Question

The Balance sheet of Oedrila Ltd for the year that ended on 31st Mar 2019 and 2020 are as follows: Additional Information: a) Depreciation of

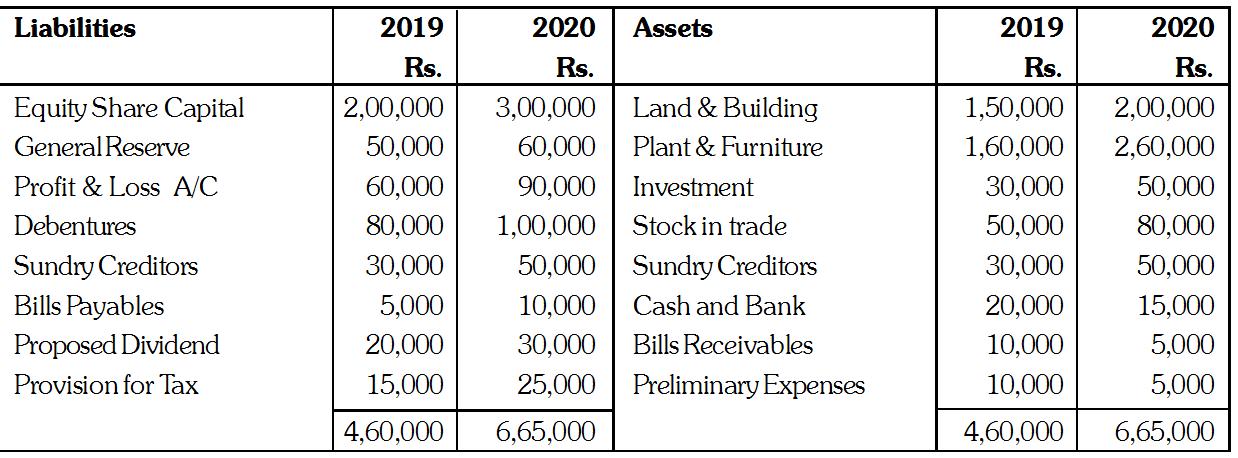

The Balance sheet of Oedrila Ltd for the year that ended on 31st Mar 2019 and 2020 are as follows:

Additional Information:

a) Depreciation of Rs. 20,000 was charged on plant and machinery during the year 2019-20.

b) A machinery costing Rs. 50,000, on which the total depreciation amounting to Rs. 30,000 was provided, was sold at Rs. 25,000 during the year 2019-20.

c) A dividend of Rs. 24,000 was paid during the year 2019-20.

Required:

Prepare a statement showing the changes in the working capital and a fund flow statement for the year that ended on 31st Mar 2020.

Liabilities Equity Share Capital General Reserve Profit & Loss A/C Debentures Sundry Creditors Bills Payables Proposed Dividend Provision for Tax 2019 Rs. 2,00,000 50,000 60,000 80,000 30,000 5,000 20,000 15,000 4,60,000 2020 Rs. Assets 3,00,000 Land & Building 60,000 Plant & Furniture 90,000 Investment 1,00,000 Stock in trade 50,000 Sundry Creditors 10,000 Cash and Bank 30,000 Bills Receivables 25,000 Preliminary Expenses 6,65,000 2019 Rs. 1,50,000 1,60,000 30,000 50,000 30,000 20,000 10,000 10,000 4,60,000 2020 Rs. 2,00,000 2,60,000 50,000 80,000 50,000 15,000 5,000 5,000 6,65,000

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the statement showing the changes in working capital and a fund flow statement for the year that ended on 31st March 2020 we need to analyze the changes in the current assets and current li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started