Answered step by step

Verified Expert Solution

Question

1 Approved Answer

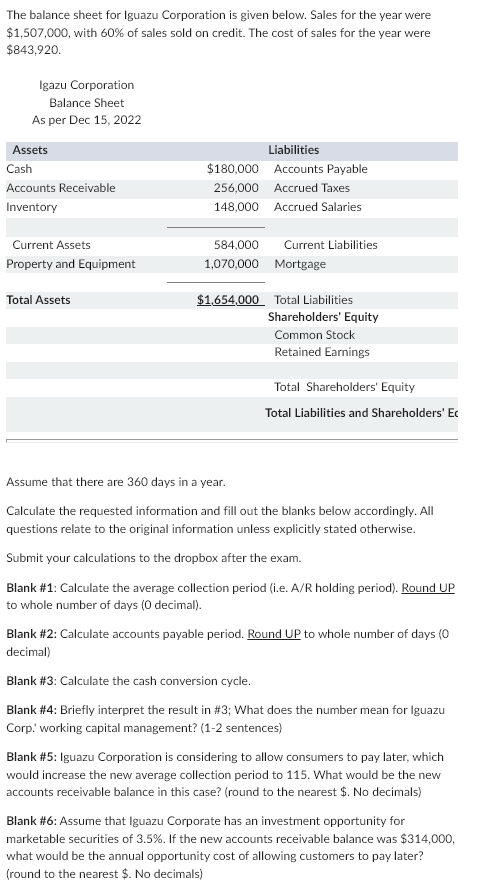

The balance sheet for Iguazu Corporation is given below. Sales for the year were $1,507,000, with 60% of sales sold on credit. The cost

The balance sheet for Iguazu Corporation is given below. Sales for the year were $1,507,000, with 60% of sales sold on credit. The cost of sales for the year were $843,920. Igazu Corporation Balance Sheet As per Dec 15, 2022 Assets Cash Accounts Receivable Inventory Liabilities $180,000 Accounts Payable 256,000 Accrued Taxes 148,000 Accrued Salaries Current Assets Property and Equipment Total Assets 584,000 Current Liabilities 1,070,000 Mortgage $1,654,000 Total Liabilities Shareholders' Equity Common Stock Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Ec Assume that there are 360 days in a year. Calculate the requested information and fill out the blanks below accordingly. All questions relate to the original information unless explicitly stated otherwise. Submit your calculations to the dropbox after the exam. Blank #1: Calculate the average collection period (i.e. A/R holding period). Round UP to whole number of days (0 decimal). Blank #2: Calculate accounts payable period. Round UP to whole number of days (0 decimal) Blank #3: Calculate the cash conversion cycle. Blank #4: Briefly interpret the result in #3; What does the number mean for Iguazu Corp. working capital management? (1-2 sentences) Blank #5: Iguazu Corporation is considering to allow consumers to pay later, which would increase the new average collection period to 115. What would be the new accounts receivable balance in this case? (round to the nearest $. No decimals) Blank #6: Assume that Iguazu Corporate has an investment opportunity for marketable securities of 3.5%. If the new accounts receivable balance was $314,000, what would be the annual opportunity cost of allowing customers to pay later? (round to the nearest $. No decimals)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started