Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The asking price for an apartment building is $1,000,000; rents are estimated at $200,000 during the first year and are expected to grow at

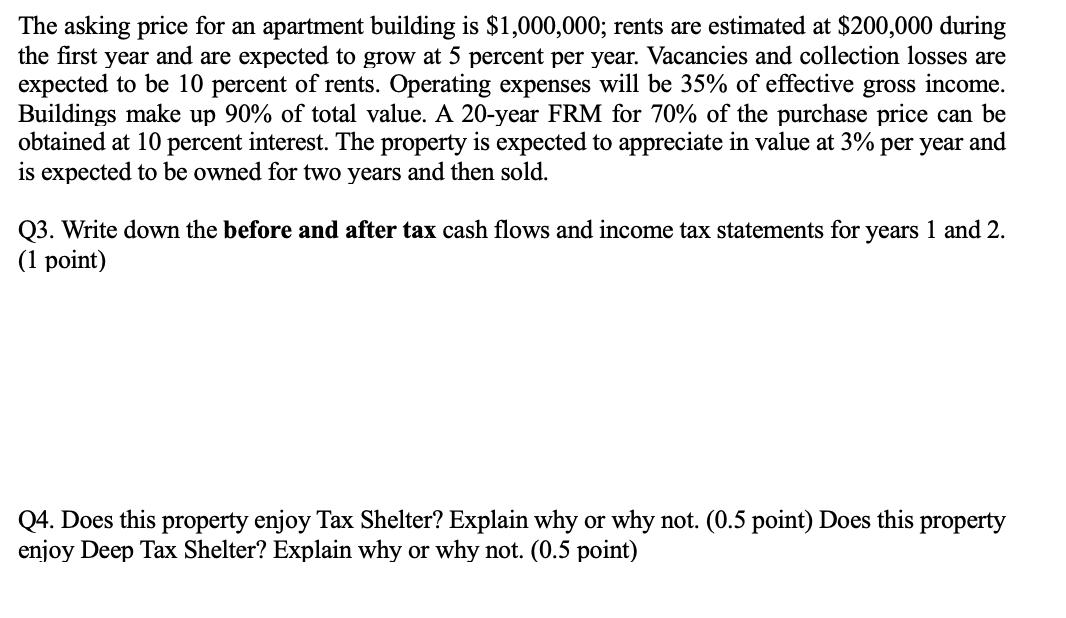

The asking price for an apartment building is $1,000,000; rents are estimated at $200,000 during the first year and are expected to grow at 5 percent per year. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35% of effective gross income. Buildings make up 90% of total value. A 20-year FRM for 70% of the purchase price can be obtained at 10 percent interest. The property is expected to appreciate in value at 3% per year and is expected to be owned for two years and then sold. Q3. Write down the before and after tax cash flows and income tax statements for years 1 and 2. (1 point) Q4. Does this property enjoy Tax Shelter? Explain why or why not. (0.5 point) Does this property enjoy Deep Tax Shelter? Explain why or why not. (0.5 point)

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Working note 1 Years Rental income Less Collection losses Gross income Less Operating ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started