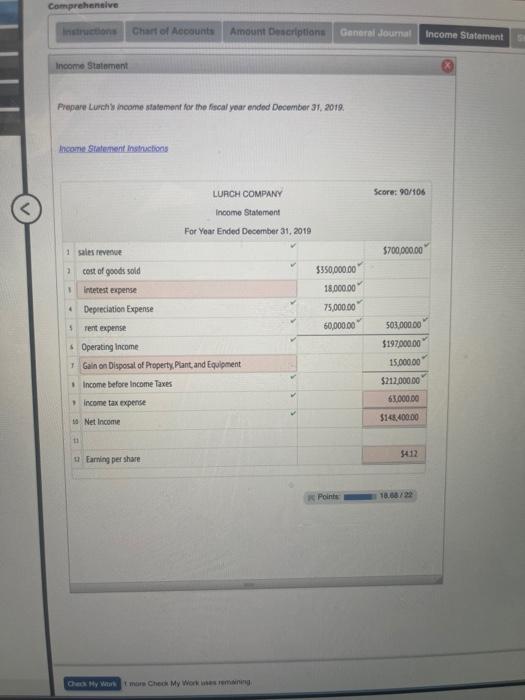

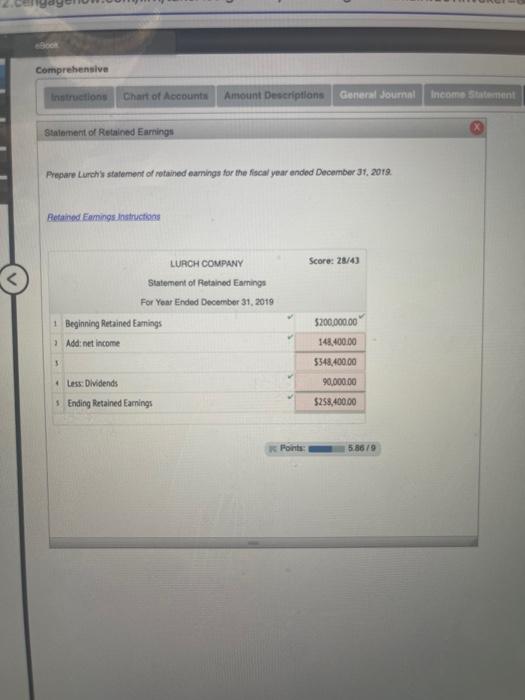

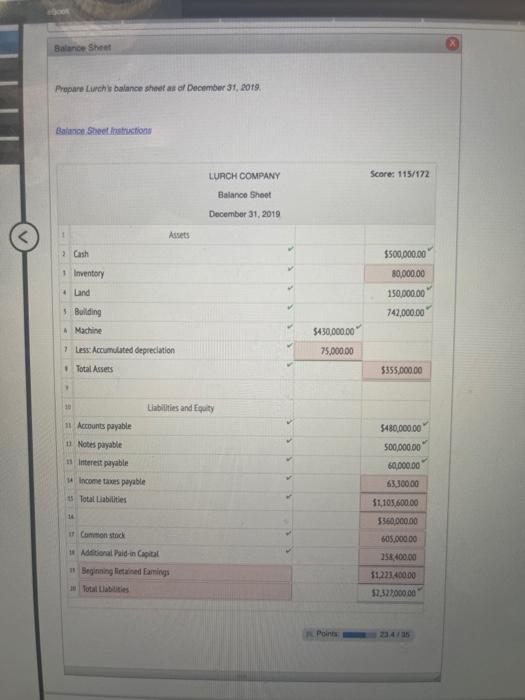

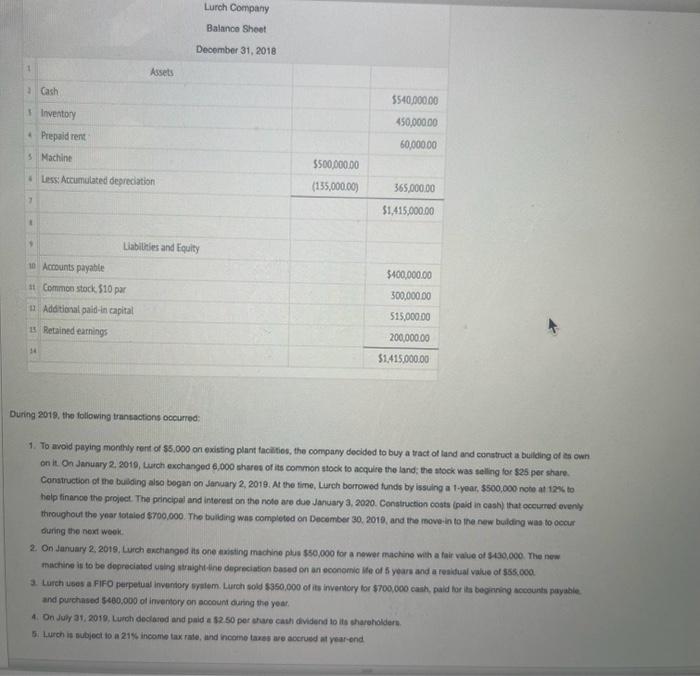

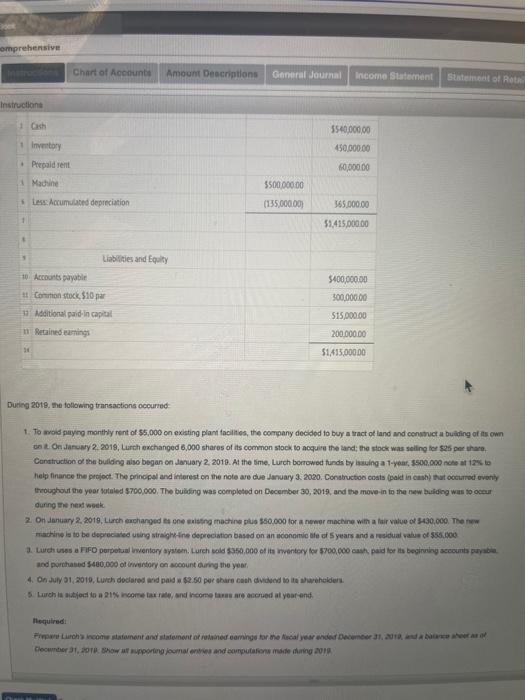

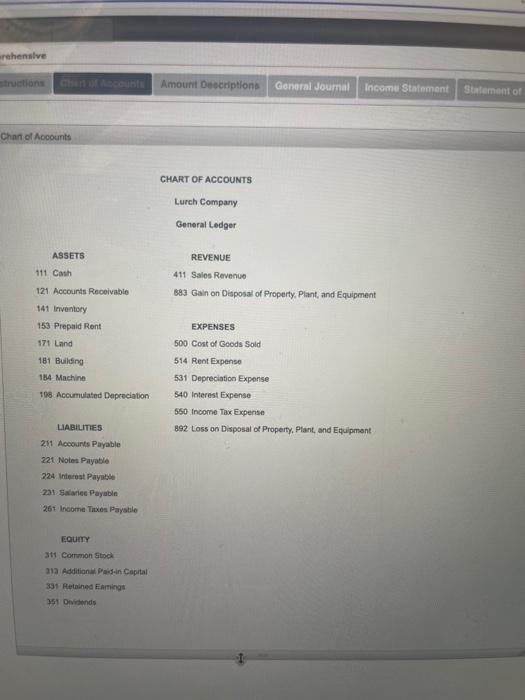

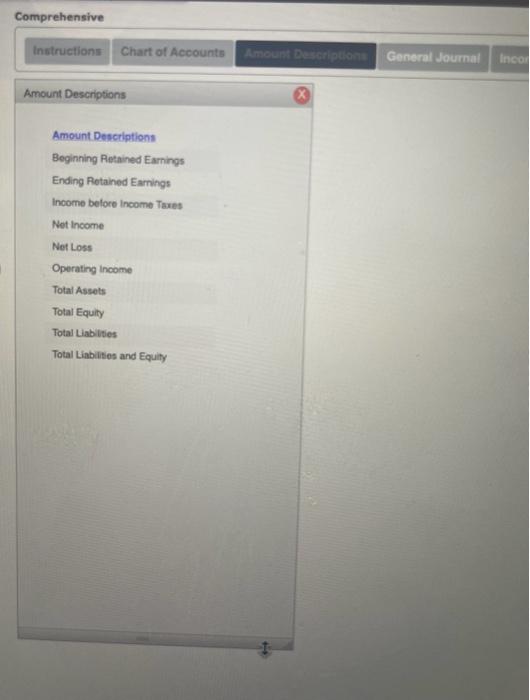

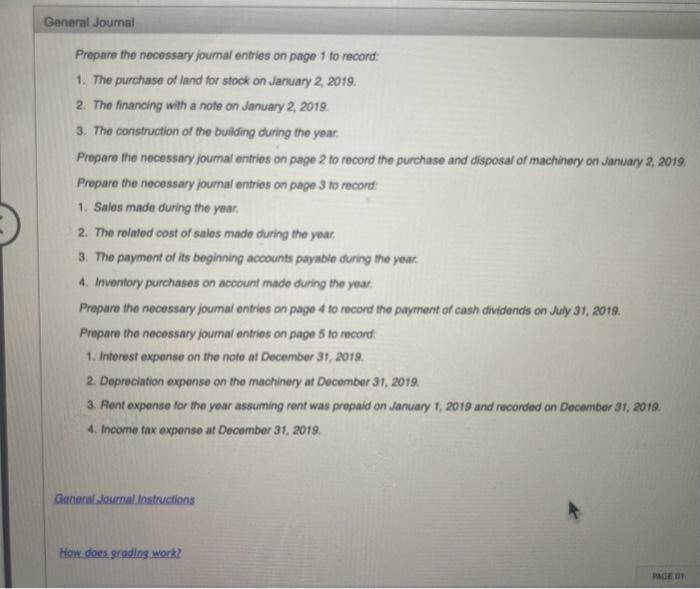

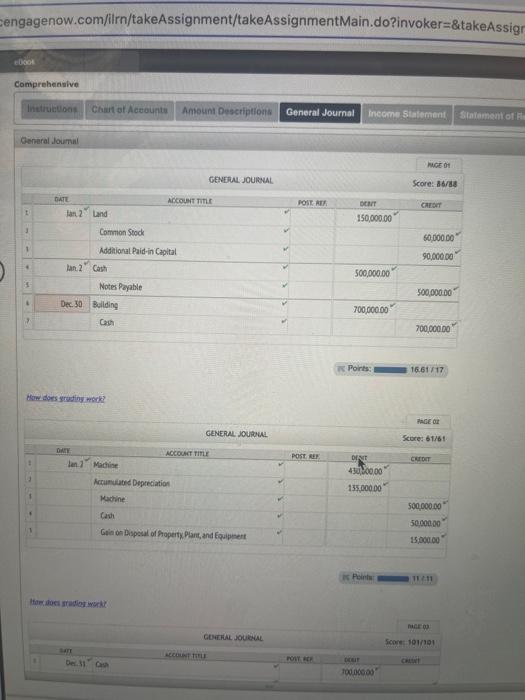

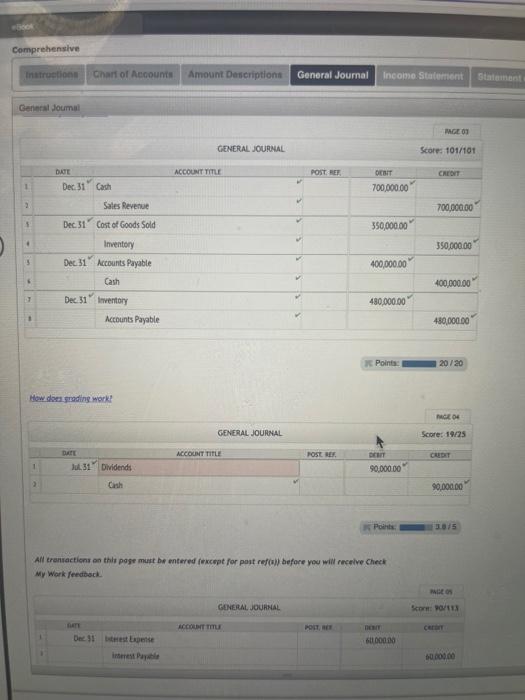

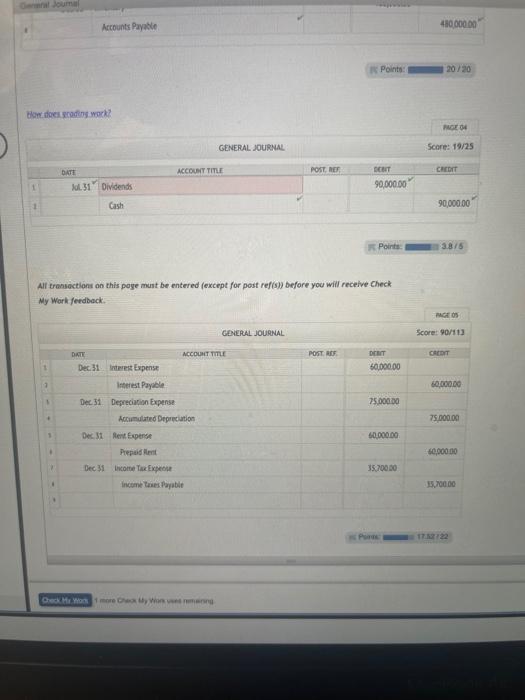

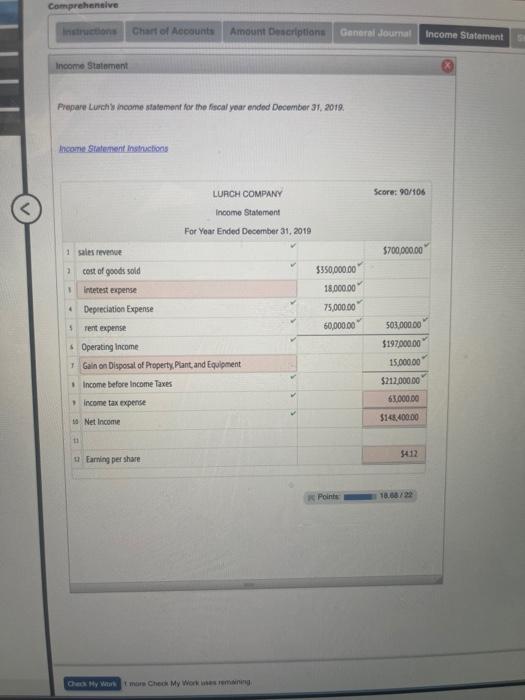

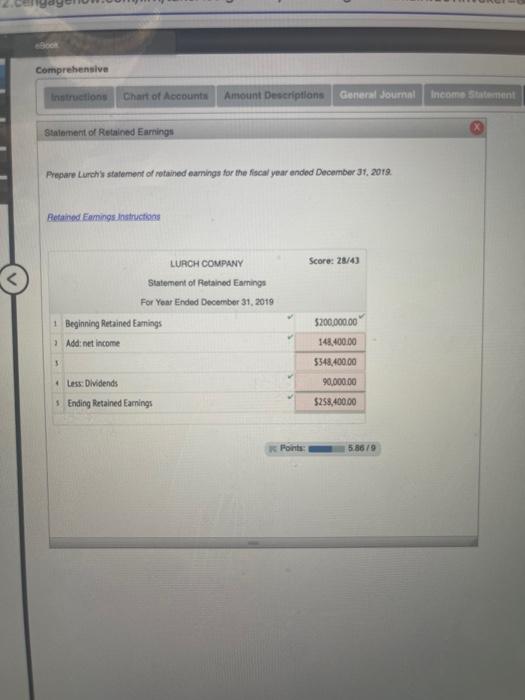

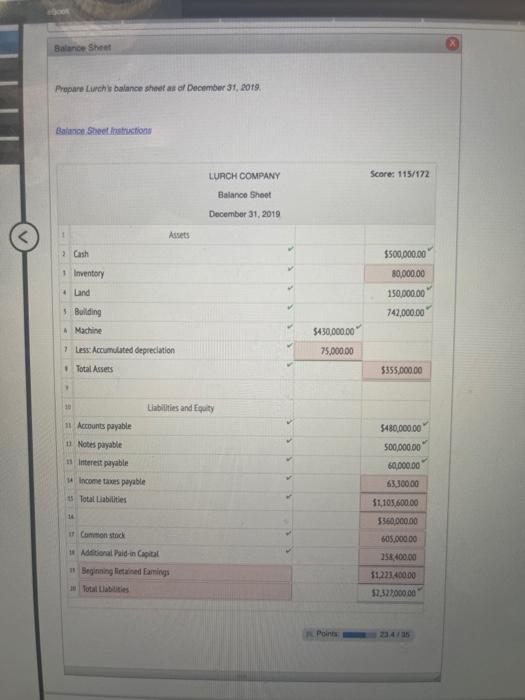

During 2019, the following transactions occurred: 1. To awoid paying monthly rent of $5,000 on existing plant facilfies, the company decidod to buy a tract of land and conatruct a buliding of es own on it On January 2, 2010, Luch exchanged 6,000 shares of its common stock to acquire the land; the stock was selling for s25 per share. Construction of the bulding