Question: Managers use projected financial statements in four ways: (1) By looking at projected statements, they can assess whether the firm's anticipated performance is in

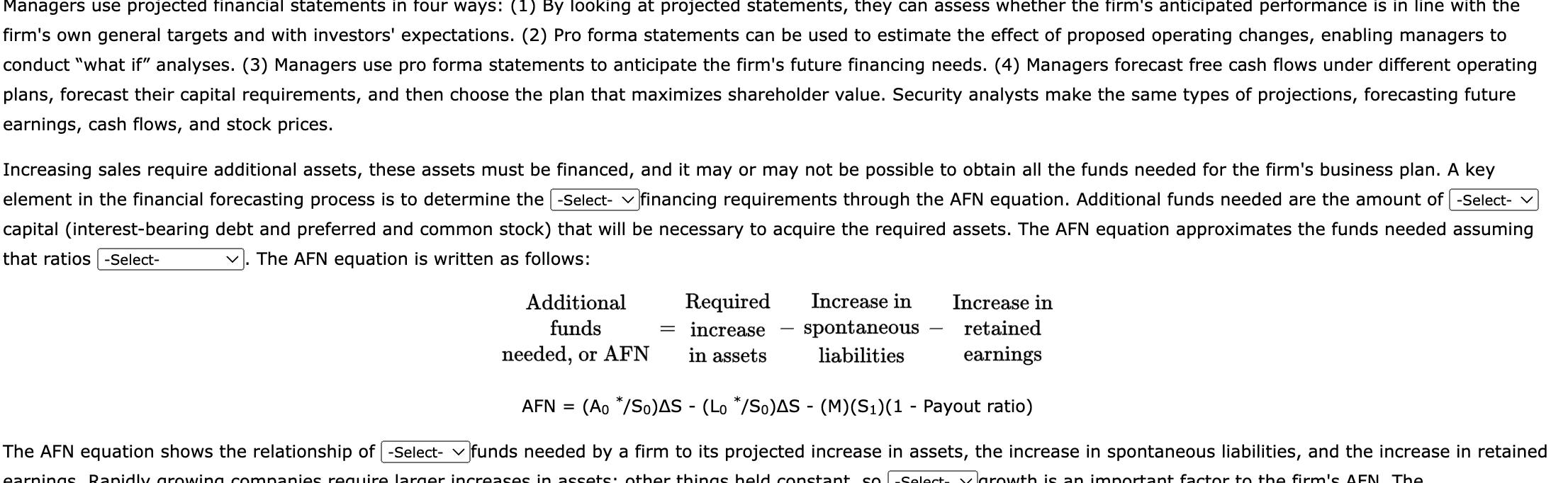

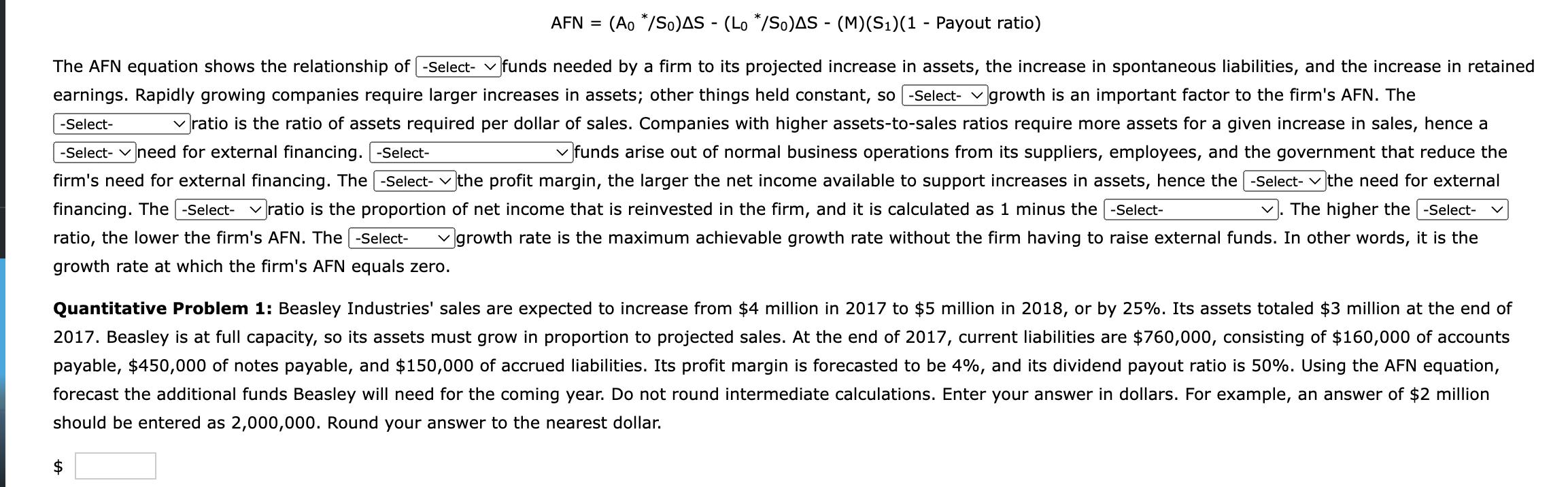

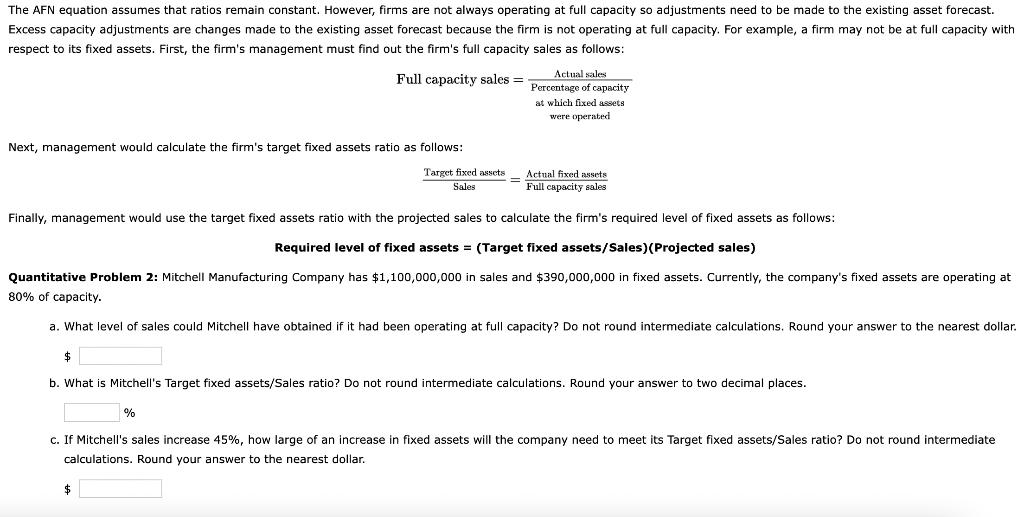

Managers use projected financial statements in four ways: (1) By looking at projected statements, they can assess whether the firm's anticipated performance is in line with the firm's own general targets and with investors' expectations. (2) Pro forma statements can be used to estimate the effect of proposed operating changes, enabling managers to conduct "what if" analyses. (3) Managers use pro forma statements to anticipate the firm's future financing needs. (4) Managers forecast free cash flows under different operating plans, forecast their capital requirements, and then choose the plan that maximizes shareholder value. Security analysts make the same types of projections, forecasting future earnings, cash flows, and stock prices. Increasing sales require additional assets, these assets must be financed, and it may or may not be possible to obtain all the funds needed for the firm's business plan. A key element in the financial forecasting process is to determine the [ -Select- financing requirements through the AFN equation. Additional funds needed are the amount of -Select- capital (interest-bearing debt and preferred and common stock) that will be necessary to acquire the required assets. The AFN equation approximates the funds needed assuming that ratios -Select- The AFN equation is written as follows: Additional funds needed, or AFN Required increase in assets Increase in spontaneous liabilities Increase in retained earnings AFN = (Ao */So)AS (Lo */So)AS - (M)(S1) (1 - Payout ratio) The AFN equation shows the relationship of -Select- funds needed by a firm to its projected increase in assets, the increase in spontaneous liabilities, and the increase in retained earnings Rapidly growing companies require larger increases in assets: other things held constant Select larowth is an important factor to the firm's AEN The AFN = - (Ao /So)AS (Lo */So)AS - (M) (S1) (1 - Payout ratio) -Select- The AFN equation shows the relationship of -Select- funds needed by a firm to its projected increase in assets, the increase in spontaneous liabilities, and the increase in retained earnings. Rapidly growing companies require larger increases in assets; other things held constant, so -Select- growth is an important factor to the firm's AFN. The ratio is the ratio of assets required per dollar of sales. Companies with higher assets-to-sales ratios require more assets for a given increase in sales, hence a -Select- need for external financing. -Select- funds arise out of normal business operations from its suppliers, employees, and the government that reduce the firm's need for external financing. The -Select- the profit margin, the larger the net