Answered step by step

Verified Expert Solution

Question

1 Approved Answer

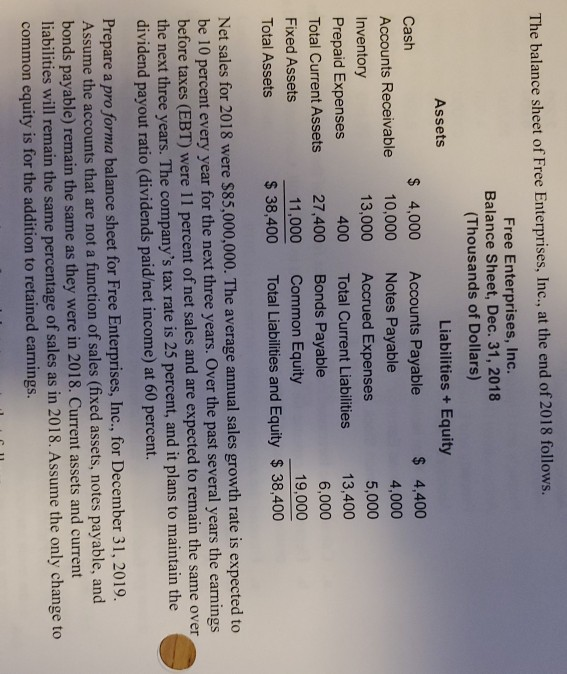

The balance sheet of Free Enterprises, Inc., at the end of 2018 follows. Assets Cash Accounts Receivable Inventory Prepaid Expenses Total Current Assets Fixed Assets

The balance sheet of Free Enterprises, Inc., at the end of 2018 follows. Assets Cash Accounts Receivable Inventory Prepaid Expenses Total Current Assets Fixed Assets Total Assets Free Enterprises, Inc. Balance Sheet, Dec. 31, 2018 (Thousands of Dollars) Liabilities + Equity $ 4,000 Accounts Payable $ 4,400 10,000 Notes Payable 4,000 13,000 Accrued Expenses 5,000 Total Current Liabilities 13,400 27,400 Bonds Payable 6.000 11,000 Common Equity 19.000 $ 38,400 Total Liabilities and Equity $ 38,400 400 Net sales for 2018 were $85,000,000. The average annual sales growth rate is expected to be 10 percent every year for the next three years. Over the past several years the earnings before taxes (EBT) were 11 percent of net sales and are expected to remain the same over the next three years. The company's tax rate is 25 percent, and it plans to maintain the dividend payout ratio (dividends paidet income) at 60 percent. Prepare a pro forma balance sheet for Free Enterprises, Inc., for December 31, 2019. Assume the accounts that are not a function of sales (fixed assets, notes payable, and bonds payable) remain the same as they were in 2018. Current assets and current liabilities will remain the same percentage of sales as in 2018. Assume the only change to common equity is for the addition to retained earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started