Answered step by step

Verified Expert Solution

Question

1 Approved Answer

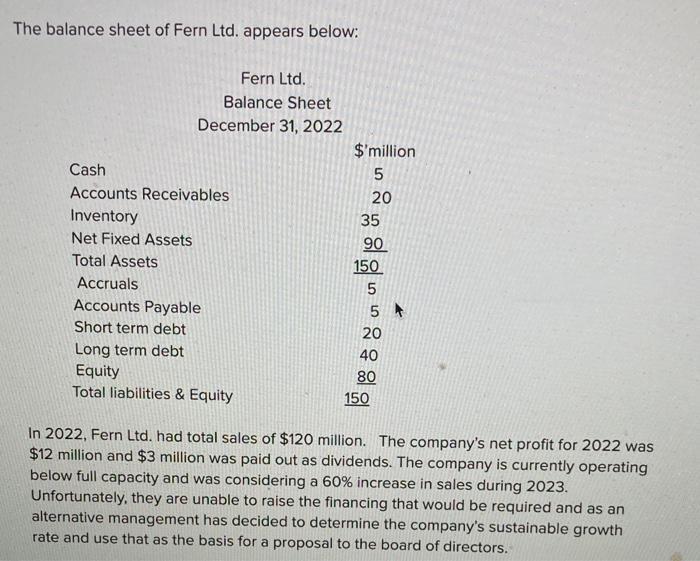

The balance sheet of Fern Ltd. appears below: Fern Ltd. Balance Sheet December 31, 2022 Cash Accounts Receivables Inventory Net Fixed Assets Total Assets

The balance sheet of Fern Ltd. appears below: Fern Ltd. Balance Sheet December 31, 2022 Cash Accounts Receivables Inventory Net Fixed Assets Total Assets Accruals Accounts Payable Short term debt Long term debt Equity Total liabilities & Equity $'million 5 20 35 90 150 5 5 20 40 80 150 In 2022, Fern Ltd. had total sales of $120 million. The company's net profit for 2022 was $12 million and $3 million was paid out as dividends. The company is currently operating below full capacity and was considering a 60% increase in sales during 2023. Unfortunately, they are unable to raise the financing that would be required and as an alternative management has decided to determine the company's sustainable growth rate and use that as the basis for a proposal to the board of directors. Required: a. Calculate the company's sustainable prowth rate and advise the company on the amount of new funding that would be required in order to achieve this level of growth in sales during 2023. (10 marks) b. Assuming that the company is able to raise these funds by way of a long-term loan, prepare the company's forecast balance sheet for the year ended December 31, 2023. (8 marks)

Step by Step Solution

★★★★★

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Lets start with part a to calculate the companys sustainable growth rate SGR The sustainable growth rate can be calculated with the following formula SGR Return on equity ROE x 1 dividend payout ratio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started