Answered step by step

Verified Expert Solution

Question

1 Approved Answer

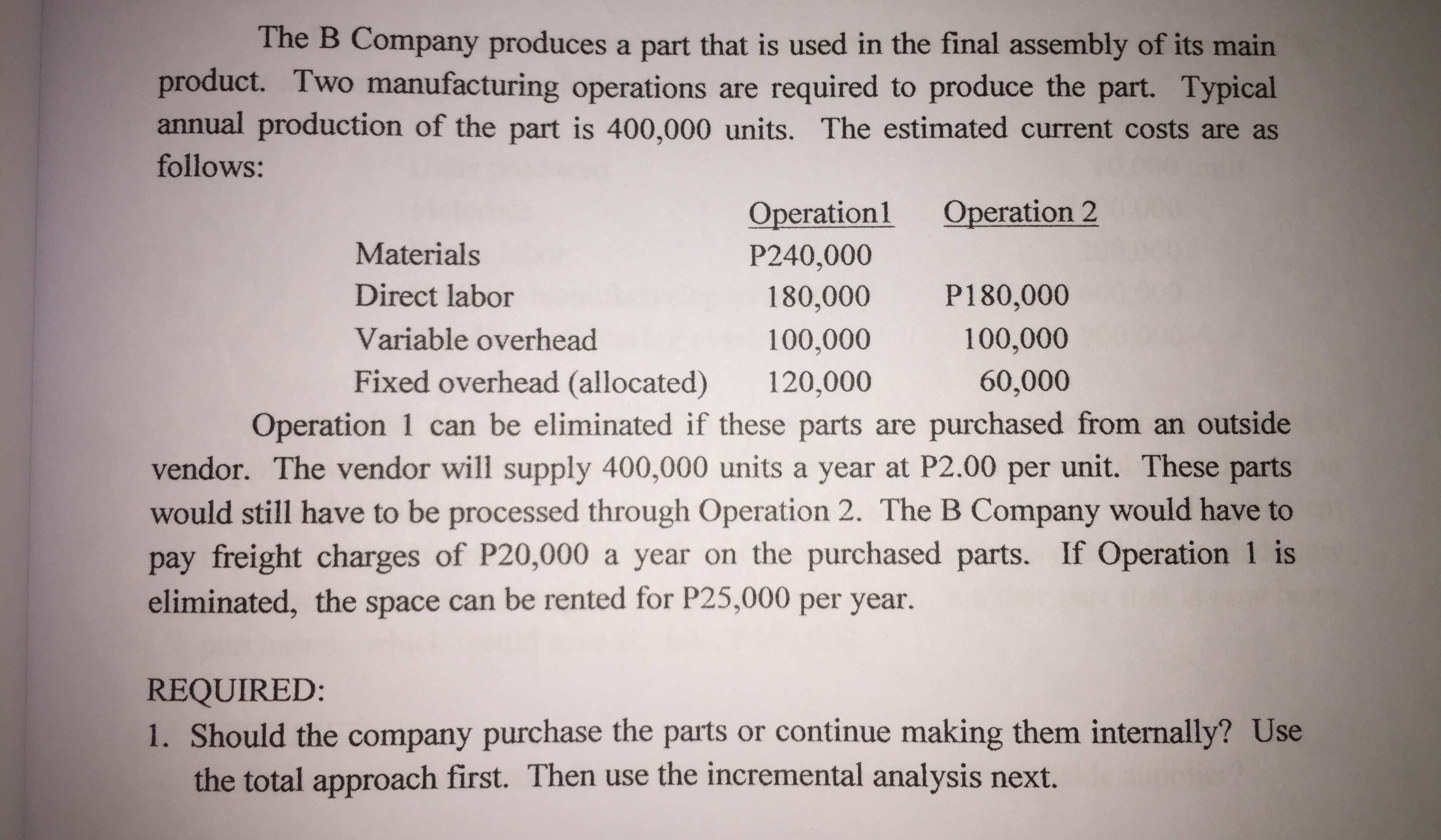

The B Company produces a part that is used in the final assembly of its main product. Two manufacturing operations are required to produce

