Question

The balance sheet (2019-annual) of a firm trading in Borsa Istanbul is given below. Sales (revenues) of the company was 787 568 000 TL. Cost

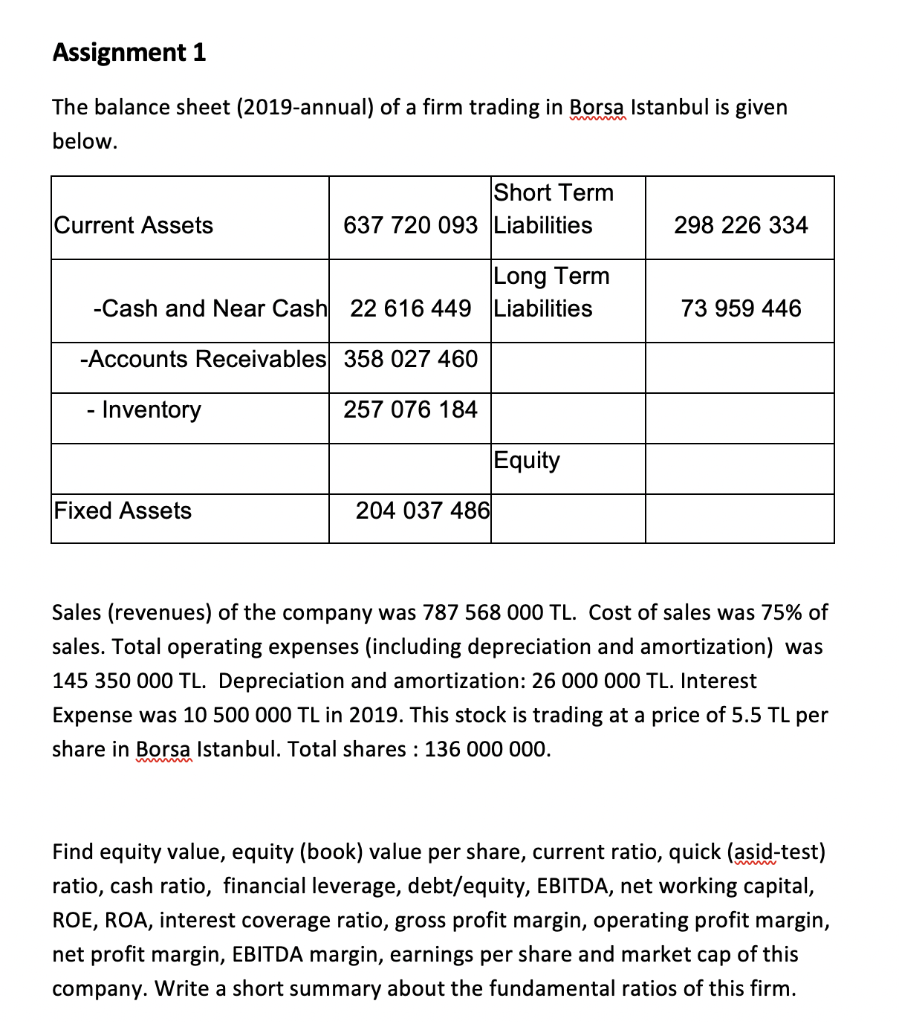

The balance sheet (2019-annual) of a firm trading in Borsa Istanbul is given below.

Sales (revenues) of the company was 787 568 000 TL. Cost of sales was 75% of sales. Total operating expenses (including depreciation and amortization) was 145 350 000 TL. Depreciation and amortization: 26 000 000 TL. Interest Expense was 10 500 000 TL in 2019. This stock is trading at a price of 5.5 TL per share in Borsa Istanbul. Total shares : 136 000 000.

Find equity value, equity (book) value per share, current ratio, quick (asid-test) ratio, cash ratio, financial leverage, debt/equity, EBITDA, net working capital, ROE, ROA, interest coverage ratio, gross profit margin, operating profit margin, net profit margin, EBITDA margin, earnings per share and market cap of this company. Write a short summary about the fundamental ratios of this firm.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started