Answered step by step

Verified Expert Solution

Question

1 Approved Answer

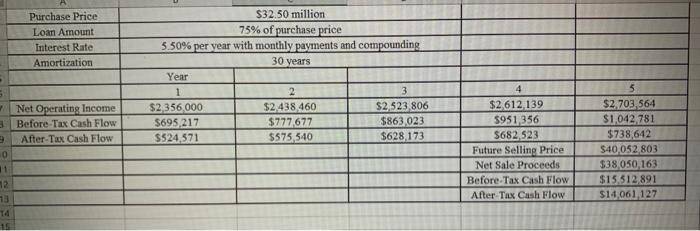

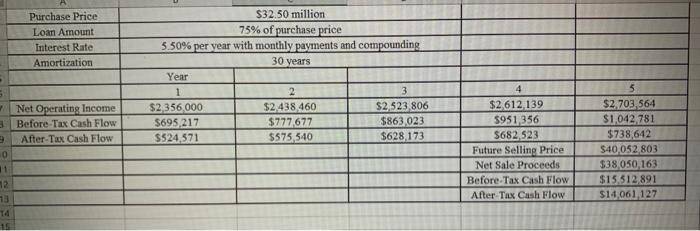

The attatched spreadsheet contains the cash flows for a real estate investment. -Why is the IRR of the BEFORE-tax levered cash flows? -If the equity

The attatched spreadsheet contains the cash flows for a real estate investment.

Purchase Price Loan Amount Interest Rate Amortization $32.50 million 75% of purchase price 3.50% per year with monthly payments and compounding 30 years . Year 1 $2 356,000 $695,217 $524,571 2 $2.438 460 $777,677 $575,540 3 $2,523 806 $863,023 $628 173 Net Operating Income 3 Before Tax Cash Flow After Tax Cash Flow 10 11 12 13 14 15 4 $2612,139 5951,356 $682.523 Future Selling Price Net Sale Proceeds Before Tax Cash Flow After Tax Cash Flow 5 $2.703,564 $1.042.781 $738,642 $40,052803 $38 050,163 $15,512 891 $14,061,127 Purchase Price Loan Amount Interest Rate Amortization $32.50 million 75% of purchase price 3.50% per year with monthly payments and compounding 30 years . Year 1 $2 356,000 $695,217 $524,571 2 $2.438 460 $777,677 $575,540 3 $2,523 806 $863,023 $628 173 Net Operating Income 3 Before Tax Cash Flow After Tax Cash Flow 10 11 12 13 14 15 4 $2612,139 5951,356 $682.523 Future Selling Price Net Sale Proceeds Before Tax Cash Flow After Tax Cash Flow 5 $2.703,564 $1.042.781 $738,642 $40,052803 $38 050,163 $15,512 891 $14,061,127 -Why is the IRR of the BEFORE-tax levered cash flows?

-If the equity discount is 18%, will the investment have a positive or negative NPV?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started