The assignment is for bonds payable and liabilities accounting; work should be done in excel with various functions

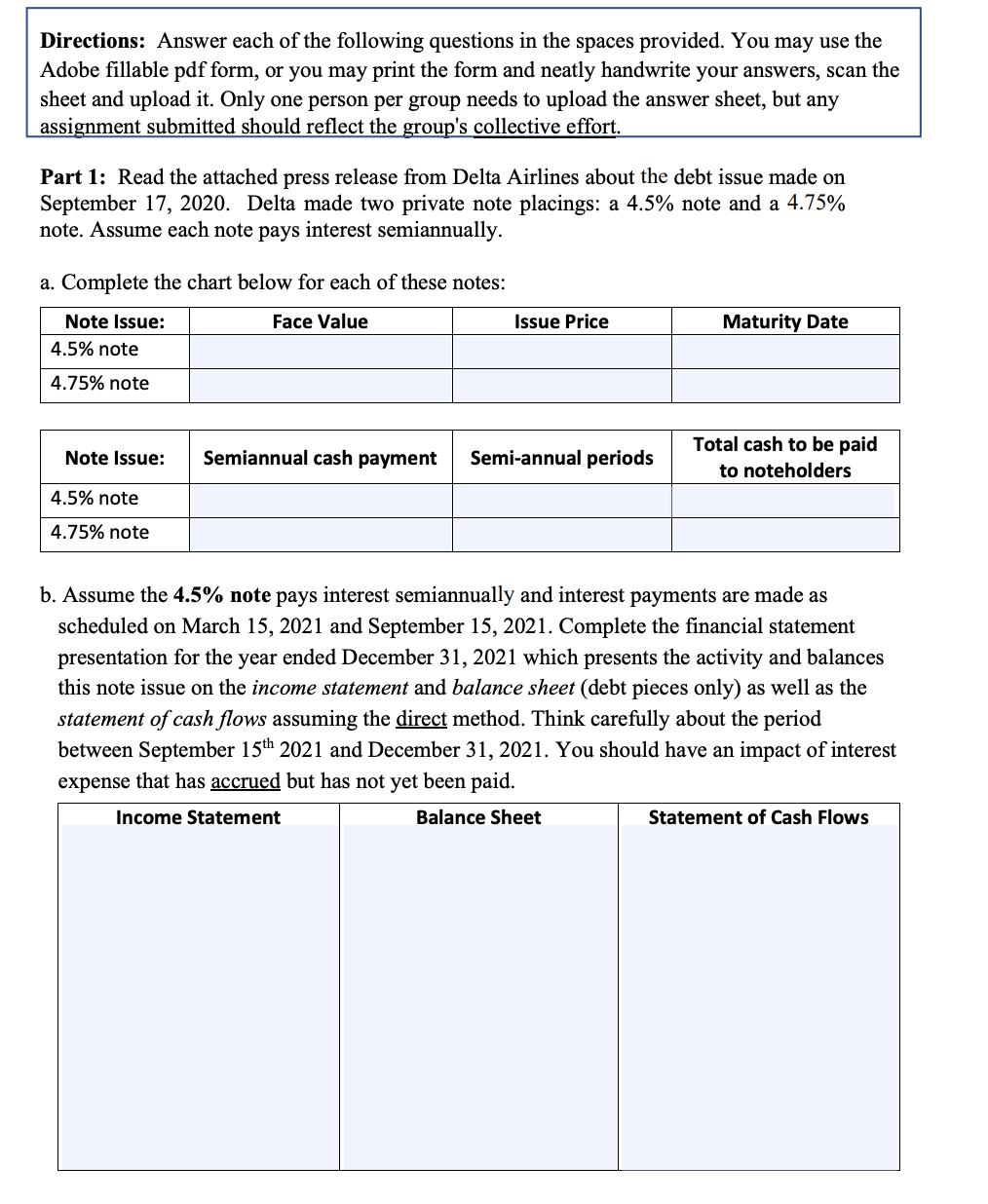

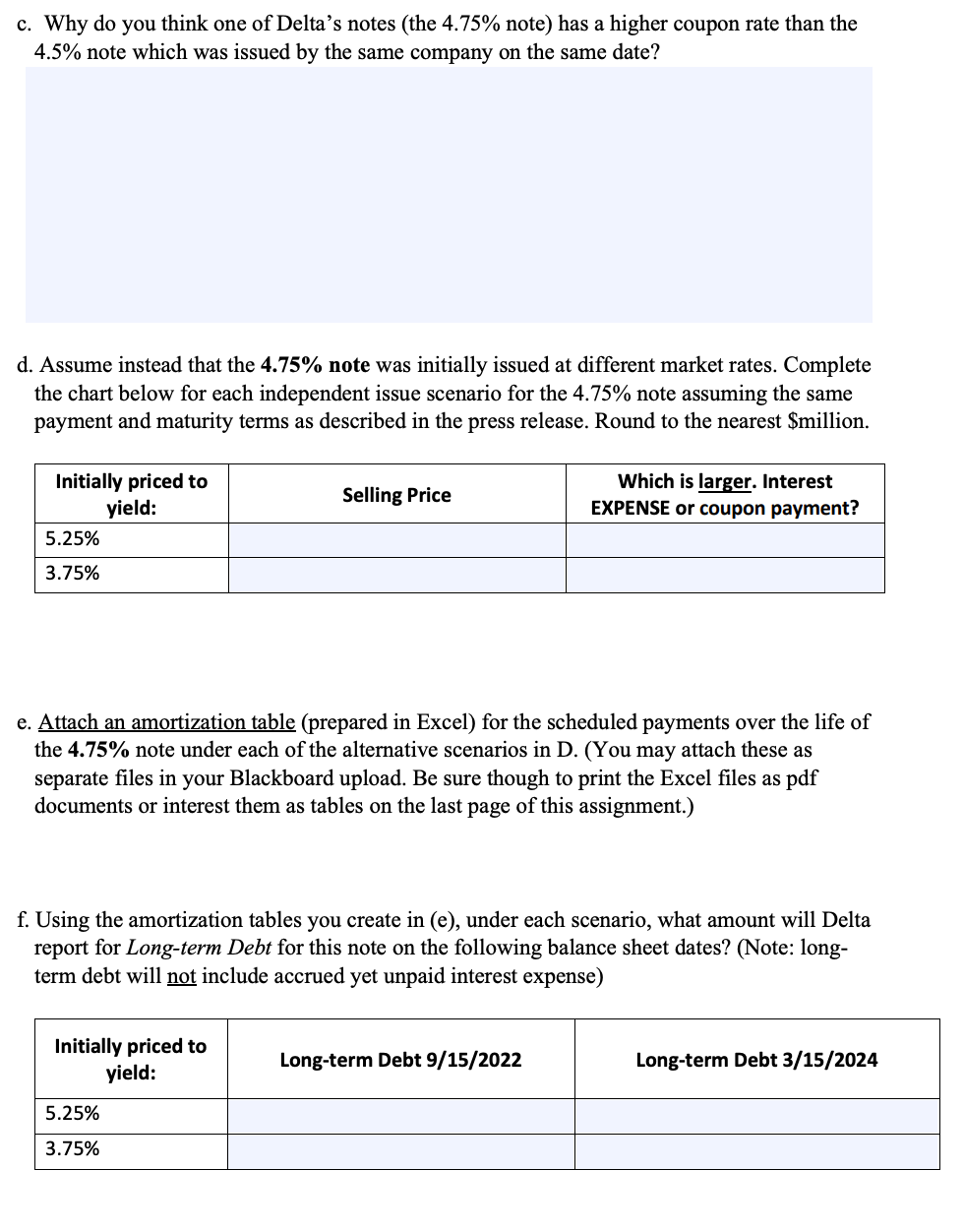

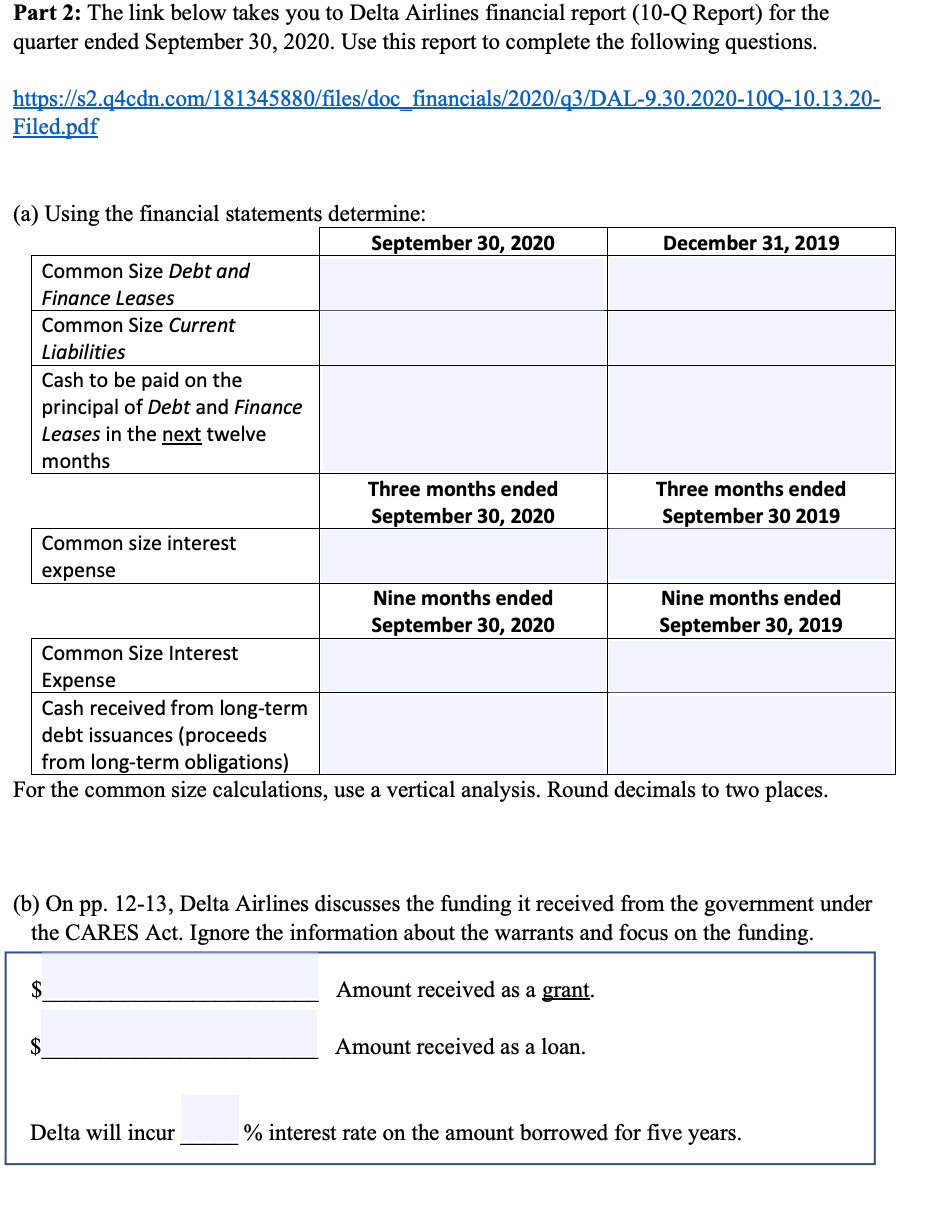

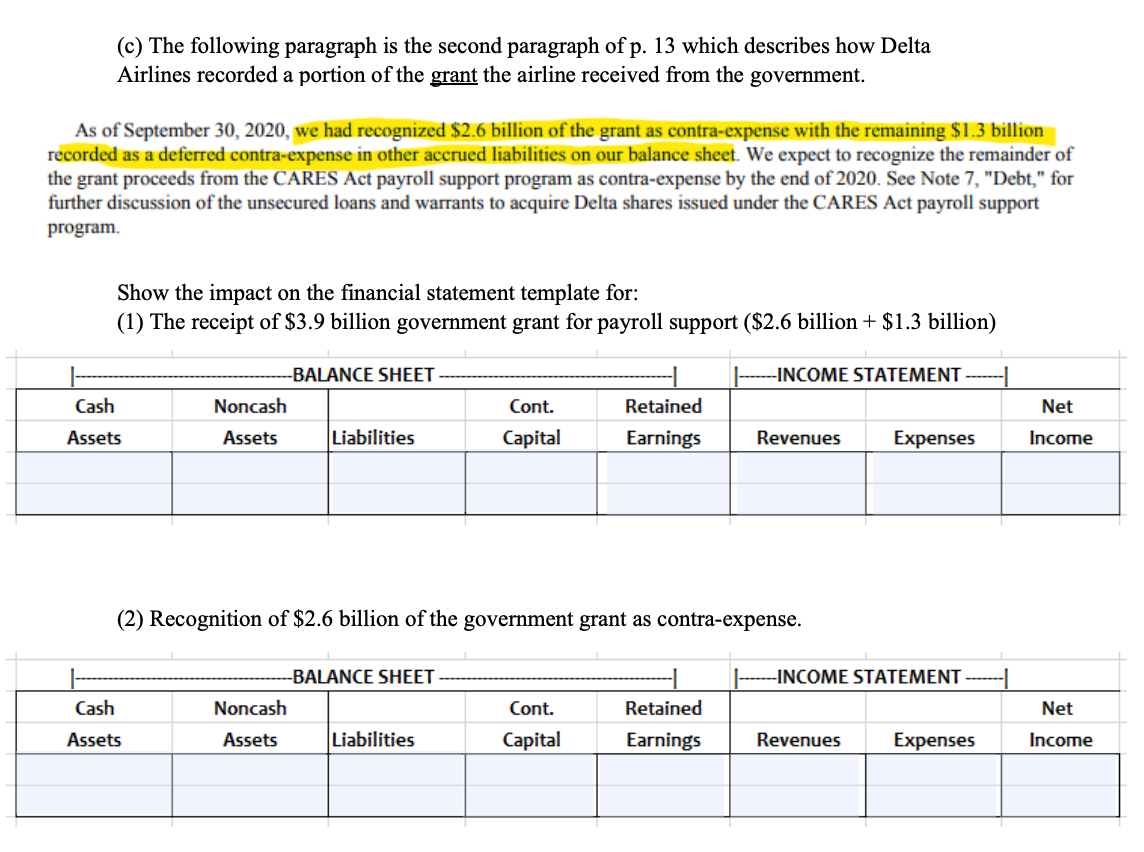

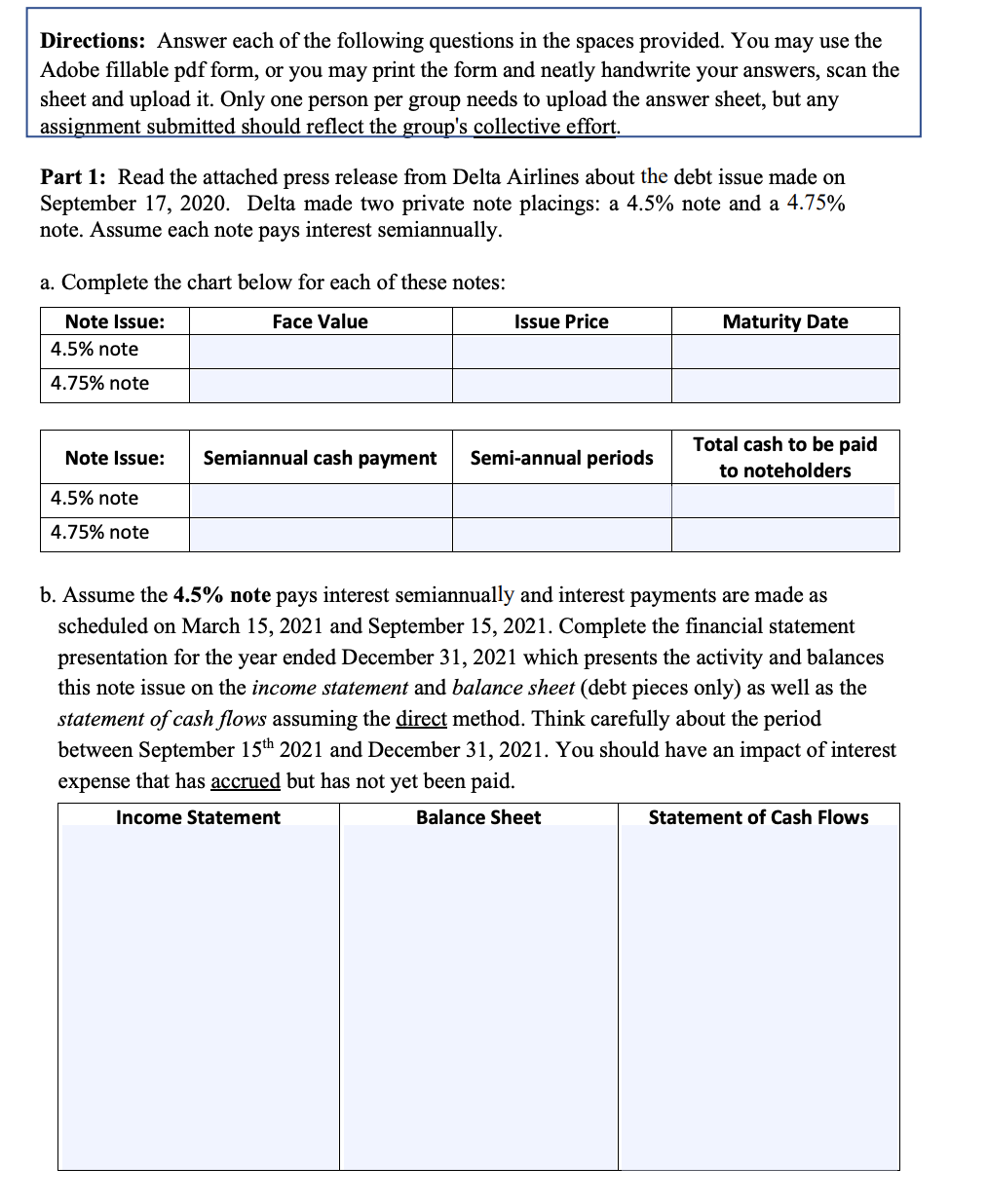

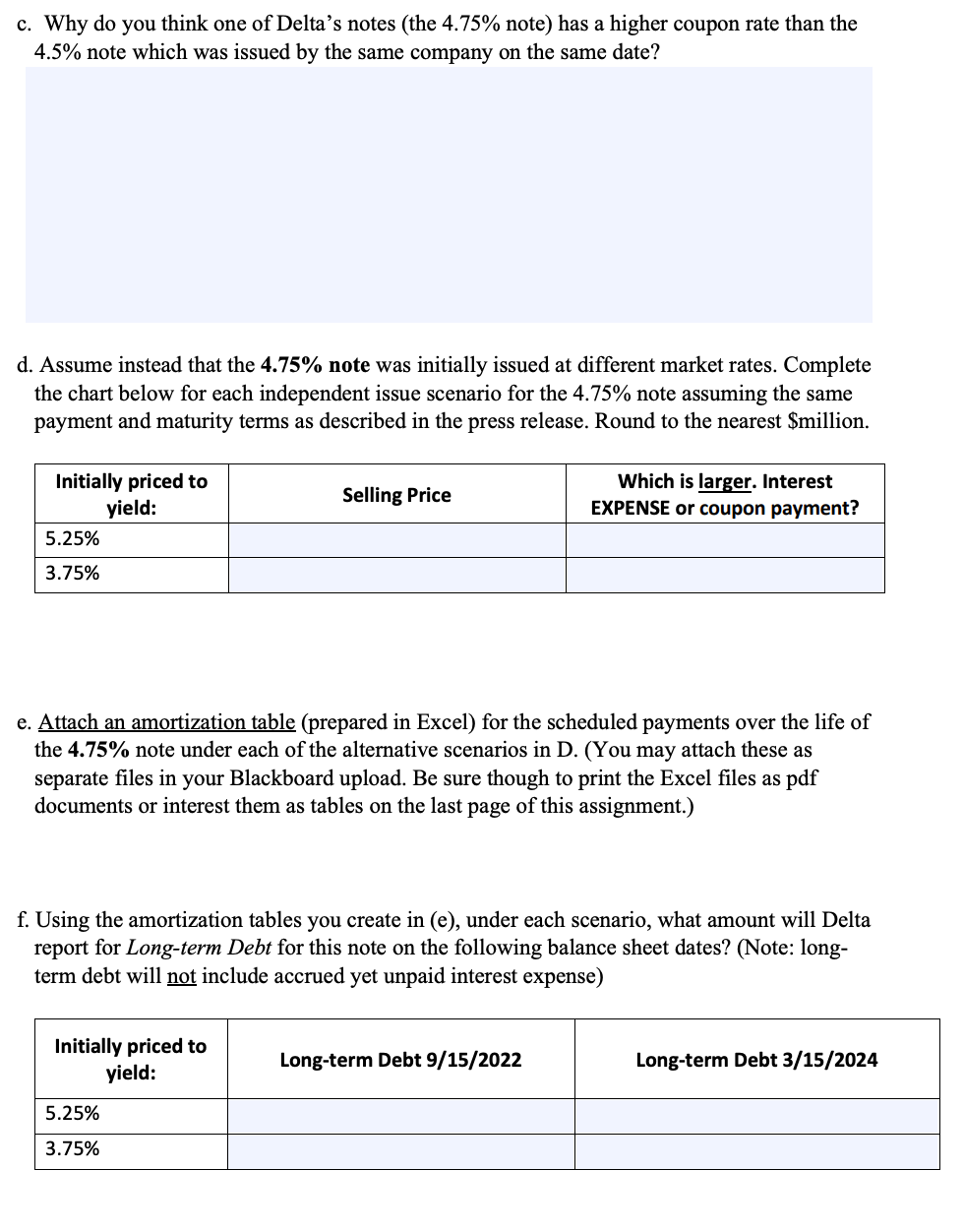

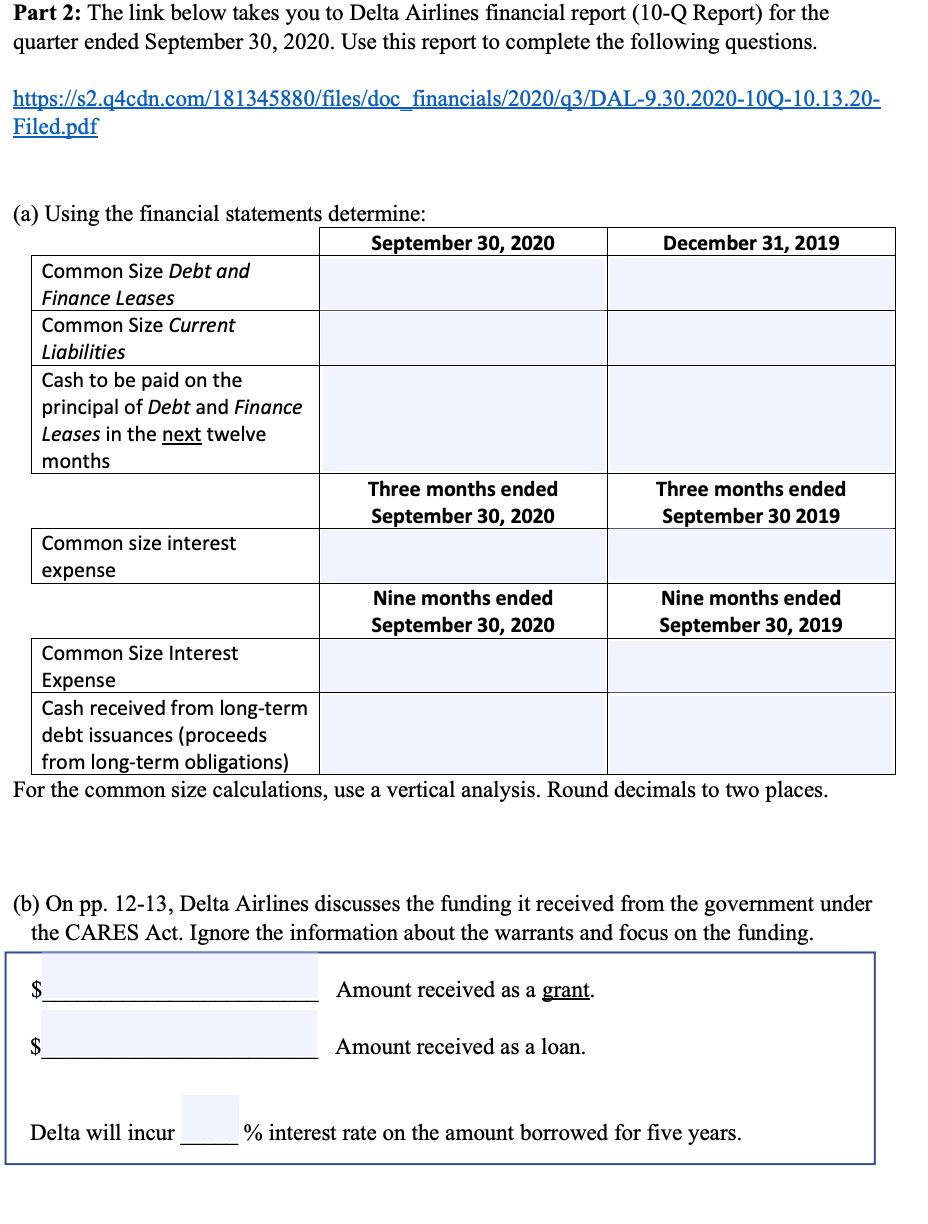

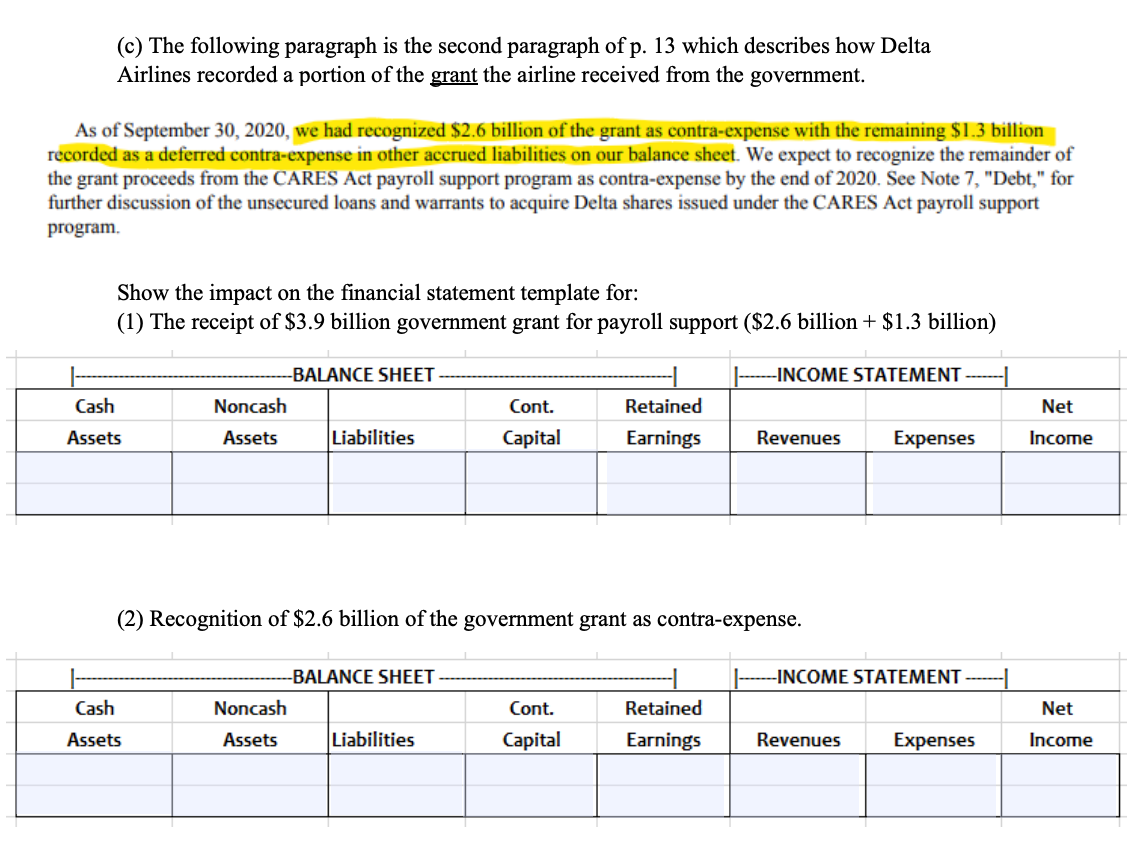

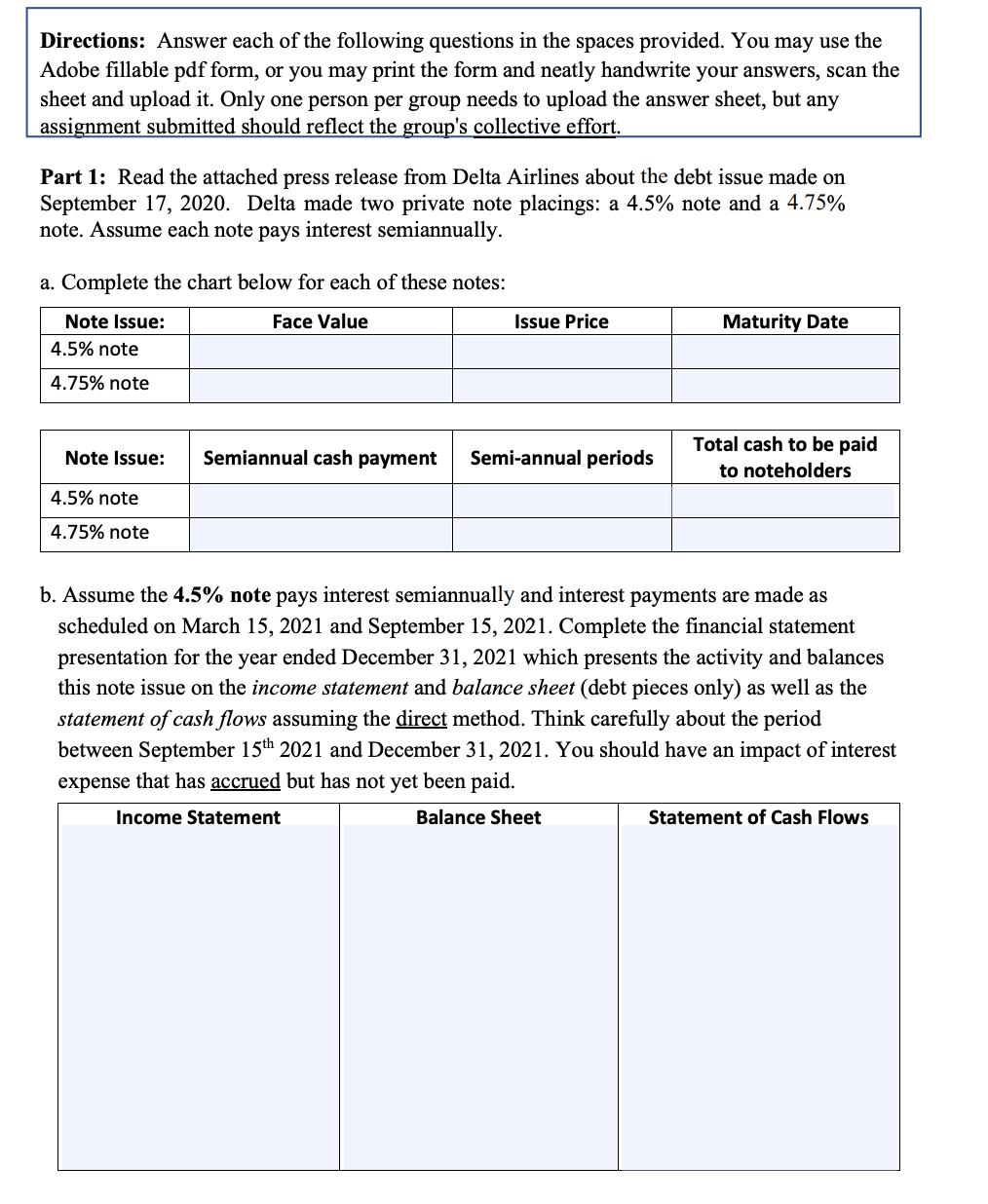

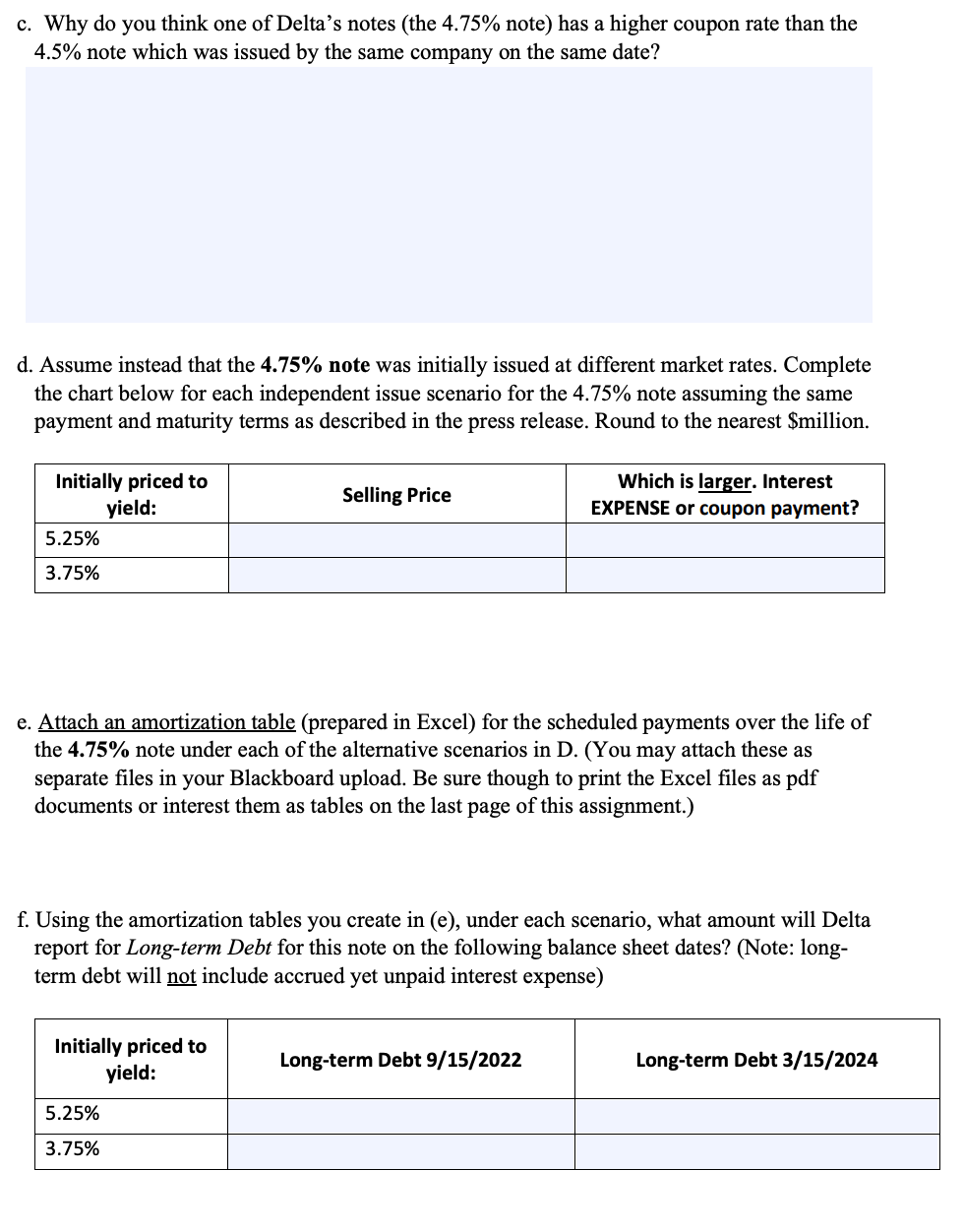

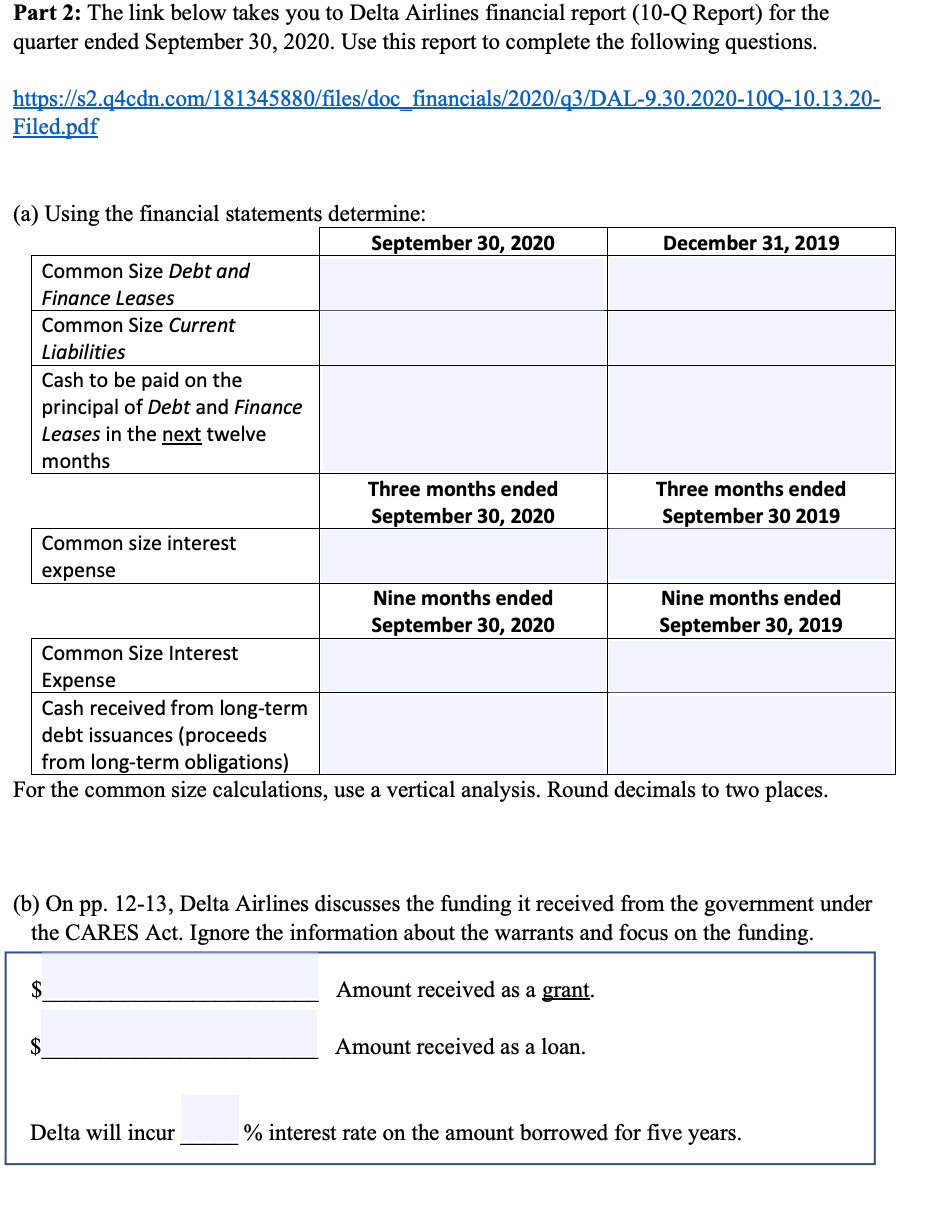

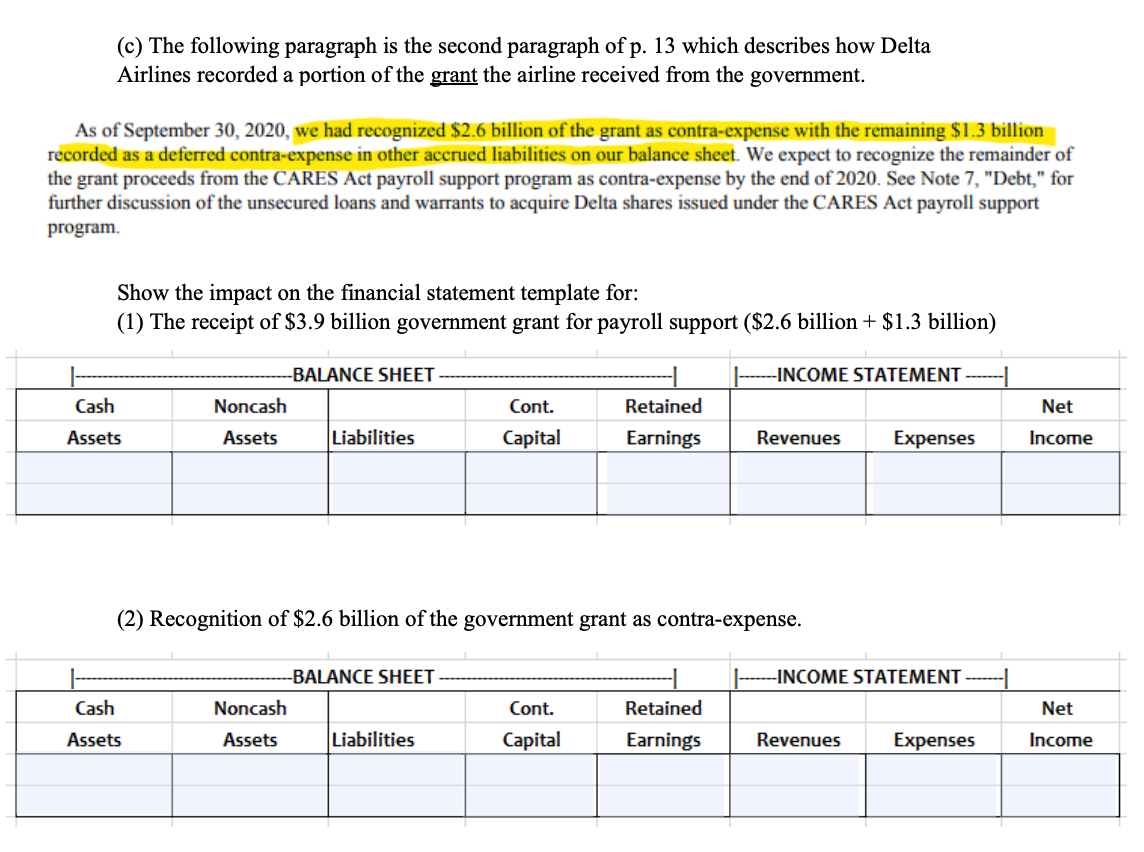

