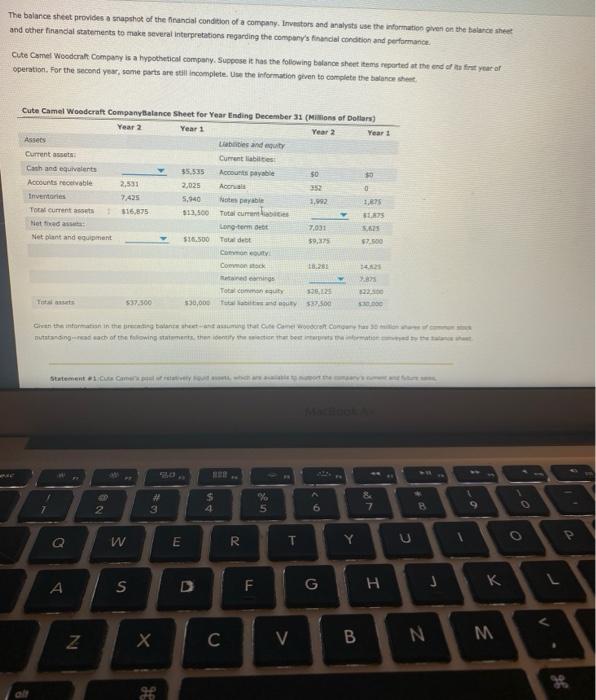

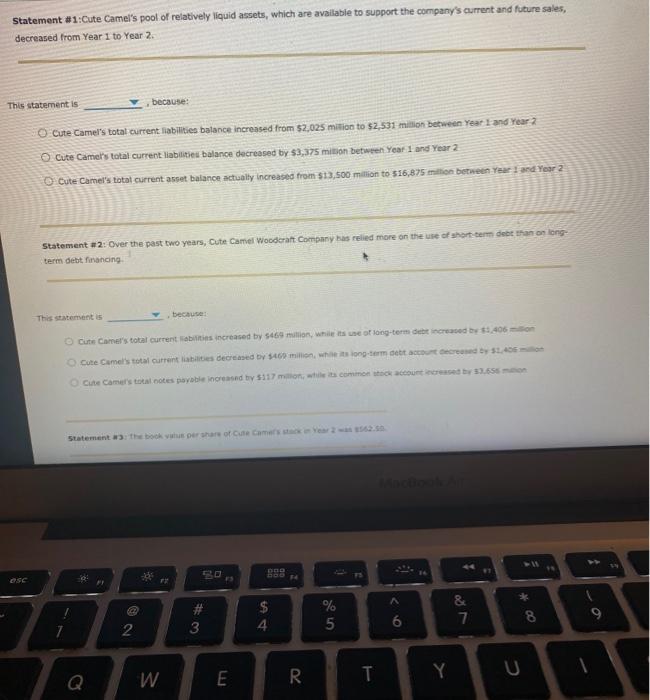

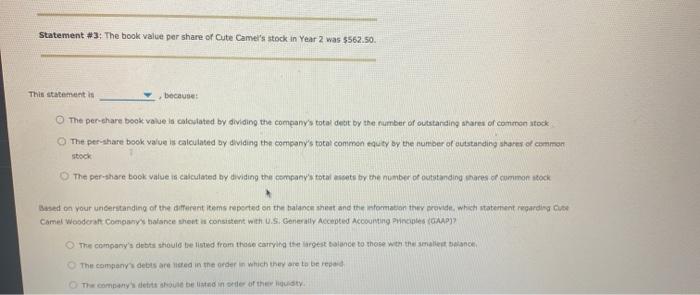

The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts the information gives on the balance sheet and other financial statements to make several interpretations regarding the company's final condition and performance Cute Corel Woodcrate Company is a hypothetical company. Suppose it has the following balance sheettoms reported at the end of a first year af operation. For the second year, some parts are still incomplete. Um the information given to complete the balance Cute Camel Woodcraft CompanyBalance Sheet for Year Ending December 31 (Millions of dollars) Year 2 Year 1 Year 2 Yeart so 30 Current assets Cash and equivalents Accounts receivable 2,531 Inventaries 7,435 Tot current $16,875 Netticas Net blant and equipment 35 535 2,025 5,940 523.500 Labies and equity Current liabilities Accounts payable Aco Notes payable Total current Long-term Tat det Concu Cook 0 1,675 3,992 BER 5.25 7,031 $16.500 59,375 92.00 18.281 82256 Totalcony 16 530,000 537.00 537.500 See Chintain the bonne het team world tong-react of the winter the other haber # $ zein 2 6 7 B Q . W E Y R C S > A F G J H K K Z C V B N M 3 Statement #1:Cute Camel's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2 This statement is because: O Cute Camel's total current liabilities balance increased from $2,025 million to $2,531 million between year and Year 2 Cute Camel's total current liabilities balance decreased by $3,375 milion between Year 1 and Year 2 Cute Camel's total current asset balance actually increased from $13.500 million to 516,875 million between years and Year 2 Statement #2: Over the past two years, Cute Camel Woodcraft Company has relied more on the use of short-term debt than on long term debt financing This statements because Cute Camer's total current abilities increased by $469 million, we use of long-term debit increased by $1,406 - Cute Camel's total current les decreased by $460 million wong-term dettur 52.46 - Cute Camer's total notes payable increased by $117 monta como account creab33.655 Statement #3 The book war of Cute came Year no OSC og # 3 $ 4 % 5 6 7 8 2 E W Q R T Y Statement #3: The book value per share of Cute Camel's stock in Year 2 was $562.50 This statement is because The per share book value is calculated by dividing the company's total det by the number of outstanding shares of common stock The per share book value is calculated by dividing the company's total common equity by the number of outstanding shares of common The per-share took value is calculated by dividing the company's total seats by the number of outstanding uners or common stock Based on your understanding of the different to reported on the balance sheet and the information they provide which statement regarding Camel Woodern Company balance sheets consistent with U.S. Generally Accepted Accounting Principles (OP) The company's debts should be listed from the carrying the largest balance to those with the smallest bence The company debts are in the order in which they are to be read The company's deben ser of the busty