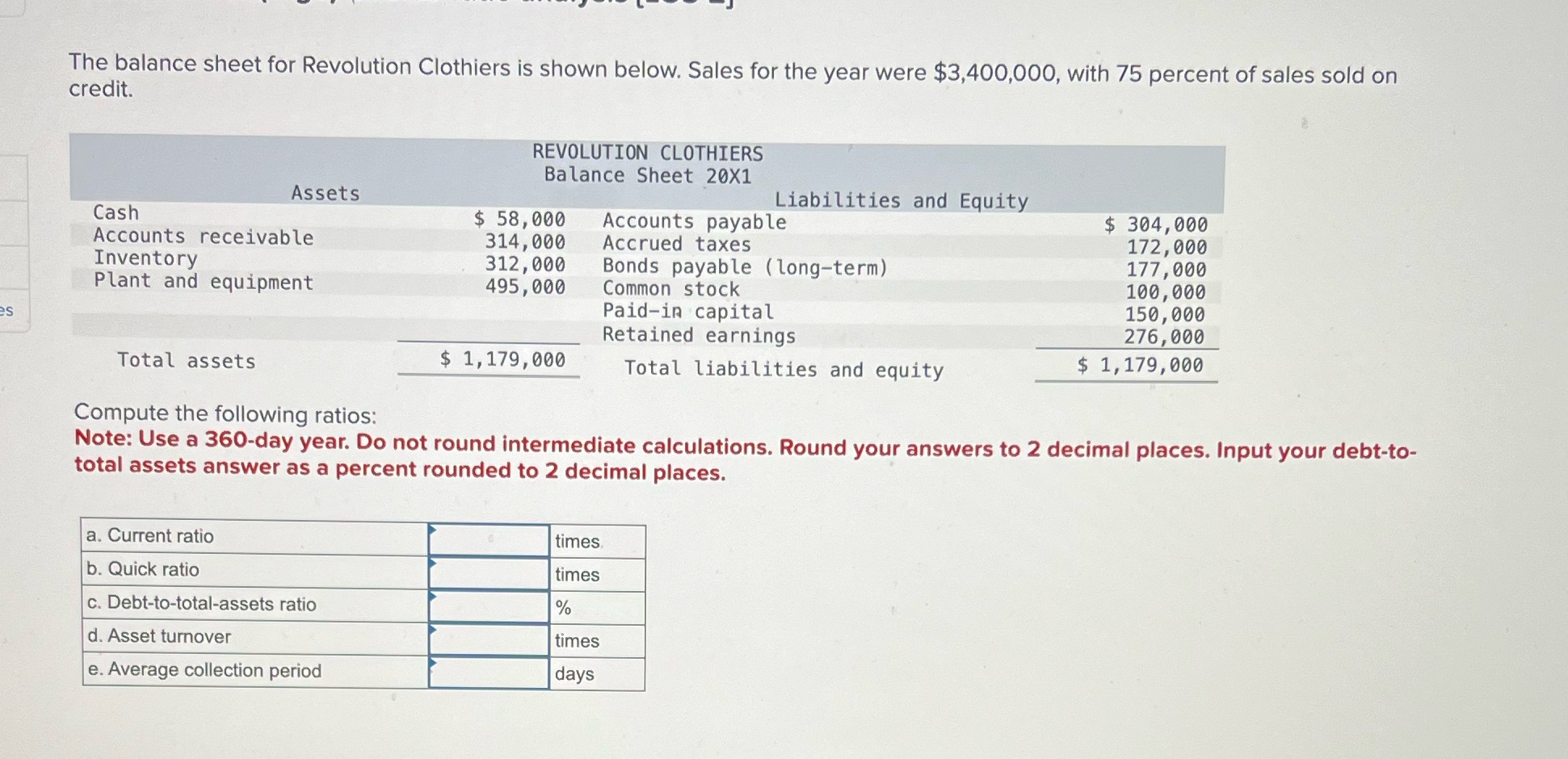

The balance sheet for Revolution Clothiers is shown below. Sales for the year were $3,400,000, with 75 percent of sales sold on credit. Cash

The balance sheet for Revolution Clothiers is shown below. Sales for the year were $3,400,000, with 75 percent of sales sold on credit. Cash Accounts receivable REVOLUTION CLOTHIERS Balance Sheet 20X1 Assets Liabilities and Equity $ 58,000 314,000 Accounts payable Accrued taxes $ 304,000 172,000 312,000 495,000 Bonds payable (long-term) 177,000 Common stock 100,000 Paid-in capital 150,000 Retained earnings 276,000 $ 1,179,000 Total liabilities and equity $ 1,179,000 Inventory Plant and equipment es Total assets Compute the following ratios: Note: Use a 360-day year. Do not round intermediate calculations. Round your answers to 2 decimal places. Input your debt-to- total assets answer as a percent rounded to 2 decimal places. a. Current ratio times b. Quick ratio times c. Debt-to-total-assets ratio % d. Asset turnover times e. Average collection period days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Current Ratio Current Ratio 684000 476000 144 time...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started