Answered step by step

Verified Expert Solution

Question

1 Approved Answer

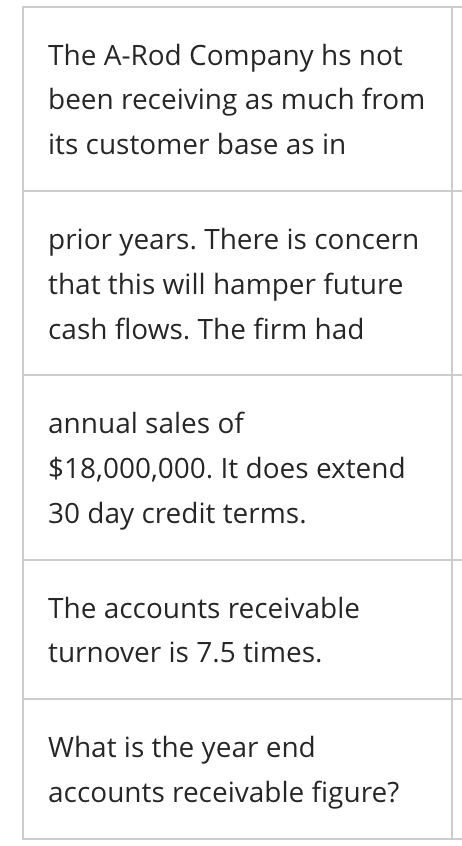

The A-Rod Company hs not been receiving as much from its customer base as in prior years. There is concern that this will hamper