also began on January 2, 2019. At the time, Lurch borrowed funds by issuing a 1-year, $500,000 note at 125 is help finance the project. The principet and interest on the note are due January 3, 2020. Construction costs (pald in cash) that occurred eventy throughout the year lotaled $700,000. The buliding was completed on December 30 . 2019, and the move-in to the new bulding was to occur during the nokt wook. machine is to be depreciated using straight dine depreciation pased on an economic ite of 5 yeare and a reakifual value of 555 . cco. and perchased see0,000 of inventory on account daring the year. 4. On Juer 31, 2019, Luiph declatod and paid a 52.50 per thare cath divident to its shareholders. During 20t8, the following transactions occurved: in 2 On Jaruary 2. 2018, Lurch exchanged 6,000 shares of its common stock, to acquire the tand; the stock was seling ice s25 per share. dung the next week. and purchated $400,000 of inctintory on acount airng the your. Hequired: CHART OF ACCOUNTS Lurch Company General Ledger ASSETS 111 Cash 121 Accounts Receivable 141 inventery 153 Prepaid Rent 171 Land 181 Builesing 184 Machine 106 Acoumulated Depceciation LABIUTRE 5 211 Acoounts Payphle 221 Notes Payabie 224 intereat Payate 201 Satariee Payabin 261 income Thxos Paryotlo Eoumy 311 Cormon stock 212 Addition Whedsin Copital 391 Retained Eamings: W51 Dovitunds Amount Descriptions Gonoral Joumal Insome Sthinment Statement of Chan of Aocounts General Ledger REVENUE 411 Salos Revenuo 693 Gain on Disposal of Property. Plant, and Equipment EXPENSES 500 Cont of Goods Sold 514 Rent Expense 531 Depreciation Expense 540 Interest Expense 580 Income Tax Expense 892 Loss on Disposal of Property, Plant, and Equipment Comprehensive Instructions Chart of Accounts Goneral Journal Amount Descriptions Amount Descriptions Beginning Retained Earnings Ending Rotahed Earnings Income belore