Answered step by step

Verified Expert Solution

Question

1 Approved Answer

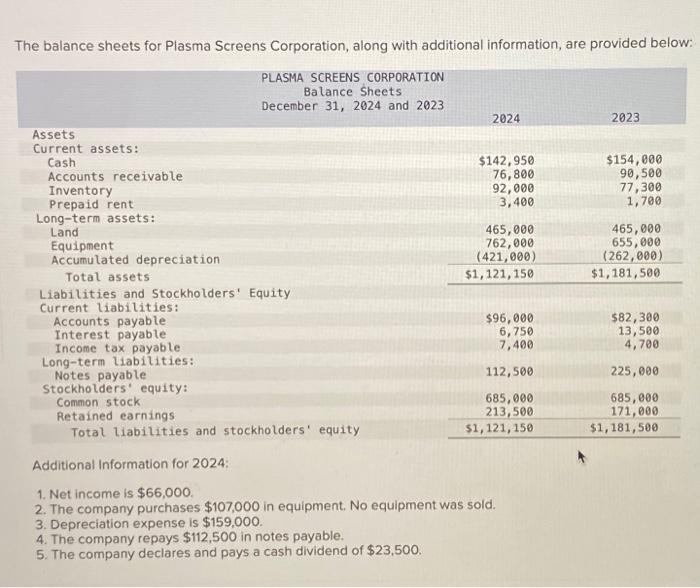

The balance sheets for Plasma Screens Corporation, along with additional information, are provided below: PLASMA SCREENS CORPORATION Balance Sheets December 31, 2024 and 2023

The balance sheets for Plasma Screens Corporation, along with additional information, are provided below: PLASMA SCREENS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Land Equipment 2024 2023 $142,950 $154,000 76,800 90,500 92,000 77,300 3,400 1,700 465,000 465,000 762,000 655,000 (421,000) (262,000) $1,181,500 Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional Information for 2024: 1. Net income is $66,000. $1,121,150 $96,000 6,750 $82,300 13,500 7,400 4,700 112,500 225,000 685,000 685,000 213,500 171,000 $1,121,150 $1,181,500 2. The company purchases $107,000 in equipment. No equipment was sold. 3. Depreciation expense is $159,000. 4. The company repays $112,500 in notes payable. 5. The company declares and pays a cash dividend of $23,500. PLASMA SCREENS CORPORATION Statement of Cash Flows For the Year Ended December 31, 2024 Cash Flows from Operating Activities Adjustments to reconcile net income to net cash flows from operating activities Net cash flows from operating activities Cash Flows from Investing Activities Net cash flows from investing activities Cash Flows from Financing Activities Net cash flows from financing activities Cash at the beginning of the period Cash at the end of the period $ 0 0 0 $ 0

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer Plasma screens Corporation Cash Flow Statement For year ended December 31 2021 A Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started