Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The automobile insurance division of the Great Benefit insurance company expects an average of 1,000 claims in the forthcoming year, with the actual number of

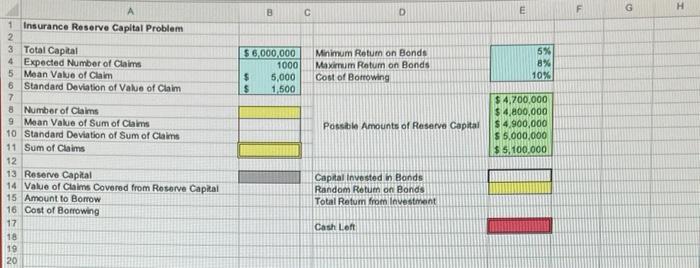

The automobile insurance division of the Great Benefit insurance company expects an average of 1,000 claims in the forthcoming year, with the actual number of claims being random and well described by a Poisson distribution. The value of each claim is a random variable, independent of all other claims, with a mean of $5,000 and a standard deviation of $1,500. The division has $6 million of capital, which is split into two parts. The first part is the reserve capital needed to pay claims over the next year. The remainder is invested in short-term bonds, which provide a random return, equally likely to be any value between 5% and 8%. If the reserve capital turns out to be less than the total value of claims for the year, the division has to borrow enough money, at a cost of 10% of the amount borrowed, to make up the difference. The firm would like to find a capital allocation that maximizes the expected amount of cash they have left at the end of the year. Suppose they have narrowed down their choice to the following possible amounts of reserve capital: $4.7 million, $4.8 million, $4.9 million, $5.0 million, and $5.1million. Which is the best option?

1 Insurance Reserve Capital Problem 2 3 Total Capital 4 Expected Number of Claims 5 Mean Value of Claim 6 Standard Deviation of Value of Claim 7 8 Number of Claims 9 Mean Value of Sum of Claims 10 Standard Deviation of Sum of Claims 11 Sum of Claims 12 13 Reserve Capital 14 Value of Claims Covered from Reserve Capital 15 Amount to Borrow 16 Cost of Borrowing 1888 17 19 20 B $6,000,000 1000 5,000 $ $ 1,500 C D Minimum Return on Bonds Maximum Retum on Bonds Cost of Borrowing Possible Amounts of Reserve Capital Capital Invested in Bonds Random Retum on Bonds Total Retum from Investment Cash Left E 5% 8% 10% $4,700,000 $4,800,000 $4,900,000 $5,000,000 $5,100,000 G H

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To determine the best option for reserve capital allocation we need to consider the expected amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started