income Taxes Net income NetLoss Operating income Total Assets Total Equity Total Liablities Total tiahilises and Equily Prepare the necossary joumal entries on page f to record: 1. The purchase of land for stock on January 2, 2019. 2. The financing with a note on January 2, 2019. 3. The construction of the building during the year: Prepare the necessary joumal entries on page 2 to record the purchase and disposal of machinery on January 2, 2019. Prepare the necessary joumal entries on page 3 to record: 1. Sales made during the year. 2. The rolated cost of sales made during the your. 3. The payment of its beginning accounts payable during the year. 4. Inventory purchases on account made during the year: Propare the necessary joumal entries on page 4 to record the payment of cash dividends on July 31, 2019. Propare the necessary joumal entries on page 5 to record: 1. Interest expense on the note at December 31, 2019. 2. Depreciation expense on the machinery at Decomber 31,2019 3. Aent expense for the yoar assuming rent was propaid on January 1, 2019 and recorded on December 31, 2019 4. Income tax expense at Decomber 31, 2019. sengagenow.com/ilirn/takeAssignment/takeAssignmentMain.do?invoker=\&takeAssigr cises Comprehensive Inatiketions Chant of Aceounth Amount Descriptions General Journal inceme statoment Sintimenit of How dors sreding mok? Hate does restiog inort? How doen srodins work? All transactions on thit poge must be entered iexcopt for post refoin) before you will recelve Check My Wark feedteck. All transactions on this poye munt be entered (except for post ref(s)) before you will receive Check Wy Wark/erdback. Prepare Lursti income statement for the fiscal year ended Docember 31, 2019 Prepare Lurch S statement of rotained eamings for the fiscal year ended December 31, 2019. Befanod Eamings Instructions Propare Livhl balance shoet as of December 31, 2019

