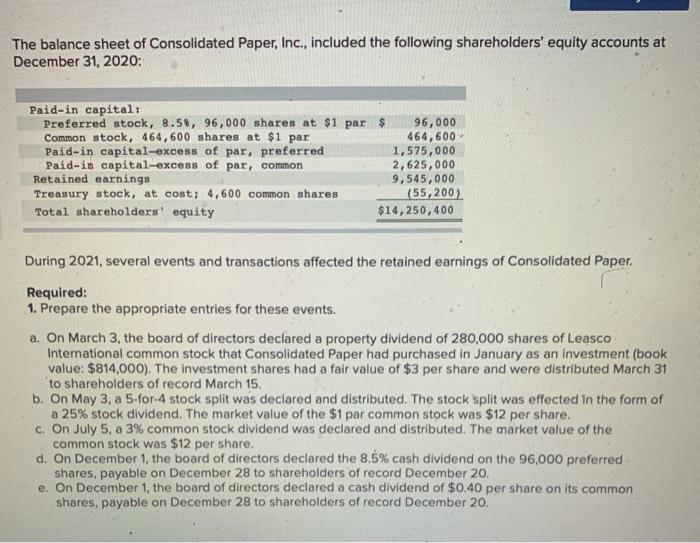

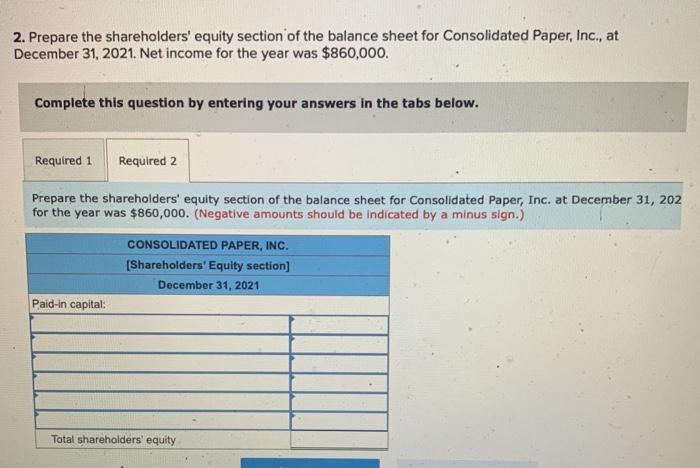

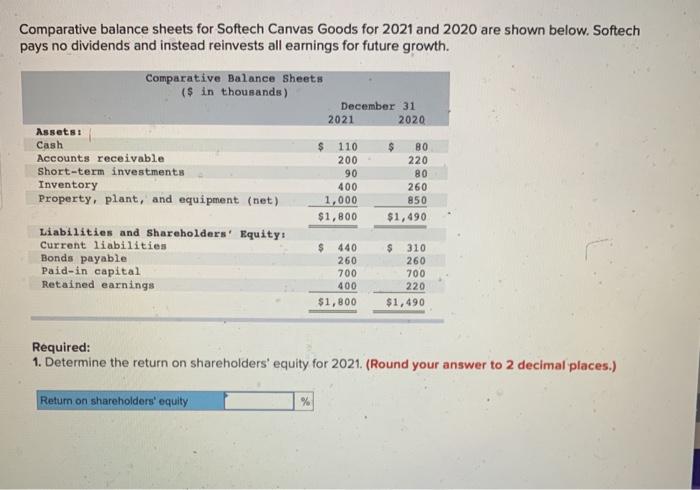

The balance sheet of Consolidated Paper, Inc., included the following shareholders' equity accounts at December 31, 2020: Paid-in capital: Preferred stock, 8.58, 96,000 shares at $1 par $ 96,000 Common stock, 464,600 shares at $1 par 464,600 Paid-in capital-excess of par, preferred 1,575,000 Paid-in capital-excess of par, common 2,625,000 Retained earnings 9,545,000 Treasury stock, at cost; 4,600 common shares (55,200) Total shareholders' equity $14,250,400 During 2021, several events and transactions affected the retained earnings of Consolidated Paper Required: 1. Prepare the appropriate entries for these events. a. On March 3, the board of directors declared a property dividend of 280,000 shares of Leasco International common stock that Consolidated Paper had purchased in January as an investment (book value: $814,000). The investment shares had a fair value of $3 per share and were distributed March 31 to shareholders of record March 15. b. On May 3, a 5-for-4 stock split was declared and distributed. The stock split was effected in the form of a 25% stock dividend. The market value of the $1 par common stock was $12 per share. c. On July 5, a 3% common stock dividend was declared and distributed. The market value of the common stock was $12 per share. d. On December 1, the board of directors declared the 8.5% cash dividend on the 96,000 preferred shares, payable on December 28 to shareholders of record December 20. e. On December 1, the board of directors declared a cash dividend of $0.40 per share on its common shares, payable on December 28 to shareholders of record December 20 2. Prepare the shareholders' equity section of the balance sheet for Consolidated Paper, Inc., at December 31, 2021. Net income for the year was $860,000. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the shareholders' equity section of the balance sheet for Consolidated Paper, Inc. at December 31, 202 for the year was $860,000. (Negative amounts should be indicated by a minus sign.) CONSOLIDATED PAPER, INC. [Shareholders' Equity section) December 31, 2021 Paid-in capital: Total shareholders' equity Comparative balance sheets for Softech Canvas Goods for 2021 and 2020 are shown below. Softech pays no dividends and instead reinvests all earnings for future growth. Comparative Balance Sheets ($ in thousands) December 31 2021 2020 Assets: Cash $ 110 $ 80 Accounts receivable 200 220 Short-term investments Inventory 400 Property, plant, and equipment (net) 1,000 850 $1,800 $1,490 Liabilities and Shareholders' Equity Current liabilities $ Bonds payable 260 Paid-in capital Retained earnings 400 220 $1,800 $1,490 90 80 260 440 $ 310 260 700 700 Required: 1. Determine the return on shareholders' equity for 2021. (Round your answer to 2 decimal places.) Return on shareholders' equity %