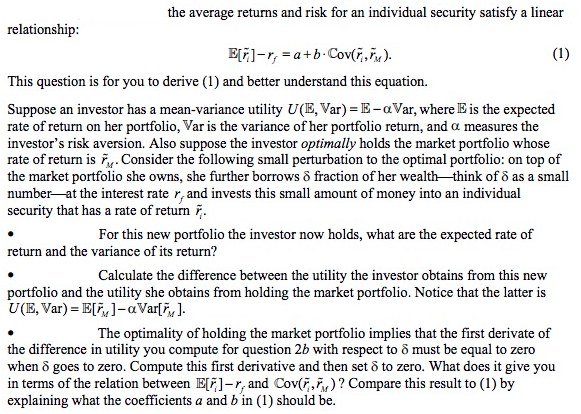

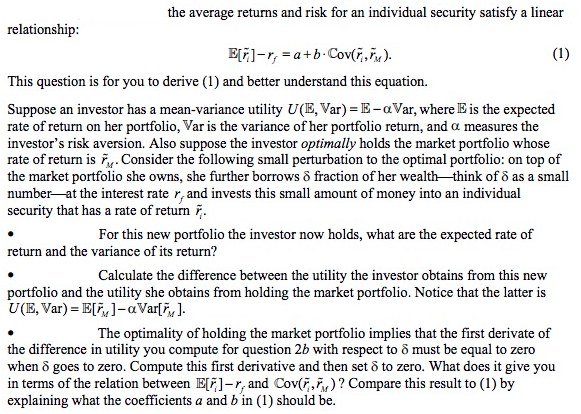

the average returns and risk for an individual security satisfy a linear relationshijp This question is for you to derive (1) and better understand this equation. Suppose an investor has a mean-variance utility U(E, Var) E-a Var, where E is the expected rate of return on her portfolio, Var is the variance of her portfolio return, and measures the investor's risk aversion. Also suppose the investor optimally holds the market portfolio whose rate of return is F. Consider the following small perturbation to the optimal portfolio: on top of the market portfolio she owns, she further borrows fraction of her wealth-think of as a small number-at the interest rate r, and invests this small amount of money into an individual security that has a rate of return For this new portfolio the investor now holds, what are the expected rate of return and the variance of its return'? Calculate the difference between the utility the investor obtains from this new portfolio and the utility she obtains from holding the market portfolio. Notice that the latter is The optimality of holding the market portfolio implies that the first derivate of the difference in utility you compute for question 2b with respect to must be equal to zero when goes to zero. Compute this first derivative and then set to zero. What does it give you in terms of the relation between E[f]-rr and Cov(r.) ? Compare this result to (1) by explaining what the coefficients a and b in (1) should be the average returns and risk for an individual security satisfy a linear relationshijp This question is for you to derive (1) and better understand this equation. Suppose an investor has a mean-variance utility U(E, Var) E-a Var, where E is the expected rate of return on her portfolio, Var is the variance of her portfolio return, and measures the investor's risk aversion. Also suppose the investor optimally holds the market portfolio whose rate of return is F. Consider the following small perturbation to the optimal portfolio: on top of the market portfolio she owns, she further borrows fraction of her wealth-think of as a small number-at the interest rate r, and invests this small amount of money into an individual security that has a rate of return For this new portfolio the investor now holds, what are the expected rate of return and the variance of its return'? Calculate the difference between the utility the investor obtains from this new portfolio and the utility she obtains from holding the market portfolio. Notice that the latter is The optimality of holding the market portfolio implies that the first derivate of the difference in utility you compute for question 2b with respect to must be equal to zero when goes to zero. Compute this first derivative and then set to zero. What does it give you in terms of the relation between E[f]-rr and Cov(r.) ? Compare this result to (1) by explaining what the coefficients a and b in (1) should be