Answered step by step

Verified Expert Solution

Question

1 Approved Answer

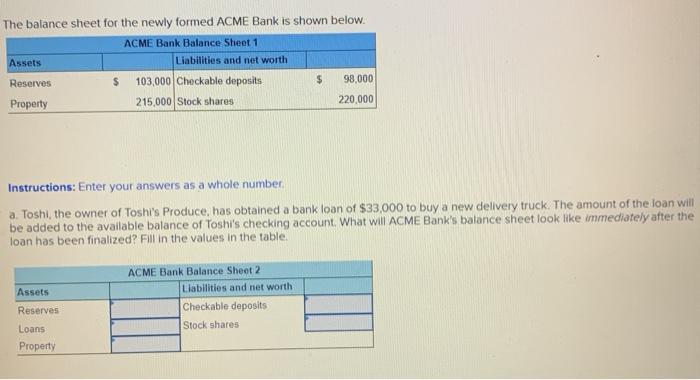

The balance sheet for the newly formed ACME Bank is shown below. ACME Bank Balance Sheet 11 Assets Reserves Property $ Assets Reserves Loans

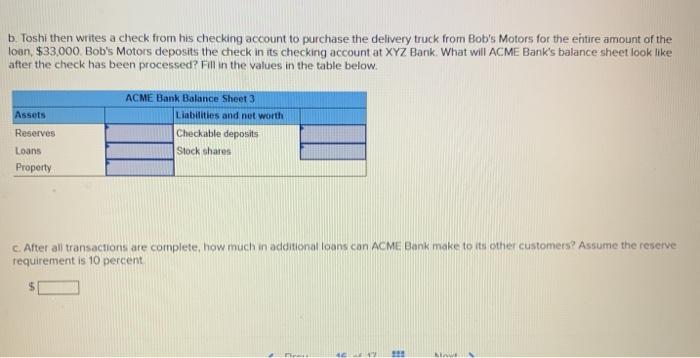

The balance sheet for the newly formed ACME Bank is shown below. ACME Bank Balance Sheet 11 Assets Reserves Property $ Assets Reserves Loans Property Liabilities and net worth i 103,000 Checkable deposits 215,000 Stock shares Instructions: Enter your answers as a whole number. a. Toshi, the owner of Toshi's Produce, has obtained a bank loan of $33,000 to buy a new delivery truck. The amount of the loan will be added to the available balance of Toshi's checking account. What will ACME Bank's balance sheet look like immediately after the loan has been finalized? Fill in the values in the table. ACME Bank Balance Sheet 2 $ Liabilities and net worth: Checkable deposits Stock shares 98,000 220,000 b. Toshi then writes a check from his checking account to purchase the delivery truck from Bob's Motors for the entire amount of the loan, $33,000. Bob's Motors deposits the check in its checking account at XYZ Bank. What will ACME Bank's balance sheet look like after the check has been processed? Fill in the values in the table below. Assets Reserves Loans Property ACME Bank Balance Sheet 3 Liabilities and net worth Checkable deposits Stock shares c. After all transactions are complete, how much in additional loans can ACME Bank make to its other customers? Assume the reserve requirement is 10 percent 111 Nove

Step by Step Solution

★★★★★

3.42 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Given in the question is the balance sheet of ACME Bank which is as follows Assets Reserves Property ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started