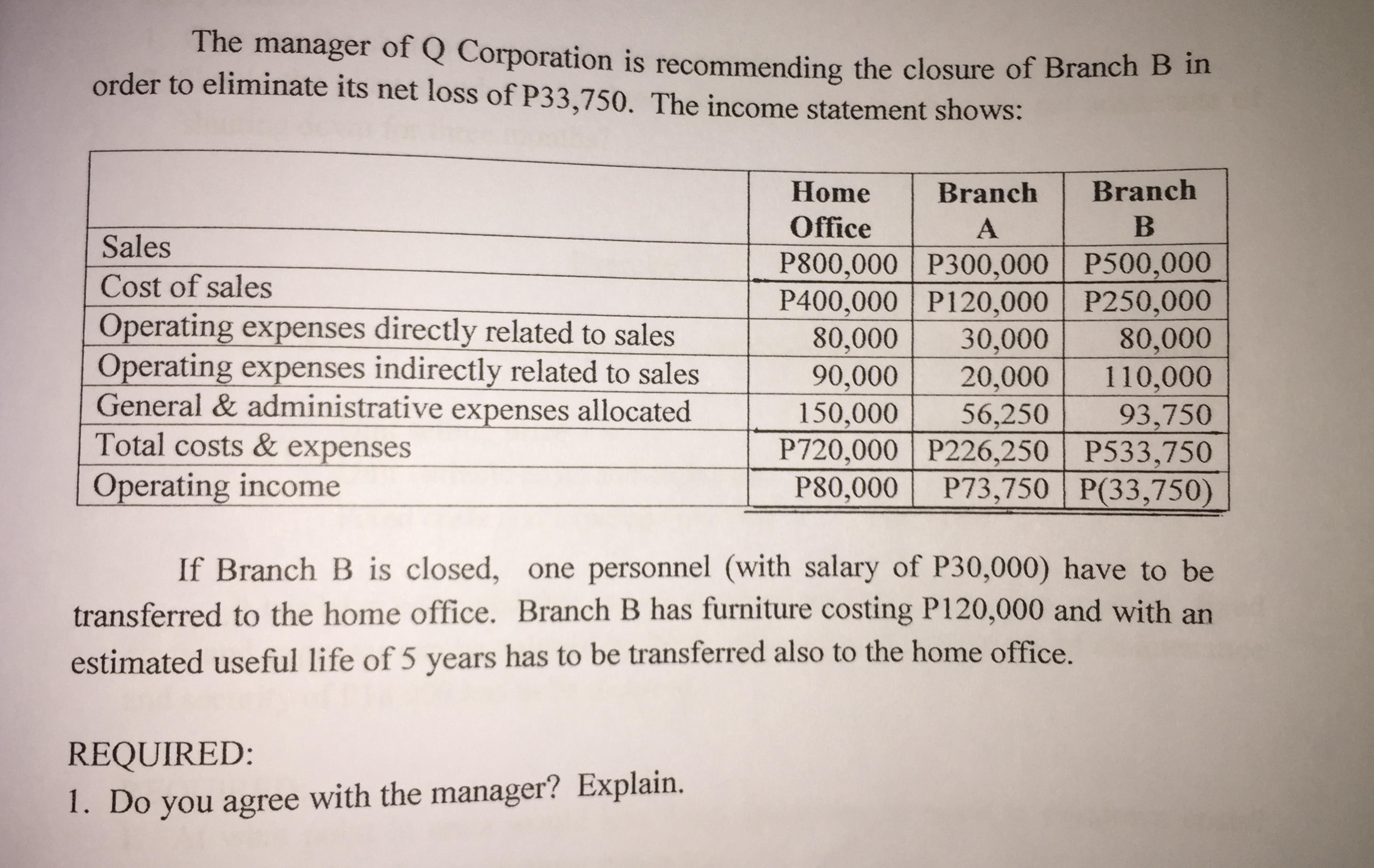

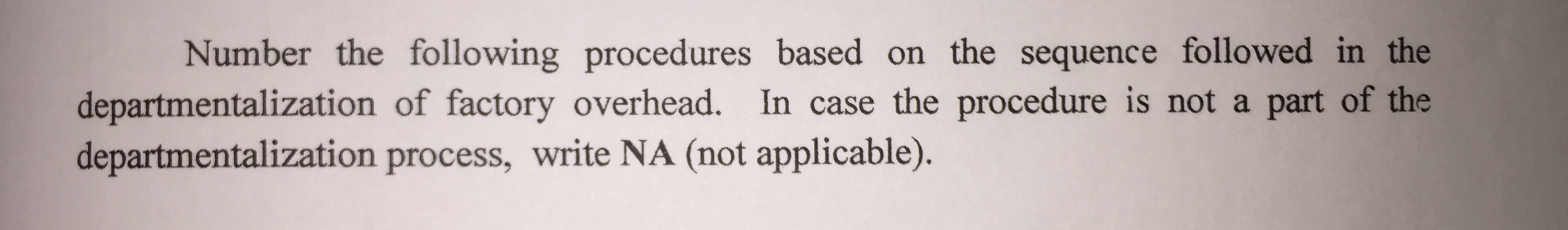

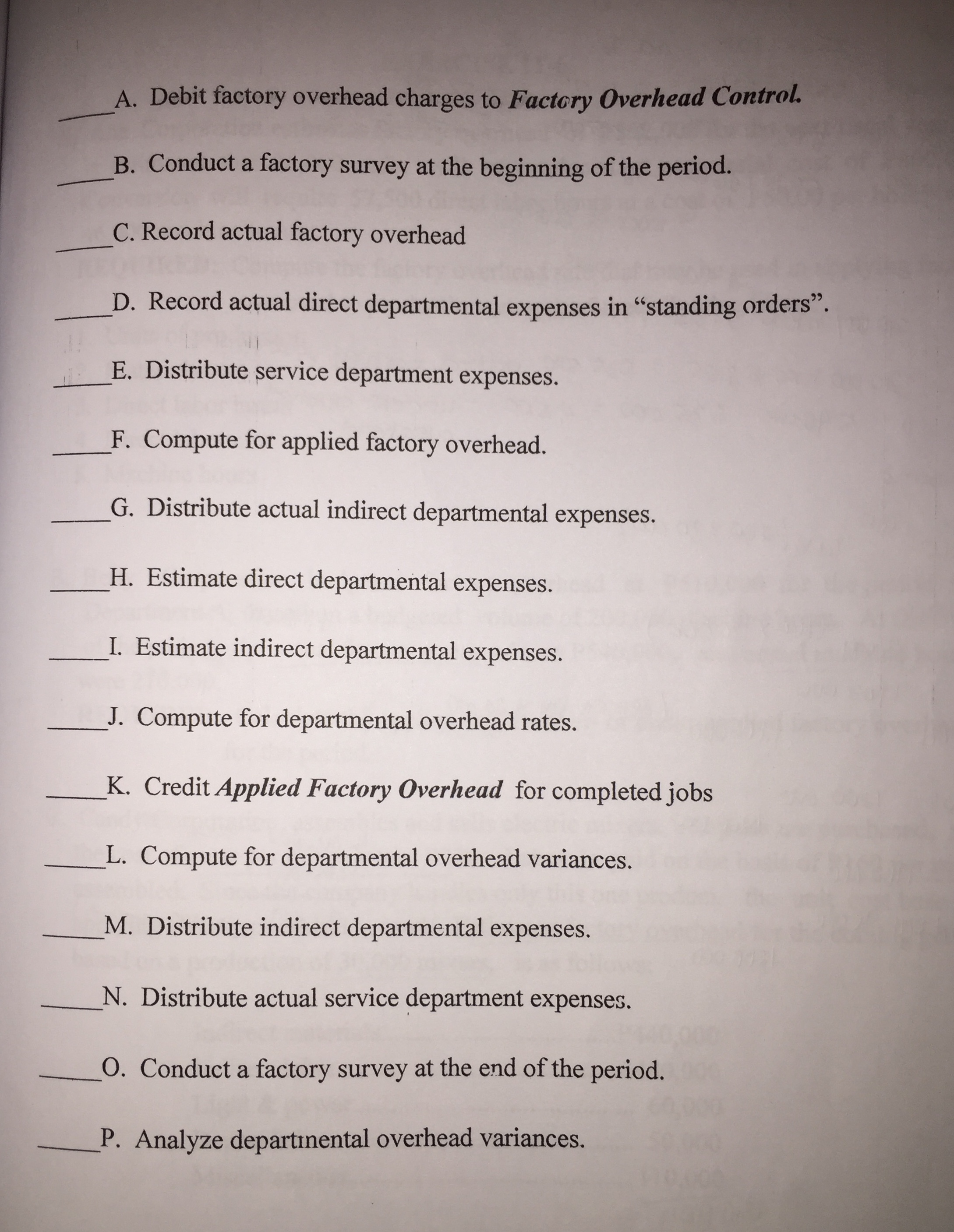

The B Company produces a part that is used in the final assembly of its main product. Two manufacturing operations are required to produce the part. Typical annual production of the part is 400,000 units. The estimated current costs are as follows: Materials Direct labor Variable overhead Fixed overhead (allocated) Operation1 Operation 2 P240,000 180,000 P180,000 100,000 100,000 120,000 60,000 Operation 1 can be eliminated if these parts are purchased from an outside vendor. The vendor will supply 400,000 units a year at P2.00 per unit. These parts would still have to be processed through Operation 2. The B Company would have to pay freight charges of P20,000 a year on the purchased parts. If Operation 1 is eliminated, the space can be rented for P25,000 per year. REQUIRED: 1. Should the company purchase the parts or continue making them