Answered step by step

Verified Expert Solution

Question

1 Approved Answer

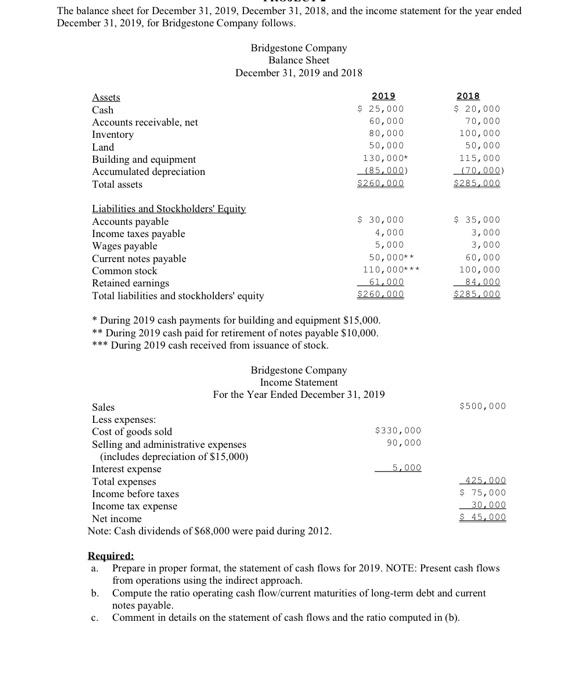

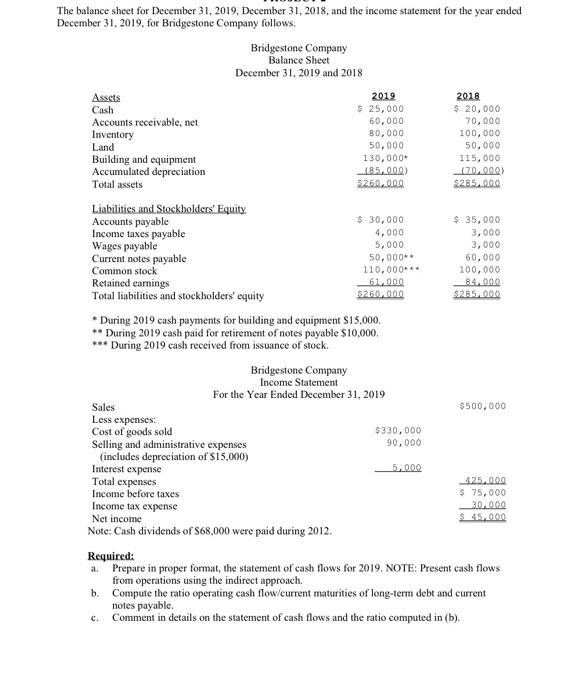

The balance sheet for December 31, 2019, December 31, 2018, and the income statement for the year ended December 31, 2019, for Bridgestone Company

The balance sheet for December 31, 2019, December 31, 2018, and the income statement for the year ended December 31, 2019, for Bridgestone Company follows. Assets Cash Accounts receivable, net Inventory Land Building and equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Income taxes payable Wages payable Current notes payable Common stock Retained earnings Total liabilities and stockholders' equity Bridgestone Company Balance Sheet December 31, 2019 and 2018 Interest expense Total expenses Income before taxes Income tax expense Sales Less expenses: Cost of goods sold Selling and administrative expenses (includes depreciation of $15,000) Required: a. b. * During 2019 cash payments for building and equipment $15,000. ** During 2019 cash paid for retirement of notes payable $10,000. *** During 2019 cash received from issuance of stock. Net income Note: Cash dividends of $68,000 were paid during 2012. CL 2019 $ 25,000 60,000 80,000 50,000 130,000* (85,000) $260,000 $ 30,000 4,000 5,000 50,000** 110,000. 61,000 $260,000 Bridgestone Company Income Statement For the Year Ended December 31, 2019 $330,000 90,000 5,000 2018 $ 20,000 70,000 100,000 50,000 115,000 (70,000) $285,000 $ 35,000 3,000 3,000 60,000 100,000 84,000 $285,000 $500,000 425.000 $ 75,000 30,000 $ 45,000 Prepare in proper format, the statement of cash flows for 2019. NOTE: Present cash flows from operations using the indirect approach. Compute the ratio operating cash flow/current maturities of long-term debt and current notes payable. Comment in details on the statement of cash flows and the ratio computed in (b). The balance sheet for December 31, 2019, December 31, 2018, and the income statement for the year ended December 31, 2019, for Bridgestone Company follows. Assets Cash Accounts receivable, net Inventory Land Building and equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Income taxes payable Wages payable Current notes payable Common stock Retained earnings Total liabilities and stockholders' equity Bridgestone Company Balance Sheet December 31, 2019 and 2018 Interest expense Total expenses Income before taxes Income tax expense Sales Less expenses: Cost of goods sold Selling and administrative expenses (includes depreciation of $15,000) Required: a. b. * During 2019 cash payments for building and equipment $15,000. ** During 2019 cash paid for retirement of notes payable $10,000. *** During 2019 cash received from issuance of stock. Net income Note: Cash dividends of $68,000 were paid during 2012. CL 2019 $ 25,000 60,000 80,000 50,000 130,000* (85,000) $260,000 $ 30,000 4,000 5,000 50,000** 110,000. 61,000 $260,000 Bridgestone Company Income Statement For the Year Ended December 31, 2019 $330,000 90,000 5,000 2018 $ 20,000 70,000 100,000 50,000 115,000 (70,000) $285,000 $ 35,000 3,000 3,000 60,000 100,000 84,000 $285,000 $500,000 425.000 $ 75,000 30,000 $ 45,000 Prepare in proper format, the statement of cash flows for 2019. NOTE: Present cash flows from operations using the indirect approach. Compute the ratio operating cash flow/current maturities of long-term debt and current notes payable. Comment in details on the statement of cash flows and the ratio computed in (b).

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of Cash Flow for 2019 Indirect Method Particulars Cash flows from operating a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started