During 2019, the following transactions occurred: 1. To awoid paying monthly rent of $5,000 on existing plant facilfies, the company decidod to buy a tract of land and conatruct a buliding of es own on it On January 2, 2010, Luch exchanged 6,000 shares of its common stock to acquire the land; the stock was selling for s25 per share. Construction of the bulding also began on January 2, 2019. At the time, Lurch borrowed funds by issuing a 1-year, $500,000 note at 125 is help finance the project. The principet and interest on the note are due January 3, 2020. Construction costs (pald in cash) that occurred eventy throughout the year lotaled $700,000. The buliding was completed on December 30 . 2019, and the move-in to the new bulding was to occur during the nokt wook. machine is to be depreciated using straight dine depreciation pased on an economic ite of 5 yeare and a reakifual value of 555 . cco. and perchased see0,000 of inventory on account daring the year. 4. On Juer 31, 2019, Luiph declatod and paid a 52.50 per thare cath divident to its shareholders. During 20t8, the following transactions occurved: in 2 On Jaruary 2. 2018, Lurch exchanged 6,000 shares of its common stock, to acquire the tand; the stock was seling ice s25 per share. dung the next week. and purchated $400,000 of inctintory on acount airng the your. Hequired: CHART OF ACCOUNTS Lurch Company General Ledger ASSETS 111 Cash 121 Accounts Receivable 141 inventery 153 Prepaid Rent 171 Land 181 Builesing 184 Machine 106 Acoumulated Depceciation LABIUTRE 5 211 Acoounts Payphle 221 Notes Payabie 224 intereat Payate 201 Satariee Payabin 261 income Thxos Paryotlo Eoumy 311 Cormon stock 212 Addition Whedsin Copital 391 Retained Eamings: W51 Dovitunds Amount Descriptions Gonoral Joumal Insome Sthinment Statement of Chan of Aocounts General Ledger REVENUE 411 Salos Revenuo 693 Gain on Disposal of Property. Plant, and Equipment EXPENSES 500 Cont of Goods Sold 514 Rent Expense 531 Depreciation Expense 540 Interest Expense 580 Income Tax Expense 892 Loss on Disposal of Property, Plant, and Equipment Comprehensive Instructions Chart of Accounts Goneral Journal Amount Descriptions Amount Descriptions Beginning Retained Earnings Ending Rotahed Earnings Income belore income Taxes Net income NetLoss Operating income Total Assets Total Equity Total Liablities Total tiahilises and Equily Prepare the necossary joumal entries on page f to record: 1. The purchase of land for stock on January 2, 2019. 2. The financing with a note on January 2, 2019. 3. The construction of the building during the year: Prepare the necessary joumal entries on page 2 to record the purchase and disposal of machinery on January 2, 2019. Prepare the necessary joumal entries on page 3 to record: 1. Sales made during the year. 2. The rolated cost of sales made during the your. 3. The payment of its beginning accounts payable during the year. 4. Inventory purchases on account made during the year: Propare the necessary joumal entries on page 4 to record the payment of cash dividends on July 31, 2019. Propare the necessary joumal entries on page 5 to record: 1. Interest expense on the note at December 31, 2019. 2. Depreciation expense on the machinery at Decomber 31,2019 3. Aent expense for the yoar assuming rent was propaid on January 1, 2019 and recorded on December 31, 2019 4. Income tax expense at Decomber 31, 2019. sengagenow.com/ilirn/takeAssignment/takeAssignmentMain.do?invoker=\&takeAssigr cises Comprehensive Inatiketions Chant of Aceounth Amount Descriptions General Journal inceme statoment Sintimenit of How dors sreding mok? Hate does restiog inort? How doen srodins work? All transactions on thit poge must be entered iexcopt for post refoin) before you will recelve Check My Wark feedteck. All transactions on this poye munt be entered (except for post ref(s)) before you will receive Check Wy Wark/erdback. Prepare Lursti income statement for the fiscal year ended Docember 31, 2019 Prepare Lurch S statement of rotained eamings for the fiscal year ended December 31, 2019. Befanod Eamings Instructions Propare Livhl balance shoet as of December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started