Answered step by step

Verified Expert Solution

Question

1 Approved Answer

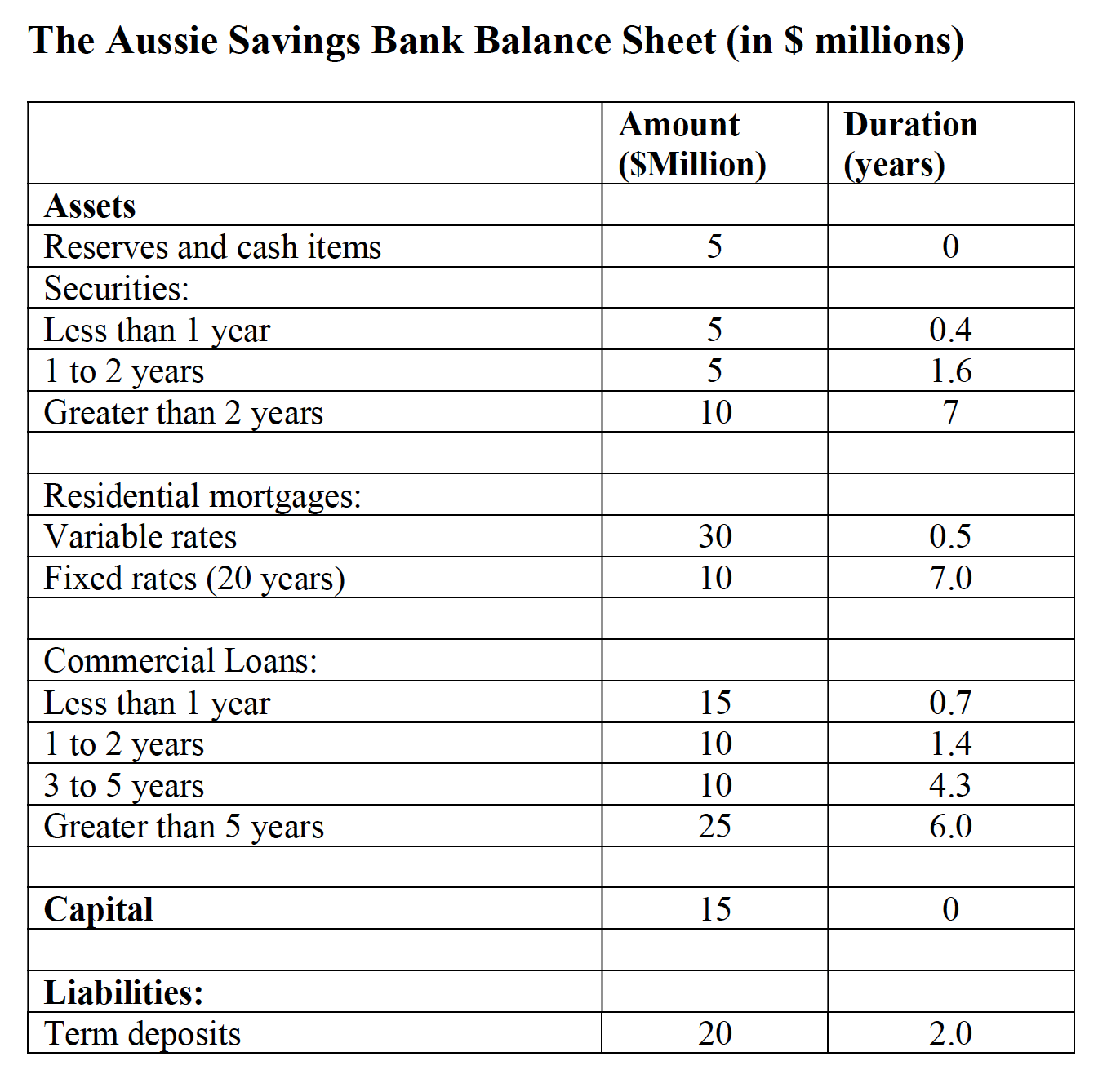

The Aussie Savings Bank Balance Sheet (in $ millions) begin{tabular}{|l|c|c|} hline & Amount($Million) & Duration(years) hline Assets & & hline Reserves and cash