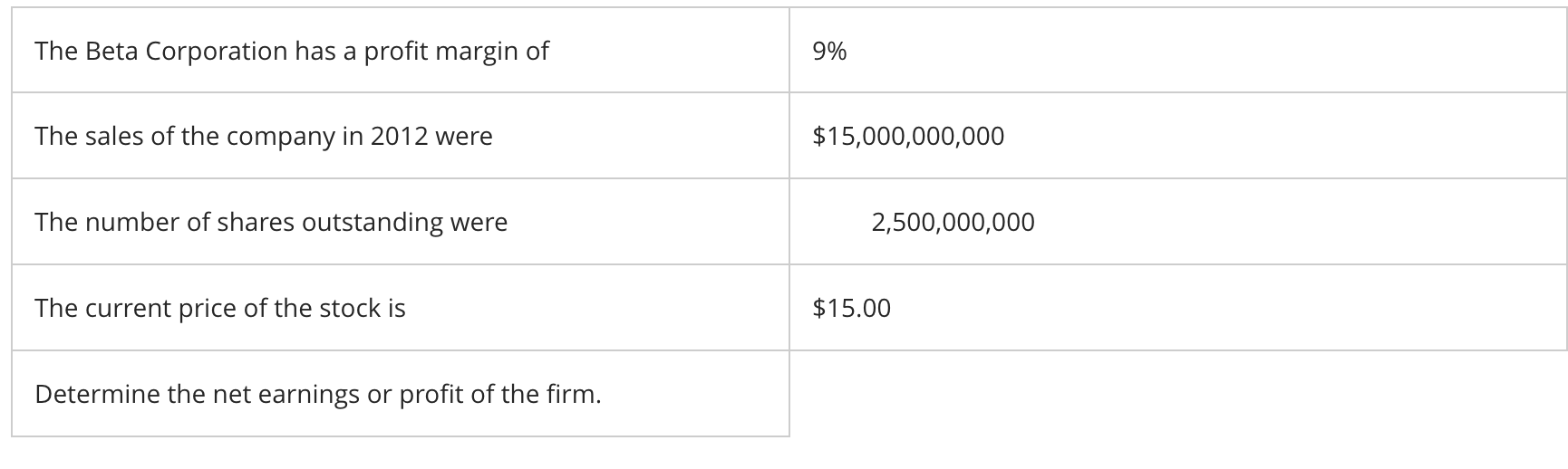

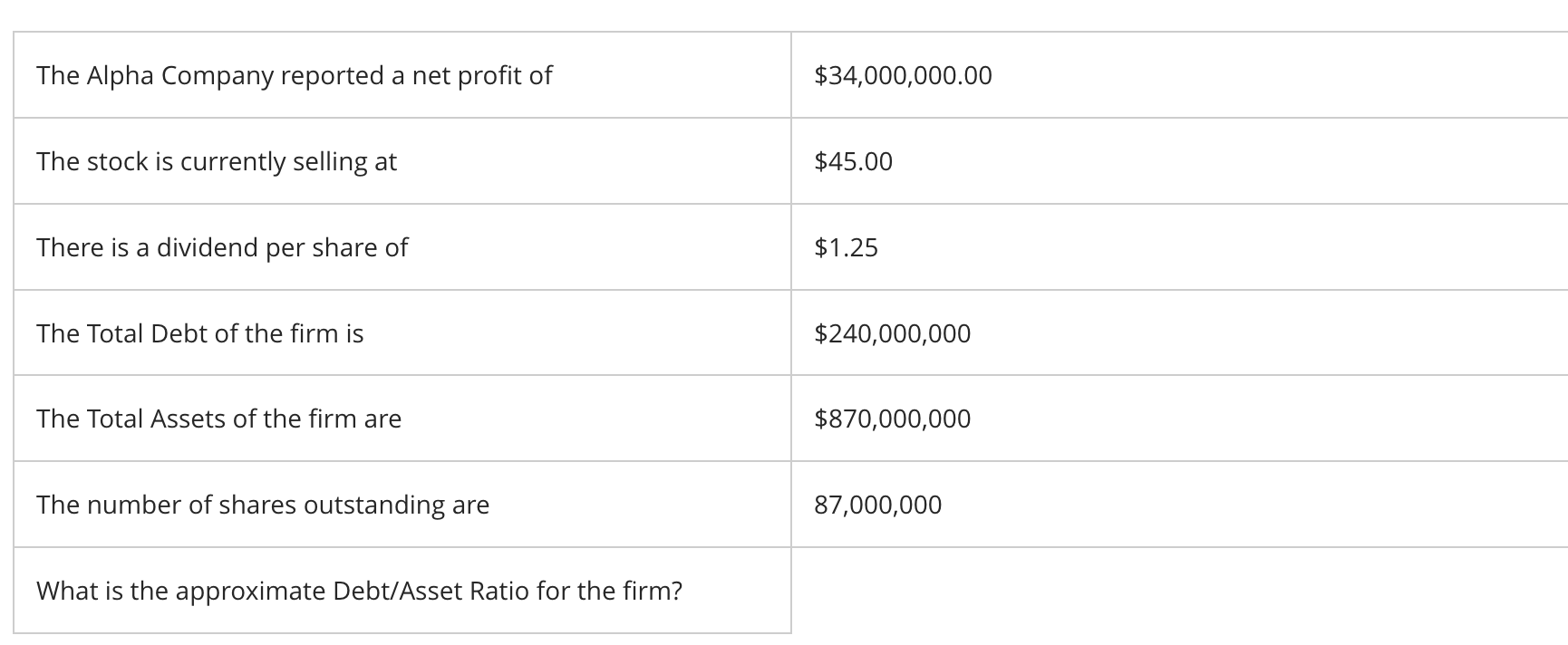

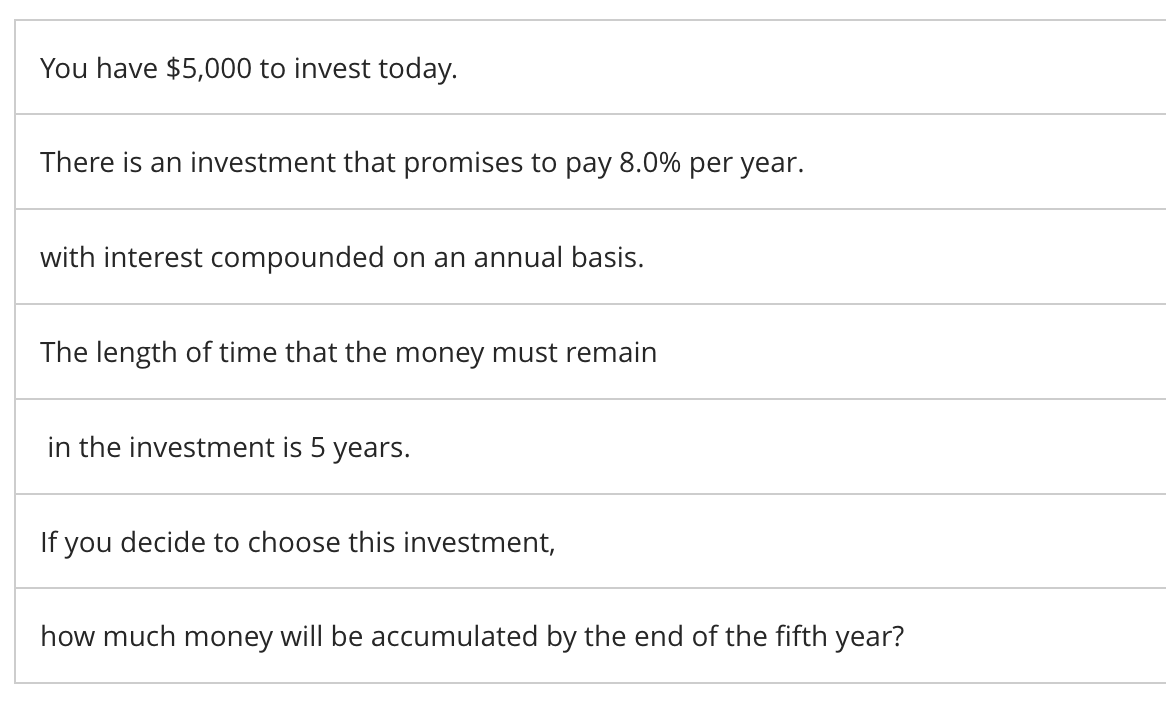

The A-Rod Company hs not been receiving as much from its customer base as in prior years. There is concern that this will hamper future cash flows. The firm had annual sales of $18,000,000. It does extend 30 day credit terms. The accounts receivable turnover is 7.5 times. What is the year end accounts receivable figure? The Beta Corporation has a profit margin of The sales of the company in 2012 were The number of shares outstanding were The current price of the stock is Determine the net earnings or profit of the firm. 9% $15,000,000,000 2,500,000,000 $15.00 The Alpha Company reported a net profit of The stock is currently selling at There is a dividend per share of The Total Debt of the firm is The Total Assets of the firm are The number of shares outstanding are What is the approximate Debt/Asset Ratio for the firm? $34,000,000.00 $45.00 $1.25 $240,000,000 $870,000,000 87,000,000 You have $5,000 to invest today. There is an investment that promises to pay 8.0% per year. with interest compounded on an annual basis. The length of time that the money must remain in the investment is 5 years. If you decide to choose this investment, how much money will be accumulated by the end of the fifth year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Lets tackle each question step by step Accounts Receivable Figure Accounts Receivable Turnove...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started