Answered step by step

Verified Expert Solution

Question

1 Approved Answer

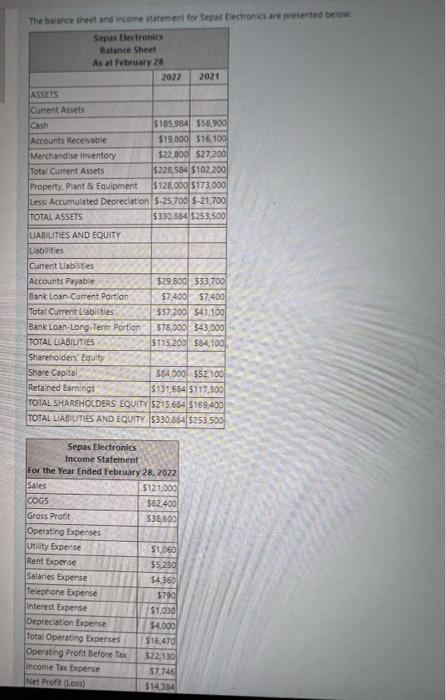

The balance sheet and income statement for Sepas Electronics are presented below Sepas Electronics Balance Sheet As at February 28 ASSETS Current Assets Cash Accounts

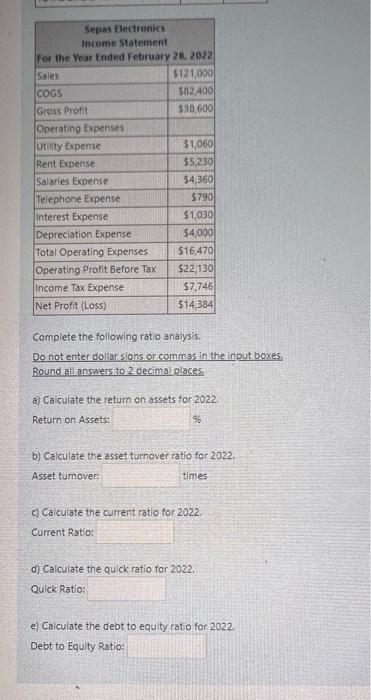

The balance sheet and income statement for Sepas Electronics are presented below Sepas Electronics Balance Sheet As at February 28 ASSETS Current Assets Cash Accounts Receivable Merchandise Inventory Total Current Assets Property, Plant & Equipment 2022 2021 $185,984 $56,900 $19,800 $16,100 $22,800 $27,200 $228,584 $102,200 $128,000 $173,000 Less: Accumulated Depreciation $-25,700 $-21,700 TOTAL ASSETS $330,884 $253,500 LIABILITIES AND EQUITY Liabilities Current Liabilities Accounts Payable $29,800 $33,700 Bank Loan-Current Portion $7,400 $7,400 Total Current Liabilities $37,200 $41,100 Bank Loan-Long-Term Portion $78,000 $43,000 TOTAL LIABILITIES $115,200 $84,100 Shareholders Equity Share Capital Retained Earnings $84,000 $52,100 $131,684 $117,300 TOTAL SHAREHOLDERS EQUITY $215.684 $169,400 TOTAL LIABILITIES AND EQUITY $330,884 $253,500 Sepas Electronics Income Statement For the Year Ended February 28, 2022 Sales $121,000 COGS $62,400 Gross Profit $36,600 Operating Expenses Utility Expense $1,060 Rent Expense $5,230 Salaries Expense $4,360 Telephone Expense $790 Interest Expense $1,030 Depreciation Expense $4,000 Total Operating Expenses $16,470 Operating Profit Before Tax $22,130 Income Tax Expense $7,746 Net Profit (Loss) $14,384 Sepas Electronics Income Statement For the Year Ended February 28, 2022 Sales $121,000 COGS $82,400 Gross Profit $38,600 Operating Expenses Utility Expense $1,060 Rent Expense $5,230 Salaries Expense 54,360 Telephone Expense $790 Interest Expense $1,030 Depreciation Expense $4,000 Total Operating Expenses $16,470 Operating Profit Before Tax $22,130 Income Tax Expense $7,746 Net Profit (Loss) $14,384 Complete the following ratio analysis. Do not enter dollar signs or commas in the input boxes, Round all answers to 2 decimal places, a) Calculate the return on assets for 2022. Return on Assets: 96 b) Calculate the asset turnover ratio for 2022. Asset turnover: times c) Calculate the current ratio for 2022. Current Ratio: d) Calculate the quick ratio for 2022. Quick Ratio: e) Calculate the debt to equity ratio for 2022. Debt to Equity Ratio

The balance sheet and income statement for Sepas Electronics are presented below Sepas Electronics Balance Sheet As at February 28 ASSETS Current Assets Cash Accounts Receivable Merchandise Inventory Total Current Assets Property, Plant & Equipment 2022 2021 $185,984 $56,900 $19,800 $16,100 $22,800 $27,200 $228,584 $102,200 $128,000 $173,000 Less: Accumulated Depreciation $-25,700 $-21,700 TOTAL ASSETS $330,884 $253,500 LIABILITIES AND EQUITY Liabilities Current Liabilities Accounts Payable $29,800 $33,700 Bank Loan-Current Portion $7,400 $7,400 Total Current Liabilities $37,200 $41,100 Bank Loan-Long-Term Portion $78,000 $43,000 TOTAL LIABILITIES $115,200 $84,100 Shareholders Equity Share Capital Retained Earnings $84,000 $52,100 $131,684 $117,300 TOTAL SHAREHOLDERS EQUITY $215.684 $169,400 TOTAL LIABILITIES AND EQUITY $330,884 $253,500 Sepas Electronics Income Statement For the Year Ended February 28, 2022 Sales $121,000 COGS $62,400 Gross Profit $36,600 Operating Expenses Utility Expense $1,060 Rent Expense $5,230 Salaries Expense $4,360 Telephone Expense $790 Interest Expense $1,030 Depreciation Expense $4,000 Total Operating Expenses $16,470 Operating Profit Before Tax $22,130 Income Tax Expense $7,746 Net Profit (Loss) $14,384 Sepas Electronics Income Statement For the Year Ended February 28, 2022 Sales $121,000 COGS $82,400 Gross Profit $38,600 Operating Expenses Utility Expense $1,060 Rent Expense $5,230 Salaries Expense 54,360 Telephone Expense $790 Interest Expense $1,030 Depreciation Expense $4,000 Total Operating Expenses $16,470 Operating Profit Before Tax $22,130 Income Tax Expense $7,746 Net Profit (Loss) $14,384 Complete the following ratio analysis. Do not enter dollar signs or commas in the input boxes, Round all answers to 2 decimal places, a) Calculate the return on assets for 2022. Return on Assets: 96 b) Calculate the asset turnover ratio for 2022. Asset turnover: times c) Calculate the current ratio for 2022. Current Ratio: d) Calculate the quick ratio for 2022. Quick Ratio: e) Calculate the debt to equity ratio for 2022. Debt to Equity Ratio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started