Directions: Answer each of the following questions in the spaces provided. You may use the Adobe fillable pdf form, or you may print the form and neatly handwrite your answers, scan the sheet and upload it. Only one person per group needs to upload the answer sheet, but any assignment submitted should reflect the group's collective effort. Part 1: Read the attached press release from Delta Airlines about the debt issue made on September 17, 2020. Delta made two private note placings: a 4.5% note and a 4.75% note. Assume each note pays interest semiannually. a. Complete the chart below for each of these notes: Note Issue: Face Value Issue Price Maturity Date 4.5% note 4.75% note Note Issue: Semiannual cash payment Semi-annual periods Total cash to be paid to noteholders 4.5% note 4.75% note b. Assume the 4.5% note pays interest semiannually and interest payments are made as scheduled on March 15, 2021 and September 15, 2021. Complete the financial statement presentation for the year ended December 31, 2021 which presents the activity and balances this note issue on the income statement and balance sheet (debt pieces only) as well as the statement of cash flows assuming the direct method. Think carefully about the period between September 15th 2021 and December 31, 2021. You should have an impact of interest expense that has accrued but has not yet been paid. Income Statement Balance Sheet Statement of Cash Flowsc. Why do you think one of Delta's notes (the 4.75% note) has a higher coupon rate than the 4.5% note which was issued by the same company on the same date? d. Assume instead that the 4.75% note was initially issued at different market rates. Complete the chart below for each independent issue scenario for the 4.75% note assuming the same payment and maturity terms as described in the press release. Round to the nearest $million. Initially priced to Which is larger. Interest yield: Selling Price EXPENSE or coupon payment? 5.25% 3.75% e. Attach an amortization table (prepared in Excel) for the scheduled payments over the life of the 4.75% note under each of the alternative scenarios in D. (You may attach these as separate files in your Blackboard upload. Be