income available to support increases in assets, hence the -Select- the need for external financing. The -Select- ratio is the proportion of net income that is reinvested in the firm, and it is calculated as 1 minus the -Select- The higher the -Select- ratio, the lower the firm's AFN. The -Select- growth rate is the maximum achievable growth rate without the firm having to raise external funds. In other words, it is the growth rate at which the firm's AFN equals zero. Quantitative Problem 1: Beasley Industries' sales are expected to increase from $4 million in 2017 to $5 million in 2018, or by 25%. Its assets totaled $3 million at the end of 2017. Beasley is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2017, current liabilities are $760,000, consisting of $160,000 of accounts payable, $450,000 of notes payable, and $150,000 of accrued liabilities. Its profit margin is forecasted to be 4%, and its dividend payout ratio is 50%. Using the AFN equation, forecast the additional funds Beasley will need for the coming year. Do not round intermediate calculations. Enter your answer in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round your answer to the nearest dollar. $ The AFN equation assumes that ratios remain constant. However, firms are not always operating at full capacity so adjustments need to be made to the existing asset forecast. Excess capacity adjustments are changes made to the existing asset forecast because the firm is not operating at full capacity. For example, a firm may not be at full capacity with respect to its fixed assets. First, the firm's management must find out the firm's full capacity sales as follows: Full capacity sales = Actual sales Percentage of capacity at which fixed assets were operated Next, management would calculate the firm's target fixed assets ratio as follows: Target fixed assets Sales Actual fixed assets Full capacity sales Finally, management would use the target fixed assets ratio with the projected sales to calculate the firm's required level of fixed assets as follows: Required level of fixed assets = (Target fixed assets/Sales)(Projected sales) Quantitative Problem 2: Mitchell Manufacturing Company has $1,100,000,000 in sales and $390,000,000 in fixed assets. Currently, the company's fixed assets are operating at 80% of capacity. a. What level of sales could Mitchell have obtained if it had been operating at full capacity? Do not round intermediate calculations. Round your answer to the nearest dollar. b. What is Mitchell's Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. % c. If Mitchell's sales increase 45%, how large of an increase in fixed assets will the company need to meet its Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

The initial response There was an error Please Contact Support was rejected The correct response should address the missing selections and provide exp... View full answer

Get step-by-step solutions from verified subject matter experts