Answered step by step

Verified Expert Solution

Question

1 Approved Answer

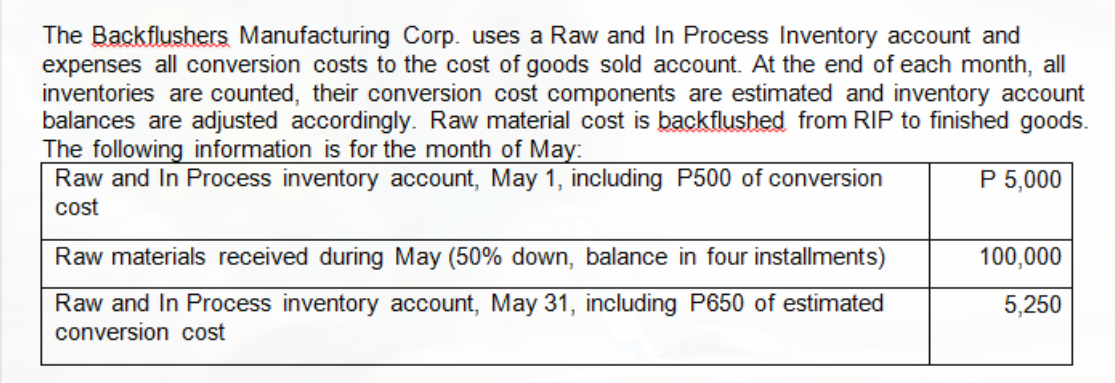

The Backflushers Manufacturing Corp. uses a Raw and In Process Inventory account and expenses all conversion costs to the cost of goods sold account.