sure though to print the Excel files as pdf documents or interest them as tables on the last page of this assignment.) f. Using the amortization tables you create in (e), under each scenario, what amount will Delta report for Long-term Debt for this note on the following balance sheet dates? (Note: long- term debt will not include accrued yet unpaid interest expense) Initially priced to yield: Long-term Debt 9/15/2022 Long-term Debt 3/15/2024 5.25% 3.75%Part 2: The link below takes you to Delta Airlines financial report (10-Q Report) for the quarter ended September 30, 2020. Use this report to complete the following questions. https://s2.q4cdn.com/181345880/files/doc_financials/2020/q3/DAL-9.30.2020-10Q-10.13.20- Filed.pdf (a) Using the financial statements determine: September 30, 2020 December 31, 2019 Common Size Debt and Finance Leases Common Size Current Liabilities Cash to be paid on the principal of Debt and Finance Leases in the next twelve months Three months ended Three months ended September 30, 2020 September 30 2019 Common size interest expense Nine months ended Nine months ended September 30, 2020 September 30, 2019 Common Size Interest Expense Cash received from long-term debt issuances (proceeds from long-term obligations) For the common size calculations, use a vertical analysis. Round decimals to two places. (b) On pp. 12-13, Delta Airlines discusses the funding it received from the government under the CARES Act. Ignore the information about the warrants and focus on the funding. EA Amount received as a grant. $ Amount received as a loan. Delta will incur % interest rate on the amount borrowed for five years.(c) The following paragraph is the second paragraph of p. 13 which describes how Delta Airlines recorded a portion of the grant the airline received from the government. As of September 30, 2020, we had recognized $2.6 billion of the grant as contra-expense with the remaining $1.3 billion recorded as a deferred contra-expense in other accrued liabilities on our balance sheet. We expect to recognize the remainder of the grant proceeds from the CARES Act payroll support program as contra-expense by the end of 2020. See Note 7, "Debt," for further discussion of the unsecured loans and warrants to acquire Delta shares issued under the CARES Act payroll support program. Show the impact on the financial statement template for: (1) The receipt of $3.9 billion government grant for payroll support ($2.6 billion + $1.3 billion) BALANCE SHEET -INCOME STATEMENT Cash Noncash Cont. Retained Net Assets Assets Liabilities Capital Earnings Revenues Expenses Income (2) Recognition of $2.6 billion of the government grant as contra-expense. BALANCE SHEET -INCOME STATEMENT Cash Noncash Cont. Retained Net Assets Assets Liabilities Capital Earnings Revenues Expenses Income