Answered step by step

Verified Expert Solution

Question

1 Approved Answer

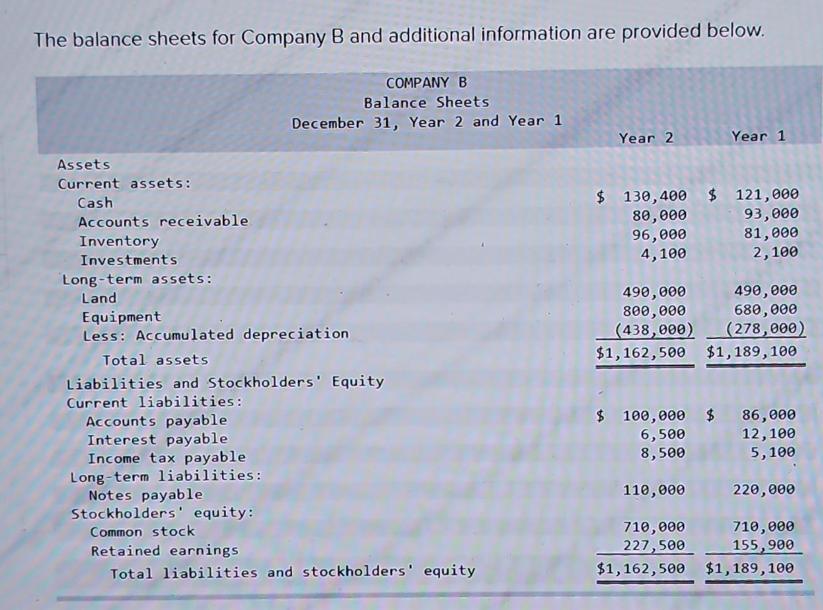

The balance sheets for Company B and additional information are provided below. COMPANY B Balance Sheets December 31, Year 2 and Year 1 Assets

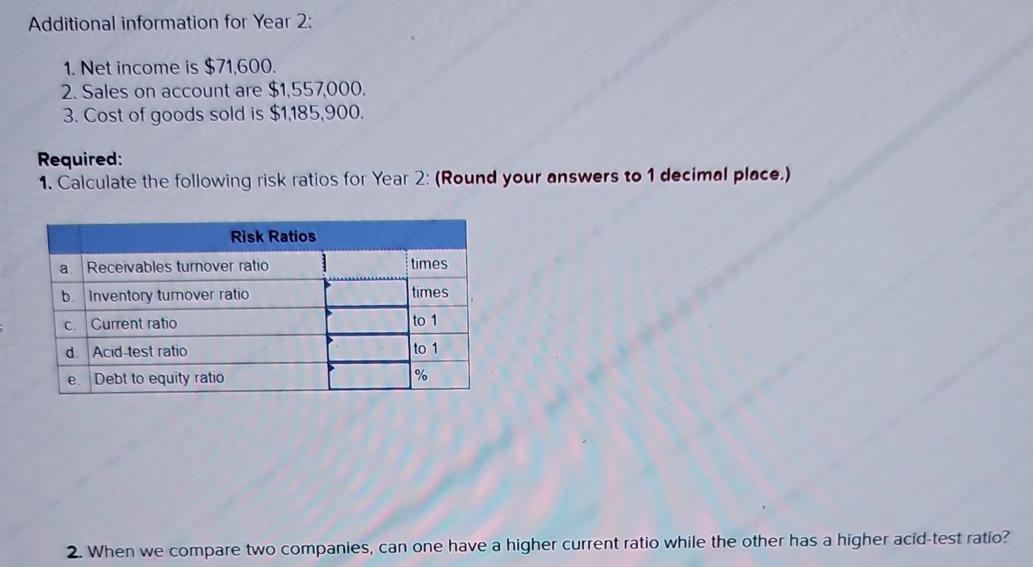

The balance sheets for Company B and additional information are provided below. COMPANY B Balance Sheets December 31, Year 2 and Year 1 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Year 2 $ 130,400 $ 121,000 80,000 93,000 96,000 81,000 4,100 2,100 Year 1 490,000 490,000 800,000 680,000 (438,000) (278,000) $1,162,500 $1,189,100 $ 100,000 $ 86,000 6,500 12, 100 5,100 8,500 110,000 710,000 227,500 $1,162,500 220,000 710,000 155,900 $1,189,100 Additional information for Year 2: 1. Net income is $71,600. 2. Sales on account are $1,557,000. 3. Cost of goods sold is $1,185,900. Required: 1. Calculate the following risk ratios for Year 2: (Round your answers to 1 decimal place.) a Receivables turnover ratio b. Inventory turnover ratio Current ratio C d e. Risk Ratios Acid-test ratio Debt to equity ratio times times to 1 to 1 % 2. When we compare two companies, can one have a higher current ratio while the other has a higher acid-test ratio?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the risk ratios for Year 2 well use the following formulas a Receivables turnover ratio Sales on account Average accounts receivable b In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started