Answered step by step

Verified Expert Solution

Question

1 Approved Answer

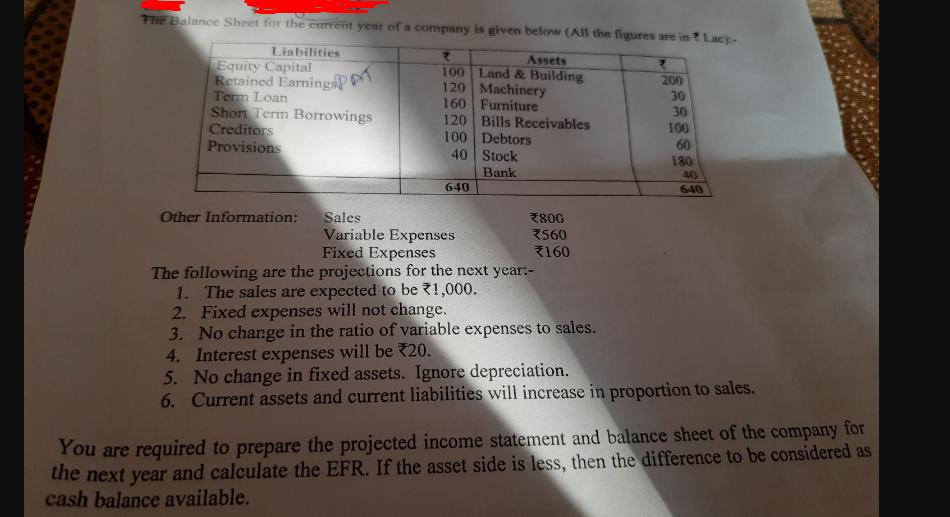

The Balance Sheet for the current year of a company is given below (All the figures are in Lacy- Liabilities Assets Equity Capital Retained

The Balance Sheet for the current year of a company is given below (All the figures are in Lacy- Liabilities Assets Equity Capital Retained EarningsP Term Loan 100 Land & Building 120 Machinery 160 Furniture Short Term Borrowings Creditors Provisions Other Information: PAT 120 Bills Receivables 100 Debtors 40 640 Stock Bank Sales Variable Expenses Fixed Expenses The following are the projections for the next year:- 1. The sales are expected to be 1,000. 800 7560 160 2. Fixed expenses will not change. 3. No change in the ratio of variable expenses to sales. 4. Interest expenses will be *20. 200 30 30 100 60 180 40 640 5. No change in fixed assets. Ignore depreciation. 6. Current assets and current liabilities will increase in proportion to sales. You are required to prepare the projected income statement and balance sheet of the company for the next year and calculate the EFR. If the asset side is less, then the difference to be considered as cash balance available.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the projected income statement and balance sheet for the next year we will use the given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started