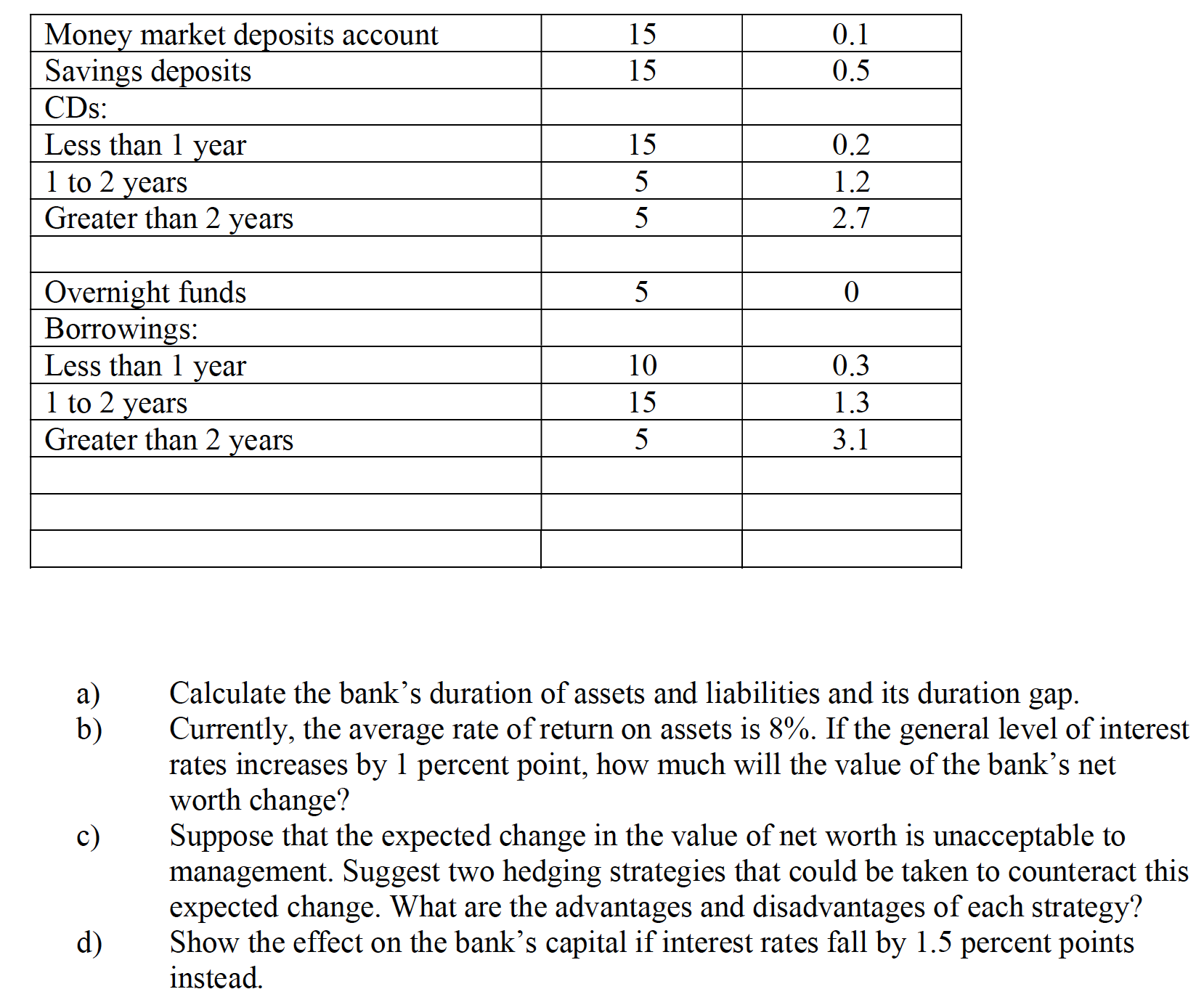

The Aussie Savings Bank Balance Sheet (in \$ millions) \begin{tabular}{|l|c|c|} \hline & Amount($Million) & Duration(years) \\ \hline Assets & & \\ \hline Reserves and cash items & 5 & 0 \\ \hline Securities: & 5 & 0.4 \\ \hline Less than 1 year & 5 & 1.6 \\ \hline 1 to 2 years & 10 & 7 \\ \hline Greater than 2 years & & \\ \hline & & \\ \hline Residential mortgages: & 30 & 0.5 \\ \hline Variable rates & 10 & 7.0 \\ \hline Fixed rates (20 years) & & \\ \hline & 15 & 0.7 \\ \hline Commercial Loans: & 10 & 1.4 \\ \hline Less than 1 year & 10 & 4.3 \\ \hline 1 to 2 years & 25 & 6.0 \\ \hline 3 to 5 years & & \\ \hline Greater than 5 years & 15 & 0 \\ \hline & & \\ \hline Capital & 20 & 2.0 \\ \hline & & \\ \hline Liabilities: & & \\ \hline Term deposits & & \\ \hline \end{tabular} a) Calculate the bank's duration of assets and liabilities and its duration gap. b) Currently, the average rate of return on assets is 8%. If the general level of interest rates increases by 1 percent point, how much will the value of the bank's net worth change? c) Suppose that the expected change in the value of net worth is unacceptable to management. Suggest two hedging strategies that could be taken to counteract this expected change. What are the advantages and disadvantages of each strategy? d) Show the effect on the bank's capital if interest rates fall by 1.5 percent points instead

The Aussie Savings Bank Balance Sheet (in \$ millions) \begin{tabular}{|l|c|c|} \hline & Amount($Million) & Duration(years) \\ \hline Assets & & \\ \hline Reserves and cash items & 5 & 0 \\ \hline Securities: & 5 & 0.4 \\ \hline Less than 1 year & 5 & 1.6 \\ \hline 1 to 2 years & 10 & 7 \\ \hline Greater than 2 years & & \\ \hline & & \\ \hline Residential mortgages: & 30 & 0.5 \\ \hline Variable rates & 10 & 7.0 \\ \hline Fixed rates (20 years) & & \\ \hline & 15 & 0.7 \\ \hline Commercial Loans: & 10 & 1.4 \\ \hline Less than 1 year & 10 & 4.3 \\ \hline 1 to 2 years & 25 & 6.0 \\ \hline 3 to 5 years & & \\ \hline Greater than 5 years & 15 & 0 \\ \hline & & \\ \hline Capital & 20 & 2.0 \\ \hline & & \\ \hline Liabilities: & & \\ \hline Term deposits & & \\ \hline \end{tabular} a) Calculate the bank's duration of assets and liabilities and its duration gap. b) Currently, the average rate of return on assets is 8%. If the general level of interest rates increases by 1 percent point, how much will the value of the bank's net worth change? c) Suppose that the expected change in the value of net worth is unacceptable to management. Suggest two hedging strategies that could be taken to counteract this expected change. What are the advantages and disadvantages of each strategy? d) Show the effect on the bank's capital if interest rates fall by 1.5 percent points instead Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started