Answered step by step

Verified Expert Solution

Question

1 Approved Answer

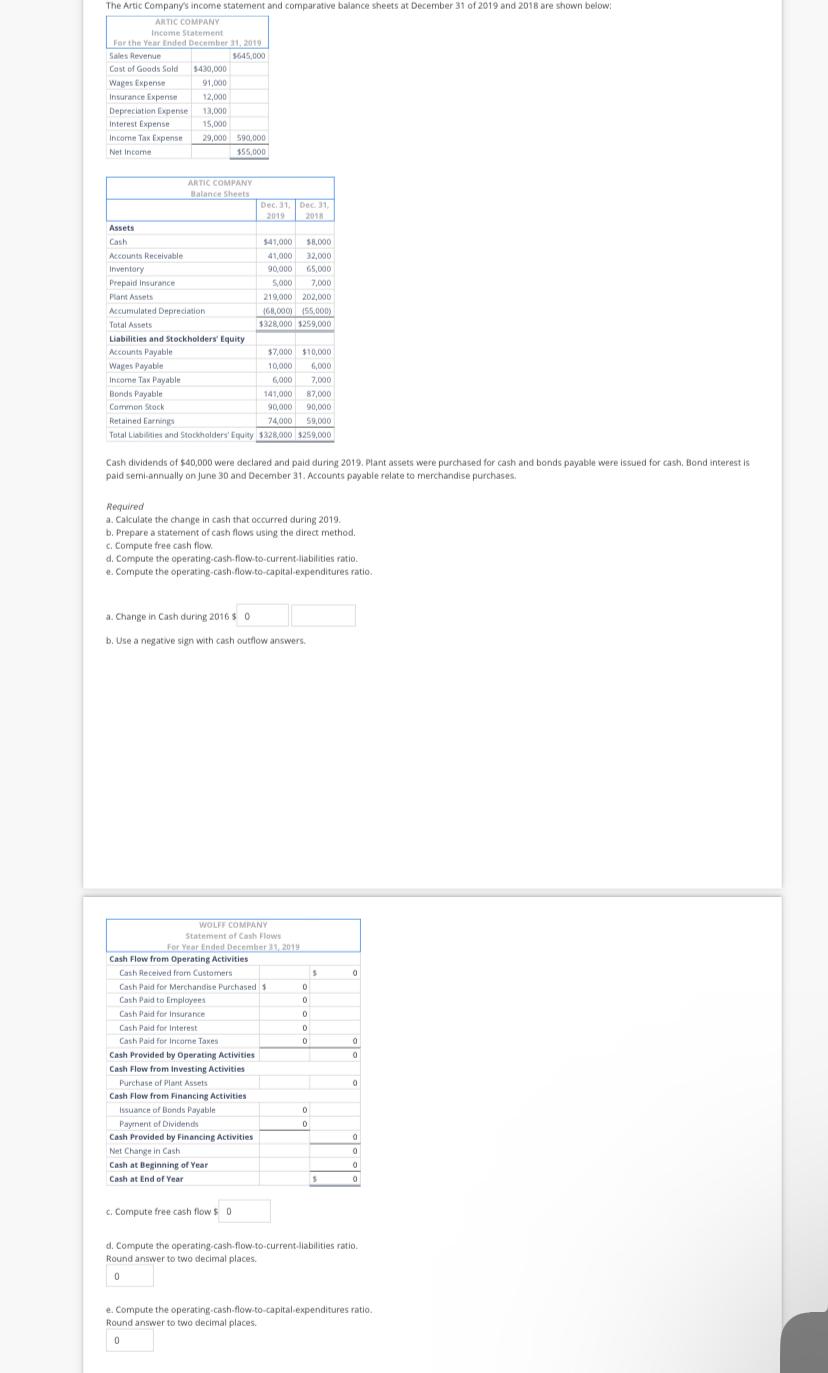

The Artic Company's income statement and comparative balance sheets at December 31 of 2019 and 2018 are shown below: ARTIC COMPANY Income Statement For

The Artic Company's income statement and comparative balance sheets at December 31 of 2019 and 2018 are shown below: ARTIC COMPANY Income Statement For the Year Ended December 31, 2019 Sales Revenue $645,000 Cast of Goods Sold $430,000 Wages Expense 91,000 Insurance Expense 12,000 Depreciation Expense 13,000 Interest Expense 15,000 Income Tax Expense 29,000 590,000 Net Income $55,000 Assets Cash Accounts Receivable Inventory Prepaid Insurance ARTIC COMPANY Balance Sheets Plant Assets Accumulated Depreciation Total Assets Liabilities and Stockholders' Equity Accounts Payable Dec. 31, Dec. 31, 2019 $41,000 $8,000 41,000 32,000 90,000 65,000 5,000 7,000 219,000 202,000 (68,000) (55,000) $328,000 $259,000 $7,000 $10,000 10,000 6,000 Wages Payable Income Tax Payable Bonds Payable Common Stock Retained Earnings 6,000 7,000 141,000 87,000 90,000 90,000 74,000 59,000 Total Liabilities and Stockholders' Equity $328,000 $259,000 Cash dividends of $40,000 were declared and paid during 2019. Plant assets were purchased for cash and bonds payable were issued for cash. Bond interest is paid semi-annually on June 30 and December 31. Accounts payable relate to merchandise purchases. Required a. Calculate the change in cash that occurred during 2019. b. Prepare a statement of cash flows using the direct method. c. Compute free cash flow. d. Compute the operating-cash-flow-to-current-liabilities ratio. e. Compute the operating-cash-flow-to-capital-expenditures ratio.. a. Change in Cash during 2016 $0 b. Use a negative sign with cash outflow answers. WOLFF COMPANY Statement of Cash Flows For Year Ended December 31, 2019 Cash Flow from Operating Activities Cash Received from Customers $ Cash Paid for Merchandise Purchased 5 0 Cash Paid to Employees Cash Paid for Insurance Cash Paid for Interest 0 0 Cash Paid for Income Taxes Cash Provided by Operating Activities Cash Flow from Investing Activities Purchase of Plant Assets Cash Flow from Financing Activities Issuance of Bonds Payable 0 Payment of Dividends 0 Cash Provided by Financing Activities Net Change in Cash Cash at Beginning of Year Cash at End of Year 0 0 0 0 $ 0 c. Compute free cash flow $0 d. Compute the operating-cash-flow-to-current-liabilities ratio. Round answer to two decimal places. e. Compute the operating-cash-flow-to-capital expenditures ratio. Round answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started