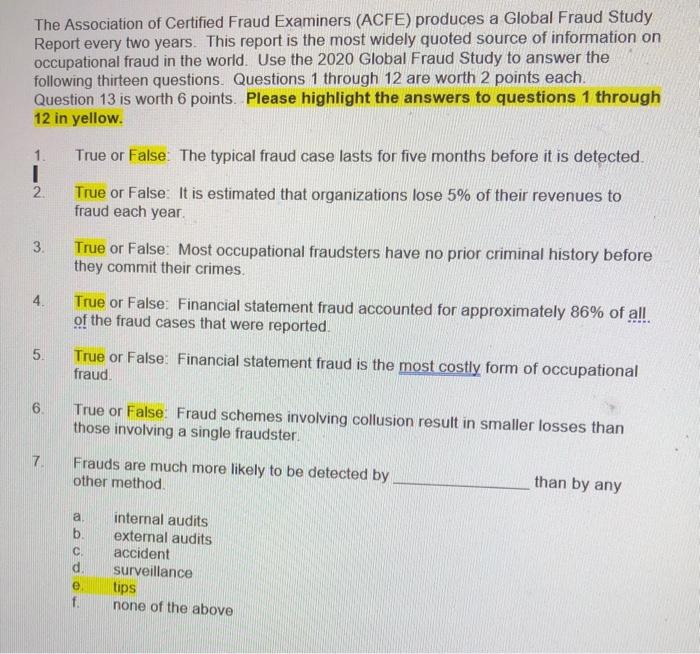

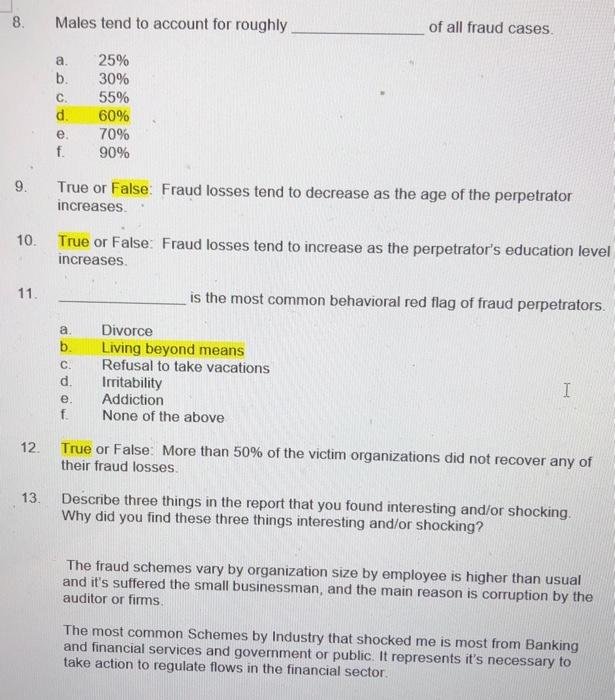

The Association of Certified Fraud Examiners (ACFE) produces a Global Fraud Study Report every two years. This report is the most widely quoted source of information on occupational fraud in the world. Use the 2020 Global Fraud Study to answer the following thirteen questions. Questions 1 through 12 are worth 2 points each. Question 13 is worth 6 points. Please highlight the answers to questions 1 through 12 in yellow. True or False: The typical fraud case lasts for five months before it is detected. 1 I 2 True or False It is estimated that organizations lose 5% of their revenues to fraud each year 3. True or False: Most occupational fraudsters have no prior criminal history before they commit their crimes. 4. True or False: Financial statement fraud accounted for approximately 86% of all of the fraud cases that were reported. True or False: Financial statement fraud is the most costly form of occupational fraud. 5. 6 True or False Fraud schemes involving collusion result in smaller losses than those involving a single fraudster. 7 Frauds are much more likely to be detected by other method. than by any a. b C d. e f. internal audits external audits accident surveillance tips none of the above 8. Males tend to account for roughly of all fraud cases a. b. C. d. e f. 25% 30% 55% 60% 70% 90% 9. True or False: Fraud losses tend to decrease as the age of the perpetrator increases 10. True or False: Fraud losses tend to increase as the perpetrator's education level increases 11. is the most common behavioral red flag of fraud perpetrators. a. b. C. d. e f. Divorce Living beyond means Refusal to take vacations Irritability Addiction None of the above I 12 True or False: More than 50% of the victim organizations did not recover any of their fraud losses. 13. Describe three things in the report that you found interesting and/or shocking Why did you find these three things interesting and/or shocking? The fraud schemes vary by organization size by employee is higher than usual and it's suffered the small businessman, and the main reason is corruption by the auditor or firms The most common Schemes by Industry that shocked me is most from Banking and financial services and government or public. It represents it's necessary to take action to regulate flows in the financial sector