Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the Balance Sheet You just started your new position as a junior credit analyst with a large Canadian bank. For your first assignment, you have

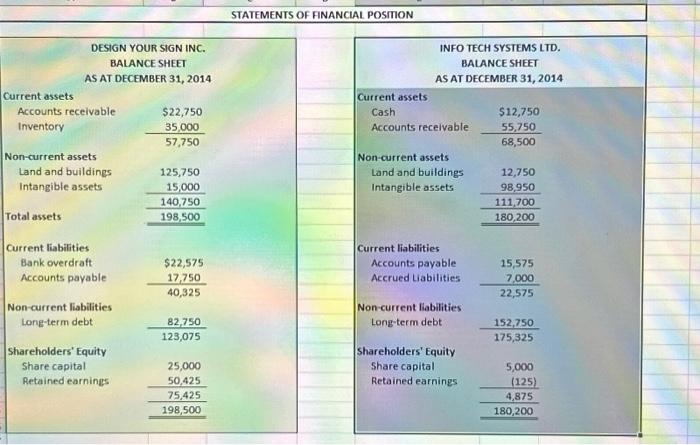

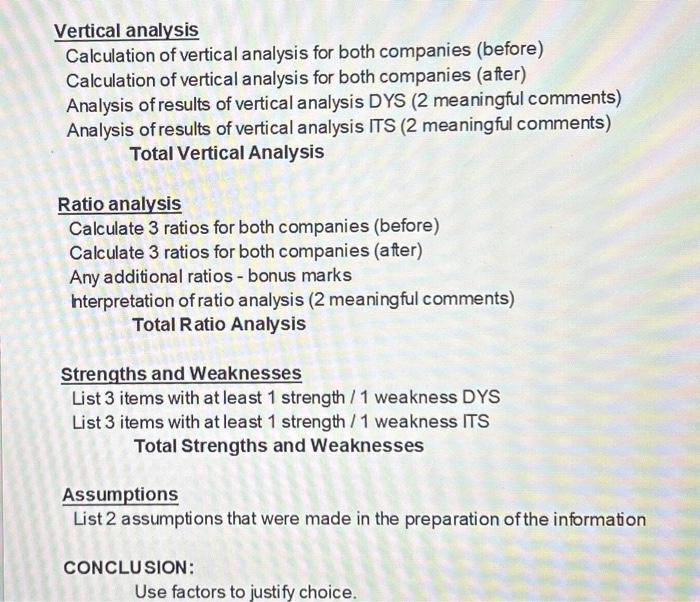

the Balance Sheet You just started your new position as a junior credit analyst with a large Canadian bank. For your first assignment, you have been asked to review the balance sheets of Design Your Sign Inc. and Info Tech Systems. Both companies have applied for a $100,000 small business loan. However, given current credit conditions, only one company will be awarded the loan. You manager has given you a brief background on the operations of each company and the purpose of the loan: >>> Design Your Sign Inc.: The company designs and prints corporate signs, business cards, letterheads, etc. Although the company is relatively new, it has been able to secure deals with various local busi- nesses. The loan will be used to purchase additional equipment to expand operations. Info Tech Systems: The company has been researching and developing a new accounting software package for small business users. The new software has significant improvements over current packages in terms of functionality and the user interface. The company has already made sales to local businesses. The loan will be used to continue to develop the software, and to begin full scale marketing. Your manager has provided you with a copy of each company's balance sheet (Exhibit I). Although she is aware that you do not have any other financial statement information at this time, your manager has asked you to prepare a brief report that outlines your key insights from an analysis of the balance sheets. In your report, you should consider the potential strengths and weaknesses (risks) of both companies. Required Prepare the report. Chapter 1. Introductory Cases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started