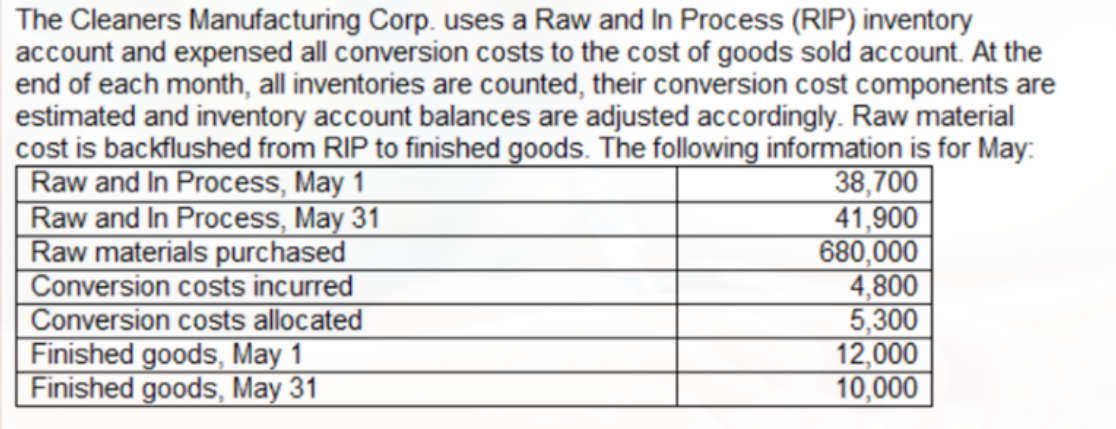

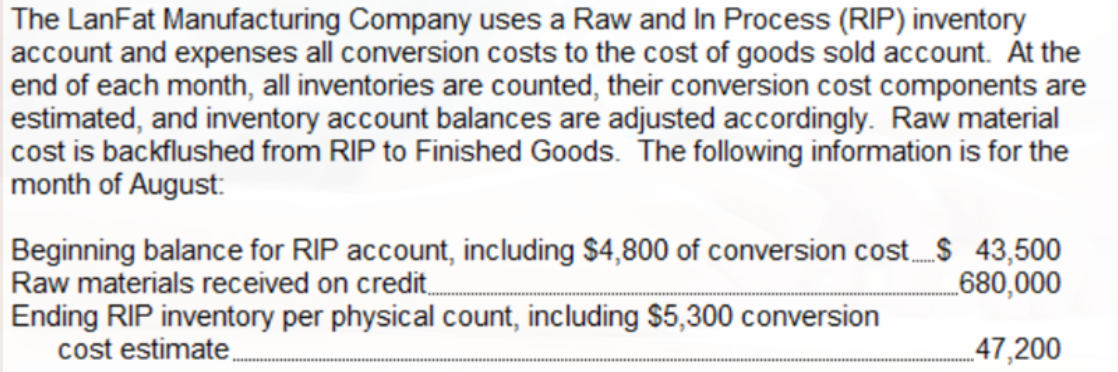

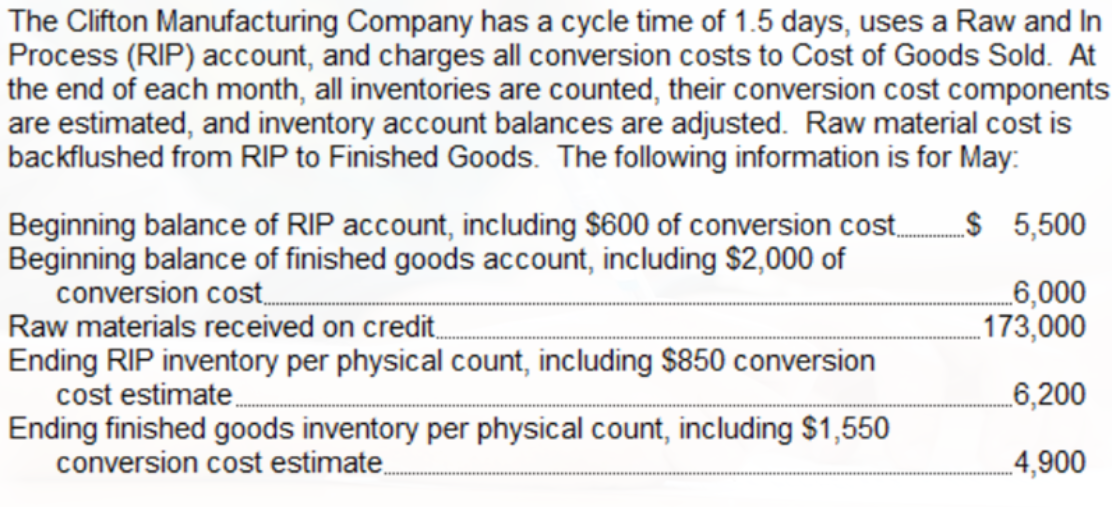

The Backflushers Manufacturing Corp. uses a Raw and In Process Inventory account and expenses all conversion costs to the cost of goods sold account. At the end of each month, all inventories are counted, their conversion cost components are estimated and inventory account balances are adjusted accordingly. Raw material cost is backflushed from RIP to finished goods. The following information is for the month of May: Raw and In Process inventory account, May 1, including P500 of conversion cost Raw materials received during May (50% down, balance in four installments) Raw and In Process inventory account, May 31, including P650 of estimated conversion cost P 5,000 100,000 5,250 38,700 The Cleaners Manufacturing Corp. uses a Raw and In Process (RIP) inventory account and expensed all conversion costs to the cost of goods sold account. At the end of each month, all inventories are counted, their conversion cost components are estimated and inventory account balances are adjusted accordingly. Raw material cost is backflushed from RIP to finished goods. The following information is for May: Raw and In Process, May 1 Raw and In Process, May 31 Raw materials purchased Conversion costs incurred Conversion costs allocated Finished goods, May 1 Finished goods, May 31 41,900 680,000 4,800 5,300 12,000 10,000 The LanFat Manufacturing Company uses a Raw and In Process (RIP) inventory account and expenses all conversion costs to the cost of goods sold account. At the end of each month, all inventories are counted, their conversion cost components are estimated, and inventory account balances are adjusted accordingly. Raw material cost is backflushed from RIP to Finished Goods. The following information is for the month of August: Beginning balance for RIP account, including $4,800 of conversion cost $ 43,500 Raw materials received on credit... Ending RIP inventory per physical count, including $5,300 conversion cost estimate. 680,000 47,200 The Clifton Manufacturing Company has a cycle time of 1.5 days, uses a Raw and In Process (RIP) account, and charges all conversion costs to Cost of Goods Sold. At the end of each month, all inventories are counted, their conversion cost components are estimated, and inventory account balances are adjusted. Raw material cost is backflushed from RIP to Finished Goods. The following information is for May: Beginning balance of RIP account, including $600 of conversion cost... $ 5,500 Beginning balance of finished goods account, including $2,000 of conversion cost.... Raw materials received on credit... Ending RIP inventory per physical count, including $850 conversion cost estimate... Ending finished goods inventory per physical count, including $1,550 conversion cost estimate... 6,000 173,000 6,200 4,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets work through the journal entries for the given information for each company 1 Backflushers ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started