Answered step by step

Verified Expert Solution

Question

1 Approved Answer

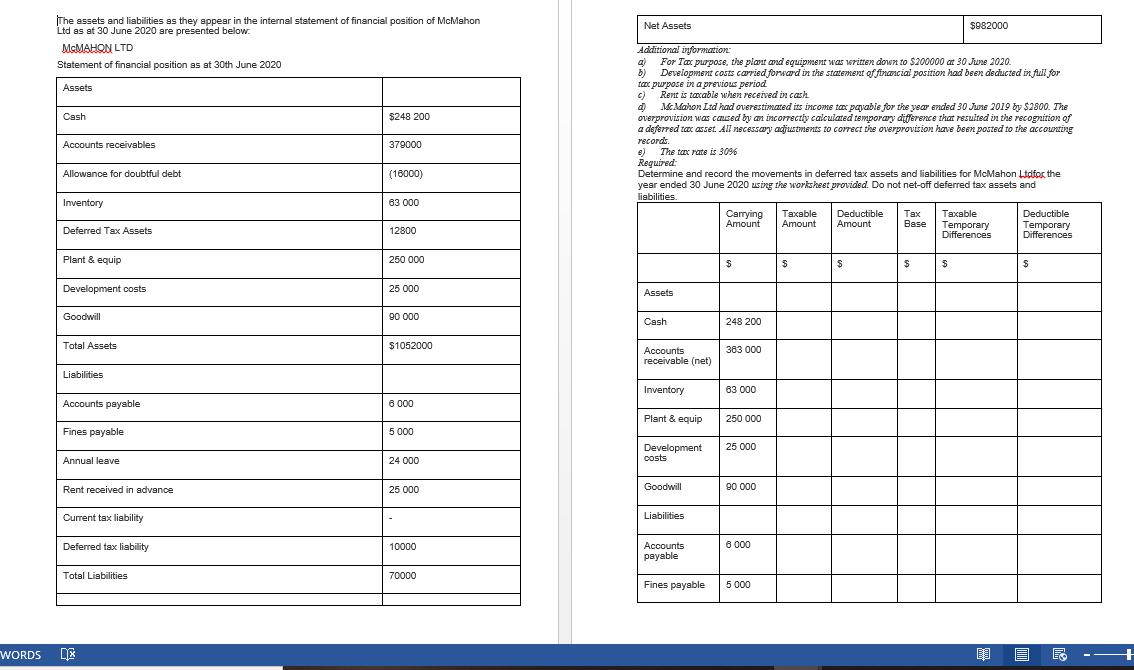

WORDS The assets and liabilities as they appear in the internal statement of financial position of McMahon Ltd as at 30 June 2020 are

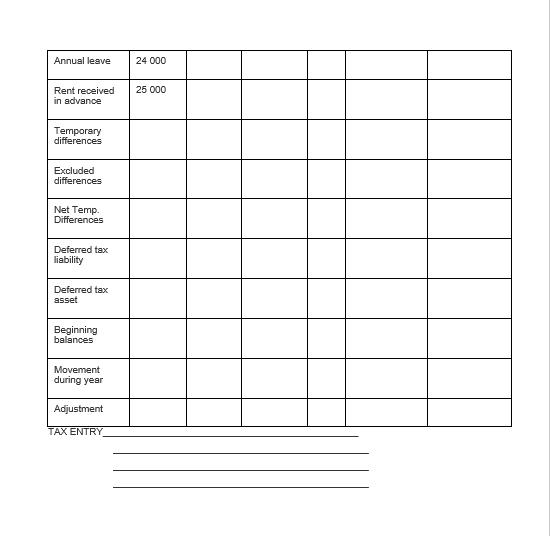

WORDS The assets and liabilities as they appear in the internal statement of financial position of McMahon Ltd as at 30 June 2020 are presented below. McMAHON LTD Statement of financial position as at 30th June 2020 Assets Cash Accounts receivables Allowance for doubtful debt Inventory Deferred Tax Assets Plant & equip Development costs Goodwill Total Assets Liabilities Accounts payable Fines payable Annual leave Rent received in advance Current tax liability Deferred tax liability Total Liabilities DX $248 200 379000 (16000) 63 000 12800 250 000 25 000 90 000 $1052000 6 000 5 000 24 000 25 000 10000 70000 Net Assets Additional information: a) For Tax purpose, the plant and equipment was written down to $200000 at 30 June 2020. b) Development costs carried forward in the statement of financial position had been deducted in full for tax purpose in a previous period c) Rent is taxable when received in cash d) McMahon Ltd had overestimated its income tax payable for the year ended 30 June 2019 by $2800. The overprovision was caused by an incorrectly calculated temporary difference that resulted in the recognition of a deferred tax asset. All necessary adjustments to correct the overprovision have been posted to the accounting records. e) The tax rate is 30% Required: Determine and record the movements in deferred tax assets and liabilities for McMahon Lidfor the year ended 30 June 2020 using the worksheet provided. Do not net-off deferred tax assets and liabilities. Assets Cash Accounts receivable (net) Inventory Plant & equip Development costs Goodwill Liabilities Accounts payable Fines payable Carrying Taxable Deductible Tax Taxable Amount Amount Amount Base $ 248 200 383 000 63 000 250 000 25 000 90 000 6 000 5 000 S $982000 $ $ Temporary Differences $ B Deductible Temporary Differences $ Annual leave Rent received in advance Temporary differences Excluded differences Net Temp. Differences Deferred tax liability Deferred tax asset Beginning balances Movement during year Adjustment TAX ENTRY 24 000 25 000

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Deferred tax liability Carrying amount Tax base Differe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started