Question

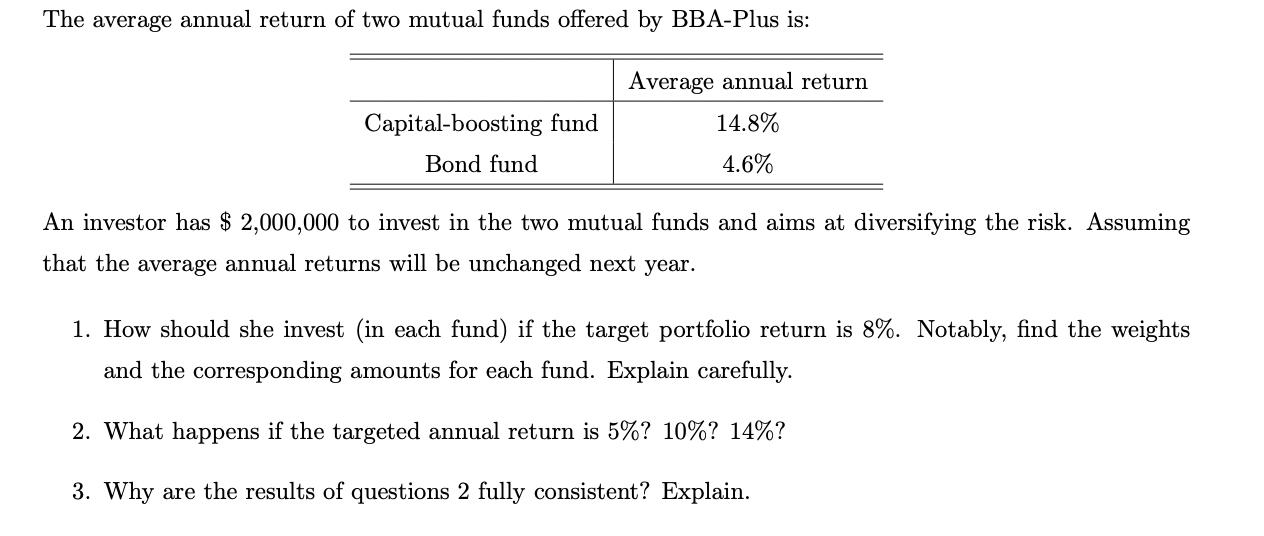

The average annual return of two mutual funds offered by BBA-Plus is: Average annual return 14.8% 4.6% Capital-boosting fund Bond fund An investor has

The average annual return of two mutual funds offered by BBA-Plus is: Average annual return 14.8% 4.6% Capital-boosting fund Bond fund An investor has $2,000,000 to invest in the two mutual funds and aims at diversifying the risk. Assuming that the average annual returns will be unchanged next year. 1. How should she invest (in each fund) if the target portfolio return is 8%. Notably, find the weights and the corresponding amounts for each fund. Explain carefully. 2. What happens if the targeted annual return is 5%? 10%? 14%? 3. Why are the results of questions 2 fully consistent? Explain.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 To determine how the investor should allocate their investment between the Capitalboosting fund and the Bond fund to achieve a target portf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

7th Edition

0073382469, 978-0073382463

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App