internally? Use the total approach first. Then use the incremental analysis next. The manager of Q Corporation is recommending the closure of Branch B in order to eliminate its net loss of P33,750. The income statement shows: Sales Cost of sales Operating expenses directly related to sales Operating expenses indirectly related to sales General & administrative expenses allocated Total costs & expenses Operating income Home Branch Branch Office A B P800,000 P300,000 P500,000 P400,000 P120,000 P250,000 80,000 30,000 90,000 20,000 150,000 56,250 P720,000 P226,250 80,000 110,000 93,750 P533,750 P80,000 P73,750 P(33,750) If Branch B is closed, one personnel (with salary of P30,000) have to be transferred to the home office. Branch B has furniture costing P120,000 and with an estimated useful life of 5 years has to be transferred also to the home office. REQUIRED: 1. Do you agree with the manager? Explain. Number the following procedures based on the sequence followed in the departmentalization of factory overhead. In case the procedure is not a part of the departmentalization process, write NA (not applicable). A. Debit factory overhead charges to Factory Overhead Control. B. Conduct a factory survey at the beginning of the period. C. Record actual factory overhead D. Record actual direct departmental expenses in "standing orders". E. Distribute service department expenses. F. Compute for applied factory overhead. G. Distribute actual indirect departmental expenses. H. Estimate direct departmental expenses. I. Estimate indirect departmental expenses. J. Compute for departmental overhead rates. K. Credit Applied Factory Overhead for completed jobs L. Compute for departmental overhead variances. M. Distribute indirect departmental expenses. N. Distribute actual service department expenses. O. Conduct a factory survey at the end of the period. P. Analyze departinental overhead variances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started